Maximize Your Tax Savings With Expert Tax Planning Consultants: Unlock Opportunities With Our Tax Planning Konsultan Services!

Tax Planning Consultant: Maximizing Your Financial Potential

Introduction

Hello Readers,

3 Picture Gallery: Maximize Your Tax Savings With Expert Tax Planning Consultants: Unlock Opportunities With Our Tax Planning Konsultan Services!

Welcome to an informative article on tax planning consultants. In today’s complex financial landscape, planning your taxes effectively can make a significant difference in optimizing your financial potential. By seeking the expertise of tax planning consultants, individuals and businesses can navigate through the intricacies of tax laws, minimize liabilities, and seize opportunities for tax savings. In this article, we will explore the ins and outs of tax planning consultants, their services, advantages, and how they can benefit you. So, let’s delve into the world of tax planning consultants and discover the possibilities.

What is Tax Planning?

Image Source: futuregenerali.in

🔑 Before we dive into the role of tax planning consultants, let’s understand the essence of tax planning itself. Tax planning refers to the strategic approach individuals and businesses employ to manage their financial affairs in a manner that legally minimizes tax liabilities. It involves analyzing tax implications, identifying tax-saving opportunities, and implementing effective strategies to optimize tax outcomes. With the ever-evolving tax laws and regulations, tax planning plays a crucial role in ensuring financial efficiency and compliance.

Why is Tax Planning Important?

Tax planning is vital for several reasons:

🔎 It helps individuals and businesses navigate complex tax laws and regulations.

💰 It enables taxpayers to maximize tax savings and minimize liabilities.

📚 It ensures compliance with tax obligations, avoiding penalties and legal issues.

🌍 It facilitates strategic decision-making by considering tax implications.

💼 It helps businesses achieve their financial objectives and maintain competitiveness.

⚖️ It contributes to a fair and equitable distribution of tax burdens.

🔒 It provides peace of mind by ensuring tax affairs are handled efficiently.

Who are Tax Planning Consultants?

Image Source: alamy.com

✨ Tax planning consultants are professionals with expertise in tax laws, regulations, and financial strategies. They offer specialized services to individuals and businesses seeking guidance in optimizing their tax positions. These consultants possess in-depth knowledge of the tax landscape and stay updated with the latest developments in tax legislation. By leveraging their expertise, tax planning consultants provide valuable insights, identify tax-saving opportunities, and help clients make informed decisions aligned with their financial goals.

Roles and Responsibilities of Tax Planning Consultants

Tax planning consultants undertake various roles and responsibilities to assist their clients:

📊 Conducting comprehensive tax assessments to identify potential areas for tax optimization.

📋 Advising clients on tax-saving strategies and legal methods to minimize tax liabilities.

📑 Assisting in tax compliance by ensuring accurate and timely filing of tax returns.

🔍 Performing thorough research to stay updated with changing tax laws and regulations.

📈 Developing customized tax planning strategies tailored to clients’ specific needs.

📞 Providing ongoing support and guidance to address tax-related queries and concerns.

💼 Collaborating with other financial professionals to offer comprehensive financial planning.

Image Source: carajput.com

When Should You Consider Hiring a Tax Planning Consultant?

🕒 Hiring a tax planning consultant can be beneficial in several situations:

📢 Starting a new business or venture.

🔀 Undergoing significant changes in personal or business finances.

🔍 Needing assistance in managing complex tax regulations.

🌍 Expanding business operations across jurisdictions.

📈 Seeking to optimize tax outcomes during financial planning.

🔒 Dealing with tax audits, disputes, or litigation.

📚 Wanting to stay updated with the latest tax laws and regulations.

Where Can You Find Tax Planning Consultants?

🌐 Tax planning consultants can be found through various channels:

🖥️ Online directories and professional networks specialized in tax consulting services.

🏢 Local accounting firms and financial institutions offering tax planning expertise.

📚 Referrals from trusted professionals, such as lawyers or financial advisors.

💼 Industry associations and organizations providing access to qualified tax planning consultants.

Why Should You Hire a Tax Planning Consultant?

🔔 Let’s explore the advantages and disadvantages of hiring a tax planning consultant:

Advantages of Hiring a Tax Planning Consultant

🔍 Expertise: Tax planning consultants possess specialized knowledge and stay updated with the latest tax laws and regulations.

💼 Tailored Strategies: They develop customized tax planning strategies aligned with clients’ unique financial goals and circumstances.

📈 Maximizing Savings: Consultants identify tax-saving opportunities to optimize clients’ tax outcomes and minimize liabilities.

📚 Compliance Assurance: They ensure clients meet their tax obligations accurately and on time, reducing the risk of penalties.

📋 Peace of Mind: By entrusting tax matters to professionals, clients can focus on their core activities with confidence.

Disadvantages of Hiring a Tax Planning Consultant

💰 Cost: Hiring a tax planning consultant entails expenses, which may vary depending on the complexity of the engagement.

⏳ Time Investment: Collaborating with a consultant may require dedicating time to provide necessary information and participate in the planning process.

⚖️ Dependency: Relying solely on consultants for tax planning may limit individuals’ or businesses’ understanding of their own tax situations and opportunities.

How Does Tax Planning Consulting Work?

📝 Tax planning consulting typically involves the following steps:

📊 Gathering necessary financial information from clients, including income, expenses, assets, and liabilities.

🔎 Conducting a comprehensive analysis of clients’ financial situations and tax obligations.

📋 Identifying tax-saving opportunities and potential areas for tax optimization based on clients’ specific circumstances.

📑 Developing customized tax planning strategies tailored to clients’ goals and compliance requirements.

📚 Implementing the agreed-upon strategies and ensuring accurate and timely filing of tax returns.

🔍 Providing ongoing support, monitoring tax developments, and adapting strategies as needed.

📞 Reviewing and reassessing tax plans periodically to accommodate changes in clients’ financial situations or tax laws.

Frequently Asked Questions (FAQ)

📝 Here are some common questions about tax planning consultants:

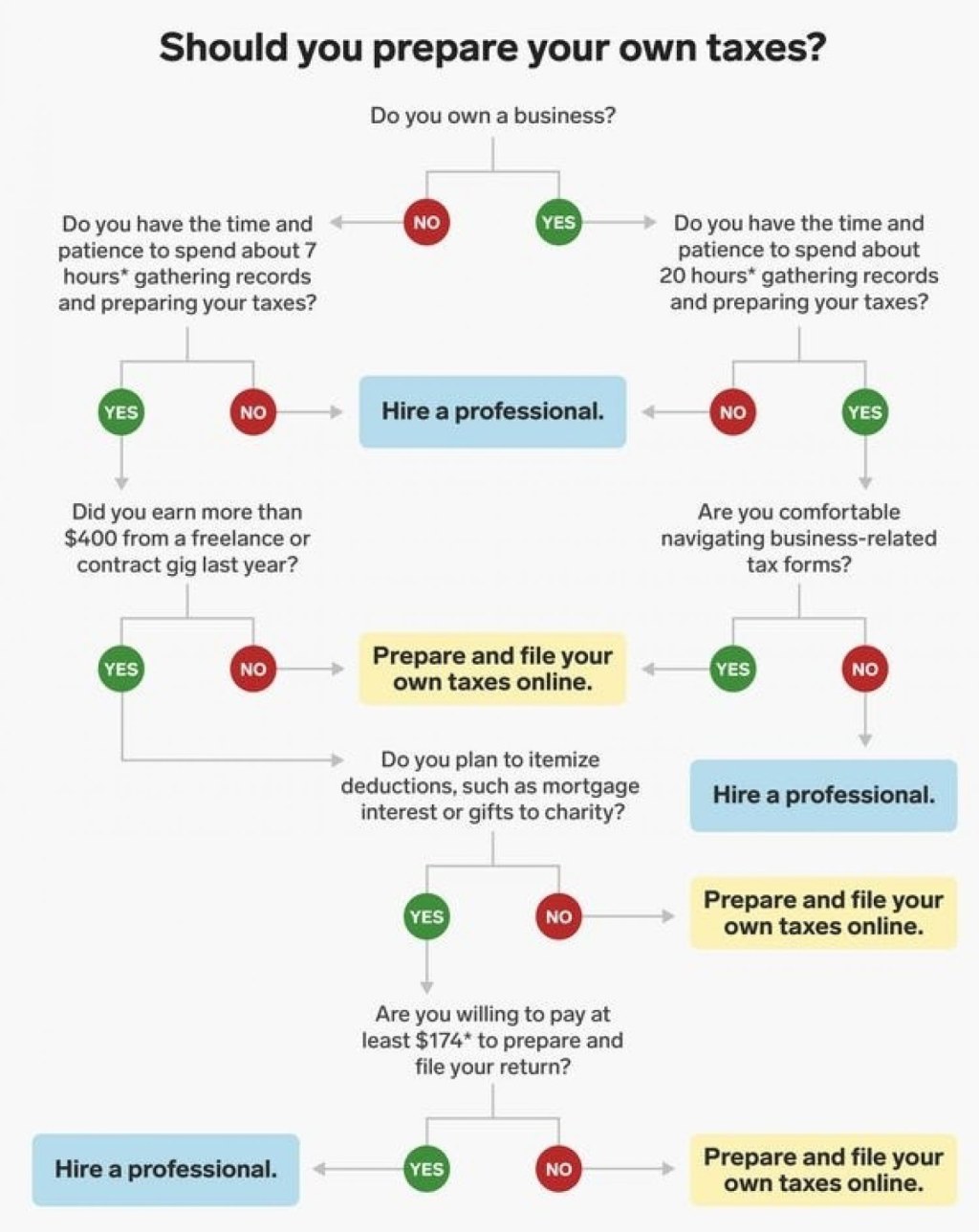

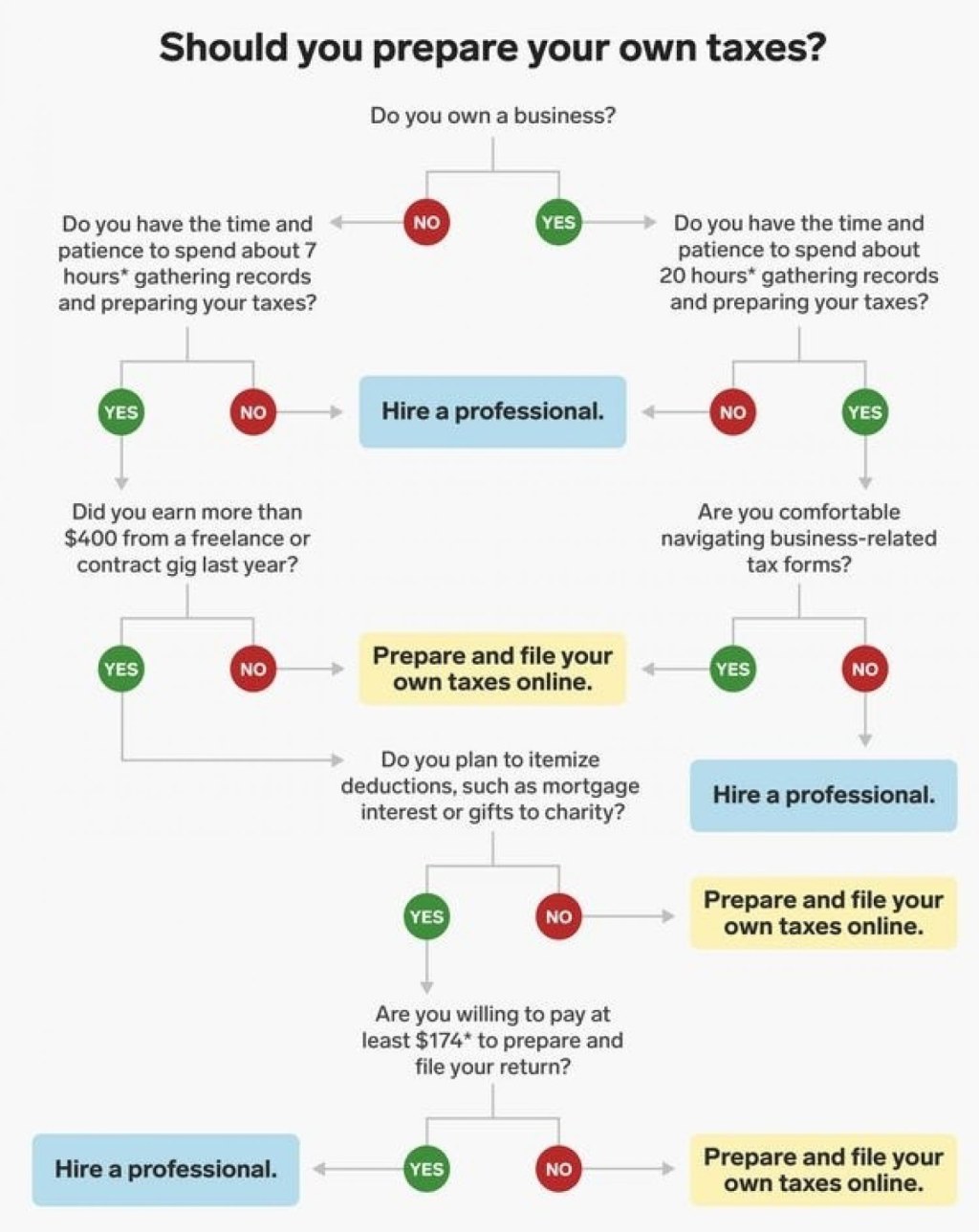

1. Can I do tax planning on my own without hiring a consultant?

Yes, you can handle tax planning personally, but hiring a tax planning consultant brings specialized knowledge and expertise, maximizing potential savings and ensuring compliance.

2. How much does tax planning consulting cost?

The cost of tax planning consulting varies depending on factors such as the complexity of your financial situation, the scope of services required, and the consultant’s fee structure. It is best to discuss fees upfront with the consultant.

3. Can tax planning consultants help with international tax matters?

Absolutely. Tax planning consultants experienced in international taxation can assist individuals and businesses navigating the complexities of cross-border tax implications.

4. Are tax planning consultants only for high-net-worth individuals?

No, tax planning consultants cater to a wide range of clients, including individuals, small businesses, and multinational corporations. Their services can be tailored to different financial capacities.

5. How often should I review my tax plan?

It is advisable to review your tax plan annually or whenever significant changes occur in your financial situation or tax laws. Regular reviews ensure your plan remains aligned with your goals and compliant with regulations.

Conclusion

💡 In today’s intricate tax landscape, tax planning consultants play a crucial role in maximizing your financial potential. By leveraging their expertise, individuals and businesses can navigate tax regulations, minimize liabilities, and optimize savings. Whether you are starting a new venture, expanding internationally, or seeking efficient tax compliance, tax planning consultants offer valuable insights and tailored strategies. So, take the first step towards financial efficiency by exploring the world of tax planning consultants and unlock the possibilities.

Final Remarks

📢 Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as professional advice. Tax laws and regulations may vary depending on your jurisdiction and individual circumstances. It is advisable to consult with qualified tax professionals or consultants regarding your specific tax situation.

This post topic: Tax Planning