Decoding Investment Accounts: Unraveling The Types For Optimal Returns – Discover Now!

Investment is Which Type of Account?

Greetings, Readers!

When it comes to managing your finances, investing is an important aspect that can help you grow your wealth and secure a better future. However, with so many options available, it can be overwhelming to determine which type of investment account is the right fit for you.

1 Picture Gallery: Decoding Investment Accounts: Unraveling The Types For Optimal Returns – Discover Now!

In this article, we will explore the different types of investment accounts and provide you with valuable insights to help you make an informed decision. Let’s dive in!

1. What is an Investment Account?

An investment account refers to a financial product or platform that allows individuals to invest their money in various assets such as stocks, bonds, mutual funds, and more. These accounts are typically offered by banks, brokerage firms, or investment companies.

🔍 Importantly, investment accounts provide individuals with opportunities to generate wealth and achieve their financial goals over the long term.

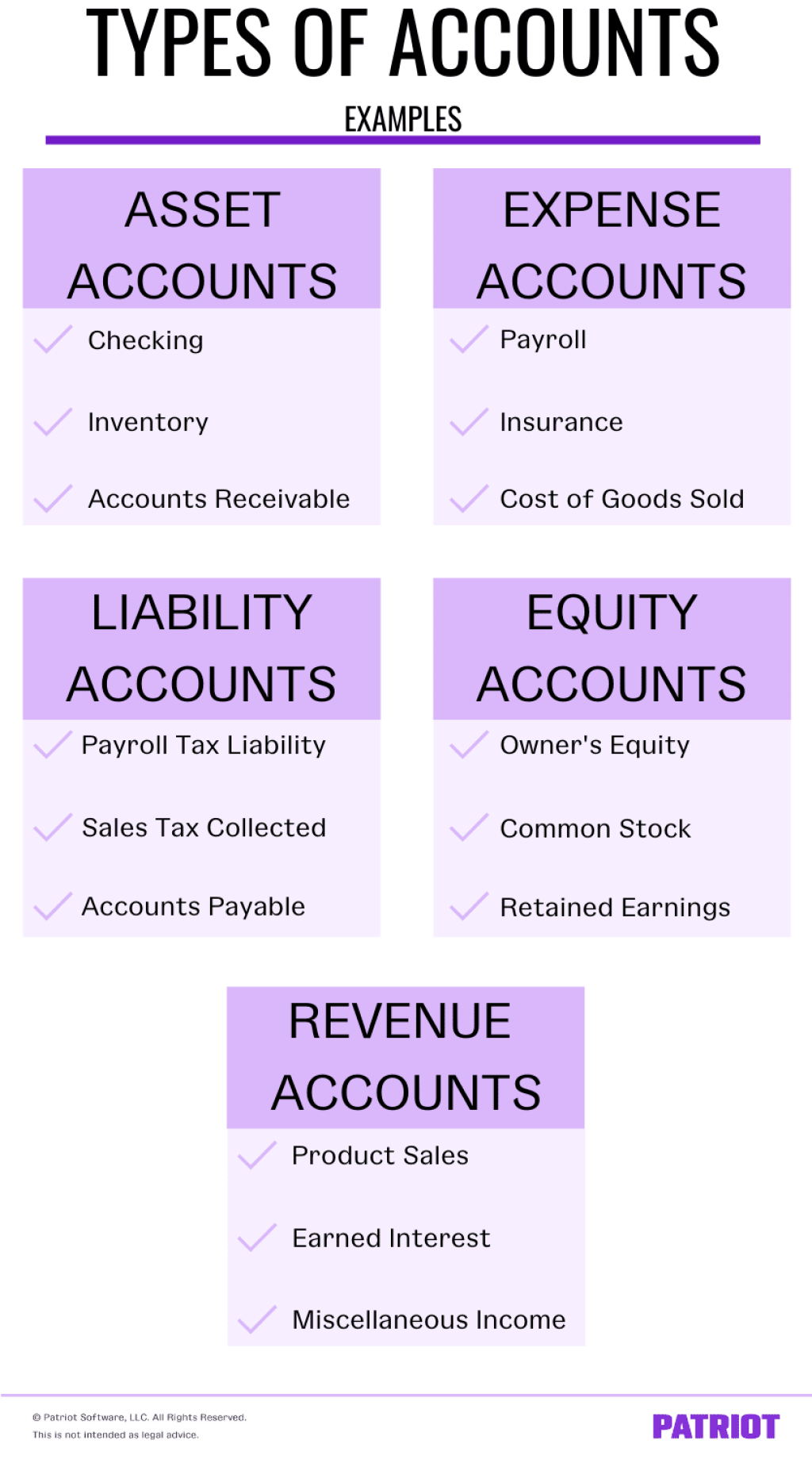

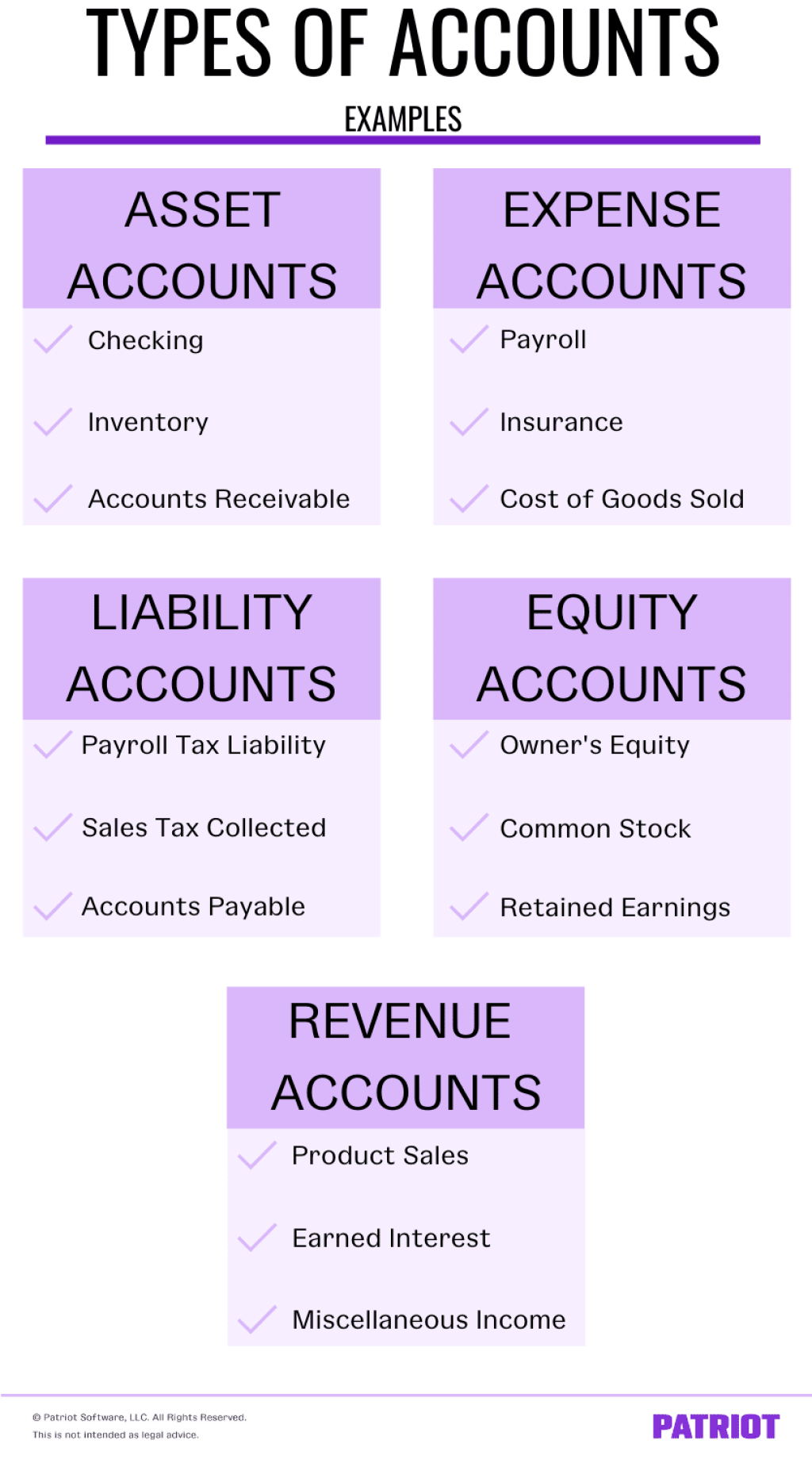

Understanding the Different Types of Investment Accounts

Image Source: patriotsoftware.com

There are several types of investment accounts available, each with its own set of characteristics and benefits. Let’s explore some of the most common ones:

2. Individual Retirement Accounts (IRAs)

IRAs are investment accounts specifically designed for retirement savings. They offer tax advantages, allowing individuals to contribute a certain amount of money each year and enjoy tax-deferred growth until retirement.

🔍 IRAs are a popular choice for individuals looking to save for retirement while enjoying potential tax benefits.

3. 401(k) Accounts

A 401(k) account is an employer-sponsored retirement plan that allows employees to contribute a portion of their salary on a pre-tax basis. Employers may also match a certain percentage of the employee’s contributions, providing an additional incentive to save.

🔍 401(k) accounts are a great way to save for retirement, especially if your employer offers matching contributions.

4. Brokerage Accounts

A brokerage account is a versatile investment account that allows individuals to buy and sell a wide range of financial assets, including stocks, bonds, mutual funds, ETFs, and more. These accounts provide individuals with the flexibility to manage their investments according to their preferences and goals.

🔍 Brokerage accounts offer a wide range of investment options and are suitable for individuals with varying levels of investment experience.

5. Education Savings Accounts (ESAs)

ESAs, also known as Coverdell Education Savings Accounts, are investment accounts specifically designed to save for educational expenses. These accounts allow individuals to invest in a variety of assets and enjoy tax-free growth, as long as the withdrawals are used for qualifying educational expenses.

🔍 ESAs are a great way to save for your child’s education while enjoying potential tax benefits.

6. Health Savings Accounts (HSAs)

HSAs are investment accounts that are designed to help individuals save for medical expenses. These accounts are only available to individuals covered by a high-deductible health plan (HDHP) and offer tax advantages, including tax-deductible contributions and tax-free withdrawals for qualified medical expenses.

🔍 HSAs are a valuable tool for managing healthcare costs while enjoying potential tax savings.

Advantages and Disadvantages of Investment Accounts

Advantages:

1. Potential for Wealth Generation: Investment accounts offer the potential for long-term wealth generation through the growth of your investments.

2. Diversification: By investing in different assets, you can spread your risk and minimize the impact of market fluctuations.

3. Tax Benefits: Many investment accounts offer tax advantages, such as tax-deferred growth or tax-free withdrawals for specific purposes.

4. Flexibility: Investment accounts provide individuals with the flexibility to manage their investments according to their goals and risk tolerance.

5. Accessibility: With the advancement of technology, investment accounts have become more accessible, allowing individuals to manage their investments conveniently.

Disadvantages:

1. Market Volatility: Investments are subject to market fluctuations, and there is always a risk of losing money.

2. Fees and Expenses: Investment accounts may come with fees and expenses that can impact your overall returns.

3. Complexity: Some investment accounts can be complex, requiring a certain level of financial knowledge and understanding.

4. Liquidity Constraints: Depending on the type of investment account, there may be limitations on accessing your funds in the short term.

5. Regulatory Changes: Regulatory changes or new legislation can impact the rules and regulations surrounding investment accounts.

Frequently Asked Questions (FAQs)

1. Can I have multiple investment accounts?

Yes, you can have multiple investment accounts. In fact, diversifying your investments across different accounts can help spread your risk and maximize potential returns.

2. Are investment accounts insured?

Investment accounts are not insured by the FDIC. However, certain types of accounts may be protected by the Securities Investor Protection Corporation (SIPC) or other similar organizations.

3. How much should I contribute to my investment account?

The amount you should contribute to your investment account depends on your financial goals, risk tolerance, and current financial situation. It is recommended to consult with a financial advisor to determine the appropriate contribution amount.

4. Can I withdraw money from my investment account anytime?

Depending on the type of investment account, there may be restrictions or penalties for early withdrawals. It is important to familiarize yourself with the specific rules and regulations of your account.

5. What is the difference between an investment account and a savings account?

An investment account is specifically designed for long-term growth and typically involves investing in a variety of assets. On the other hand, a savings account is primarily used to store money and earn interest, usually with lower returns compared to investments.

Conclusion

In summary, choosing the right investment account is crucial for achieving your financial goals. Whether it’s saving for retirement, education, or managing healthcare costs, there are various types of investment accounts available to suit your needs. Consider your goals, risk tolerance, and consult with a financial advisor to make an informed decision. Start investing today and secure a better financial future!

Final Remarks

Investing involves risks, and the value of investments can fluctuate. It is important to conduct thorough research, seek advice from professionals, and carefully consider your financial situation before making any investment decisions. The information provided in this article is for educational purposes only and should not be considered as financial advice. Remember to always do your due diligence and make informed decisions.

This post topic: Tax Planning