Maximize Your Savings: Essential Tax Planning Strategies For 6 Lakhs Salary

Tax Planning for 6 Lakhs Salary

Introduction

Dear Readers,

2 Picture Gallery: Maximize Your Savings: Essential Tax Planning Strategies For 6 Lakhs Salary

Welcome to our comprehensive guide on tax planning for those earning a salary of 6 lakhs. In this article, we will explore various strategies and tips to help you minimize your tax liability legally and efficiently. By implementing effective tax planning techniques, you can optimize your savings and secure a better financial future.

Overview

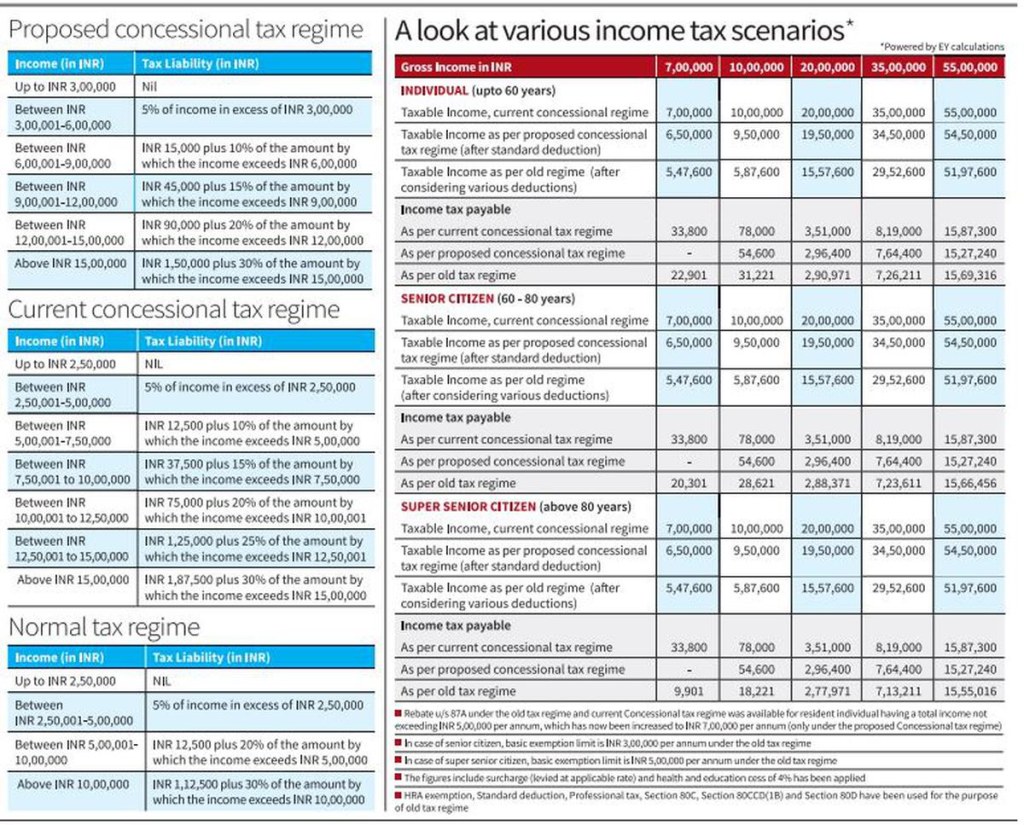

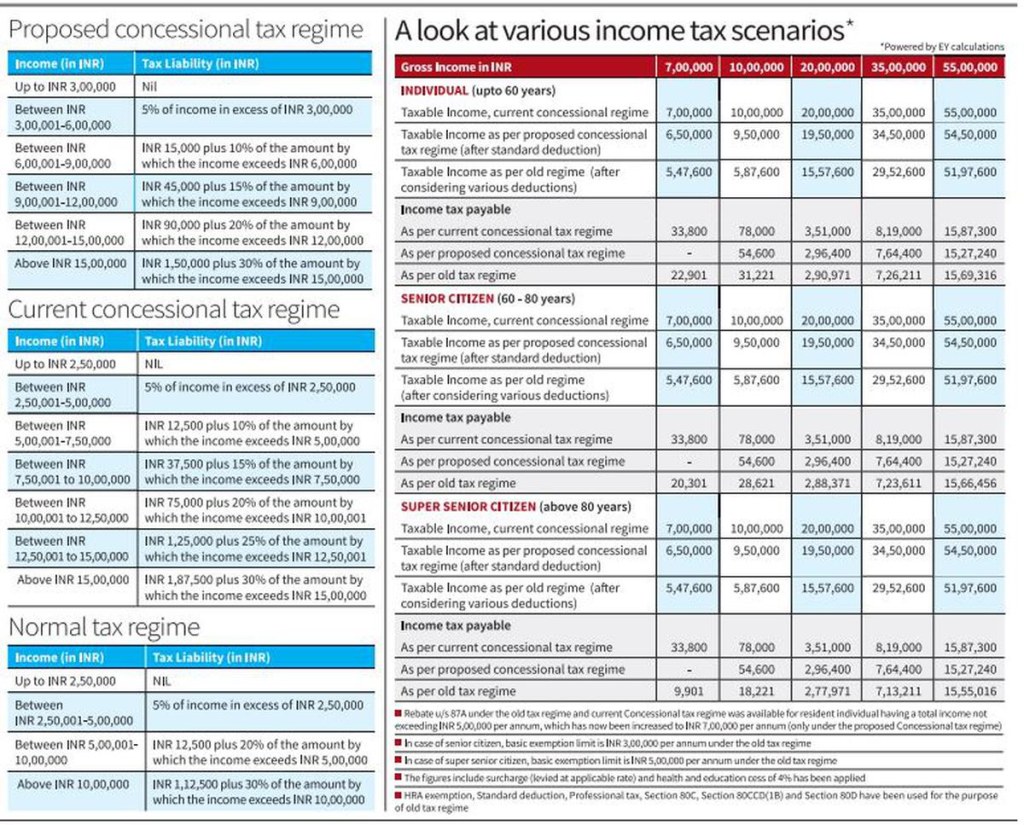

Image Source: thgim.com

Before we delve into the details, let’s understand the basics of tax planning. Tax planning is the process of organizing your finances in a way that reduces your tax liability. It involves utilizing legal exemptions, deductions, and incentives provided by the government to minimize the amount of tax you have to pay.

What is Tax Planning?

✅ Tax planning refers to the proactive arrangement of your financial affairs to minimize your tax liability.

Tax planning involves analyzing your income, investments, and expenses to identify opportunities for reducing your tax burden. By strategically managing these factors, you can legally lower the amount of tax you owe to the government.

Who Can Benefit from Tax Planning?

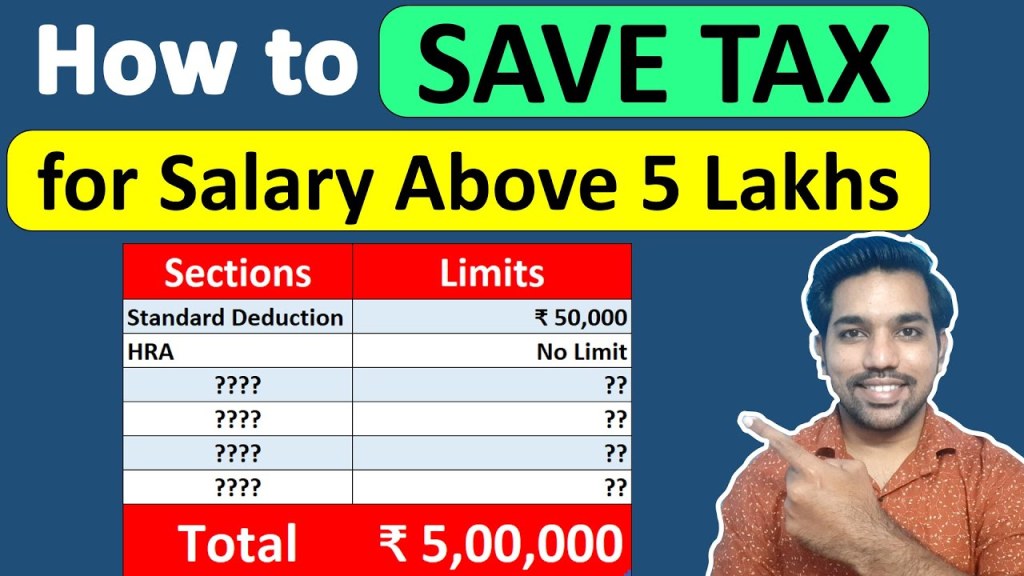

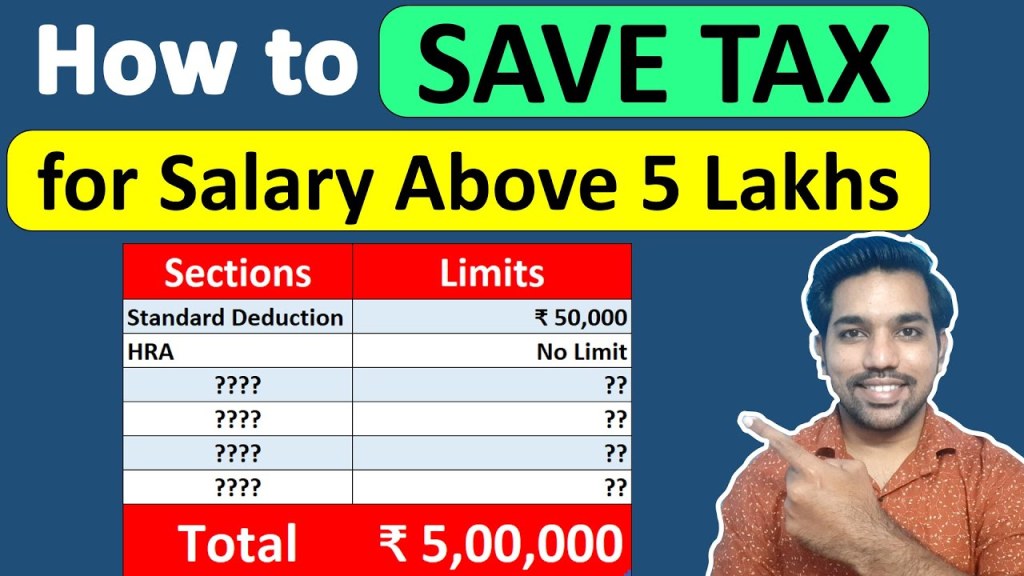

Image Source: ytimg.com

✅ Employees earning a salary of 6 lakhs can benefit from tax planning strategies.

If you earn a salary of 6 lakhs, tax planning can help you optimize your savings by reducing your taxable income and taking advantage of deductions and exemptions available under the tax laws. By effectively planning your taxes, you can ensure that you pay only what is legally required and retain more of your hard-earned money.

When Should You Start Tax Planning?

✅ It is advisable to start tax planning at the beginning of the financial year.

To maximize your tax savings, it’s essential to start tax planning early in the financial year. By planning in advance, you can structure your investments and expenses in a way that aligns with the tax laws and guidelines. This will enable you to take advantage of available tax deductions and exemptions throughout the year.

Where to Seek Professional Help?

✅ Consulting a qualified tax professional can ensure effective tax planning.

Tax laws and regulations can be complex and subject to frequent changes. Seeking assistance from a qualified tax professional, such as a certified public accountant or a tax advisor, can help you navigate through the intricacies of tax planning. They can provide expert advice tailored to your specific financial situation and ensure compliance with tax laws.

Why Is Tax Planning Important?

✅ Tax planning is important to optimize your savings and minimize your tax liability.

Effective tax planning allows you to take advantage of various tax deductions, exemptions, and incentives provided by the government. By reducing your taxable income, you can lower your overall tax liability and retain more money in your pocket. Additionally, tax planning helps you stay compliant with tax laws and avoid any penalties or legal issues.

How to Begin Tax Planning?

✅ To start tax planning, gather all relevant financial information and familiarize yourself with tax laws.

The first step in tax planning is to gather all your financial documents, such as salary slips, investment statements, and expense records. Next, educate yourself about the latest tax laws and regulations applicable to your income bracket. This will help you identify eligible deductions, exemptions, and other tax-saving opportunities. Finally, create a comprehensive tax plan that aligns with your financial goals and objectives.

Advantages and Disadvantages of Tax Planning for 6 Lakhs Salary

Advantages:

✅ Lower tax liability, leading to increased savings.

✅ Optimization of tax exemptions and deductions.

✅ Improved financial planning and goal achievement.

✅ Reduction of tax-related stress and anxiety.

✅ Enhanced knowledge and understanding of personal finance.

Disadvantages:

❌ Time-consuming process requiring thorough research and analysis.

❌ Need for professional assistance in complex tax matters.

❌ Frequent changes in tax laws and regulations.

❌ Possibility of errors or mistakes leading to penalties.

❌ Limited availability of certain tax benefits based on income and investments.

Frequently Asked Questions (FAQs)

1. Can tax planning help me save money?

✅ Yes, tax planning can help you save money by minimizing your tax liability and optimizing deductions and exemptions.

2. Are tax planning strategies the same for everyone?

✅ No, tax planning strategies vary based on individual circumstances, income, and investments. It is advisable to consult a tax professional for personalized guidance.

3. Can tax planning help me reduce tax-related stress?

✅ Yes, effective tax planning can reduce tax-related stress by ensuring compliance with tax laws and minimizing the chances of penalties or legal issues.

4. Is tax planning legal?

✅ Yes, tax planning involves utilizing legal exemptions, deductions, and incentives provided by the government to minimize tax liability. It is essential to stay within the legal boundaries while planning your taxes.

5. What happens if I make a mistake in my tax planning?

✅ Mistakes in tax planning can lead to penalties, additional tax liability, or legal consequences. It is advisable to seek professional assistance and double-check your tax returns to avoid errors.

Conclusion

In conclusion, tax planning is a crucial aspect of financial management, especially for individuals earning a salary of 6 lakhs. By implementing effective tax planning strategies, you can optimize your savings, reduce your tax liability, and secure a better financial future. Remember to gather all relevant financial information, seek professional advice when needed, and stay updated with the latest tax laws and regulations. Start your tax planning journey today and take control of your finances!

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as professional advice. Tax laws and regulations are subject to change, and individual circumstances may vary. It is advisable to consult a qualified tax professional for personalized guidance tailored to your specific financial situation. We do not assume any responsibility or liability for the use of the information provided.

This post topic: Tax Planning