Maximize Tax Savings With Expert HUF Tax Planning – Unlock Your Financial Potential Now!

Tax Planning of HUF

Introduction

Dear Readers,

3 Picture Gallery: Maximize Tax Savings With Expert HUF Tax Planning – Unlock Your Financial Potential Now!

Welcome to our informative article on tax planning of HUF (Hindu Undivided Family). In this article, we will provide you with valuable insights into the concept of tax planning for HUFs and how it can help you optimize your tax liabilities. Understanding the nuances of tax planning for HUFs is crucial for individuals and families seeking to mitigate their tax burdens while complying with the legal framework.

In the following sections, we will elaborate on various aspects of tax planning for HUFs, including what it entails, who is eligible, when it can be implemented, where it can be beneficial, why it is important, and how it can be executed effectively. We will also discuss the advantages and disadvantages of tax planning for HUFs and address frequently asked questions to provide you with a comprehensive understanding of this topic.

Table of Contents

Introduction

What is tax planning of HUF?

Who is eligible for tax planning of HUF?

When can tax planning of HUF be implemented?

Where is tax planning of HUF beneficial?

Why is tax planning of HUF important?

How to execute tax planning of HUF effectively?

Advantages and disadvantages of tax planning of HUF

FAQs about tax planning of HUF

Conclusion

Final Remarks

Image Source: ytimg.com

What is tax planning of HUF? 🧾

HUF, or Hindu Undivided Family, is a unique form of business entity recognized by Indian tax laws. Tax planning of HUF refers to the strategic utilization of legal provisions to minimize tax liabilities for the HUF and its members. By utilizing various deductions, exemptions, and tax-saving instruments, an HUF can optimize its tax obligations and ensure efficient wealth management.

Explanation:

Under the Income Tax Act, an HUF is treated as a separate entity for tax purposes. It has its own PAN (Permanent Account Number) and is eligible to earn income, claim deductions, and pay taxes like an individual. Tax planning for HUFs involves utilizing tax-saving strategies to minimize the overall tax burden on the HUF’s income.

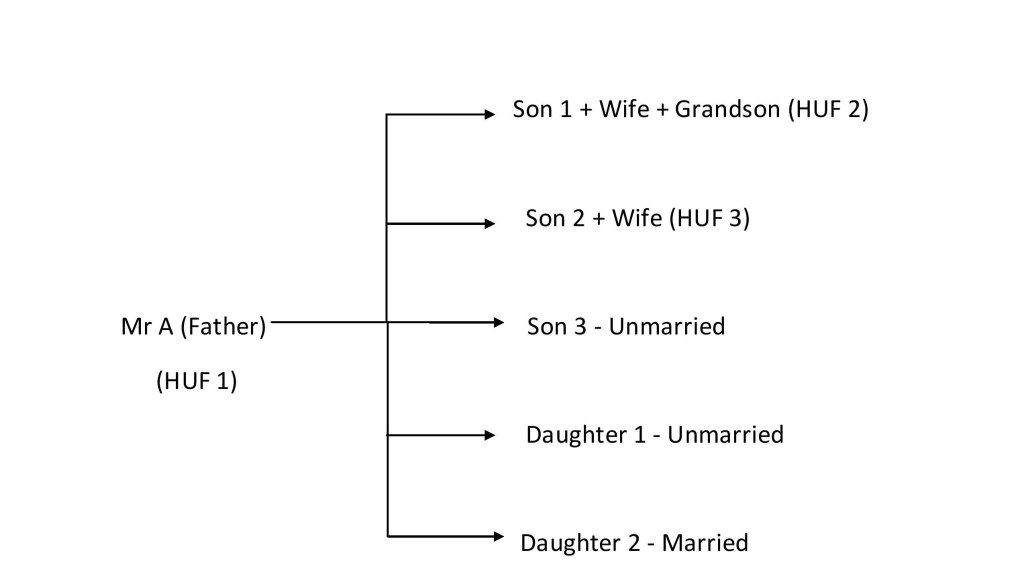

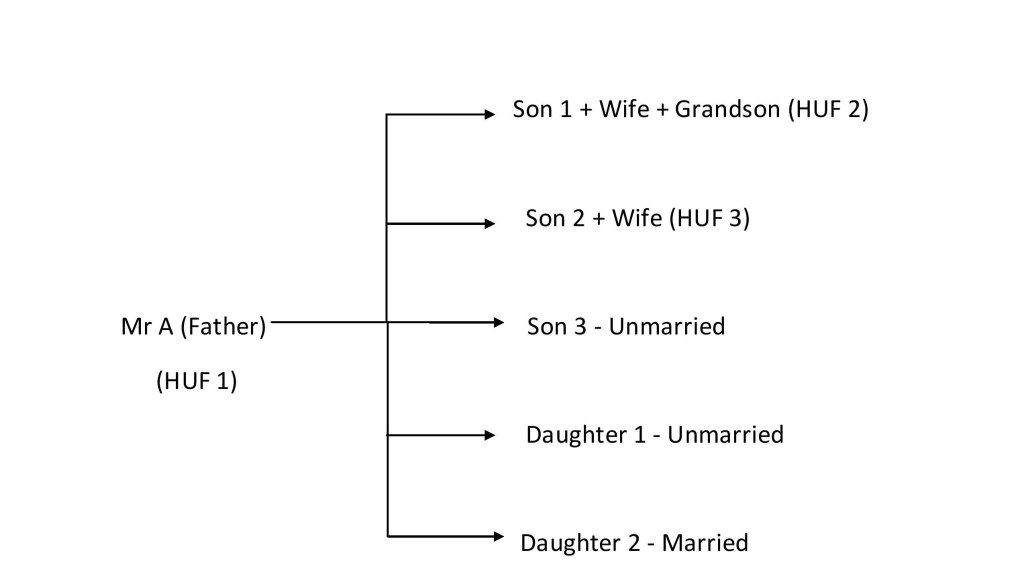

Who is eligible for tax planning of HUF? 👥

Image Source: labourlawadvisor.in

An HUF consists of members belonging to the same Hindu family, including their spouses and children. To be eligible for tax planning of HUF, one must belong to a Hindu family and have a valid PAN for the HUF. Additionally, individuals who are co-parceners in the HUF can actively contribute to tax planning decisions and investments.

Explanation:

The HUF can include all direct descendants of a common ancestor and their spouses and children. However, members from other religions or individuals not related by blood cannot be a part of the HUF. The co-parceners, usually the male members, have the authority to manage the affairs of the HUF, including tax planning decisions.

When can tax planning of HUF be implemented? ⏰

Image Source: itrtoday.com

Tax planning for HUFs can be implemented throughout the financial year. However, it is advisable to start tax planning at the beginning of the financial year to maximize the benefits and explore various investment avenues. By starting early, the HUF can take advantage of different tax-saving instruments and plan their investments accordingly.

Explanation:

Since the tax-saving options for HUFs are similar to those available for individuals, it is essential to plan investments and expenses in advance to optimize tax benefits. By initiating tax planning at the start of the financial year, the HUF can distribute investments across different tax-saving instruments and ensure compliance with the prescribed limits.

Where is tax planning of HUF beneficial? 🌍

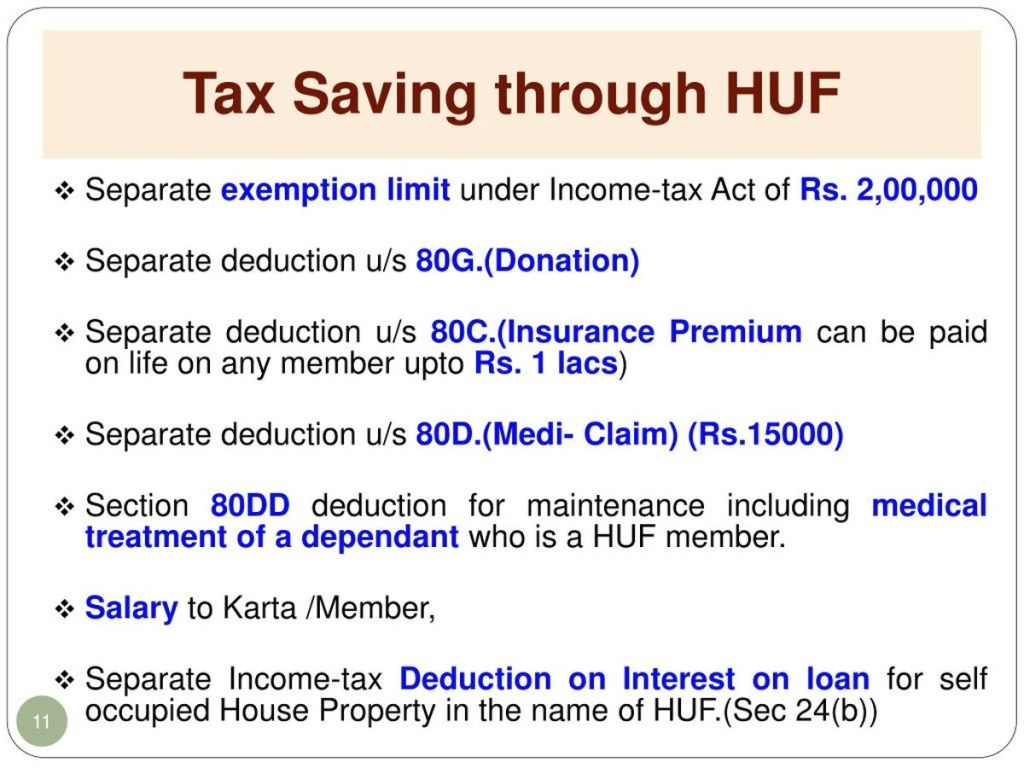

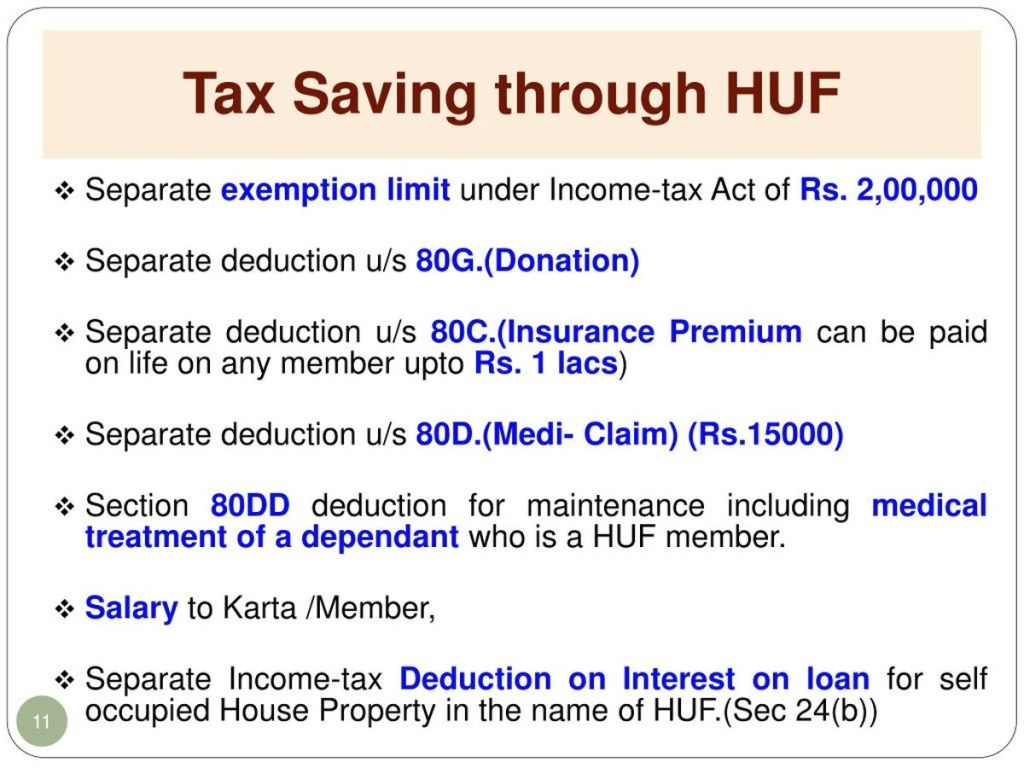

Tax planning for HUFs is beneficial in multiple ways and can be implemented across various income-generating activities. HUFs engaged in businesses, investments, or rental income can utilize tax planning strategies to minimize tax burdens and improve overall financial management. Additionally, HUFs residing in states where HUFs enjoy tax benefits can leverage such provisions for tax optimization.

Explanation:

HUFs involved in businesses can plan their expenses and investments to claim various deductions available under the Income Tax Act. By utilizing tax-saving instruments like life insurance, health insurance, and other eligible expenditures, HUFs can minimize their taxable income. Additionally, certain states in India provide specific tax benefits and exemptions for HUFs, enabling them to further optimize their tax liabilities.

Why is tax planning of HUF important? ❓

Tax planning for HUFs holds significant importance due to its potential to reduce tax liabilities and ensure efficient wealth management. By strategically utilizing tax-saving provisions, an HUF can maximize the benefits available under the Income Tax Act and create a robust financial foundation for its members. Effective tax planning can lead to substantial savings and facilitate the growth of the HUF’s assets.

Explanation:

Without proper tax planning, HUFs may end up paying higher taxes and miss out on potential deductions and exemptions. By proactively planning their investments, expenses, and claiming eligible deductions, HUFs can significantly reduce their tax liabilities. This not only leads to immediate savings but also helps in wealth accumulation and preservation for future generations.

How to execute tax planning of HUF effectively? 💼

Effective execution of tax planning for HUFs involves careful consideration of various factors and aligning investments with the HUF’s financial goals. Some key strategies include determining the appropriate investment mix, utilizing tax-saving instruments, leveraging exemptions and deductions, and ensuring compliance with legal provisions. Professional advice from tax experts can also play a vital role in executing tax planning effectively.

Explanation:

While executing tax planning for HUFs, it is crucial to analyze the HUF’s income sources, evaluate investment options, and select the ones that align with the HUF’s financial objectives. By diversifying investments and utilizing tax-saving instruments like Equity Linked Savings Schemes (ELSS), National Savings Certificates (NSC), and Public Provident Fund (PPF), HUFs can optimize their tax liabilities. Regular monitoring and timely compliance with tax-related responsibilities are equally important.

Advantages and Disadvantages of tax planning of HUF 📊

Advantages:

📈 Tax optimization and reduction of tax liabilities.

💼 Efficient wealth management and growth of HUF’s assets.

🌍 Access to various tax-saving instruments and deductions.

🏦 Preservation of wealth for future generations.

💼 Flexibility in investment options and financial planning.

Disadvantages:

⚖️ Stringent legal compliance requirements.

⚖️ Complex documentation and record-keeping.

⚖️ Limited applicability to Hindu families only.

⚖️ Dependence on the expertise of tax professionals.

⚖️ Potential liability issues in case of non-compliance.

FAQs about tax planning of HUF ❔

1. Can a married daughter be a member of an HUF?

Yes, a married daughter can be a member of an HUF if she is still a part of the Hindu family and fulfills the requirements set by the Income Tax Act.

2. Can an HUF claim deductions for expenses related to its members?

No, an HUF can only claim deductions for expenses directly related to its income-generating activities. Personal expenses of members cannot be claimed as deductions by the HUF.

3. Are HUFs eligible for tax benefits available to individuals?

Yes, HUFs can avail of the same tax benefits available to individuals, subject to the specific provisions applicable to HUFs.

4. Can an HUF invest in the stock market?

Yes, an HUF can invest in the stock market and claim tax benefits based on the applicable provisions for capital gains, dividends, and other related aspects.

5. Can an HUF open a bank account in its name?

Yes, an HUF can open a bank account in its name by providing the necessary documentation, including the PAN card and the declaration of the HUF’s members.

Conclusion

In conclusion, tax planning for HUFs is a crucial aspect of financial management for Hindu families in India. By effectively utilizing tax-saving strategies and complying with legal provisions, HUFs can significantly reduce their tax liabilities and ensure efficient wealth management. It is essential to start tax planning early in the financial year and seek professional advice to maximize the benefits available under the Income Tax Act.

Final Remarks

Dear Readers, tax planning for HUFs requires a thorough understanding of the legal framework and careful consideration of various factors. While this article provides valuable insights into tax planning for HUFs, it is recommended to consult tax professionals or experts for personalized advice based on your specific circumstances. Proper tax planning can help you optimize your tax liabilities and achieve your financial goals effectively.

This post topic: Tax Planning