Maximize Your Returns: Unleash The Power Of Tax Planning For 2023 Now!

Tax Planning for 2023

Introduction

Hello Readers,

1 Picture Gallery: Maximize Your Returns: Unleash The Power Of Tax Planning For 2023 Now!

Welcome to our comprehensive guide on tax planning for 2023. As the new year approaches, it is essential to understand the various strategies and considerations for optimizing your tax situation. This article will provide you with valuable insights and expert advice on how to plan your taxes effectively for the upcoming year.

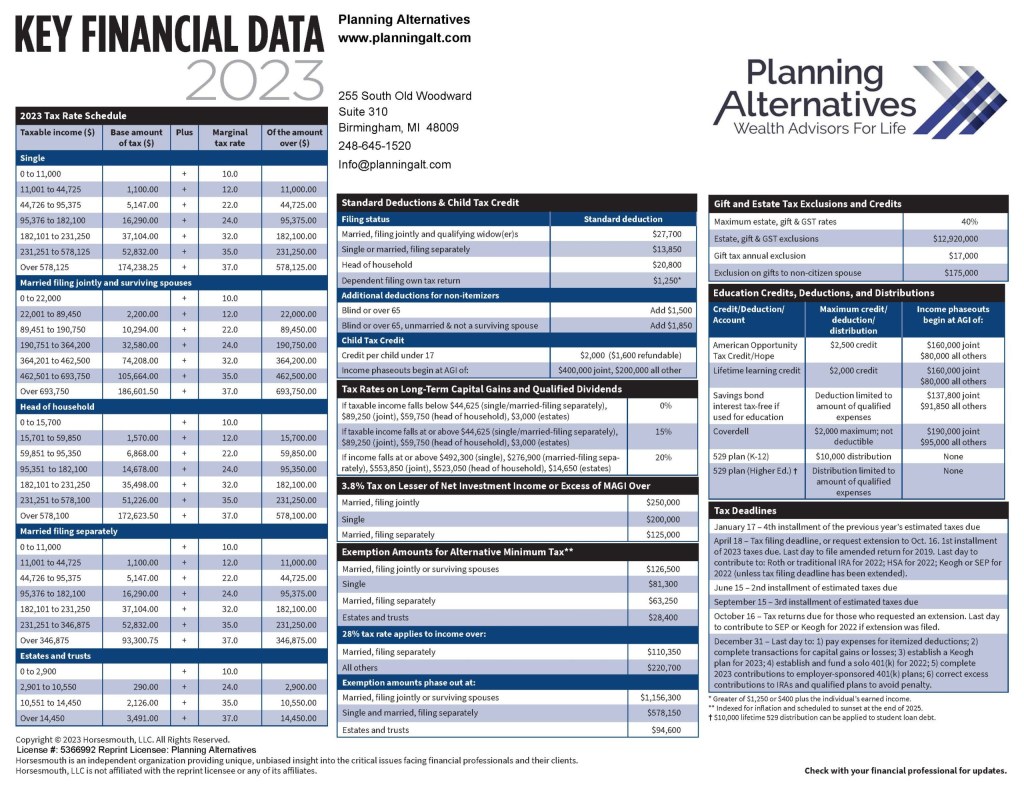

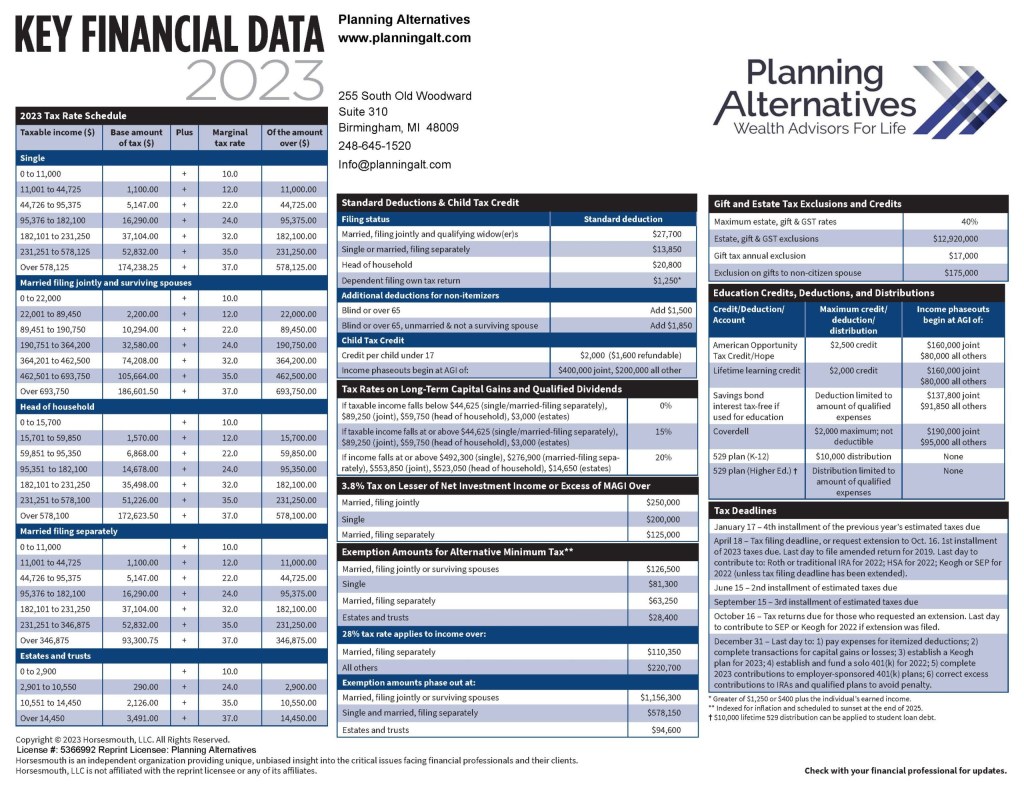

Image Source: planningalt.com

Tax planning involves making use of available deductions, credits, exemptions, and other tax-saving opportunities to minimize your tax liability. By implementing effective tax planning strategies, you can ensure that you optimize your finances and retain more of your hard-earned money.

In this article, we will discuss the key aspects of tax planning for 2023, including the what, who, when, where, why, and how. We will also explore the advantages and disadvantages of tax planning and address frequently asked questions to provide you with a comprehensive understanding. Let’s dive in!

What is Tax Planning for 2023?

🔍 Tax planning for 2023 refers to the process of analyzing your financial situation and organizing your affairs in a way that maximizes tax savings for the upcoming fiscal year. It involves strategic decision-making and utilizing available tax-saving opportunities within the legal framework.

🔍 The goal of tax planning is to minimize your tax liability by taking advantage of deductions, credits, exemptions, and other incentives offered by the tax laws. By effectively planning your taxes, you can legally reduce the amount of tax you owe and optimize your overall financial situation.

🔍 Tax planning is not about evading taxes or engaging in illegal activities. It is a legitimate practice that helps individuals and businesses make informed financial decisions while complying with the tax regulations.

Who Needs Tax Planning for 2023?

🔍 Tax planning is essential for individuals, families, and businesses of all sizes. Whether you are an employee, self-employed professional, or a business owner, understanding and implementing tax planning strategies can significantly impact your financial situation.

🔍 Individuals who want to minimize their tax liability and maximize their tax savings should engage in tax planning. Similarly, businesses of all sizes can benefit from tax planning to optimize their profits and reinvest in growth opportunities.

🔍 Regardless of your income level, tax planning can help you make the most of your financial resources and ensure you comply with the relevant tax laws and regulations.

When Should You Start Tax Planning for 2023?

🔍 It is never too early to start tax planning. The earlier you begin, the more time you have to analyze your financial situation, identify potential tax-saving opportunities, and implement necessary strategies.

🔍 Ideally, you should start tax planning for 2023 at the beginning of the fiscal year. By staying proactive and organized throughout the year, you can make informed decisions and avoid any last-minute rush during tax season.

🔍 However, if you haven’t started planning yet, don’t worry. There are still several steps you can take to optimize your tax situation for the upcoming year.

Where Can You Implement Tax Planning Strategies?

🔍 Tax planning strategies can be implemented in various aspects of your financial life. From your personal finances to your business operations, there are several areas where you can optimize your tax situation.

🔍 Some common areas where tax planning can be effective include income management, deductions and exemptions, investments, retirement planning, estate planning, and charitable contributions.

🔍 Depending on your specific circumstances, you may need to consult with a tax professional or financial advisor to identify the best strategies for your situation and ensure compliance with the tax laws.

Why is Tax Planning Important for 2023?

🔍 Tax planning is crucial for several reasons. Firstly, it allows you to legally minimize your tax liability and optimize your finances. By taking advantage of available tax-saving opportunities, you can keep more of your hard-earned money.

🔍 Secondly, tax planning helps you stay compliant with the tax laws and avoid any potential penalties or fines. By understanding and following the regulations, you can ensure that your tax filings are accurate and timely.

🔍 Moreover, tax planning enables you to make informed financial decisions. By analyzing your financial situation and considering tax implications, you can make strategic choices that align with your long-term goals and objectives.

How Can You Implement Tax Planning Strategies for 2023?

🔍 Implementing tax planning strategies for 2023 requires careful analysis and attention to detail. Here are some steps to help you get started:

Evaluate your current financial situation and income sources.

Identify potential deductions, exemptions, and tax credits applicable to your circumstances.

Explore investment opportunities that offer tax benefits.

Consider retirement planning options and their tax implications.

Review your estate plan and ensure it aligns with your tax goals.

Consult with a tax professional or financial advisor for personalized advice.

Maintain organized financial records and stay updated with the latest tax laws.

Advantages and Disadvantages of Tax Planning for 2023

Advantages:

✅ Minimizes tax liability

✅ Maximizes tax savings

✅ Allows for strategic financial decision-making

✅ Ensures compliance with tax laws

✅ Optimizes overall financial situation

Disadvantages:

❌ Requires time and effort

❌ Complex and ever-changing tax laws

❌ Potential need for professional assistance

❌ Involves careful record-keeping and documentation

❌ May require upfront costs for certain tax-saving strategies

Frequently Asked Questions (FAQ)

Q: Can tax planning help me reduce my overall tax liability?

A: Yes, tax planning allows you to strategically minimize your tax liability and maximize your tax savings.

Q: Do I need professional assistance for tax planning?

A: While it is possible to plan your taxes on your own, consulting with a tax professional or financial advisor can provide valuable insights and ensure compliance with the tax laws.

Q: What are some common tax deductions and exemptions available for individuals?

A: Common tax deductions and exemptions for individuals include mortgage interest, student loan interest, medical expenses, and charitable contributions.

Q: Are there any tax credits available for small businesses?

A: Yes, small businesses may be eligible for tax credits such as the Research & Development (R&D) tax credit, Work Opportunity Tax Credit (WOTC), and the Small Business Health Care Tax Credit.

Q: Can tax planning help with estate planning?

A: Yes, tax planning can play a crucial role in estate planning by minimizing estate taxes and ensuring a smooth transfer of assets to beneficiaries.

Conclusion

In conclusion, tax planning for 2023 is a crucial aspect of financial management. By proactively analyzing your financial situation, identifying tax-saving opportunities, and implementing effective strategies, you can minimize your tax liability and optimize your overall financial situation.

Remember to start your tax planning early, maintain organized records, and consult with a tax professional or financial advisor for personalized advice. By staying informed and proactive, you can make informed financial decisions and keep more of your hard-earned money.

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as professional advice. Tax laws and regulations may vary based on your jurisdiction and individual circumstances. It is always recommended to consult with a qualified tax professional or financial advisor for personalized advice tailored to your specific situation.

This post topic: Tax Planning