Unlocking The Power Of Tax Planning: Understanding Meaning And Objectives For Financial Success

Tax Planning Meaning and Objectives

Greetings, Readers! In this article, we will delve into the meaning and objectives of tax planning. Tax planning is a crucial aspect of financial management for individuals and businesses alike. By strategically organizing your financial affairs, tax planning aims to minimize tax liabilities while remaining compliant with applicable laws and regulations.

Introduction

1. What is Tax Planning?

1 Picture Gallery: Unlocking The Power Of Tax Planning: Understanding Meaning And Objectives For Financial Success

Tax planning refers to the process of analyzing an individual’s or business’s financial situation to ensure that taxes are minimized. It involves making informed decisions about how to structure transactions, investments, and other financial activities in a way that maximizes tax benefits and minimizes tax liabilities.

2. Who is Involved in Tax Planning?

Image Source: scribdassets.com

Various stakeholders are involved in tax planning, including individuals, businesses, tax professionals, and government authorities. Individuals and businesses seek tax planning to optimize their financial position, while tax professionals provide expertise and guidance in navigating complex tax laws. Government authorities establish and enforce tax regulations and policies.

3. When is Tax Planning Necessary?

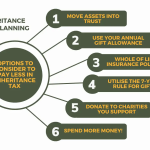

Tax planning is necessary throughout the year, as it requires careful consideration and proactive decision-making. However, it becomes particularly crucial during key financial events such as starting a business, buying or selling assets, estate planning, and retirement planning. By planning ahead, individuals and businesses can optimize their tax positions.

4. Where Does Tax Planning Apply?

Tax planning applies in various jurisdictions where tax laws and regulations exist. Each country has its own tax system and legal framework, making it essential for individuals and businesses to understand the tax implications of their financial activities in the specific jurisdictions they operate in.

5. Why is Tax Planning Important?

Tax planning is important for several reasons. Firstly, it helps individuals and businesses comply with tax laws and regulations, avoiding penalties and legal issues. Secondly, it enables them to optimize their financial resources by minimizing tax liabilities, thereby maximizing their wealth. Lastly, effective tax planning contributes to economic growth by encouraging investment and entrepreneurship.

6. How Does Tax Planning Work?

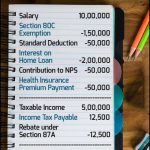

Tax planning involves a comprehensive analysis of an individual’s or business’s financial situation, identifying opportunities for tax optimization. Strategies may include taking advantage of tax deductions, credits, exemptions, and deferral options. Tax professionals play a crucial role in developing and implementing effective tax planning strategies.

Advantages and Disadvantages of Tax Planning

Advantages:

1. Tax Savings: Effective tax planning can result in significant tax savings, allowing individuals and businesses to retain more of their hard-earned income.

2. Increased Cash Flow: By minimizing tax liabilities, tax planning enhances cash flow, providing individuals and businesses with more financial resources for their needs and goals.

3. Wealth Preservation: Tax planning strategies can help preserve wealth for future generations through efficient estate planning and asset protection.

4. Compliance and Risk Management: Proper tax planning ensures compliance with tax laws and regulations, minimizing the risk of penalties and legal issues.

5. Financial Stability: By optimizing tax positions, tax planning contributes to overall financial stability, enabling individuals and businesses to navigate economic uncertainties more effectively.

Disadvantages:

1. Complexity: Tax planning can be complex, requiring a deep understanding of tax laws and regulations. It may necessitate the assistance of tax professionals, adding to the overall cost.

2. Time and Effort: Effective tax planning demands time and effort to gather and analyze financial information, develop strategies, and implement them appropriately.

3. Changing Tax Laws: Tax laws and regulations are subject to change, and tax planning strategies may need to be adjusted accordingly to remain effective.

4. Potential Risk: Aggressive tax planning strategies may face scrutiny from tax authorities, leading to audits or legal challenges. It is essential to ensure compliance and avoid engaging in illegal or unethical practices.

5. Limited Impact: Tax planning can only provide savings within the boundaries of existing tax laws and regulations. It cannot eliminate tax obligations entirely.

Frequently Asked Questions (FAQ)

1. Is tax planning legal?

Yes, tax planning is legal as long as it is carried out within the framework of applicable tax laws and regulations. Engaging in illegal tax evasion practices is strictly prohibited.

2. Do individuals need tax planning?

Yes, tax planning is beneficial for individuals as it helps optimize their tax positions, reduce tax liabilities, and maximize savings and wealth accumulation.

3. How can businesses benefit from tax planning?

Businesses can benefit from tax planning by minimizing tax liabilities, optimizing cash flow, preserving wealth, and promoting overall financial stability.

4. What are some common tax planning strategies?

Common tax planning strategies include utilizing tax deductions, credits, exemptions, deferring income or expenses, and structuring transactions to maximize tax benefits.

5. Can tax planning mitigate the risk of audits?

While there is no guarantee that tax planning will prevent audits, proper tax planning can reduce the likelihood of errors, inconsistencies, or suspicious activities that may trigger an audit.

Conclusion

In conclusion, tax planning plays a vital role in managing financial affairs effectively. By understanding the meaning and objectives of tax planning, individuals and businesses can optimize their tax positions, reduce tax liabilities, and maximize their financial resources. However, it is crucial to engage in legal and ethical tax planning practices, ensuring compliance with tax laws and regulations.

Final Remarks

It is important to note that tax planning should always be tailored to individual circumstances and implemented with the guidance of qualified tax professionals. The information provided in this article is for general informational purposes only and should not be construed as professional advice. Consult with a tax professional or accountant to address specific tax planning needs and ensure compliance with applicable laws and regulations.

This post topic: Tax Planning