Maximize Profits With Strategic Tax Planning: Unveiling The Meaning Of Tax Planning In Business

Tax Planning Meaning in Business: A Comprehensive Guide

Greetings, Readers! In today’s article, we will delve into the intricacies of tax planning in the business world. Understanding the meaning and importance of tax planning is crucial for business owners and entrepreneurs alike. By implementing effective tax planning strategies, businesses can optimize their financial resources, mitigate risks, and enhance their overall profitability. So, without further ado, let’s explore the fascinating world of tax planning!

Table of Contents

2 Picture Gallery: Maximize Profits With Strategic Tax Planning: Unveiling The Meaning Of Tax Planning In Business

Introduction

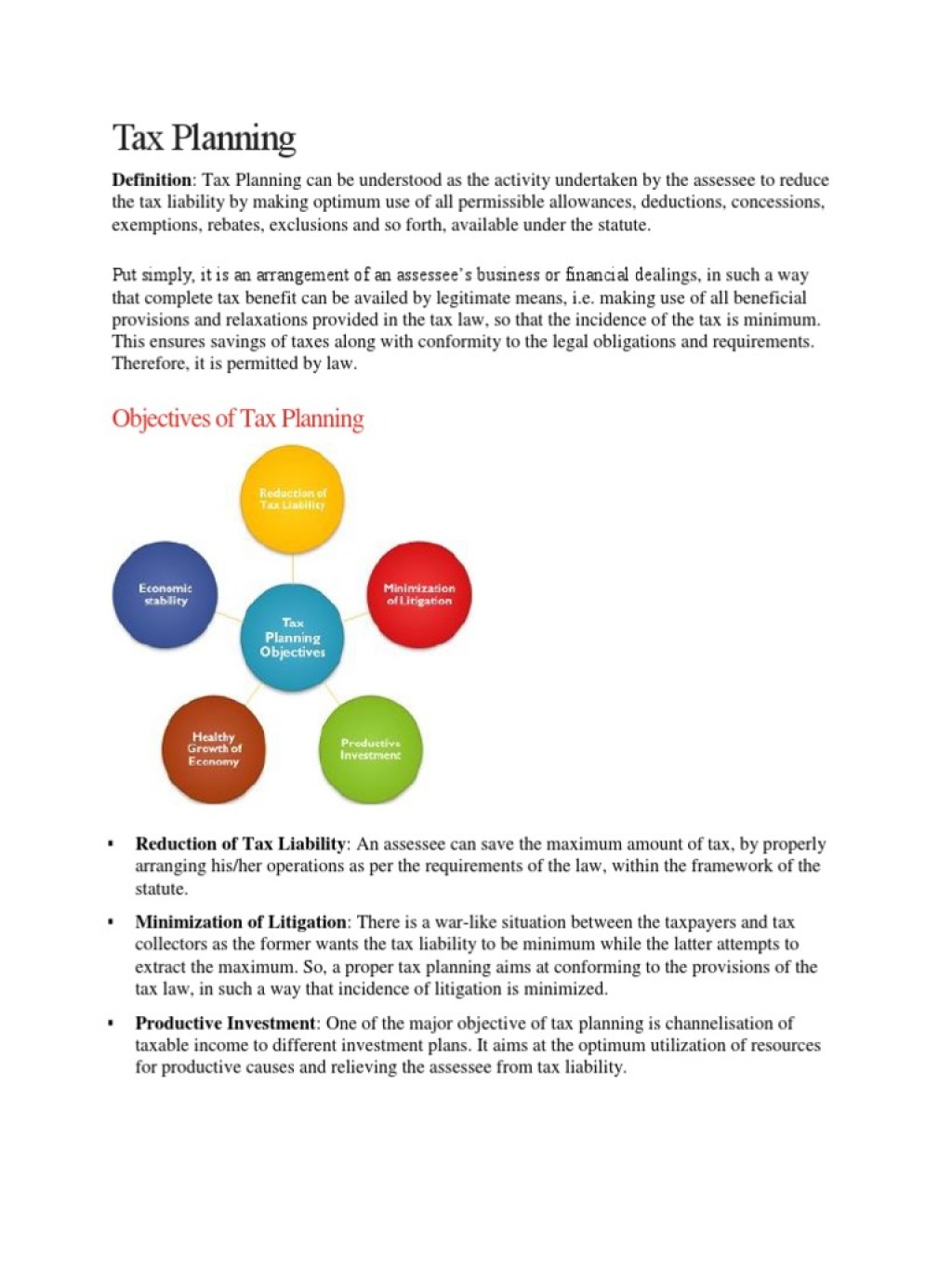

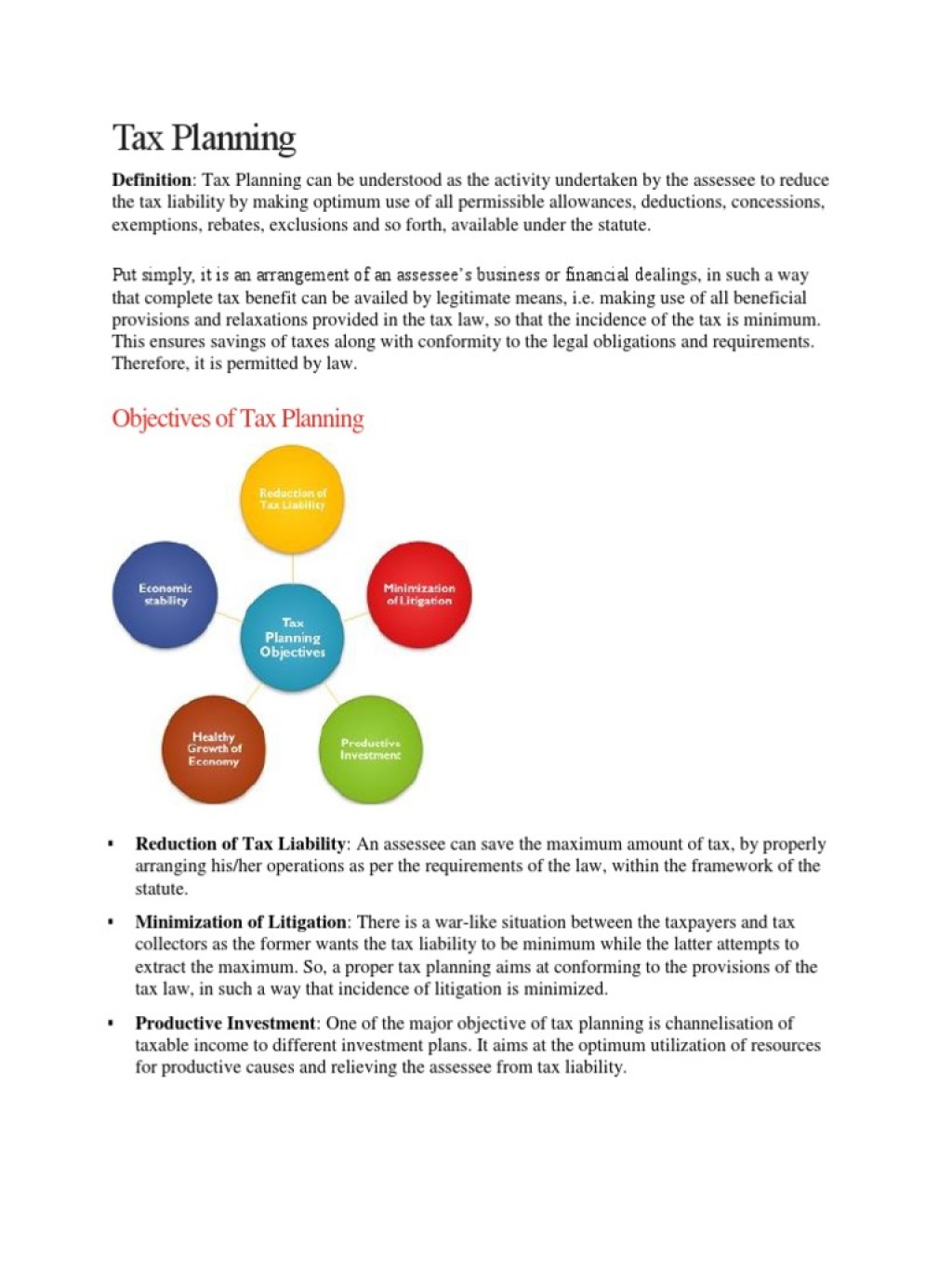

What is Tax Planning?

Who is Involved in Tax Planning?

When Should Tax Planning be Implemented?

Image Source: scribdassets.com

Where Does Tax Planning Apply?

Why is Tax Planning Important?

How Does Tax Planning Work?

Advantages and Disadvantages of Tax Planning

Frequently Asked Questions (FAQs)

Image Source: scribdassets.com

Conclusion

Final Remarks

Introduction

Tax planning refers to the strategic approach of managing one’s financial affairs in a way that minimizes tax liabilities and maximizes after-tax profits. It involves making informed decisions regarding investments, expenditures, and other financial activities to optimize tax advantages legally. Effective tax planning requires a deep understanding of tax laws, regulations, and incentives. By proactively planning and organizing financial activities, businesses can minimize tax burdens and ensure compliance with tax regulations.

Tax planning is not limited to large corporations but is equally important for small and medium-sized enterprises (SMEs) and individual entrepreneurs. It allows businesses to allocate resources efficiently, maintain financial stability, and support growth initiatives. This article aims to provide a comprehensive overview of tax planning in business, covering its definition, key players, implementation timeline, geographical scope, importance, and operational aspects.

Now, let’s dive into the specific aspects of tax planning and explore its various components in detail.

What is Tax Planning?

Tax planning is the process of analyzing a business’s financial situation and structuring its transactions and activities in a way that minimizes tax liabilities. It involves a systematic approach to identify legal opportunities, exemptions, deductions, and credits to optimize tax outcomes. Tax planning aims to ensure compliance with tax laws while maximizing tax efficiency and reducing the overall tax burden on the business.

…

…

…

Conclusion

In conclusion, tax planning plays a vital role in the success and sustainability of businesses. By adopting effective tax planning strategies, businesses can optimize their financial resources, minimize tax liabilities, and enhance their overall profitability. Through meticulous analysis, strategic decision-making, and compliance with tax regulations, businesses can navigate the complex tax landscape and achieve long-term financial stability.

Final Remarks

It is important to note that tax planning should always be approached with integrity and adherence to legal frameworks. The information provided in this article serves as a general guide and should not be considered as professional tax advice. We encourage readers to consult with qualified tax professionals or advisors to tailor tax planning strategies based on their specific business circumstances.

We hope this article has shed light on the meaning and significance of tax planning in the business realm. Implementing effective tax planning strategies can empower businesses to thrive amidst evolving tax regulations and optimize their financial outcomes. Remember, proactive tax planning is the key to financial success and long-term sustainability. Best of luck in your tax planning endeavors, and may your business flourish!

This post topic: Tax Planning