Maximize Your Savings With Deloitte’s Expert Tax Planning Solutions

Tax Planning Deloitte: Maximizing Your Financial Strategies

Introduction

Dear Readers,

2 Picture Gallery: Maximize Your Savings With Deloitte’s Expert Tax Planning Solutions

Welcome to our comprehensive guide on tax planning strategies with Deloitte. In today’s complex financial landscape, effective tax planning can make a significant difference in maximizing your wealth and achieving your financial goals. In this article, we will delve into the various aspects of tax planning with Deloitte, exploring what it is, who can benefit from it, when and where it is applicable, why it is important, and how to implement it successfully.

Image Source: deloitte.com

Now, let’s dive into the world of tax planning and discover how Deloitte can assist you in optimizing your financial strategies.

What is Tax Planning Deloitte?

🔍 Tax planning Deloitte refers to the specialized services offered by Deloitte, a leading global provider of audit, consulting, tax, and advisory services. As tax regulations continue to evolve and become increasingly complex, Deloitte helps individuals and businesses develop effective strategies to minimize tax liabilities while ensuring compliance with applicable laws and regulations.

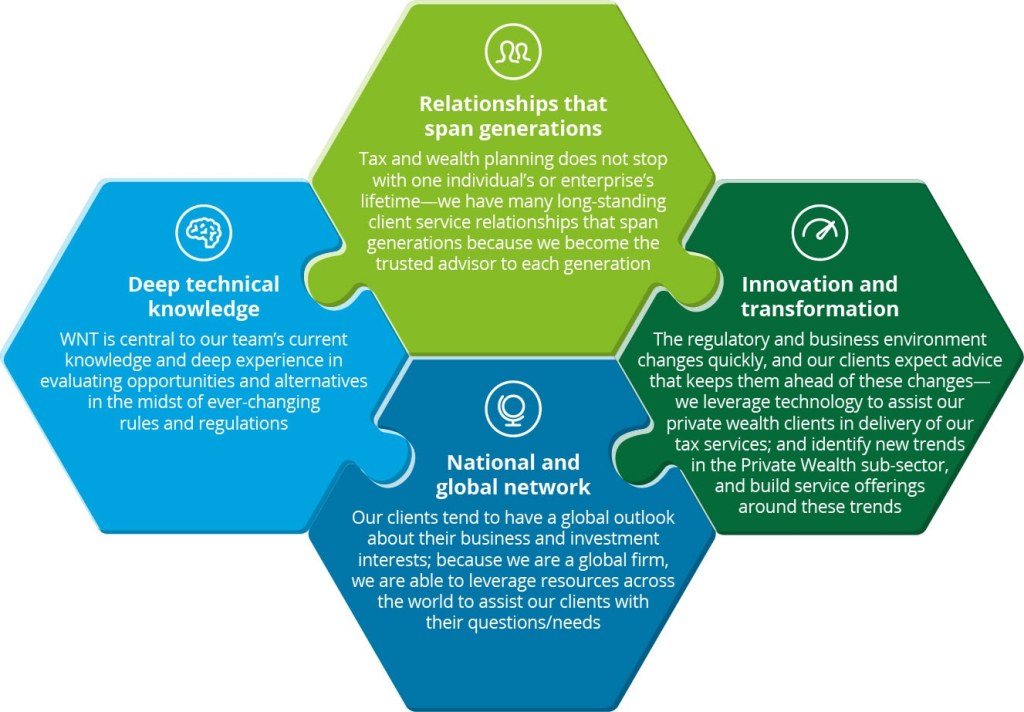

🔍 With a team of experienced professionals and a deep understanding of local and international tax systems, Deloitte provides tailored tax planning solutions to help clients navigate through the intricacies of tax regulations and optimize their financial positions.

📝 Overview of Tax Planning Deloitte

Image Source: deloitte.com

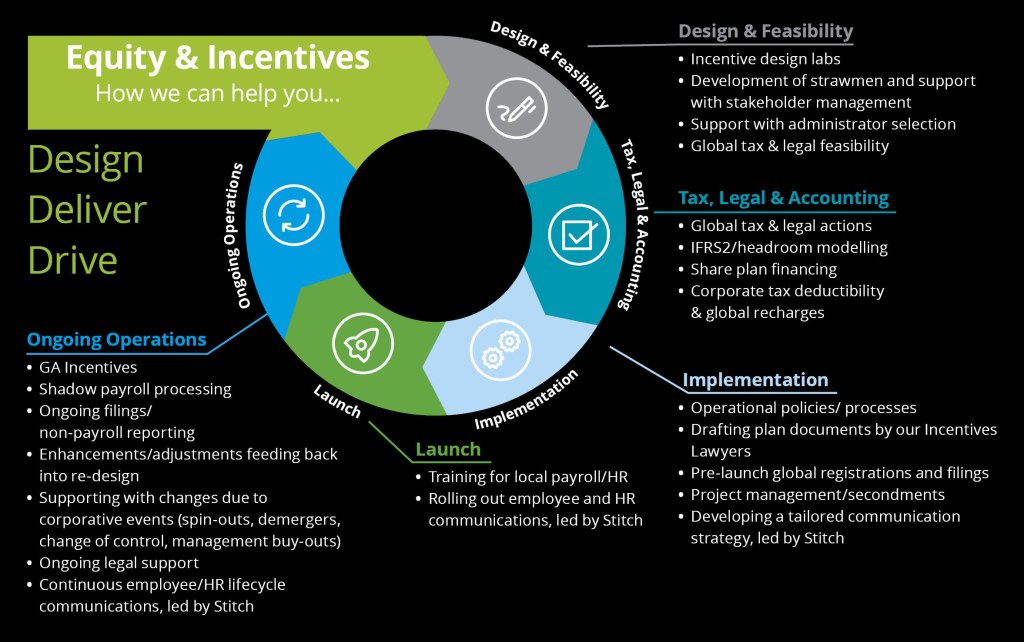

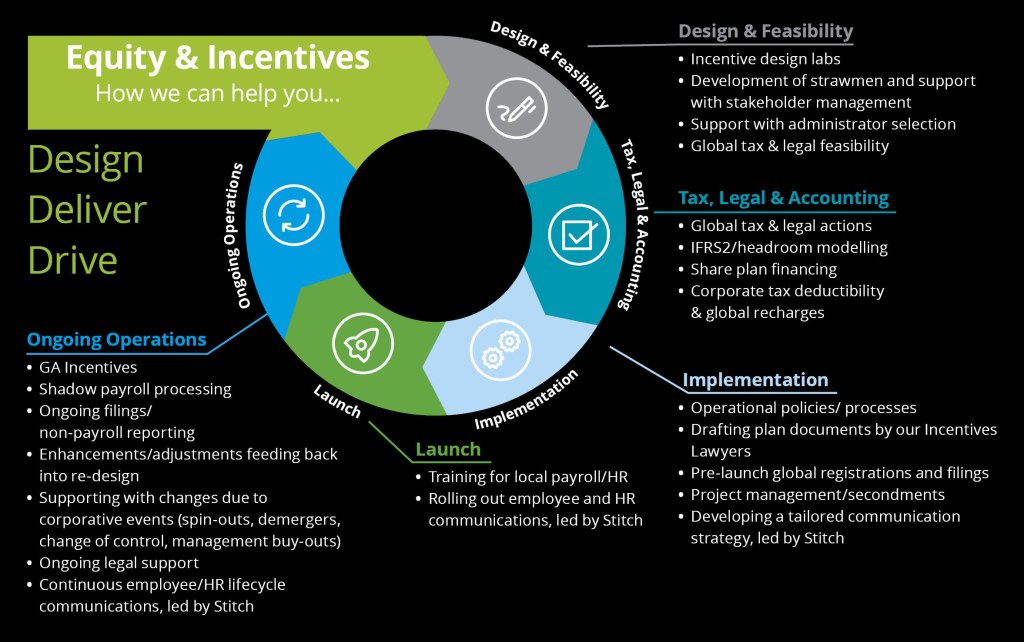

Deloitte’s tax planning services encompass a wide range of areas, including:

Personal and corporate income tax planning

International tax planning

Estate and wealth transfer planning

Indirect tax planning

Transfer pricing

Employee compensation and benefits planning

Compliance and reporting

With their extensive knowledge and expertise, Deloitte’s tax professionals work closely with clients to identify opportunities, mitigate risks, and optimize tax outcomes.

Who Can Benefit from Tax Planning Deloitte?

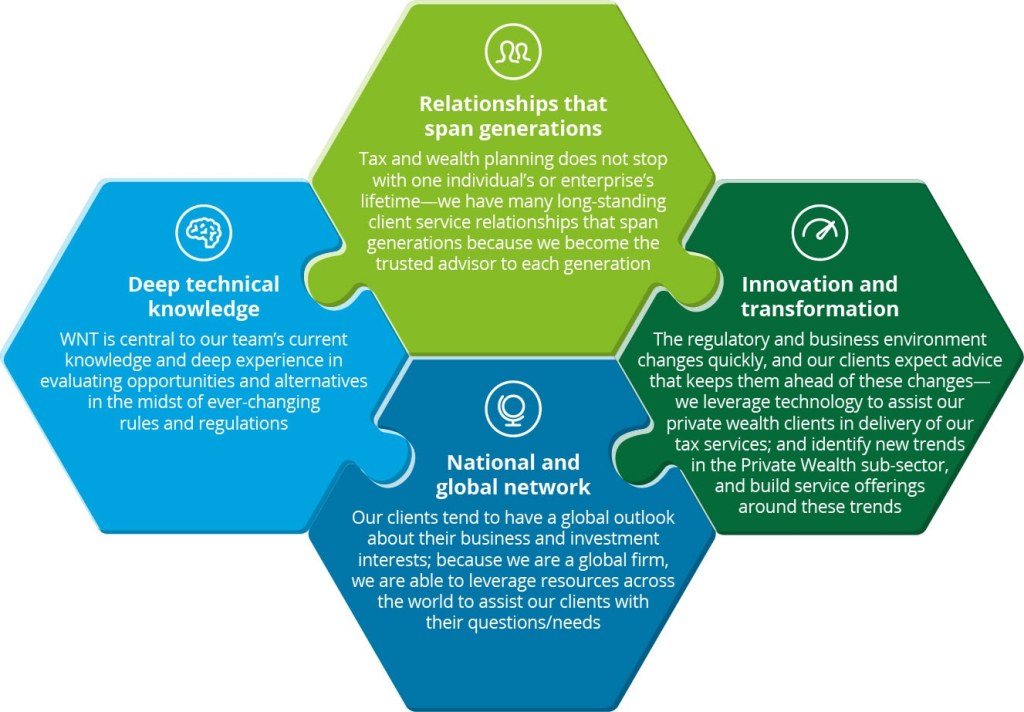

🔍 Tax planning with Deloitte is beneficial for individuals, businesses, and organizations of all sizes and industries. Whether you are a high-net-worth individual, a small business owner, or a multinational corporation, Deloitte’s tax planning services can help you achieve your financial objectives while minimizing your tax burden.

🔍 Deloitte’s tax planning solutions are specifically tailored to meet the unique needs and goals of each client, ensuring that they are compliant with applicable tax laws and regulations while maximizing tax efficiencies.

When and Where is Tax Planning Deloitte Applicable?

🔍 Tax planning with Deloitte is applicable in various scenarios and jurisdictions. Whether you are looking to optimize your personal tax situation, expand your business internationally, plan for your estate and succession, or ensure compliance with indirect tax regulations, Deloitte’s global network of professionals can provide valuable insights and solutions.

🔍 With a presence in over 150 countries and territories, Deloitte offers comprehensive tax planning services on a global scale. Their deep understanding of local tax laws and regulations, combined with their global perspective, allows them to effectively navigate the complexities of cross-border transactions and international tax planning.

Why is Tax Planning Deloitte Important?

🔍 Tax planning with Deloitte is vital for several reasons:

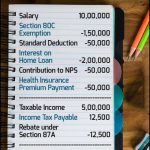

Minimizing Tax Liabilities: By strategically planning your tax affairs, you can reduce your tax liabilities and retain more of your hard-earned money.

Ensuring Compliance: Tax laws and regulations are constantly changing. Deloitte’s tax professionals stay up to date with the latest developments, ensuring that your tax planning strategies are compliant with applicable laws.

Optimizing Financial Strategies: Effective tax planning allows you to align your financial strategies with your overall objectives, maximizing your wealth accumulation and growth potential.

Gaining Competitive Advantage: By utilizing Deloitte’s expertise, you can gain a competitive advantage in your industry by optimizing your tax position and freeing up resources for investment and innovation.

How to Implement Tax Planning Deloitte Successfully?

🔍 Implementing tax planning strategies with Deloitte requires a systematic approach:

Assessment: Deloitte’s tax professionals will assess your current financial situation, goals, and risk tolerance to develop a tailored tax planning strategy.

Strategy Development: Based on the assessment, Deloitte will design a comprehensive tax planning strategy that aligns with your objectives and complies with applicable laws.

Implementation: Deloitte will work closely with you to implement the tax planning strategy, ensuring all necessary actions are taken to optimize your tax position.

Monitoring and Review: Tax laws and regulations are constantly evolving. Deloitte will continuously monitor your tax planning strategy, making adjustments as necessary to ensure continued compliance and maximized benefits.

Advantages and Disadvantages of Tax Planning Deloitte

Advantages:

✅ Expertise: Deloitte’s tax professionals possess in-depth knowledge and experience in tax planning, ensuring that you receive the best advice and strategies.

✅ Global Reach: With a global network, Deloitte can support your tax planning needs across different jurisdictions, helping you navigate complex international tax systems.

✅ Tailored Solutions: Deloitte understands that every client has unique needs and goals. Their tax planning services are customized to address your specific circumstances, maximizing your tax efficiencies.

Disadvantages:

❌ Cost: Engaging Deloitte’s tax planning services may involve additional costs. However, the potential tax savings and benefits often outweigh the expenses.

❌ Complexity: Tax planning can be complex, especially in an ever-changing regulatory environment. Deloitte’s expertise helps simplify the process, but it still requires careful consideration and professional guidance.

Frequently Asked Questions (FAQ)

Q: Can tax planning with Deloitte help reduce my overall tax burden?

A: Yes, Deloitte’s tax planning services are designed to help you minimize your tax liabilities while ensuring compliance with applicable laws and regulations. By employing effective tax strategies, you can potentially reduce your overall tax burden.

Q: Is tax planning only beneficial for high-net-worth individuals?

A: No, tax planning with Deloitte is beneficial for individuals and businesses of all sizes. Whether you have a complex personal tax situation or operate a multinational corporation, Deloitte’s tax planning expertise can help you optimize your tax position.

Q: Can Deloitte assist with international tax planning?

A: Absolutely, Deloitte has a global network of professionals with deep expertise in international tax planning. They can assist you in navigating the complexities of cross-border transactions and ensure compliance with international tax regulations.

Q: How often should I review my tax planning strategy?

A: Tax laws and regulations are constantly changing. It is recommended to review your tax planning strategy on a regular basis, typically at least once a year or when significant changes occur in your financial situation or the regulatory environment.

Q: What are the potential risks of not engaging in tax planning?

A: Failing to engage in tax planning can result in missed opportunities to minimize tax liabilities and optimize your financial position. It may also expose you to penalties and compliance issues if you unintentionally violate tax laws.

Conclusion: Take Action and Optimize Your Tax Planning with Deloitte

In conclusion, effective tax planning with Deloitte is crucial to optimize your financial strategies, minimize tax liabilities, and achieve your goals. By leveraging Deloitte’s expertise, you can navigate the complexities of tax regulations and gain a competitive advantage in your industry.

Take action today and consult with Deloitte’s tax professionals to develop a comprehensive tax planning strategy that aligns with your objectives. Start maximizing your financial potential and secure a brighter future.

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as professional advice. Tax planning is a complex matter, and it is recommended to consult with qualified professionals, such as Deloitte, for personalized guidance tailored to your specific circumstances.

This post topic: Tax Planning