Unlocking Financial Success: Essential Tax Planning Questions To Ask Clients For Maximum Savings – Take Action Now!

Tax Planning Questions to Ask Clients

Greetings, Readers!

Welcome to our article on tax planning questions to ask clients. In this comprehensive guide, we will explore the various aspects of tax planning and provide you with a list of essential questions to ask your clients. By asking the right questions, you can gain valuable insights and tailor your tax planning strategies to meet the specific needs and goals of your clients. So without further ado, let’s dive into the world of tax planning!

3 Picture Gallery: Unlocking Financial Success: Essential Tax Planning Questions To Ask Clients For Maximum Savings – Take Action Now!

Introduction

Tax planning is a crucial aspect of financial management that involves the analysis of a client’s financial situation to optimize their tax liabilities. By proactively planning taxes, individuals and businesses can minimize their tax burdens and maximize their savings and potential for growth. To embark on an effective tax planning journey, it is essential to ask your clients the right questions. In this article, we will provide you with a comprehensive list of questions categorized into several key areas. These questions will help you gather the necessary information to develop customized tax planning strategies for your clients.

1. What: Understanding the client’s financial situation

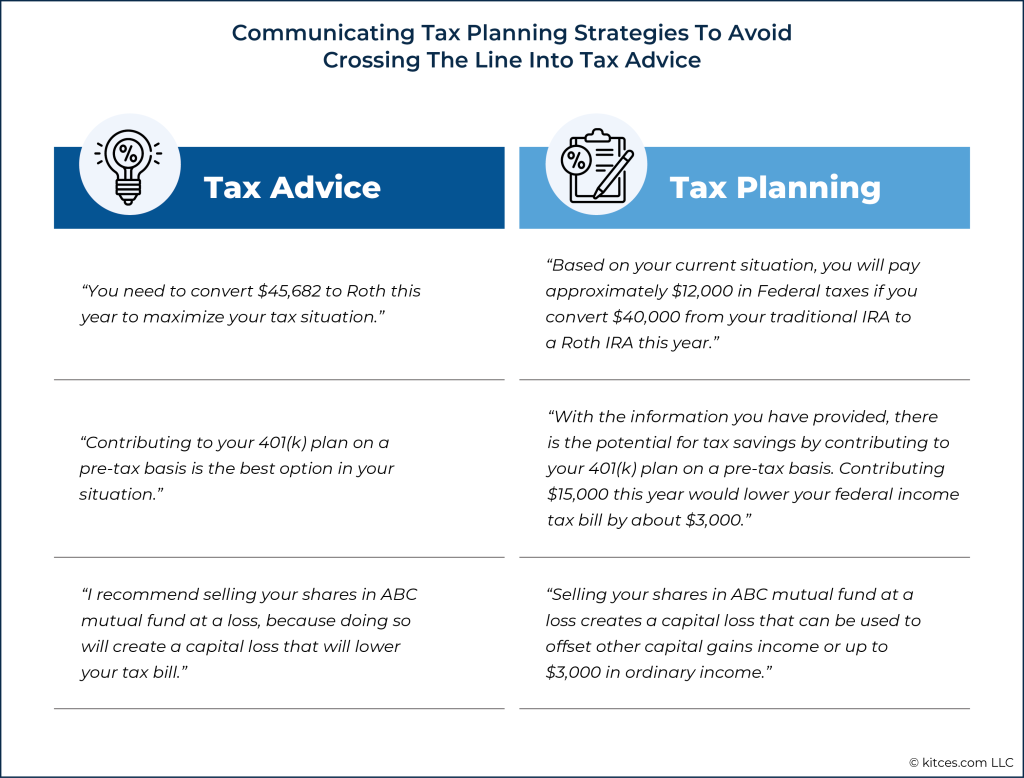

Image Source: kitces.com

First and foremost, it is crucial to gather information about your client’s financial situation. This includes their sources of income, assets, investments, and liabilities. By understanding their financial position, you can identify potential tax-saving opportunities and develop a tailored tax plan.

2. Who: Identifying the stakeholders

Next, it is important to identify the stakeholders involved in the tax planning process. This could include the client, their spouse, business partners, or family members. By understanding who is involved, you can ensure that the tax plan considers the interests and objectives of all relevant parties.

3. When: Determining the time frame

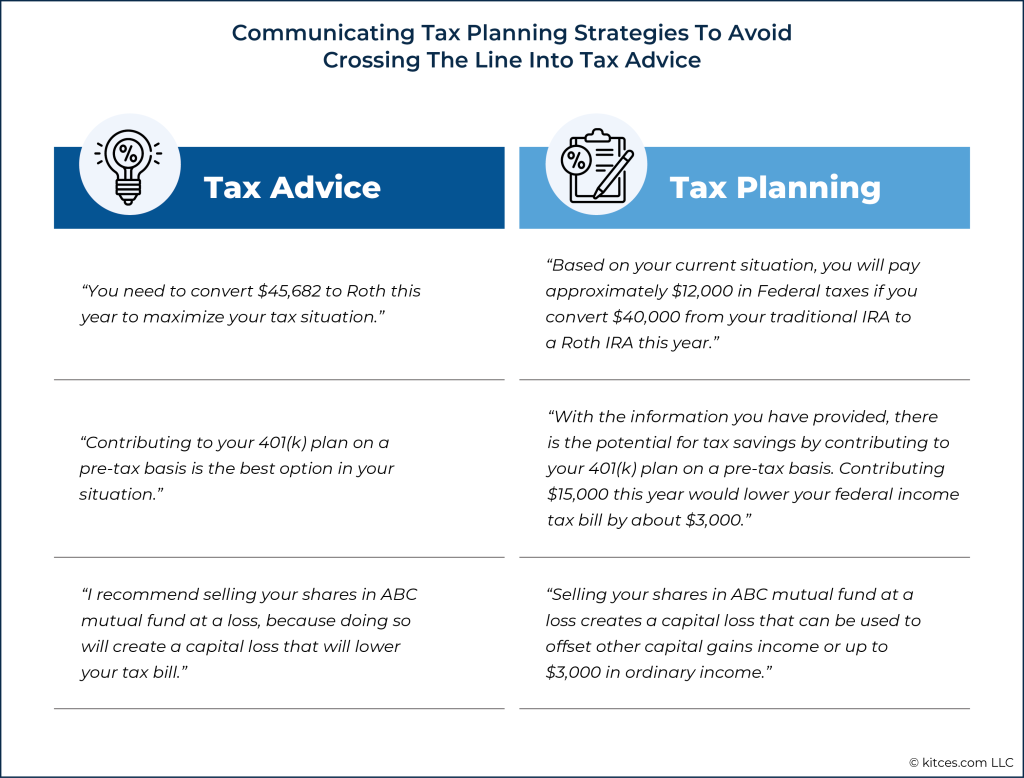

Image Source: tcgtax.com

The timing of tax planning is crucial. It is important to assess whether the client requires immediate tax-saving strategies or long-term tax planning solutions. By determining the time frame, you can structure the tax plan accordingly and make the necessary adjustments along the way.

4. Where: Assessing the geographical and legal considerations

Tax planning is influenced by geographical and legal factors. It is essential to consider the client’s jurisdiction, residency, and any international implications. By assessing the geographical and legal considerations, you can ensure compliance with tax laws and identify potential opportunities or risks.

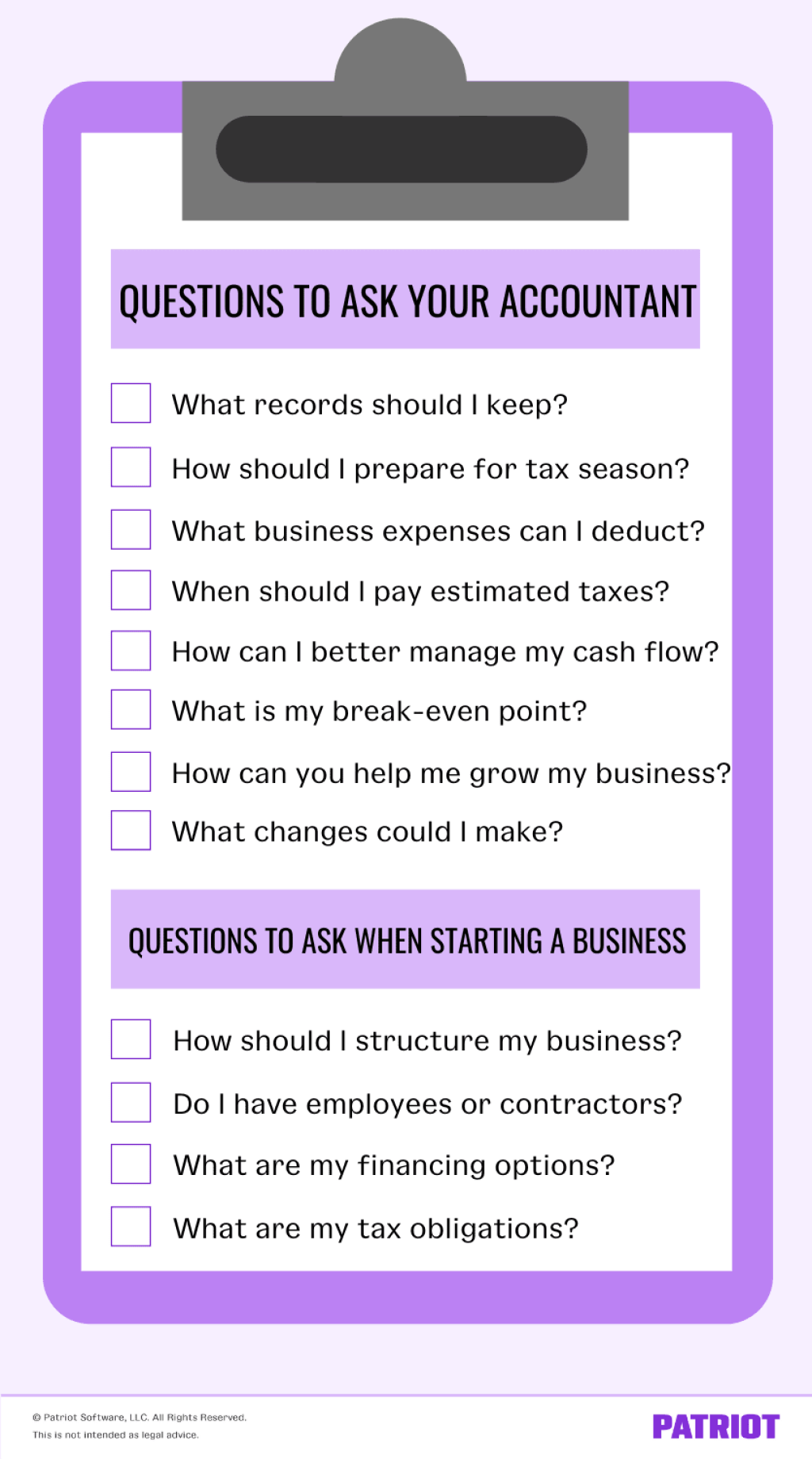

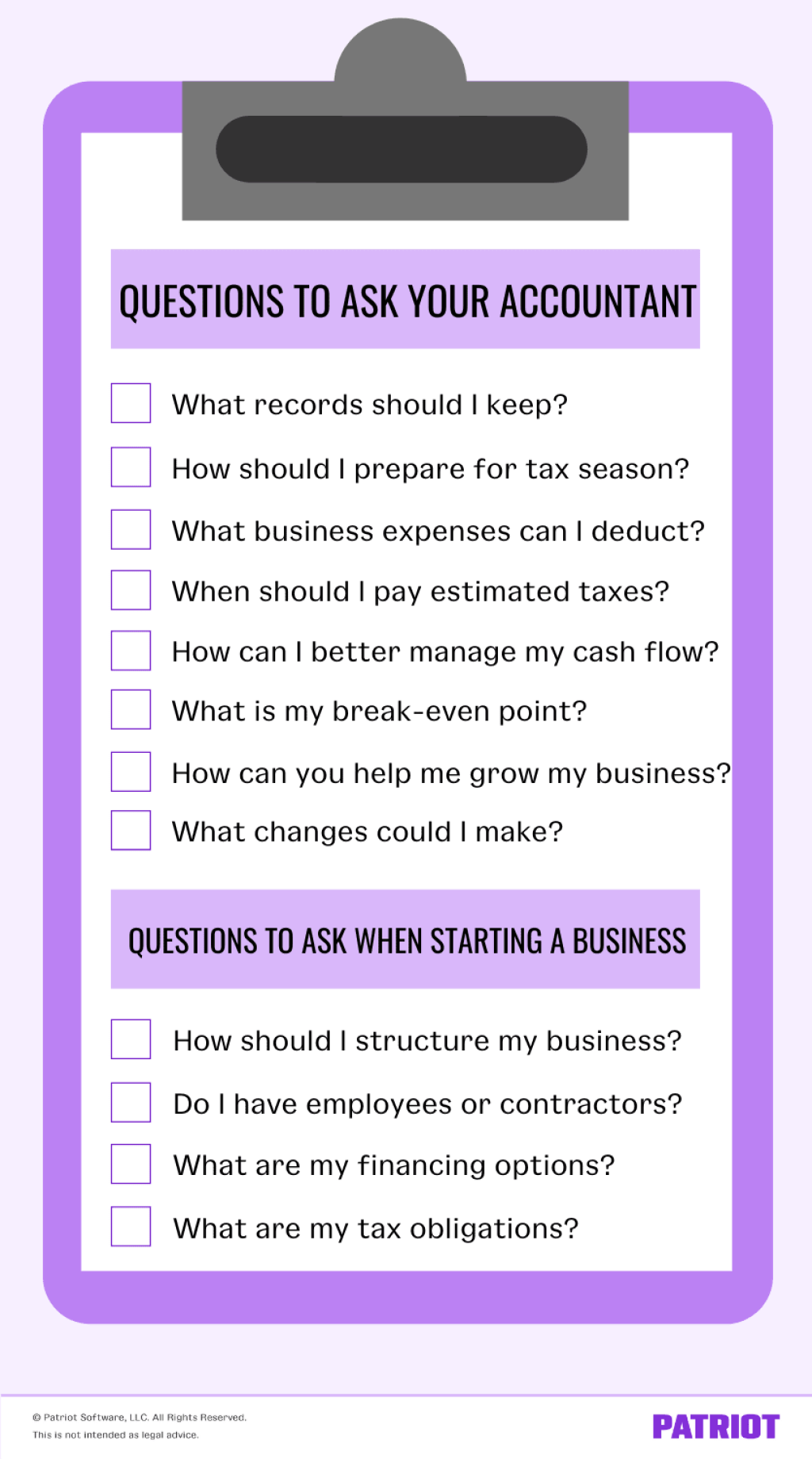

Image Source: patriotsoftware.com

5. Why: Understanding the client’s goals and objectives

Every client has unique goals and objectives when it comes to tax planning. It is crucial to understand why the client wants to engage in tax planning and what they hope to achieve. By understanding their motivations, you can develop a tax plan that aligns with their aspirations and maximizes their financial outcomes.

6. How: Implementing the tax planning strategies

Once you have gathered all the necessary information, it’s time to develop and implement the tax planning strategies. This involves analyzing the client’s financial data, identifying tax-saving opportunities, and executing the plan in a timely and efficient manner. By following a structured approach, you can ensure the successful implementation of the tax plan.

Advantages and Disadvantages of Tax Planning Questions to Ask Clients

Like any strategy, tax planning questions have their advantages and disadvantages. Let’s take a closer look:

Advantages:

Gain a comprehensive understanding of the client’s financial situation.

Identify potential tax-saving opportunities specific to the client.

Create customized tax planning strategies tailored to the client’s goals.

Maximize tax savings and reduce tax liabilities.

Ensure compliance with tax laws and regulations.

Disadvantages:

Time-consuming process to gather all the necessary information.

Requires expertise and knowledge in tax laws and regulations.

May uncover complex tax issues that require further analysis.

Potential resistance or reluctance from clients to share financial information.

Implementation of tax planning strategies may require ongoing monitoring and adjustments.

Frequently Asked Questions (FAQ)

1. Q: Do tax planning questions apply to individuals only?

A: No, tax planning questions apply to both individuals and businesses. The questions may vary depending on the entity’s structure and nature of operations.

2. Q: Are tax planning questions a one-time process?

A: Tax planning questions should be revisited periodically to account for any changes in the client’s financial situation or tax laws. It is an ongoing process to ensure optimal tax efficiency.

3. Q: Should all clients be asked the same tax planning questions?

A: While there may be some common questions, it is important to tailor the questions to each client’s unique circumstances. This ensures that the tax planning strategies are personalized and aligned with their goals.

4. Q: Can tax planning questions help with estate planning?

A: Yes, tax planning questions can provide valuable insights for estate planning by considering tax implications on inheritance, gifting, and wealth transfer strategies.

5. Q: What if a client is hesitant to share financial information?

A: It is important to build trust and assure clients that their financial information will be treated with utmost confidentiality. Explain the benefits of tax planning and how it can help them achieve their financial goals.

Conclusion

In conclusion, tax planning questions play a vital role in developing effective tax strategies for clients. By asking the right questions, you can gather the necessary information to tailor tax plans that maximize savings and minimize tax liabilities. Remember to consider the client’s financial situation, stakeholders, time frame, geographical and legal considerations, goals, and objectives. Be aware of the advantages and disadvantages of tax planning questions and address any concerns or hesitations from clients. By implementing thorough tax planning, you can help your clients navigate the complexities of the tax landscape and achieve their financial goals.

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be construed as legal or financial advice. It is important to consult with a qualified tax professional or advisor to assess your specific tax planning needs.

This post topic: Tax Planning