Maximize Your Returns With Strategic Investment In Final Accounts: Unlock Your Financial Potential Now!

Investment in Final Accounts: Managing Your Finances for Long-term Success

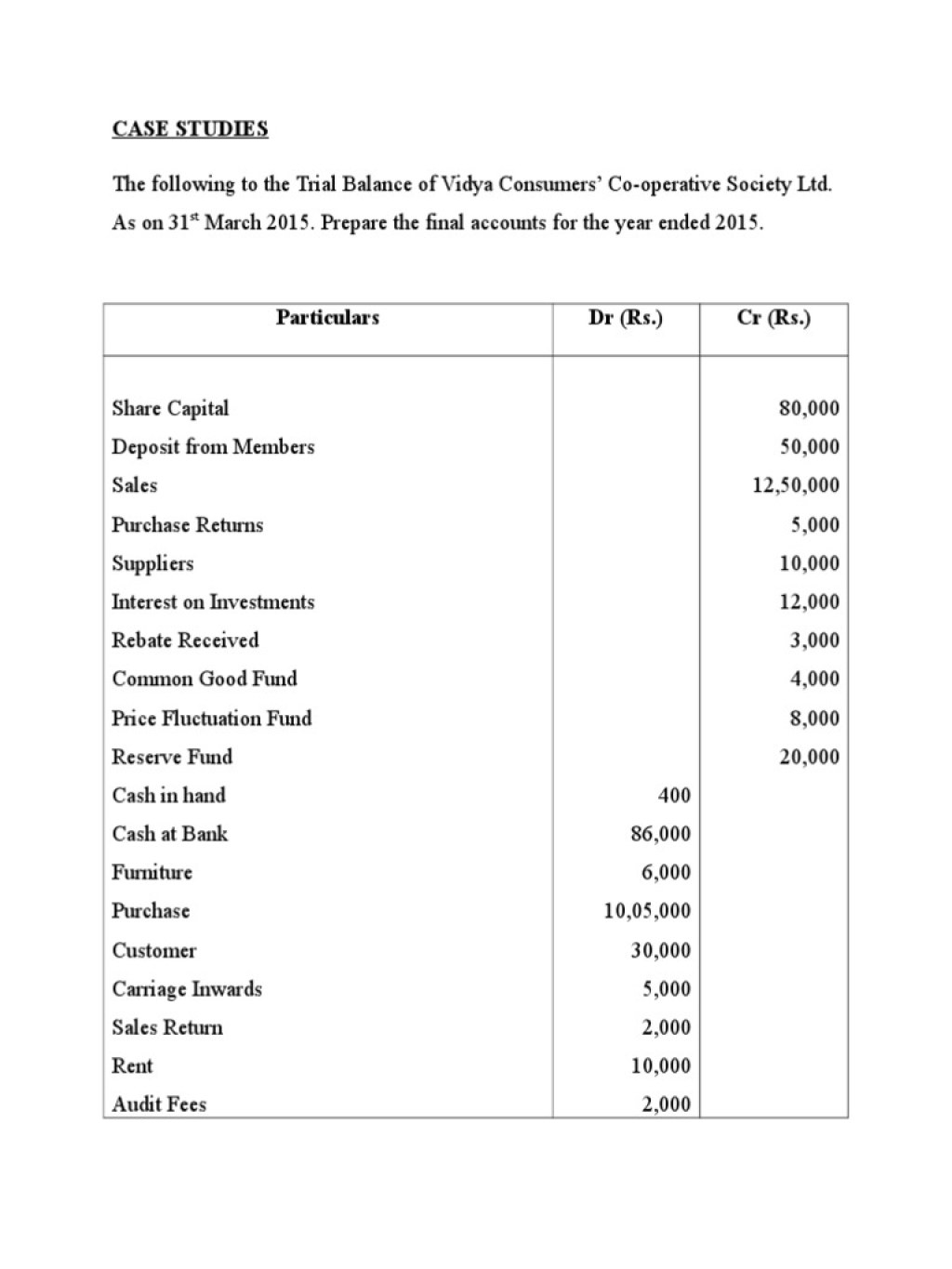

Greetings, Readers! In today’s article, we will delve into the topic of investment in final accounts and explore its significance in ensuring financial stability and growth. Whether you are an individual investor or a business owner, understanding the importance of effectively managing your finances is crucial for long-term success. So, let’s dive right in and explore the world of investment in final accounts.

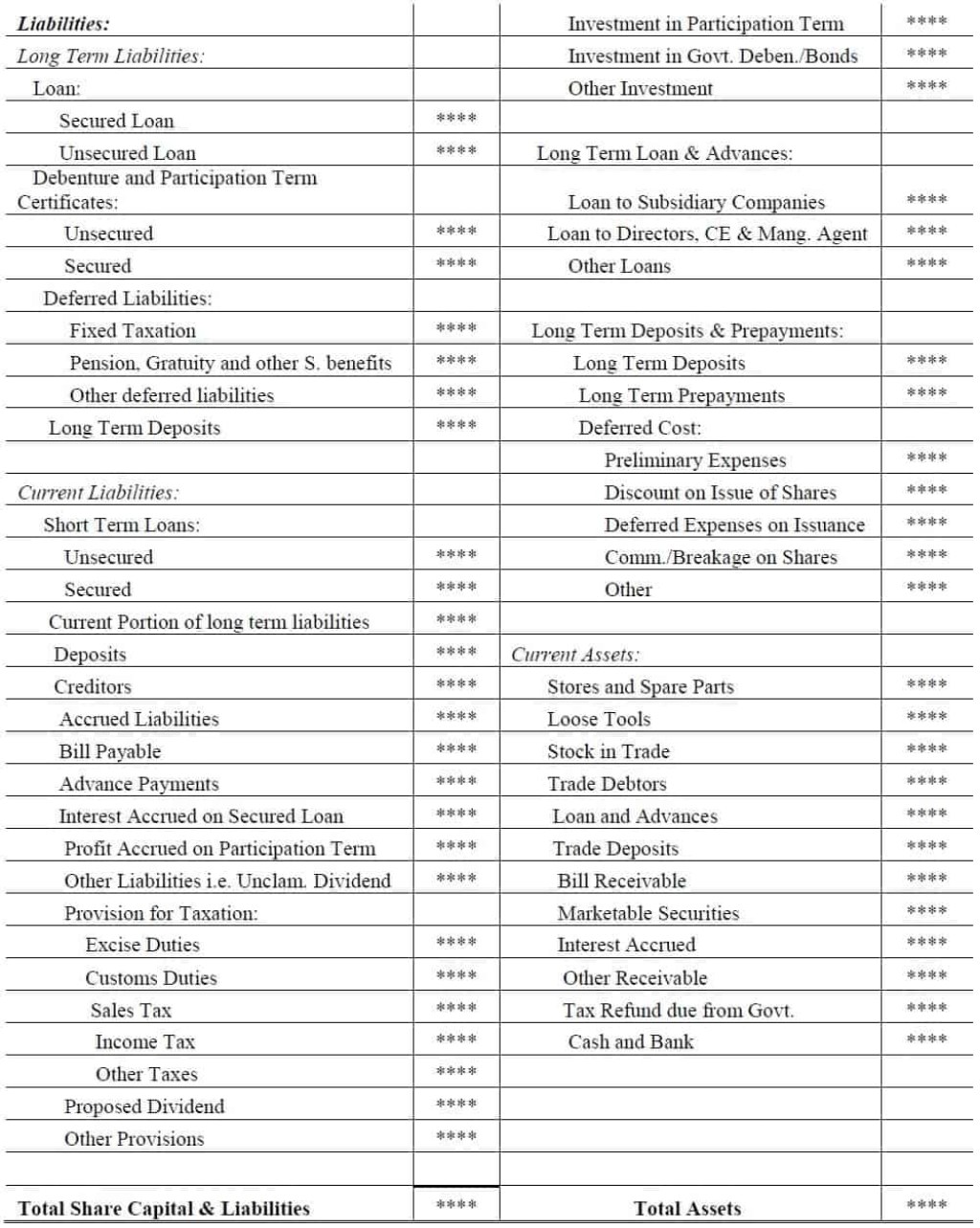

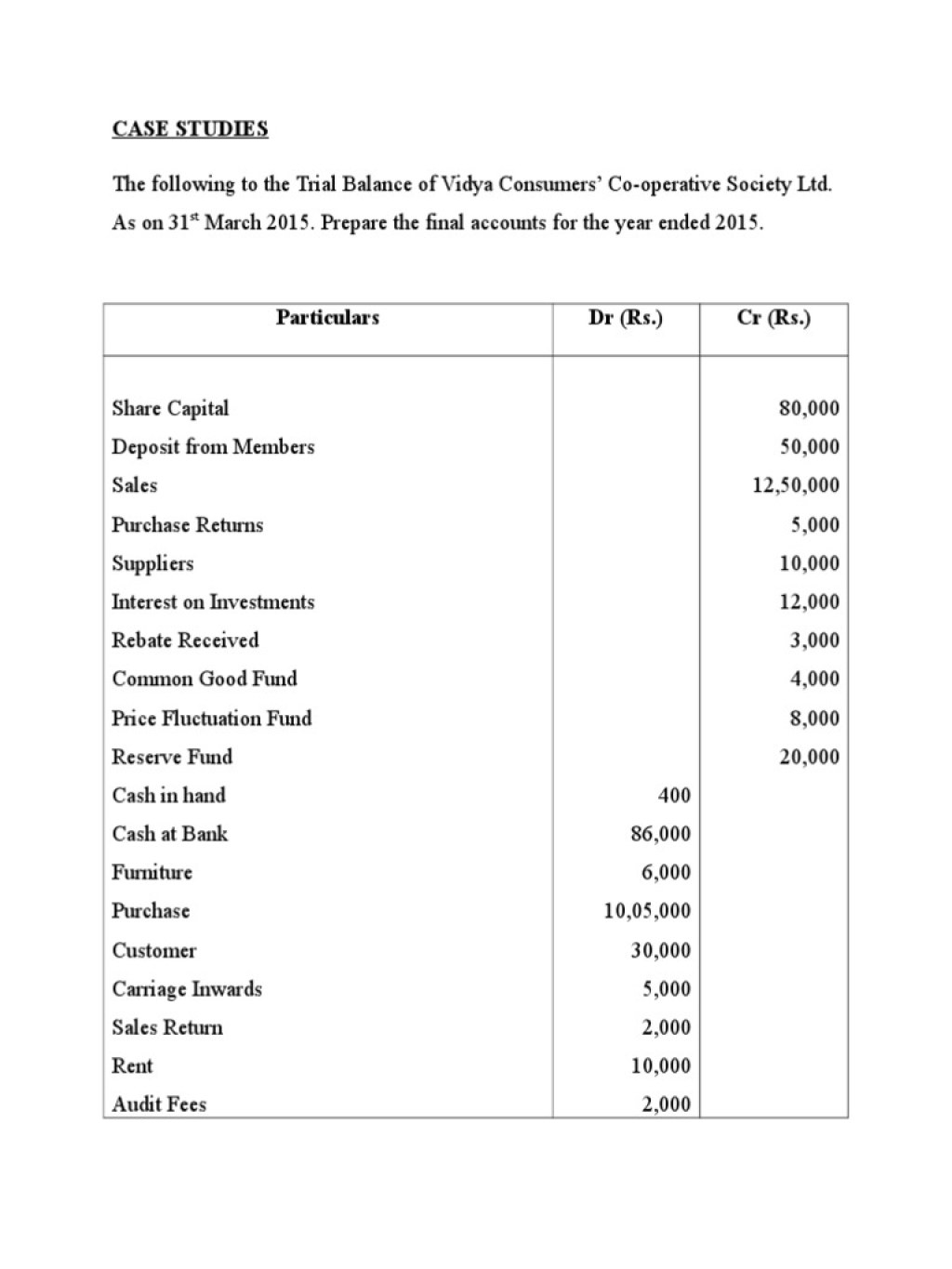

The Basics of Investment in Final Accounts

🔍 What is investment in final accounts?

2 Picture Gallery: Maximize Your Returns With Strategic Investment In Final Accounts: Unlock Your Financial Potential Now!

Investment in final accounts refers to the process of allocating financial resources to different assets and investments while considering their potential returns and risks. It involves carefully analyzing and planning the allocation of funds to maximize profits and achieve financial goals.

👥 Who can benefit from investment in final accounts?

Image Source: i0.wp.com

Investment in final accounts is relevant for individuals, businesses, and organizations of all sizes. Whether you are a small business owner looking to expand your operations or an individual seeking financial security for the future, this concept applies to you.

⌛ When should you consider investment in final accounts?

Investment in final accounts should be an ongoing process. However, it becomes particularly important during periods of financial growth, expansion, or when planning for retirement or future financial goals. Regular reviews and adjustments are essential to ensure optimal performance.

Image Source: scribdassets.com

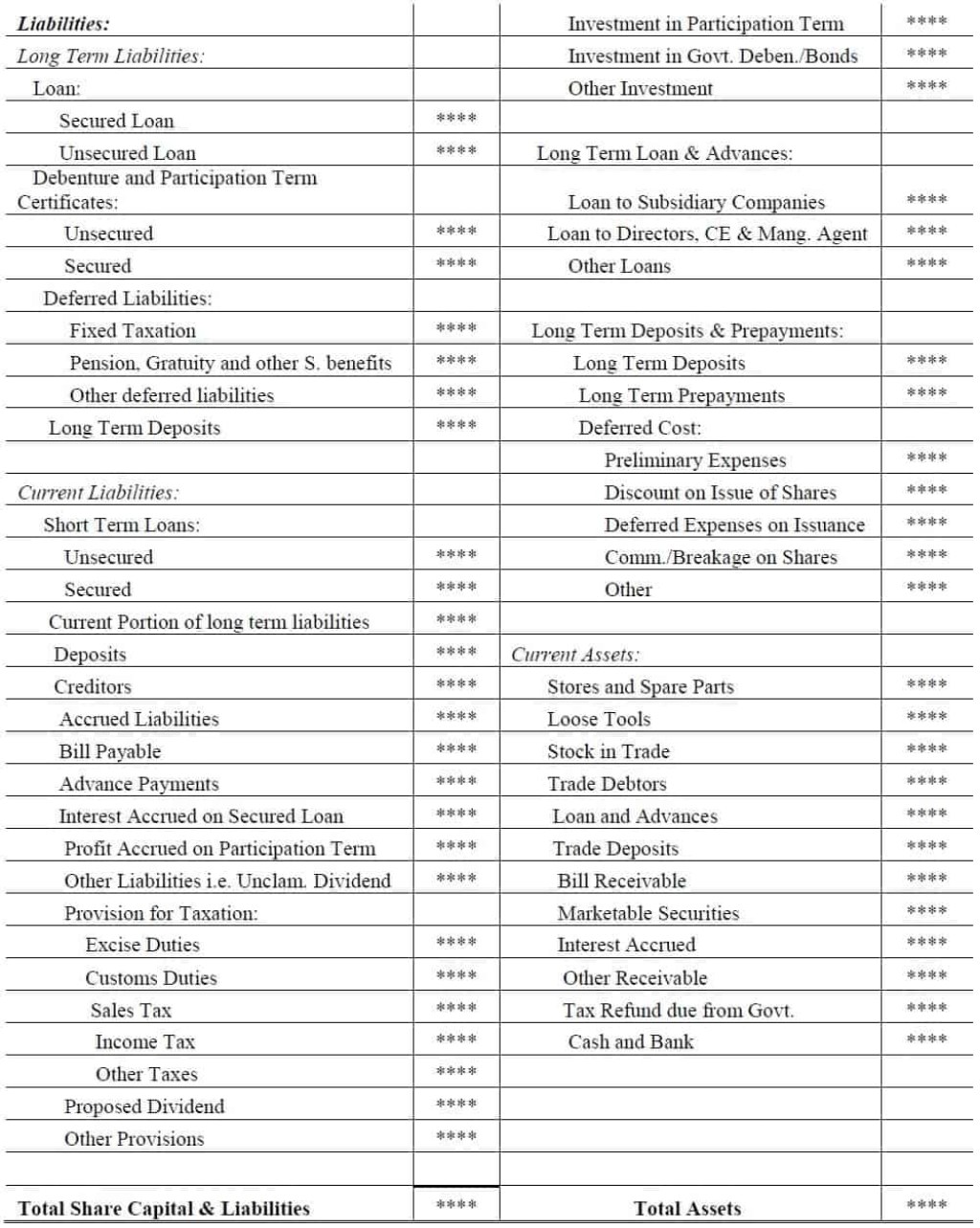

🌍 Where does investment in final accounts take place?

Investment in final accounts can be conducted in various financial markets, such as stock markets, bond markets, real estate, mutual funds, and other investment vehicles. The choice of investments depends on individual preferences, risk tolerance, and return expectations.

❓ Why is investment in final accounts crucial for financial success?

Investment in final accounts allows individuals and businesses to grow their wealth, preserve assets, and generate income streams. It provides opportunities to increase net worth through capital appreciation, dividends, interest, or rental income.

💡 How can you effectively implement investment in final accounts?

To effectively implement investment in final accounts, it is essential to conduct thorough research, seek professional advice, and develop a well-diversified investment portfolio. Regular monitoring, risk assessment, and adjusting strategies are crucial for long-term success.

The Advantages and Disadvantages of Investment in Final Accounts

Advantages:

📈 Potential for capital appreciation and wealth accumulation.

💰 Diversification of investment risks.

🌐 Access to various investment options and markets.

🔒 Preservation and protection of assets.

💼 Potential for generating passive income.

Disadvantages:

📉 Possibility of financial losses due to market volatility.

💸 Potential for investment scams and fraud.

⏳ Time-consuming research and monitoring requirements.

📊 Difficulty in predicting and timing market movements.

💼 Risk of investment portfolio underperformance.

Frequently Asked Questions (FAQ)

1. Q: Is investment in final accounts only for wealthy individuals?

A: No, investment in final accounts is suitable for individuals of all income levels. It can be tailored to meet specific financial goals and risk tolerance.

2. Q: How much should I invest in final accounts?

A: The amount to invest depends on your financial situation, goals, and risk appetite. Consult a financial advisor to determine an appropriate investment plan.

3. Q: Can investment in final accounts guarantee high returns?

A: Investment returns are subject to market fluctuations and risks. While higher returns are possible, they are not guaranteed. Diversification and risk management are essential.

4. Q: Should I invest in final accounts during economic downturns?

A: Economic downturns can present investment opportunities. However, careful analysis and consideration of risks are crucial during such periods.

5. Q: Can I invest in final accounts without professional assistance?

A: While professional assistance can be beneficial, individuals can also educate themselves and make informed investment decisions. However, self-research and due diligence are essential.

Conclusion: Take Control of Your Financial Future

In conclusion, investment in final accounts plays a vital role in managing and growing your finances. It allows you to seize opportunities, preserve wealth, and work towards your financial goals. However, it is important to remember that investment decisions should be made based on individual circumstances, risk tolerance, and thorough analysis.

By understanding the basics, advantages, and disadvantages of investment in final accounts, you can make informed decisions and take control of your financial future. Remember to seek professional advice when needed and stay updated with market trends.

So, start exploring your investment options today and embark on a journey towards financial success!

Final Remarks:

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice. Investing involves risks, and individuals should conduct their own research and consult professionals before making investment decisions. The author and website are not responsible for any financial losses or damages incurred.

This post topic: Tax Planning