Unlock Greater Tax Savings: Beyond 80c Tax Planning Strategies

Tax Planning Other Than 80C: Maximizing Your Savings

Introduction

Hello Readers,

3 Picture Gallery: Unlock Greater Tax Savings: Beyond 80c Tax Planning Strategies

Welcome to this informative article about tax planning other than 80C. In today’s fast-paced world, it is crucial to understand various tax-saving options available to individuals. While most people are familiar with Section 80C of the Income Tax Act, which offers deductions up to ₹1.5 lakh, there are several other avenues that can help you optimize your tax savings. In this article, we will explore these alternative tax planning strategies that can benefit you and your financial goals. So, let’s dive in!

The Basics: What is Tax Planning Other Than 80C?

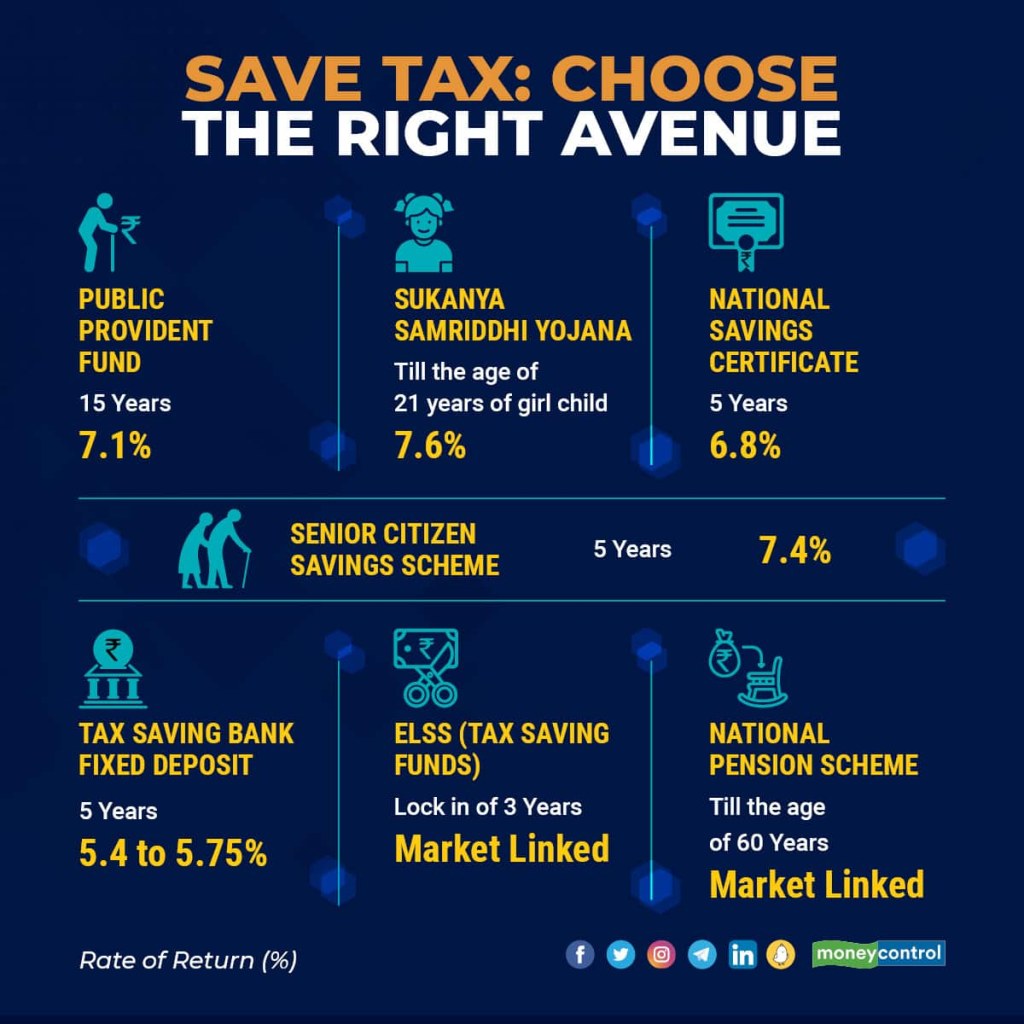

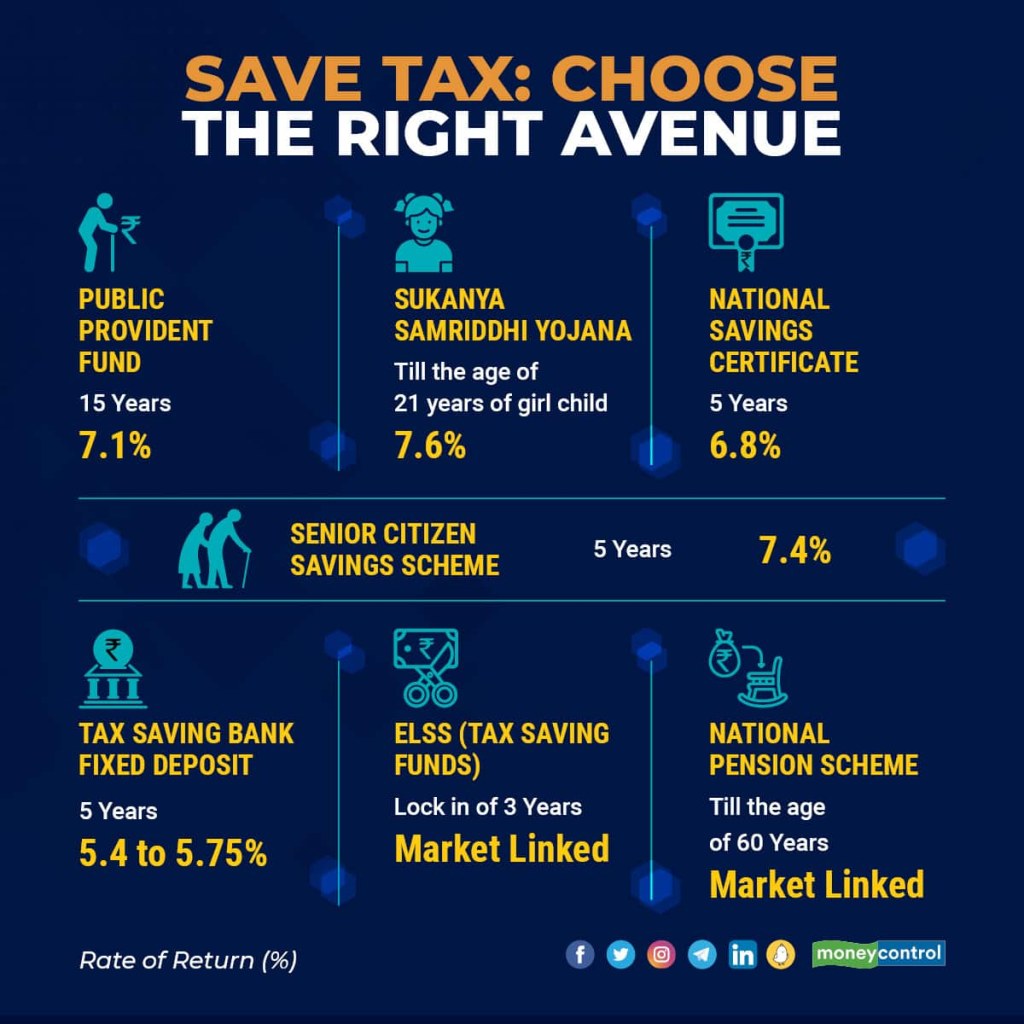

Image Source: insurancefunda.in

✅ Tax planning other than 80C refers to the legal methods and strategies employed by individuals to minimize their tax liability beyond the benefits offered by Section 80C.

✅ It involves exploring various sections of the Income Tax Act and taking advantage of deductions, exemptions, and rebates available to reduce the overall tax burden.

✅ By utilizing these alternative tax planning options, individuals can optimize their savings and potentially increase their disposable income.

Who Can Benefit from Tax Planning Other Than 80C?

Image Source: moneycontrol.com

✅ Salaried employees can explore alternative tax planning options to maximize their savings and reduce their taxable income.

✅ Self-employed individuals, freelancers, and professionals can also utilize these strategies to optimize their tax planning and increase their savings.

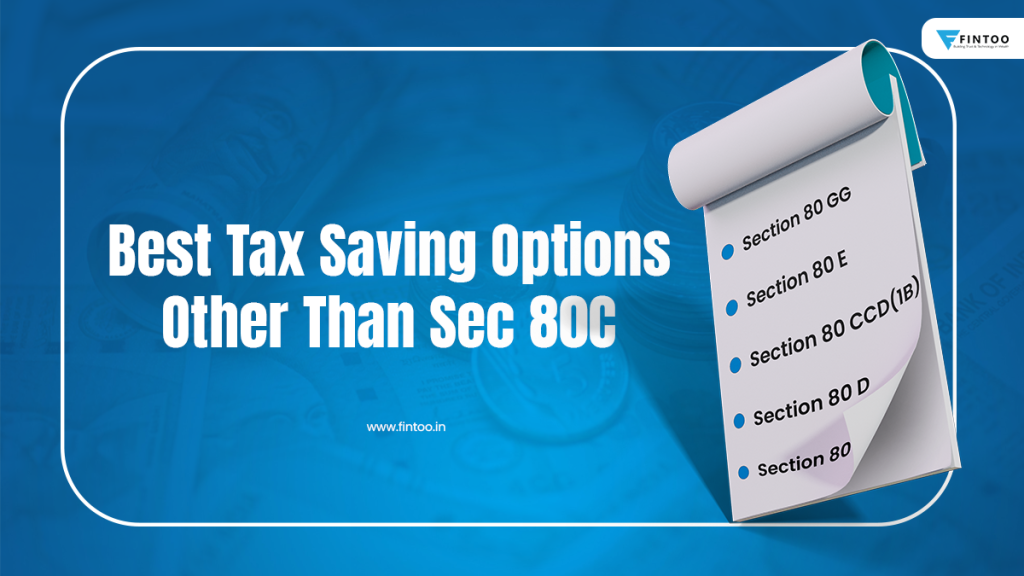

Image Source: fintoo.in

✅ Investors and individuals with diverse financial portfolios can benefit from exploring tax planning options beyond 80C to minimize their tax liability and enhance their long-term financial stability.

When Should You Consider Tax Planning Other Than 80C?

✅ It is advisable to start considering alternative tax planning options at the beginning of each financial year to effectively plan and strategize your taxes.

✅ Individuals who anticipate a higher taxable income or have specific financial goals in mind can benefit from early tax planning.

✅ If you aim to optimize your savings, reduce your tax liability, and potentially invest in other financial instruments, exploring tax planning options beyond 80C is essential.

Where Can You Implement Tax Planning Other Than 80C?

✅ Tax planning other than 80C can be implemented in various financial instruments and avenues offered by the government and financial institutions.

✅ Some popular options include Section 80D (Health Insurance Premium), Section 24(b) (Home Loan Interest), Section 10(14) (Leave Travel Allowance), and more.

✅ It is crucial to understand the eligibility criteria, limits, and conditions associated with each option to make informed decisions.

Why Should You Consider Tax Planning Other Than 80C?

✅ By exploring tax planning options other than 80C, you can significantly reduce your tax liability and increase your disposable income.

✅ It allows you to invest in various financial instruments and avenues that align with your long-term financial goals.

✅ Utilizing these strategies can provide you with additional financial security, savings, and potential growth opportunities.

How to Implement Tax Planning Other Than 80C?

✅ Begin by assessing your financial goals, income sources, and expenses to determine the most suitable tax planning strategies.

✅ Consult with a financial advisor or tax professional who can guide you through the process and help optimize your tax planning.

✅ Research and understand the available tax-saving options, their eligibility criteria, limits, and potential benefits.

✅ Keep proper documentation and maintain accurate records to ensure a seamless tax filing process.

✅ Regularly review and reassess your tax planning strategies to adapt to changing financial circumstances and maximize your savings.

Advantages and Disadvantages of Tax Planning Other Than 80C

✅ Advantage: Increased Savings – Utilizing tax planning options beyond 80C allows you to maximize your savings and potentially increase your disposable income.

✅ Advantage: Diversified Investments – By exploring alternative tax planning avenues, you can invest in diverse financial instruments, thereby spreading your risks and potentially earning higher returns.

✅ Advantage: Financial Security – Implementing these strategies can provide you with financial security and stability, ensuring a comfortable future for you and your family.

❌ Disadvantage: Complexity – Understanding the different tax planning options can be challenging for individuals who are not well-versed in financial matters, necessitating the need for professional guidance.

❌ Disadvantage: Time-consuming – Properly evaluating and implementing tax planning strategies can be time-consuming, requiring thorough research and analysis.

Frequently Asked Questions (FAQs)

Q1: Can I avail deductions under both Section 80C and tax planning options other than 80C?

A1: Yes, you can avail deductions under both Section 80C and other tax planning options, as long as you meet the eligibility criteria and adhere to the specified limits.

Q2: Are there any restrictions on the amount of deduction I can claim under tax planning other than 80C?

A2: Yes, each tax planning option has its own limits and conditions, which must be met for claiming deductions.

Q3: Can I switch between tax planning options other than 80C every year?

A3: Yes, you can switch between different tax planning options each year based on your financial goals, income sources, and eligibility.

Q4: How can I keep track of my tax planning investments and deductions?

A4: It is essential to maintain accurate records, keep track of your investments, and retain relevant documents to ensure a smooth tax filing process.

Q5: Is tax planning other than 80C suitable for senior citizens and retired individuals?

A5: Absolutely! Senior citizens and retired individuals can benefit from exploring tax planning options beyond 80C, such as Section 80D and Section 10(14), to optimize their savings and reduce tax liability.

Conclusion

In conclusion, tax planning other than 80C offers individuals numerous avenues to minimize their tax liability and maximize their savings. By exploring these alternative options, you can diversify your investments, increase your disposable income, and secure your financial future. It is essential to research, consult with professionals, and reassess your tax planning strategies regularly to align them with your evolving financial goals. So, start exploring these options today and make the most of your tax savings!

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute professional advice. It is advisable to consult with a qualified tax professional or financial advisor before making any financial decisions. The author and the website are not responsible for any actions taken based on the information provided.

This post topic: Tax Planning