Boost Your Financial Growth With Tax Plan G – Take Action Now!

Tax Plan G: A Comprehensive Approach to Taxation

Introduction

Dear Readers,

2 Picture Gallery: Boost Your Financial Growth With Tax Plan G – Take Action Now!

Welcome to our in-depth analysis of Tax Plan G, a comprehensive tax plan designed to address the complexities and challenges of the current tax system. In this article, we will delve into the details of Tax Plan G and explore its potential impact on individuals, businesses, and the economy as a whole.

Image Source: chinadaily.com.cn

With the ever-evolving landscape of taxation, it is crucial to stay informed and understand the implications of any proposed tax plan. Tax Plan G aims to streamline the tax code, promote economic growth, and ensure a fair and efficient tax system for all. So, let’s dive into the details and explore the key aspects of Tax Plan G.

Overview of Tax Plan G

Tax Plan G is a comprehensive tax reform proposal that seeks to simplify the tax code while maintaining fairness and efficiency. It introduces several key changes to the current tax system, including modifications to tax rates, deductions, and credits.

Under Tax Plan G, the tax rates will be restructured to provide relief for middle-income individuals and families while maintaining a competitive environment for businesses. It also aims to eliminate loopholes and deductions that disproportionately benefit the wealthy, ensuring a more equitable distribution of tax burdens.

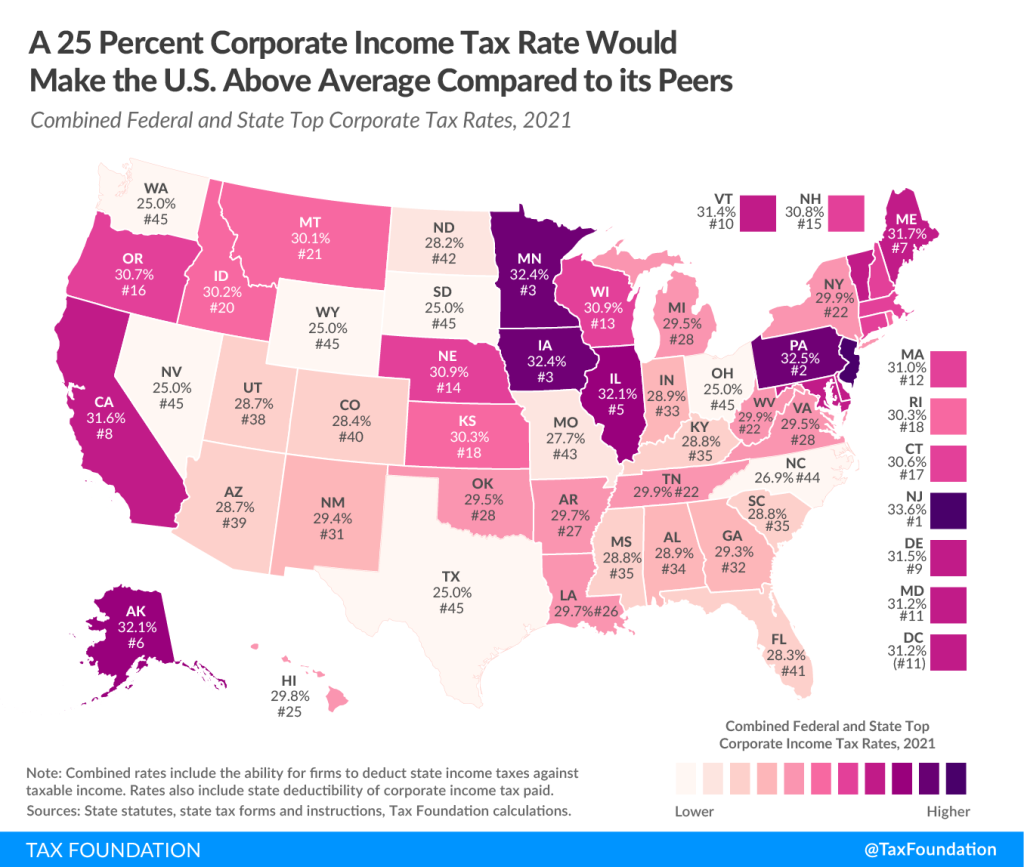

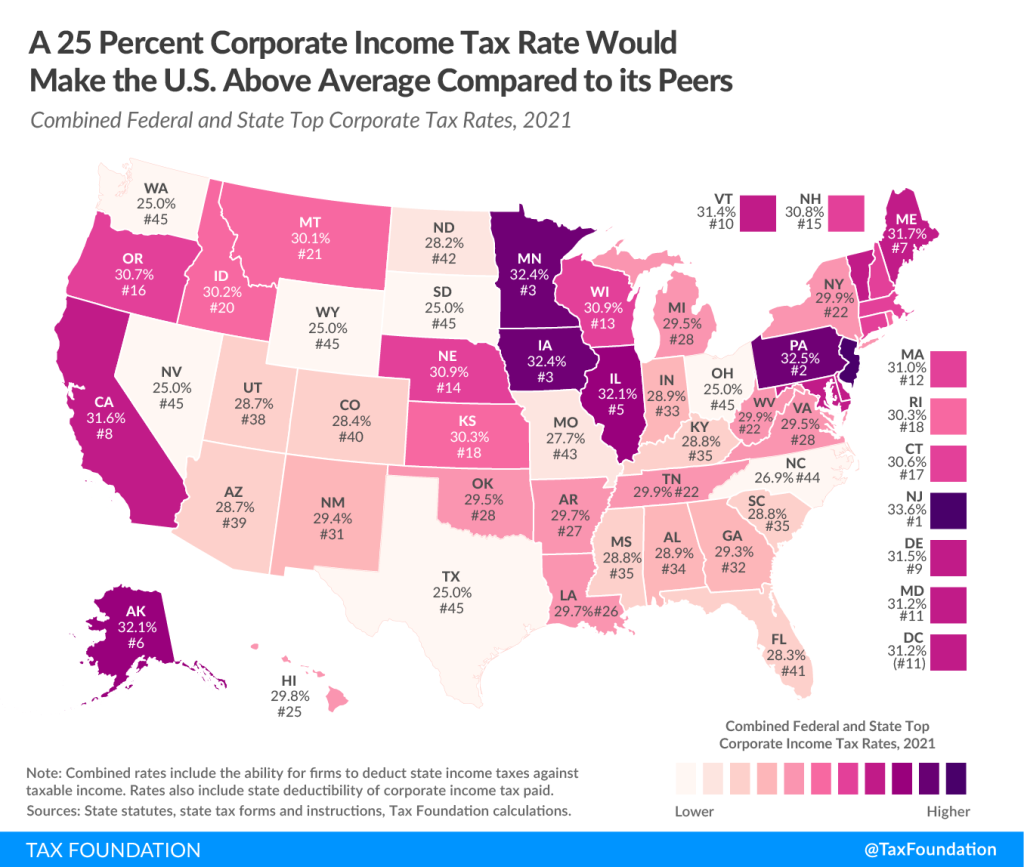

Image Source: taxfoundation.org

Furthermore, Tax Plan G proposes enhanced measures to combat tax evasion and promote tax compliance. It aims to strengthen enforcement efforts and close existing loopholes, ensuring that everyone pays their fair share of taxes.

Now, let’s dive deeper into the details of Tax Plan G and explore its key components.

What is Tax Plan G?

🔎 What: Tax Plan G is a comprehensive tax reform proposal aimed at simplifying the tax code and promoting fairness and efficiency.

Tax Plan G includes provisions to restructure tax rates, deductions, and credits to create a more equitable tax system.

📌 Why: The current tax system is complex and burdensome, often favoring the wealthy. Tax Plan G seeks to address these issues and create a fairer tax environment for all individuals and businesses.

📌 Who: Tax Plan G is proposed by a bipartisan group of lawmakers who recognize the need for comprehensive tax reform.

📌 When: The implementation of Tax Plan G is subject to legislative approval and may require additional considerations and amendments before becoming law.

📌 Where: Tax Plan G will have a nationwide impact, affecting individuals, businesses, and the overall economy.

📌 How: Tax Plan G will be implemented through changes to the tax code, requiring legislation and potential coordination between federal and state tax authorities.

Advantages and Disadvantages of Tax Plan G

Advantages:

1. 👍 Economic Growth: Tax Plan G aims to stimulate economic growth by providing relief for middle-income individuals and families, encouraging consumer spending and investment.

2. 👍 Fairness: By restructuring tax rates and eliminating loopholes, Tax Plan G aims to create a more equitable tax system, ensuring that all individuals and businesses pay their fair share.

3. 👍 Simplicity: Tax Plan G simplifies the tax code, making it easier for individuals and businesses to understand and comply with their tax obligations.

Disadvantages:

1. 👎 Revenue Impact: The implementation of Tax Plan G may result in a temporary reduction in tax revenue, which could require additional measures to maintain fiscal stability.

2. 👎 Transition Challenges: The transition to Tax Plan G may pose challenges for individuals and businesses in adjusting to the new tax rules and regulations.

3. 👎 Political Considerations: The approval and implementation of Tax Plan G may face political hurdles, as lawmakers may have differing opinions and priorities regarding tax reform.

Frequently Asked Questions (FAQs)

1. What impact will Tax Plan G have on small businesses?

Tax Plan G aims to provide tax relief for small businesses through lower tax rates and simplified tax reporting requirements. This can free up resources for investment and expansion.

2. Will Tax Plan G affect my personal income taxes?

Yes, Tax Plan G will likely impact personal income taxes. The restructuring of tax rates and deductions may result in changes to the amount of taxes individuals owe.

3. How will Tax Plan G address tax evasion?

Tax Plan G proposes enhanced measures to combat tax evasion, including stronger enforcement efforts, closing loopholes, and promoting tax compliance through stricter penalties for non-compliance.

4. Will Tax Plan G benefit low-income individuals?

Yes, Tax Plan G aims to provide relief for low-income individuals through targeted tax credits and deductions. This can help alleviate the tax burden on those with lower incomes.

5. What is the timeline for implementing Tax Plan G?

The timeline for implementing Tax Plan G depends on legislative approval and potential amendments. It may take time to coordinate and implement the necessary changes to the tax code.

Conclusion

In conclusion, Tax Plan G presents an opportunity for comprehensive tax reform that addresses the complexities and challenges of the current tax system. By streamlining the tax code, promoting fairness, and stimulating economic growth, Tax Plan G has the potential to create a more efficient and equitable tax environment for all individuals and businesses.

We encourage you to stay informed about the progress and developments surrounding Tax Plan G as it moves through the legislative process. Understanding the potential impact and implications of tax reform is crucial for individuals and businesses alike.

Thank you for joining us on this journey of exploring Tax Plan G. If you have any further questions or would like more information, please feel free to reach out to us.

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as legal or financial advice. The implementation and impact of tax reform can vary based on individual circumstances. We recommend consulting with a qualified tax professional for personalized guidance.

This post topic: Tax Planning