Maximize Your Savings With Expert Tax Planning IRS – Take Control Now!

Tax Planning IRS: Maximizing Your Financial Strategy

Greetings, Readers! In today’s article, we will explore the world of tax planning with the Internal Revenue Service (IRS). As we navigate the complexities of tax regulations and financial strategies, we aim to provide you with valuable information to enhance your financial planning. Let’s dive into the world of tax planning with the IRS!

Introduction

Tax planning with the IRS is a crucial aspect of financial management for individuals and businesses alike. It involves strategically organizing and managing your financial affairs to minimize tax liabilities while maximizing financial gains. By understanding the tax laws and regulations set by the IRS, individuals and businesses can make informed decisions to optimize their financial strategies.

3 Picture Gallery: Maximize Your Savings With Expert Tax Planning IRS – Take Control Now!

Effective tax planning allows you to take advantage of various deductions, credits, and exemptions provided by the IRS. It helps you reduce your taxable income, ultimately leading to significant savings. However, it is essential to navigate tax planning within legal boundaries to avoid penalties or audits from the IRS.

Let’s explore the key aspects of tax planning with the IRS:

What is Tax Planning IRS? 🧐

Tax planning with the IRS involves developing strategies to minimize tax liabilities while maximizing financial benefits within the framework of tax laws and regulations. It encompasses various activities such as analyzing financial transactions, structuring investments, and utilizing available tax incentives to optimize tax outcomes.

Image Source: twimg.com

Through tax planning, individuals and businesses can legally reduce the amount of tax they owe by taking advantage of deductions, credits, and exemptions provided by the IRS. It is a proactive approach that allows taxpayers to strategically manage their financial affairs and achieve their financial goals while complying with tax regulations.

Understanding the Internal Revenue Service (IRS) 🏛️

The IRS is the revenue service of the United States federal government. It is responsible for the administration and enforcement of the Internal Revenue Code, which encompasses tax laws and regulations. The IRS ensures that taxpayers meet their tax obligations and provides guidance on tax-related matters.

Working closely with the IRS during tax planning allows individuals and businesses to ensure compliance with tax laws while exploring opportunities for tax optimization. It is essential to stay informed about the latest IRS guidelines and regulations to make well-informed financial decisions.

Who Should Engage in Tax Planning with the IRS? 🤝

Tax planning with the IRS is relevant for individuals, families, and businesses of all sizes. From employees and self-employed individuals to small enterprises and large corporations, everyone can benefit from effective tax planning. Regardless of your income level or business size, understanding tax laws and implementing strategic tax planning can help you minimize tax liabilities and maximize financial gains.

Benefits of Tax Planning with the IRS ✅

1. Minimizing Tax Liabilities: By analyzing your financial situation and leveraging available tax incentives, you can strategically reduce your taxable income and lower your overall tax burden.

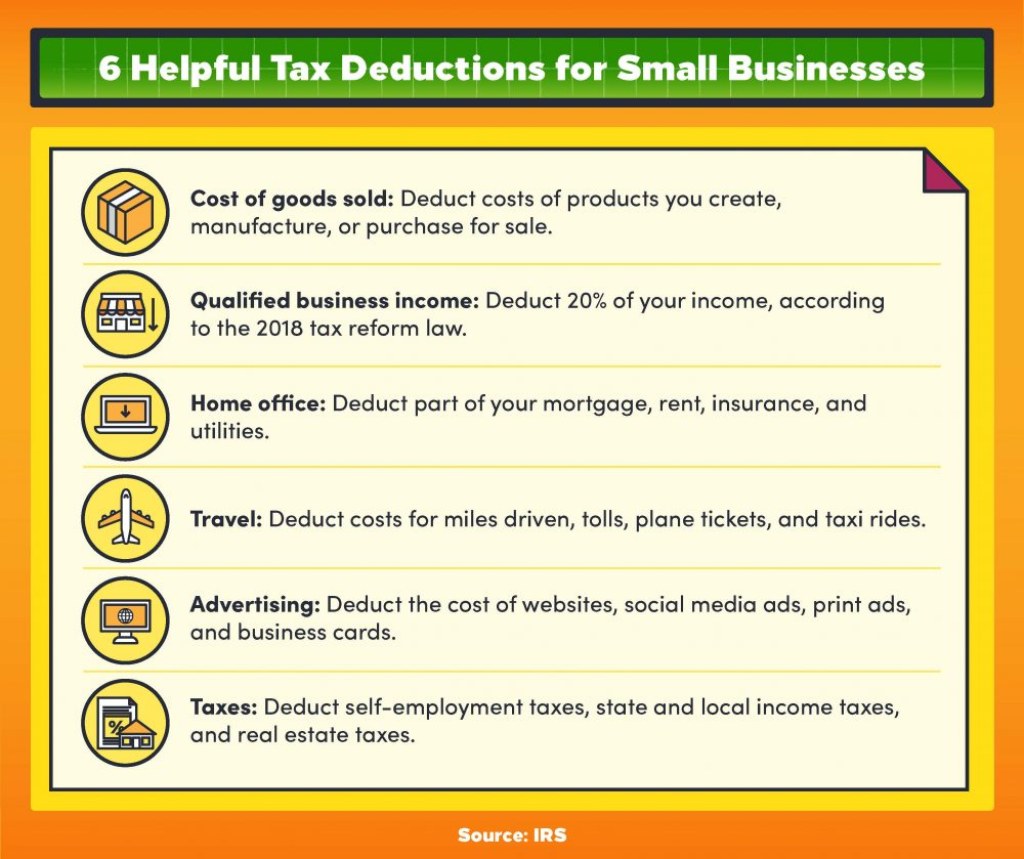

Image Source: amazonaws.com

2. Maximizing Deductions and Credits: Proper tax planning allows you to identify and utilize deductions and credits to their fullest extent, resulting in increased savings and financial benefits.

3. Optimizing Investment Strategies: Understanding the tax implications of various investment options helps you make informed decisions, ensuring tax efficiency and maximizing returns.

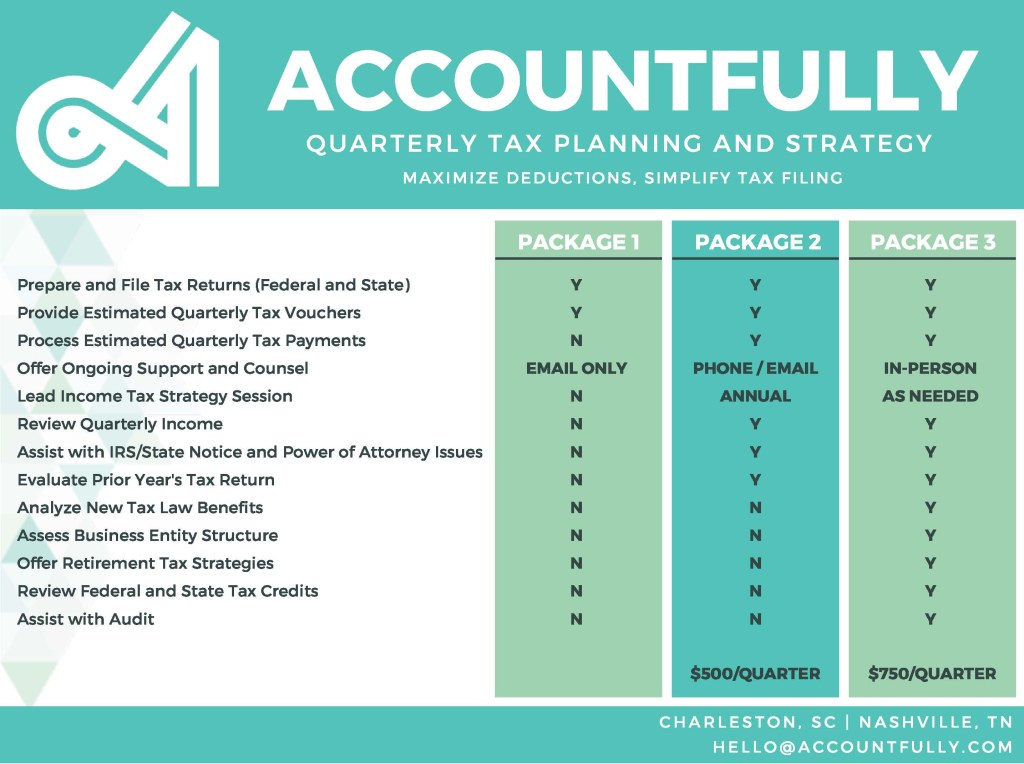

Image Source: website-files.com

4. Avoiding Penalties and Audits: Engaging in tax planning with the IRS ensures compliance with tax laws, reducing the risk of penalties or audits that may arise from unintentional errors or omissions.

5. Achieving Financial Goals: By strategically managing your tax liabilities, tax planning helps you allocate more resources towards achieving your financial goals, such as saving for retirement or funding education.

Disadvantages of Tax Planning with the IRS ❌

1. Complexity and Time-Consuming: Tax planning requires a thorough understanding of tax laws and regulations, which can be complex and time-consuming, especially for individuals without a financial background.

2. Changing Tax Laws: Tax laws and regulations are subject to change, making it essential for taxpayers to stay updated and adapt their tax planning strategies accordingly.

3. Potential Risks: Engaging in aggressive tax planning strategies or crossing legal boundaries can result in penalties, audits, or damage to your reputation.

4. Dependence on Professional Advice: Some tax planning strategies may require the assistance of tax professionals, incurring additional expenses.

5. Limited Flexibility: Tax planning strategies may limit certain financial decisions, as they are designed to minimize tax liabilities rather than solely focus on individual financial goals.

When Should You Start Tax Planning with the IRS? ⏰

Tax planning with the IRS should ideally start at the beginning of each financial year. By proactively planning your finances and considering tax implications, you can maximize your tax savings and ensure compliance with tax laws. However, it is never too late to start tax planning, and individuals can benefit from tax planning strategies at any time.

Where Can You Seek Tax Planning Assistance? 🌍

Seeking professional assistance from tax advisors, accountants, or tax attorneys is highly recommended for effective tax planning with the IRS. These professionals are well-versed in tax laws and regulations and can provide valuable guidance tailored to your specific financial situation. Additionally, online resources and IRS publications can also serve as helpful references.

Why Is Tax Planning with the IRS Essential? 🤔

Tax planning with the IRS is essential for several reasons:

1. Minimizing Tax Liabilities: Effective tax planning helps individuals and businesses minimize their tax liabilities, allowing them to keep more of their hard-earned money.

2. Legal Compliance: Tax planning ensures compliance with tax laws and regulations, reducing the risk of penalties, audits, or legal issues.

3. Financial Optimization: By strategically managing tax liabilities, individuals and businesses can allocate resources towards achieving their financial goals.

4. Maximizing Savings: Proper tax planning allows taxpayers to take advantage of deductions, credits, and exemptions, resulting in increased savings.

5. Planning for the Future: Engaging in tax planning enables individuals and businesses to plan for future financial milestones, such as retirement, education, or business expansion.

How Can You Implement Tax Planning Strategies? 📝

Implementing tax planning strategies involves several key steps:

1. Assess Your Financial Situation: Understand your income, expenses, assets, and liabilities to determine the most effective tax planning strategies for your specific circumstances.

2. Stay Informed: Keep up-to-date with the latest tax laws, regulations, and IRS guidelines to ensure compliance and identify potential tax-saving opportunities.

3. Utilize Available Tax Incentives: Identify deductions, credits, and exemptions relevant to your financial situation and leverage them to minimize tax liabilities.

4. Consider Long-Term Financial Goals: Align your tax planning strategies with your long-term financial goals to ensure tax efficiency while achieving your objectives.

5. Seek Professional Guidance: Consult with tax advisors, accountants, or tax attorneys to receive personalized advice based on your financial situation and goals.

Frequently Asked Questions (FAQs) ❓

1. Is tax planning legal?

Yes, tax planning is legal as long as it is conducted within the boundaries of tax laws and regulations set by the IRS. Engaging in legal tax planning strategies allows individuals and businesses to optimize their financial outcomes while ensuring compliance.

2. Can tax planning save me money?

Yes, tax planning can save you money by minimizing your tax liabilities through the strategic use of deductions, credits, and exemptions. By taking advantage of available tax incentives, you can reduce your taxable income and increase your savings.

3. Do I need a tax advisor for tax planning?

While it is not mandatory to have a tax advisor, seeking professional guidance can significantly benefit your tax planning endeavors. Tax advisors possess in-depth knowledge of tax laws and regulations and can provide valuable insights tailored to your specific financial situation.

4. Can tax planning help me with estate planning?

Yes, tax planning often goes hand in hand with estate planning. By structuring your estate in a tax-efficient manner, you can minimize estate tax liabilities and ensure a smooth transfer of assets to your heirs.

5. How often should I review my tax planning strategies?

It is recommended to review your tax planning strategies annually, especially at the beginning of each financial year. However, major life events such as marriage, the birth of a child, or significant changes in income should prompt a reassessment of your tax planning strategies.

Conclusion: Take Charge of Your Financial Strategy! ✔️

By engaging in tax planning with the IRS, you can optimize your financial strategy and achieve your long-term goals. Effective tax planning allows you to minimize tax liabilities, maximize savings, and ensure compliance with tax laws. Remember to stay informed, seek professional guidance when needed, and align your tax planning strategies with your financial objectives. Take charge of your financial future today!

Disclaimer:

The information provided in this article is for general informational purposes only and should not be considered as professional advice. Tax laws and regulations can vary, and it is advisable to consult with a qualified tax professional before making any financial decisions based on the information presented in this article.

This post topic: Tax Planning