Maximize Your Wealth: The Ultimate Inheritance Tax Planning Guide UK – Take Control Of Your Legacy Today!

Inheritance Tax Planning Guide UK

Introduction

Dear Readers,

3 Picture Gallery: Maximize Your Wealth: The Ultimate Inheritance Tax Planning Guide UK – Take Control Of Your Legacy Today!

Welcome to our comprehensive guide on inheritance tax planning in the United Kingdom. In this article, we will provide you with all the necessary information to navigate through the complex world of inheritance taxation and help you make informed decisions regarding your financial future.

Image Source: sunnyavenue.co.uk

Understanding inheritance tax planning is crucial, as it allows individuals to minimize the tax burden that their beneficiaries may face upon their demise. By utilizing various strategies and legal provisions, you can preserve your wealth and ensure that your loved ones receive the maximum benefits from your estate.

This guide will cover all aspects of inheritance tax planning, from the basics of what it is and who it affects, to more detailed information about when and where it applies, as well as why and how you should plan accordingly. In addition, we will explore the advantages and disadvantages of inheritance tax planning and address some frequently asked questions. Finally, we will provide some concluding remarks to encourage action and a final disclaimer.

Table of Contents

1. Introduction

Image Source: theprivateoffice.com

2. What is Inheritance Tax Planning?

3. Who Does Inheritance Tax Planning Affect?

Image Source: theprivateoffice.com

4. When Does Inheritance Tax Apply?

5. Where Does Inheritance Tax Apply?

6. Why Should You Consider Inheritance Tax Planning?

7. How Can You Plan for Inheritance Tax?

8. Advantages of Inheritance Tax Planning

9. Disadvantages of Inheritance Tax Planning

10. FAQ

11. Conclusion

12. Final Remarks

What is Inheritance Tax Planning?

Inheritance tax planning refers to the process of arranging your estate and assets in a manner that minimizes the inheritance tax liability for your beneficiaries. It involves utilizing legal and financial strategies to preserve your wealth and ensure that more of it is passed on to your loved ones, rather than being paid in taxes.

Emoji: 💼

Inheritance tax planning is not about evading taxes or engaging in illegal activities. Instead, it focuses on taking advantage of the tax allowances and exemptions provided by the UK government to reduce the overall tax burden on your estate.

Emojis: ❓📝

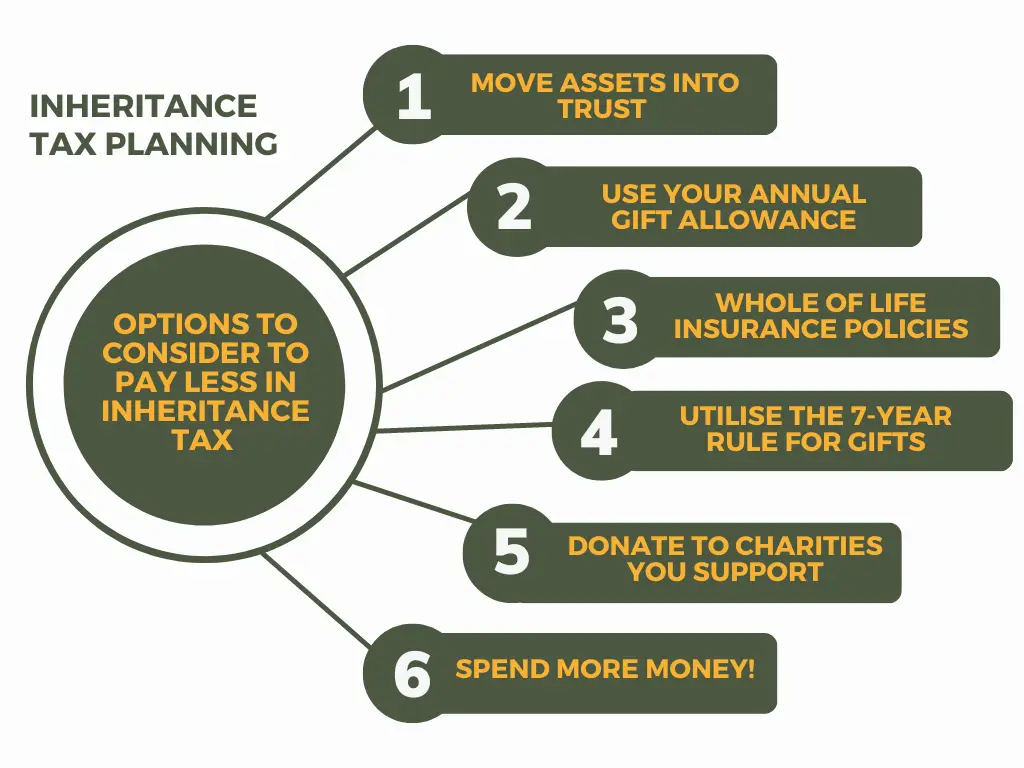

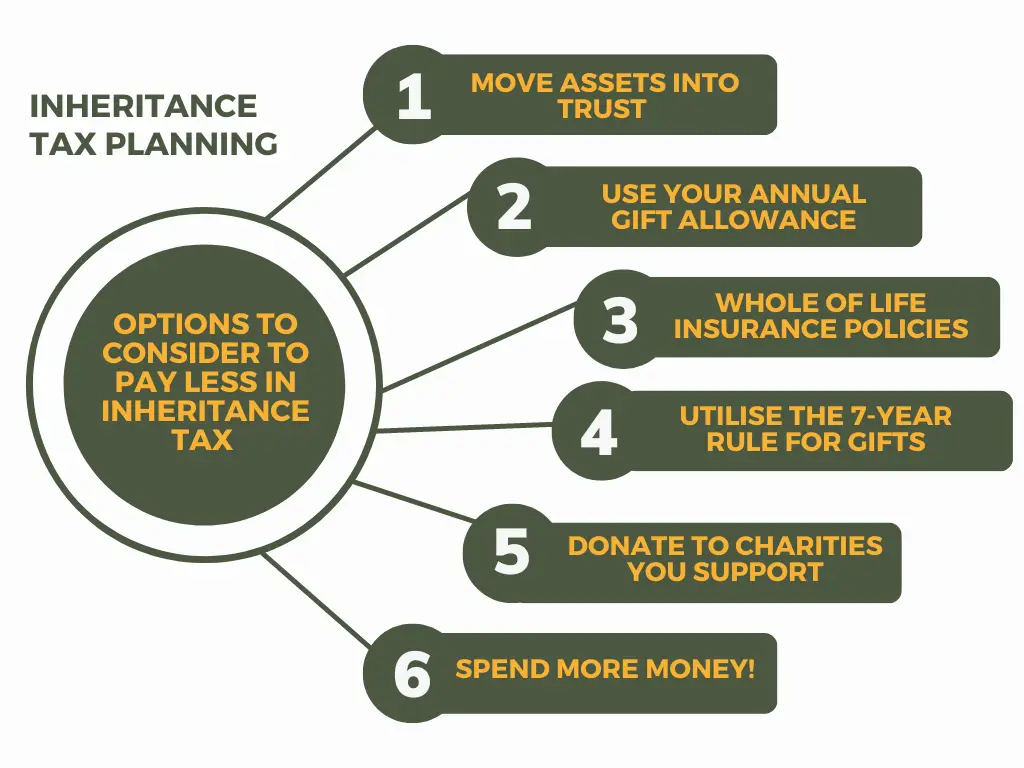

There are various methods of inheritance tax planning, including making gifts, establishing trusts, and utilizing business and agricultural reliefs. By implementing these strategies, you can effectively manage and distribute your assets to ensure your beneficiaries receive the maximum benefit.

Emojis: 💸🏦

It’s important to note that inheritance tax planning requires careful consideration and should be tailored to your specific circumstances. Seeking professional guidance from tax advisors and solicitors can help ensure that your planning is compliant with the law and tailored to your unique needs.

Emojis: 📚🔍

Who Does Inheritance Tax Planning Affect?

Inheritance tax planning affects individuals who have assets and properties that they wish to pass on to their beneficiaries upon their death. It is especially relevant for those with estates that exceed the current inheritance tax threshold.

Emoji: 🏠

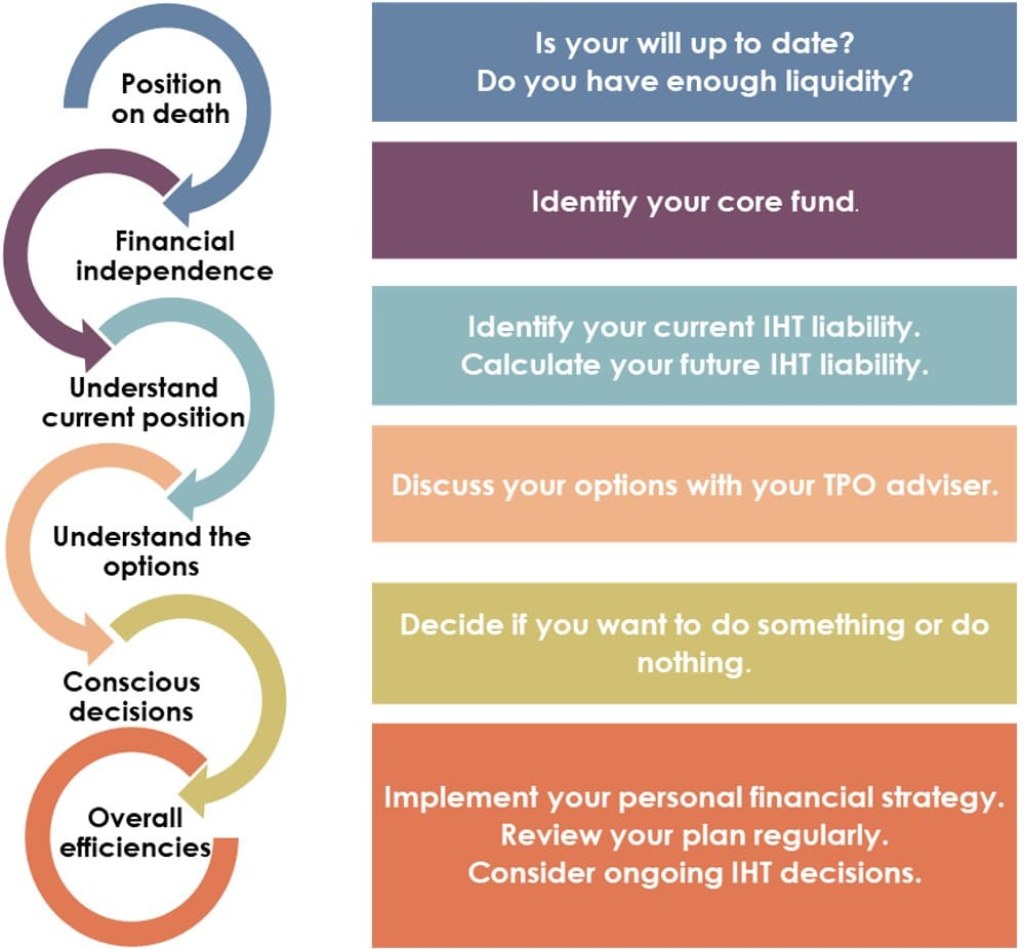

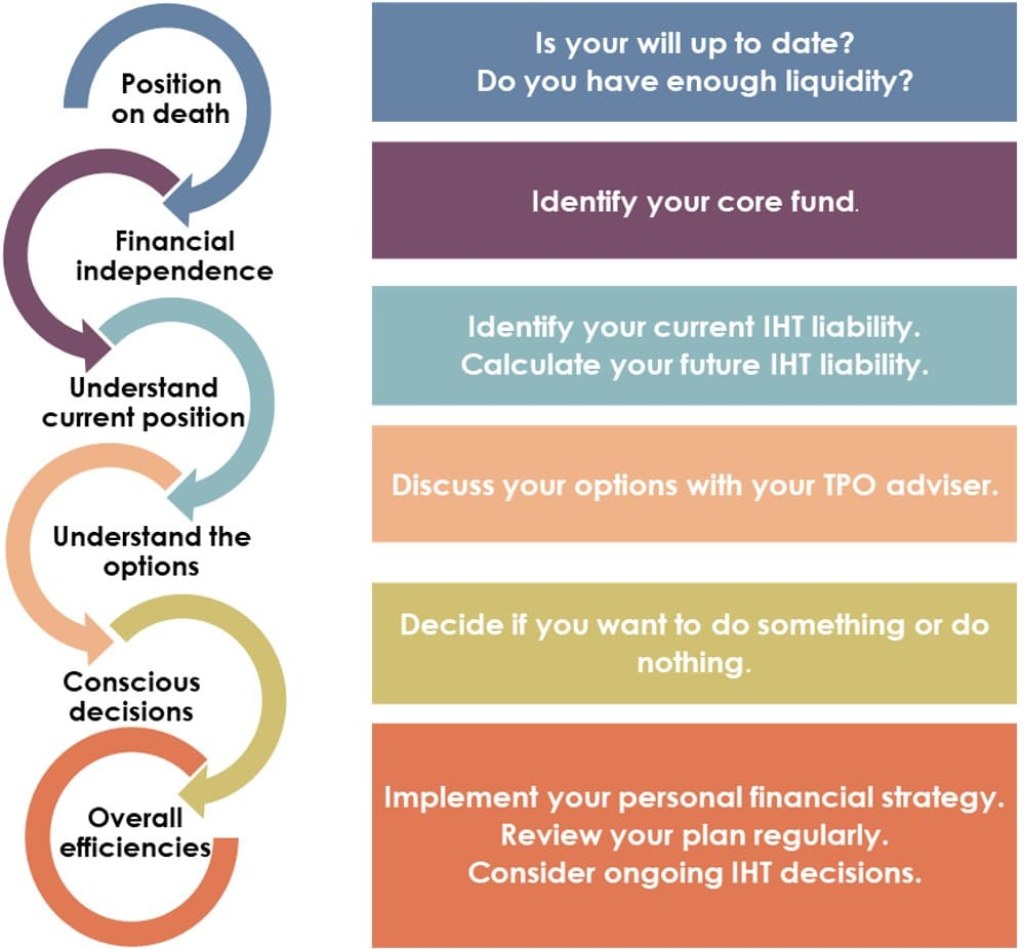

Understanding your potential inheritance tax liability and planning accordingly can benefit not only your beneficiaries but also you during your lifetime. By taking proactive steps to minimize your tax liability, you can ensure that your hard-earned wealth is preserved for future generations.

Emoji: 👨👩👧👦

It’s important to note that inheritance tax planning applies to both UK residents and non-residents who have assets located in the UK. Therefore, regardless of your residency status, if you have assets in the UK, it’s essential to consider how inheritance tax may impact your estate.

Emoji: 🌍

Each individual’s circumstances are unique, and the impact of inheritance tax planning will vary depending on factors such as the value of your estate, the nature of your assets, and your personal and financial goals. Seeking professional advice can help you understand how inheritance tax planning applies to your specific situation.

Emoji: 🗂️🔒

When Does Inheritance Tax Apply?

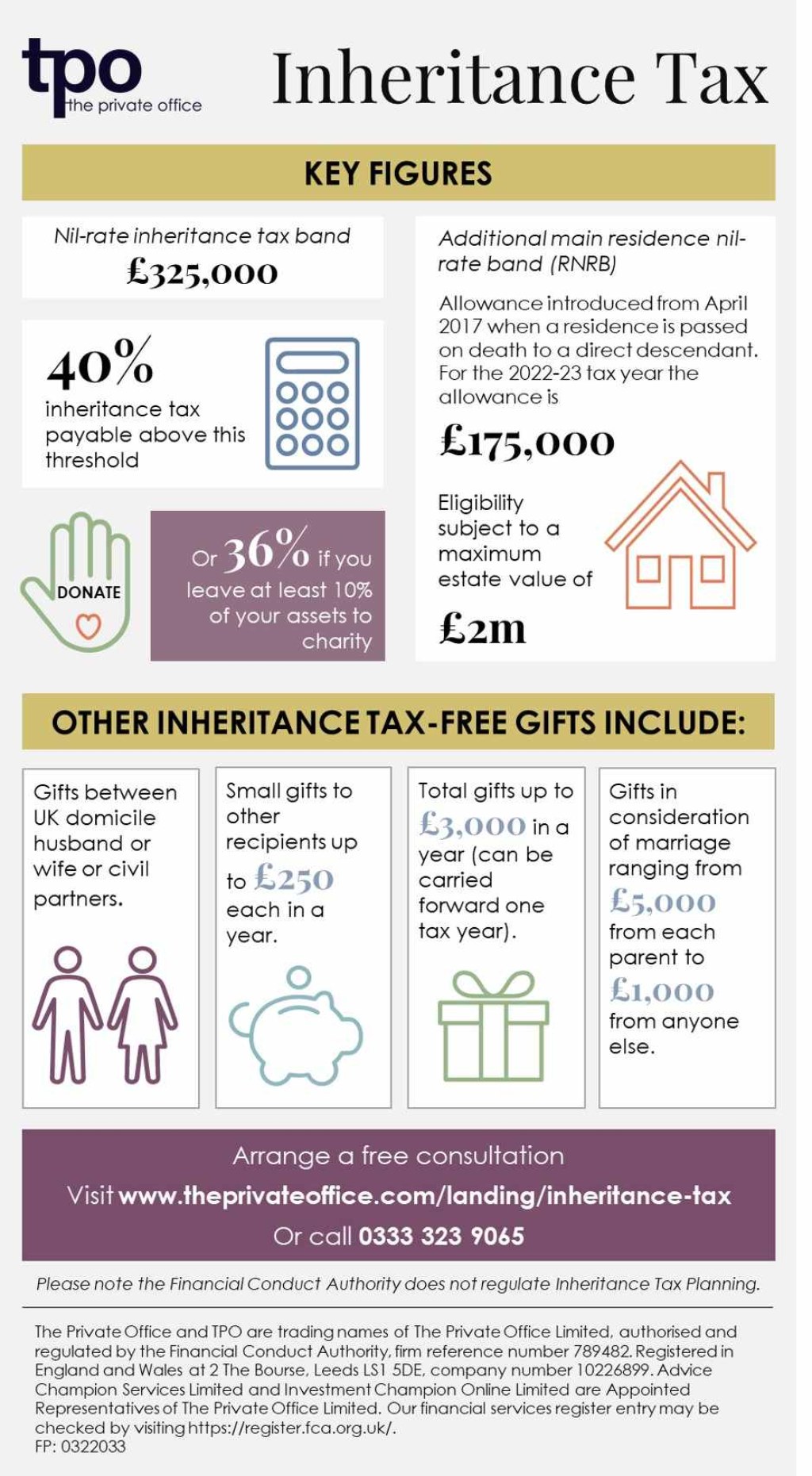

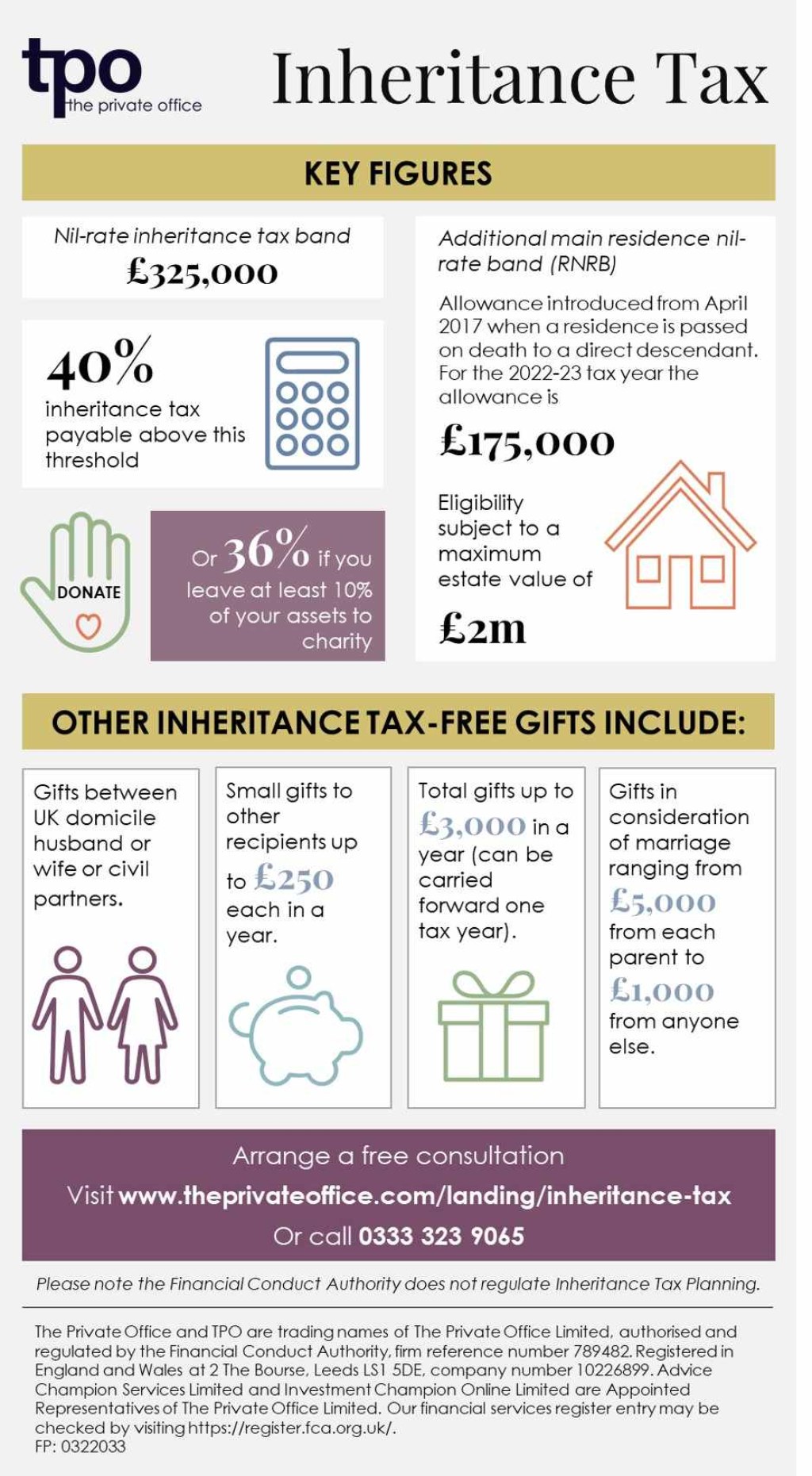

Inheritance tax applies when an individual passes away and their estate exceeds the current inheritance tax threshold. As of the writing of this article, the threshold is £325,000 for individuals and £650,000 for married couples or civil partners.

Emoji: ⌛

When an individual dies, their estate is subject to inheritance tax at a rate of 40% on the portion that exceeds the threshold. However, certain exemptions and reliefs may apply, allowing individuals to reduce their overall tax liability.

Emoji: 📉💰

It’s important to consider inheritance tax when planning your estate, as failing to do so may result in a significant reduction in the value of your assets that can be passed on to your beneficiaries.

Emoji: 💔

By taking proactive steps and implementing effective inheritance tax planning strategies, you can minimize the tax burden on your estate and ensure that more of your wealth is preserved for your loved ones.

Emoji: 📈💡

Where Does Inheritance Tax Apply?

Inheritance tax applies to individuals who have assets located in the United Kingdom, regardless of their residency status.

Emoji: 🇬🇧

If you own properties, businesses, or other assets in the UK, the value of these assets may be subject to inheritance tax upon your death.

Emoji: 🏢💼

It’s important to note that if you are a UK resident but own assets located outside the UK, these assets may also be subject to inheritance tax. This is known as domicile status, and it’s essential to consider how it impacts your overall tax liability.

Emoji: 🌍🗝️

Inheritance tax planning should take into account the location of your assets and the potential tax implications in each jurisdiction to ensure that your planning is effective and compliant.

Emoji: 🌐⚖️

Why Should You Consider Inheritance Tax Planning?

There are several reasons why you should consider inheritance tax planning:

1. Preserve Your Wealth: Inheritance tax planning allows you to preserve your wealth and ensure that more of it is passed on to your loved ones, rather than being paid in taxes.

Emoji: 💰🔒

2. Minimize Tax Liability: By utilizing various inheritance tax planning strategies, you can effectively reduce the overall tax liability on your estate.

Emoji: 📉💸

3. Financial Security for Your Beneficiaries: Proper planning ensures that your beneficiaries are financially secure and can inherit your assets without a significant tax burden.

Emoji: 🏦🔒

4. Maintain Control over Your Assets: Inheritance tax planning allows you to maintain control over your assets and decide how they will be distributed after your demise.

Emoji: 🗝️📜

5. Peace of Mind: Planning for the future provides peace of mind that your loved ones will be taken care of and that your estate will be managed according to your wishes.

Emoji: ☮️😌

It’s important to start inheritance tax planning early and regularly review your plans to ensure they remain up to date and aligned with your changing circumstances.

Emoji: 🔄📅

How Can You Plan for Inheritance Tax?

When it comes to planning for inheritance tax, there are several strategies and options available:

1. Make Use of Tax-Free Allowances: The UK government provides various tax-free allowances, such as the nil-rate band and the residence nil-rate band, which individuals can utilize to reduce their inheritance tax liability.

Emoji: 💷🆓

2. Gifts and Exemptions: Making gifts during your lifetime can help reduce your estate’s value and, consequently, the inheritance tax liability. There are also specific exemptions and reliefs available for gifts made to certain individuals and organizations.

Emoji: 🎁🤲

3. Trusts: Establishing trusts allows you to transfer assets while retaining some control over them. Trusts can provide flexibility, protection, and potential tax advantages when it comes to inheritance tax planning.

Emoji: 📚🔒

4. Business and Agricultural Reliefs: If you own a business or agricultural property, you may be eligible for specific reliefs that reduce the value of these assets for inheritance tax purposes.

Emoji: 🏢🌾

5. Seek Professional Advice: Inheritance tax planning can be complex, and it’s crucial to seek professional advice from tax advisors and solicitors who specialize in this area. They can help you navigate the intricacies of inheritance tax law and tailor a plan that suits your specific needs.

Emoji: 📞💼

Each individual’s circumstances are unique, and the strategies that work best for one person may not be suitable for another. Therefore, it’s essential to seek personalized advice to ensure that your inheritance tax planning aligns with your goals and objectives.

Emoji: 🚀🎯

Advantages of Inheritance Tax Planning

Inheritance tax planning offers several advantages:

1. Maximizing Inheritance: Effective planning allows you to maximize the inheritance your loved ones receive by reducing the tax burden on your estate.

Emoji: 💸🎁

2. Financial Security: By minimizing the inheritance tax liability, you provide financial security to your beneficiaries, ensuring they receive the full benefits of your estate.

Emoji: 🏦🔐

3. Control and Flexibility: Inheritance tax planning allows you to maintain control over your assets and decide how they will be distributed after your demise.

Emoji: 🗝️🔄

4. Preservation of Family Wealth: Effective planning helps to preserve your family’s wealth and pass it on to future generations.

Emoji: 👨👩👧👦💼

5. Philanthropy and Legacy: Inheritance tax planning enables you to support charitable causes and leave a lasting legacy by including charitable donations in your estate planning.

Emoji: ❤️🩹🌍

It’s important to note that the advantages of inheritance tax planning can vary depending on individual circumstances. Seeking professional advice can help you understand the specific benefits that apply to your situation.

Emoji: 📚📞

Disadvantages of Inheritance Tax Planning

While there are several advantages to inheritance tax planning, it’s essential to consider the potential disadvantages:

1. Complexity: Inheritance tax planning can be complex, requiring a deep understanding of tax laws and regulations. This complexity may necessitate professional advice and incur additional costs.

Emoji: 🧩💼

2. Potential Changes in Tax Laws: Tax laws and regulations can change over time, impacting the effectiveness of your inheritance tax planning strategies. Regular reviews and updates are necessary to ensure your plans remain effective.

Emoji: 📜📅

3. Financial Implications: Some inheritance tax planning strategies may have financial implications. For example, making large gifts during your lifetime may deplete your own financial resources.

Emoji: 💰💔

4. Time and Effort: Effective inheritance tax planning requires time and effort to gather relevant information, consider various options, and implement the chosen strategies.

Emoji: ⌛💪

5. Inheritance Equalization: In some cases, inheritance tax planning may result in an unequal distribution of assets among beneficiaries. Balancing fairness and tax efficiency can be challenging.

Emoji: ⚖️🎁

It’s important to weigh the potential disadvantages against the benefits and consult with professionals to ensure that your inheritance tax planning aligns with your overall financial goals.

Emoji: 📚📞

FAQ

1. What is the current inheritance tax threshold in the UK?

The current inheritance tax threshold in the UK is £325,000 for individuals and £650,000 for married couples or civil partners.

Emoji: 💷⏫

2. Are there any exemptions or reliefs available for inheritance tax?

Yes, there are several exemptions and reliefs available for inheritance tax, such as the residence nil-rate band, business property relief, and agricultural property relief. These can help reduce the overall tax liability on your estate.

Emoji: 🆓🏘️🌾

3. Can I give gifts to my loved ones to reduce my inheritance tax liability?

Yes, making gifts during your lifetime can help reduce your estate’s value and, consequently, your inheritance tax liability. However, there are specific rules and exemptions that apply to gifts, and it’s important to seek professional advice.

Emoji: 🎁🎉

This post topic: Tax Planning