Unlock Tax Benefits With Our Powerful Tax Plan 1031 Exchange – Act Now!

Tax Plan 1031 Exchange: A Comprehensive Guide to Understanding the Benefits and Implications

Introduction

Greetings, dear readers! Today, we delve into the intricacies of the tax plan 1031 exchange. Whether you are a seasoned investor or someone exploring the world of real estate, this tax plan is worth your attention. In this article, we will provide you with a comprehensive overview of the tax plan 1031 exchange, highlighting its benefits, implications, and everything else you need to know.

3 Picture Gallery: Unlock Tax Benefits With Our Powerful Tax Plan 1031 Exchange – Act Now!

Now, let’s begin our journey into the world of tax planning!

Table of Contents

What is the tax plan 1031 exchange?

Who can benefit from it?

When should you consider it?

Where does it apply?

Why is it advantageous?

How does it work?

Advantages and disadvantages

Frequently Asked Questions

Conclusion

Final Remarks

What is the tax plan 1031 exchange?

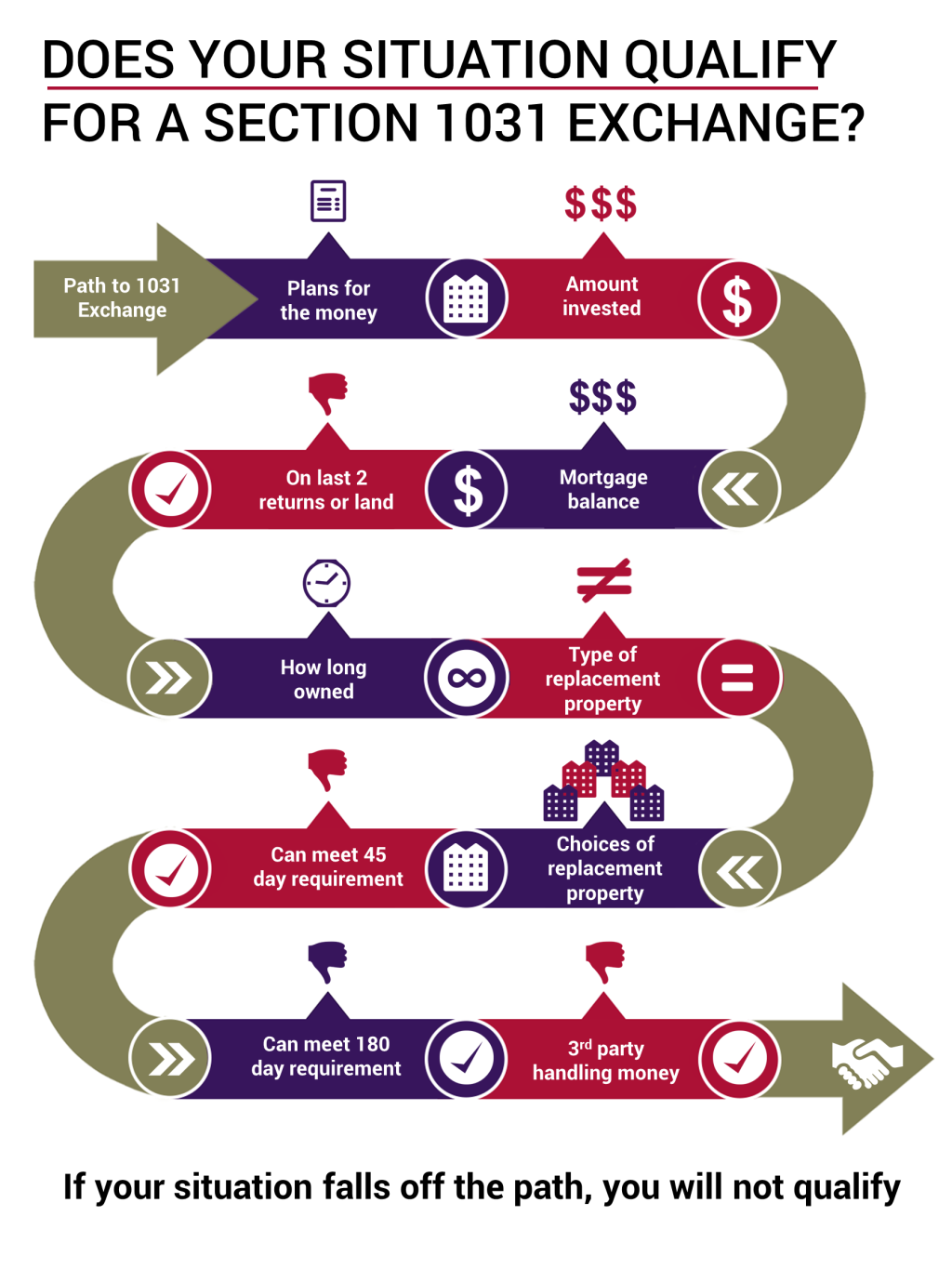

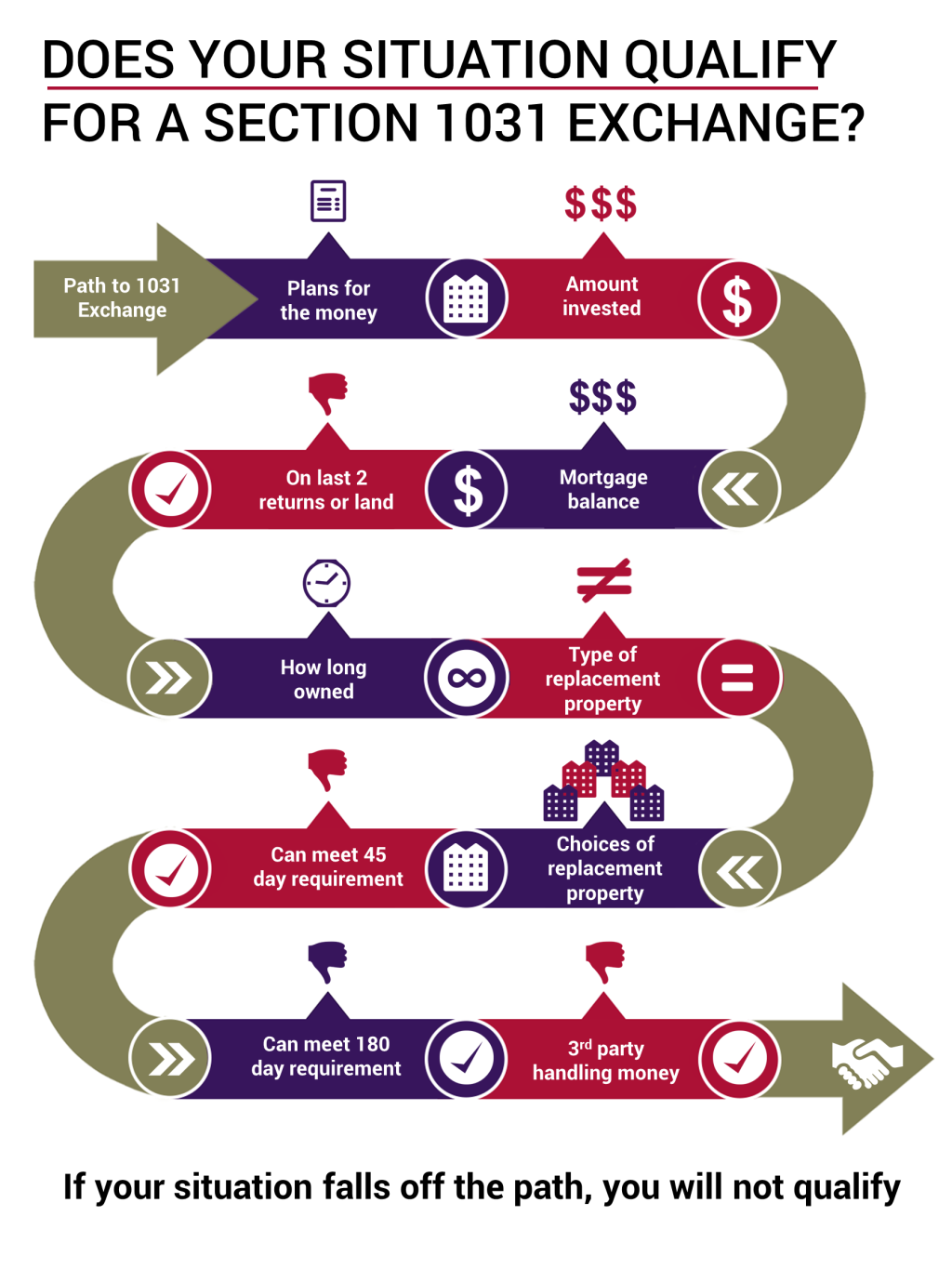

Image Source: section1031.com

The tax plan 1031 exchange, also known as a like-kind exchange, is a provision in the U.S. tax code that allows real estate investors to defer capital gains tax on the sale of an investment property by reinvesting the proceeds into another property of equal or greater value. This provision is governed by Section 1031 of the Internal Revenue Code.

🔍 To learn more about the intricacies of the tax plan 1031 exchange, continue reading.

Overview of the tax plan 1031 exchange:

The tax plan 1031 exchange offers investors the flexibility to defer capital gains tax and potentially build wealth through real estate investments. By reinvesting the proceeds from the sale of an investment property into another property, investors can postpone the payment of taxes, allowing their money to grow and compound over time.

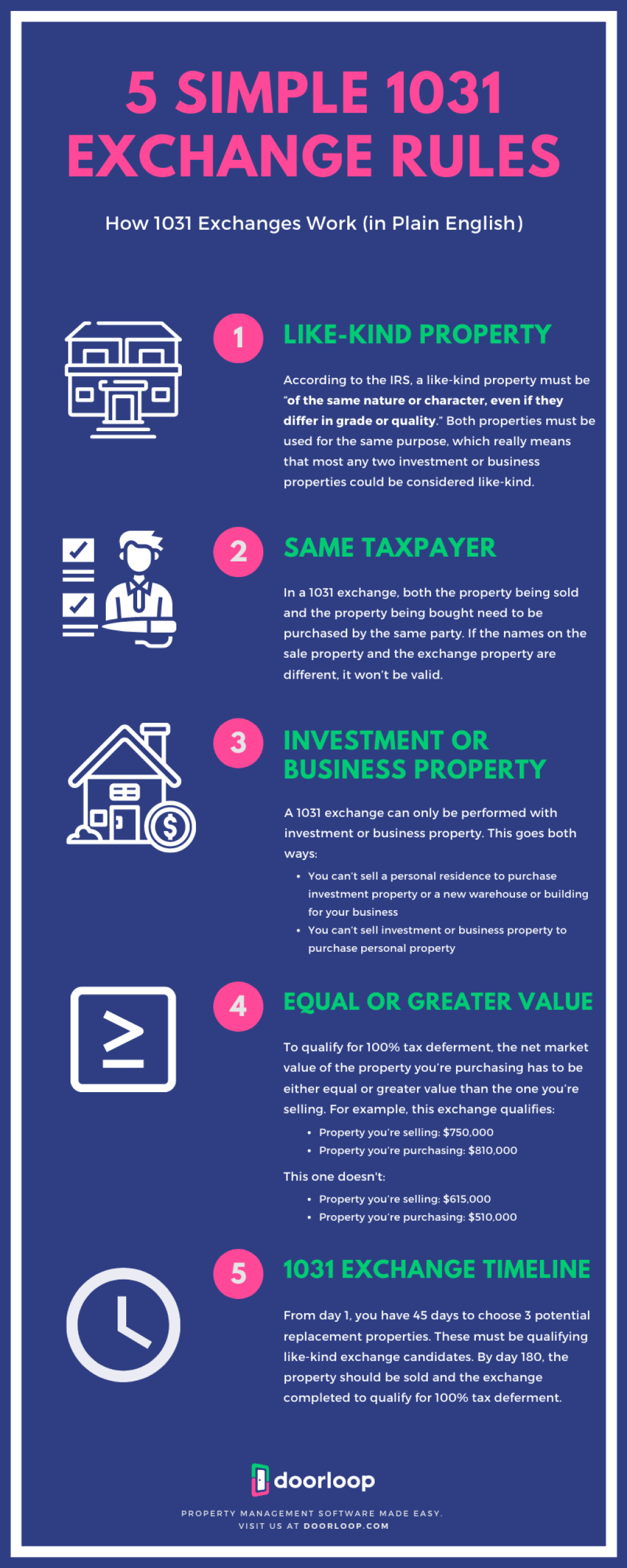

Image Source: provident1031.com

…

Final Remarks

In conclusion, the tax plan 1031 exchange provides real estate investors with a powerful tool to defer capital gains tax and maximize their investment potential. However, it is essential to consult with a qualified tax advisor or attorney before undertaking any like-kind exchanges to ensure compliance with the IRS regulations.

Always remember that tax laws can change, so staying informed and seeking professional guidance is crucial. The tax plan 1031 exchange presents numerous advantages, but it may not be suitable for every investor or every situation.

Before embarking on a like-kind exchange, carefully consider your investment goals, consult with experts, and evaluate the potential risks and benefits. By doing so, you can make informed decisions and take full advantage of the tax plan 1031 exchange to optimize your real estate investments.

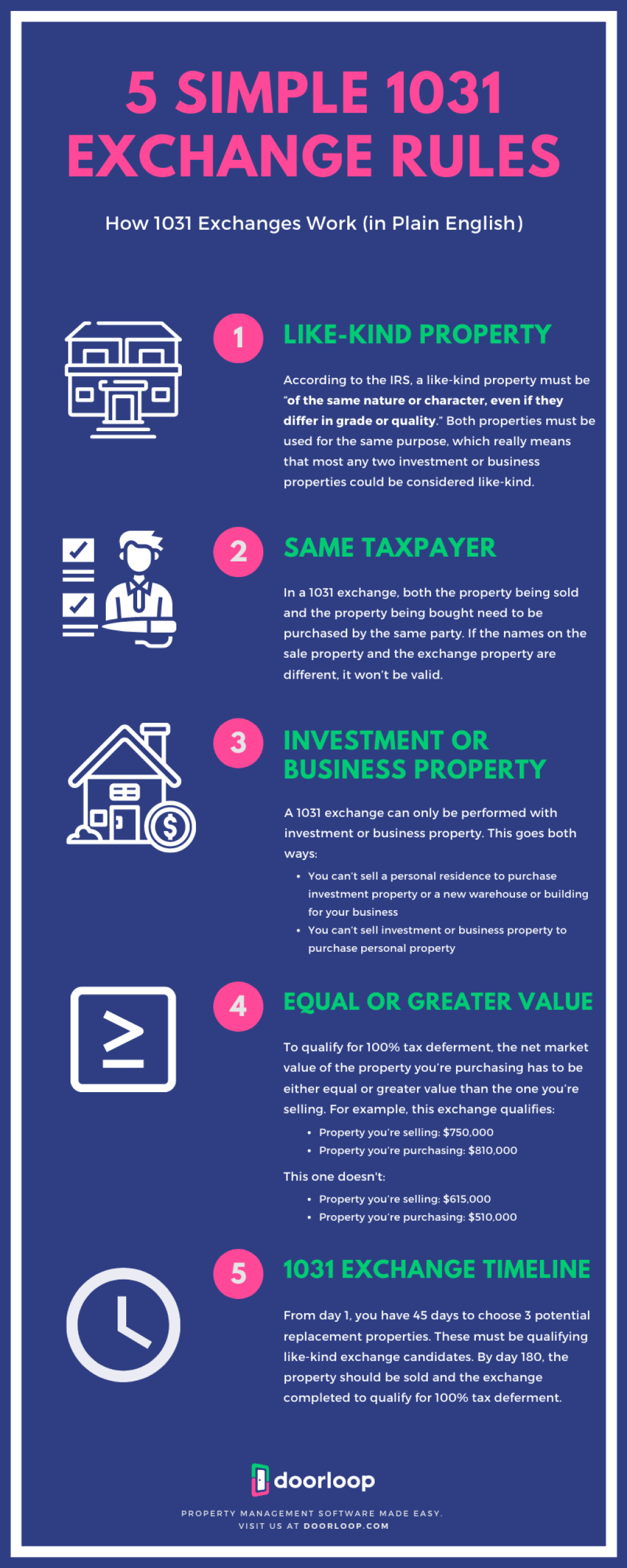

Image Source: website-files.com

Now that you have gained valuable insights into the tax plan 1031 exchange, it’s time to put your knowledge into action. Explore the possibilities, seek professional advice, and make informed decisions to maximize your investment potential.

Happy investing!

This post topic: Tax Planning