Maximize Your Savings With Strategic Tax Planning HMRC: Take Action Now!

Tax Planning HMRC: Maximizing Efficiency and Compliance

Introduction

Dear Readers,

1 Picture Gallery: Maximize Your Savings With Strategic Tax Planning HMRC: Take Action Now!

Welcome to this informative article on tax planning and the role of HMRC in ensuring efficient and compliant practices. In today’s complex financial landscape, understanding tax planning strategies is crucial for individuals and businesses alike.

Image Source: saffery.com

In this article, we will provide a comprehensive overview of tax planning, discuss the responsibilities of HMRC, and explore the benefits and drawbacks associated with these practices. So, let’s dive in and uncover the key aspects of tax planning HMRC.

Overview of Tax Planning HMRC

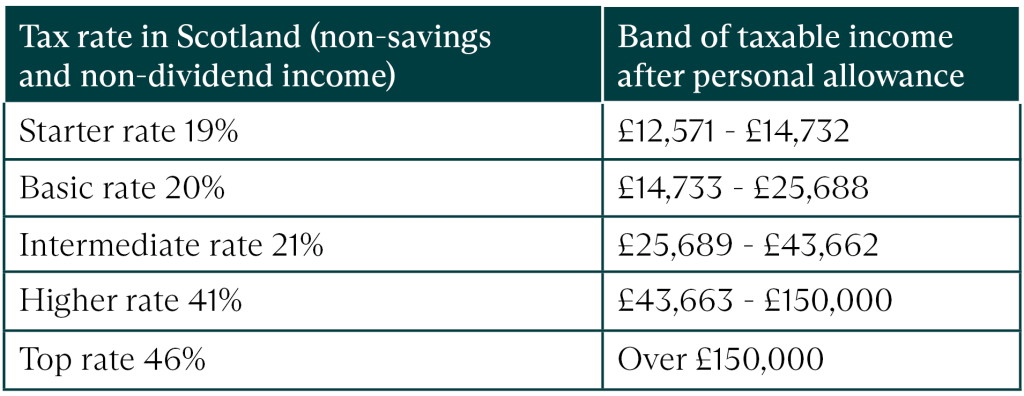

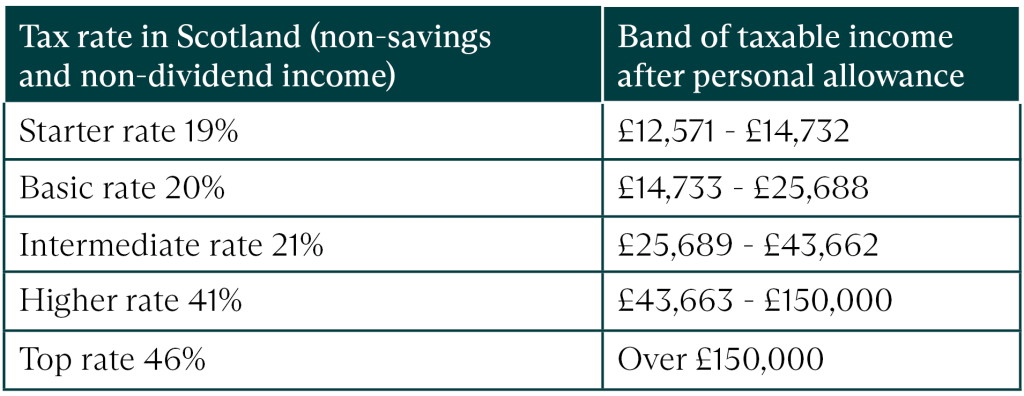

Tax planning involves making strategic decisions to minimize tax liabilities while maintaining compliance with the legal framework. HMRC, short for Her Majesty’s Revenue and Customs, is the UK government department responsible for collecting taxes and implementing tax policies. Their role is to ensure that individuals and businesses pay the correct amount of tax and adhere to the tax legislation.

Effective tax planning can help individuals and businesses legally reduce their tax burden, optimize financial resources, and increase overall efficiency. However, it’s essential to strike a balance between optimizing tax benefits and remaining compliant with HMRC regulations.

What is Tax Planning HMRC?

🔍 Tax planning HMRC refers to the strategic and lawful management of financial affairs to minimize tax liabilities while complying with HMRC regulations. It involves utilizing various tax allowances, exemptions, and incentives provided by HMRC to optimize tax efficiency.

🔍 The objective of tax planning HMRC is to ensure individuals and businesses pay their fair share of taxes while utilizing legitimate strategies to reduce their overall tax burden.

🔍 This process requires a comprehensive understanding of tax legislation, financial planning, and the ability to navigate the complex tax landscape effectively.

Who Benefits from Tax Planning HMRC?

🔍 Individuals: Tax planning HMRC offers individuals the opportunity to structure their financial affairs in a tax-efficient manner, ensuring they are not paying more tax than required.

🔍 Small Businesses: Proper tax planning enables small businesses to optimize their tax position, free up cash flow, and reinvest in growth opportunities.

🔍 Large Corporations: Tax planning HMRC strategies allow large corporations to manage their tax liabilities, reduce costs, and improve profitability.

🔍 Charities and Non-Profit Organizations: These entities can utilize tax planning strategies to maximize their fundraising efforts and minimize their tax obligations, enabling them to allocate more resources to their core objectives.

When Should You Consider Tax Planning HMRC?

🔍 Starting a Business: Proper tax planning from the outset can help new businesses structure their operations in a tax-efficient manner, ensuring compliance and reducing tax liabilities.

🔍 Significant Life Events: Major life events such as marriage, divorce, inheritance, or retirement can have significant tax implications. Tax planning HMRC can help individuals navigate these situations and minimize tax obligations.

🔍 Business Expansion: As businesses grow, tax planning becomes critical to manage increased tax liabilities, optimize funding, and explore available tax incentives.

Where Can You Seek Tax Planning HMRC Advice?

🔍 Professional Advisors: Tax consultants, accountants, and financial advisors possess the expertise to guide individuals and businesses through the complexities of tax planning HMRC.

🔍 HMRC Resources: HMRC provides extensive online resources, tax guides, and publications to help taxpayers understand their responsibilities and utilize tax planning strategies effectively.

Why Is Tax Planning HMRC Important?

🔍 Optimize Tax Efficiency: Effective tax planning HMRC allows individuals and businesses to minimize tax liabilities, retain more of their hard-earned income, and allocate resources towards their financial goals.

🔍 Compliance with Legal Obligations: Tax planning HMRC ensures that individuals and businesses adhere to tax legislation, avoiding penalties and legal consequences associated with non-compliance.

🔍 Financial Stability: By reducing tax burdens, tax planning HMRC enhances financial stability, enabling individuals and businesses to invest in growth opportunities, save for the future, and weather economic uncertainties.

How Does Tax Planning HMRC Work?

🔍 Assessing Tax Liabilities: Tax planning HMRC begins with a comprehensive assessment of an individual’s or business’s financial situation, income sources, and applicable tax regulations.

🔍 Identifying Opportunities: After evaluating the financial landscape, tax planning HMRC experts identify legitimate opportunities to reduce tax liabilities, such as tax deductions, credits, or allowances offered by HMRC.

🔍 Implementing Strategies: Once the tax planning strategies are developed, individuals or businesses can implement them to optimize their tax position and achieve the desired tax efficiency.

Advantages of Tax Planning HMRC

🔍 Increased Savings: Tax planning HMRC allows individuals and businesses to maximize their tax savings, freeing up resources for other purposes.

🔍 Improved Cash Flow: By reducing tax obligations, tax planning HMRC enhances cash flow, providing more liquidity for operations or investments.

🔍 Optimal Resource Allocation: Effective tax planning HMRC enables individuals and businesses to allocate resources strategically and pursue growth opportunities or long-term financial goals.

Disadvantages of Tax Planning HMRC

🔍 Complexity: Tax planning HMRC involves navigating a complex web of tax legislation, which can be challenging for individuals without proper expertise.

🔍 Changing Regulations: The tax landscape is subject to frequent changes, and what may be a valid tax planning strategy today could become obsolete or restricted tomorrow.

🔍 Ethical Considerations: Some tax planning strategies may push the boundaries of ethical behavior, and individuals or businesses should carefully weigh the moral implications of their actions.

Frequently Asked Questions (FAQ)

Q: Is tax planning HMRC legal?

A: Yes, tax planning HMRC is legal as long as individuals and businesses adhere to tax legislation and utilize legitimate strategies to optimize their tax position.

Q: Can tax planning HMRC reduce my tax obligations to zero?

A: While tax planning can help minimize tax liabilities, reducing them to zero is unlikely. The objective is to optimize tax efficiency within the boundaries of the law.

Q: Do I need professional help for tax planning HMRC?

A: While it is possible to navigate tax planning independently, seeking professional advice from tax consultants or accountants can ensure a thorough understanding of the complexities involved and maximize tax benefits.

Q: Can tax planning HMRC lead to tax evasion?

A: Tax planning HMRC focuses on legal strategies to minimize tax liabilities. Tax evasion, on the other hand, involves illegal activities to evade taxes. It is essential to distinguish between tax planning and tax evasion.

Q: Is tax planning HMRC only for high-income individuals?

A: Tax planning HMRC is beneficial for individuals and businesses of all income levels. It allows individuals to optimize their tax position based on their specific financial circumstances and goals.

Conclusion

In conclusion, tax planning HMRC is a vital aspect of financial management for individuals and businesses. By understanding the strategies and opportunities available, individuals can minimize their tax liabilities while complying with HMRC regulations.

We encourage you to explore tax planning HMRC options and seek professional advice if needed. Remember, the key is to strike a balance between optimizing tax benefits and maintaining compliance. By doing so, you can maximize your financial efficiency and pave the way for long-term success.

Final Remarks

Dear Readers,

We hope this article has provided valuable insights into tax planning HMRC and its significance in today’s financial landscape. It is crucial to approach tax planning with integrity, ensuring compliance with the law while optimizing your tax position.

While every effort has been made to ensure the accuracy and relevance of the information provided, it is essential to consult with professional advisors for specific tax planning HMRC advice tailored to your unique circumstances. Tax legislation and regulations are subject to change, and professional guidance can help navigate these complexities effectively.

Thank you for reading!

This post topic: Tax Planning