Unlocking The Secrets: Unveiling The Truth Behind Tax Planning – Legal Or Illegal?

Tax Planning: Legal or Illegal?

Introduction

Dear Readers,

2 Picture Gallery: Unlocking The Secrets: Unveiling The Truth Behind Tax Planning – Legal Or Illegal?

Welcome to this informative article on tax planning. In this article, we will delve into the topic of whether tax planning is legal or illegal. Tax planning is a crucial aspect of financial management for individuals and businesses alike. It involves making strategic decisions to minimize tax liabilities within the bounds of the law. However, there have been debates and controversies surrounding the legality of certain tax planning practices. In this article, we aim to provide you with a comprehensive understanding of tax planning and its legal implications. So, let’s dive right in!

What is Tax Planning?

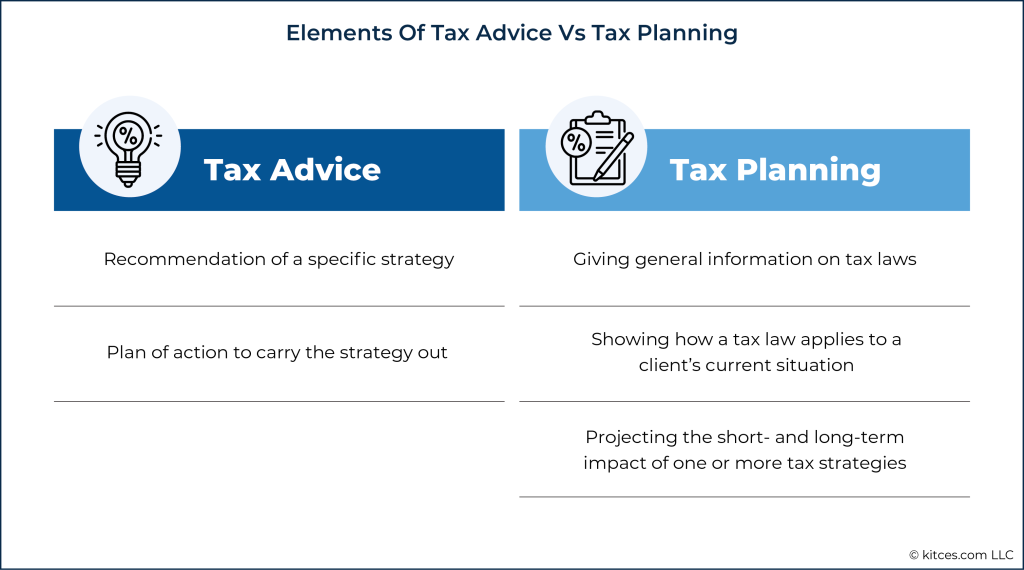

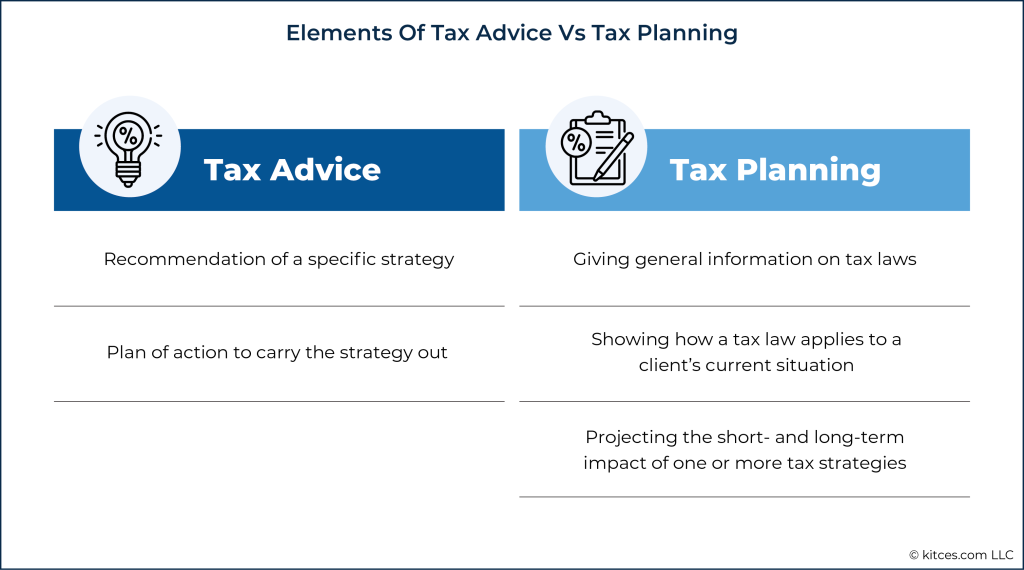

Image Source: kitces.com

🔍 Tax planning refers to the process of organizing financial affairs in a way that maximizes tax benefits and minimizes tax liabilities. It involves strategic decision-making, taking advantage of tax exemptions, deductions, and credits provided by tax laws.

🔍 The purpose of tax planning is to ensure that individuals and businesses pay the correct amount of tax while optimizing their financial position.

🔍 Tax planning is a legal and legitimate practice, as long as it adheres to the tax laws and regulations established by the government.

Who Needs Tax Planning?

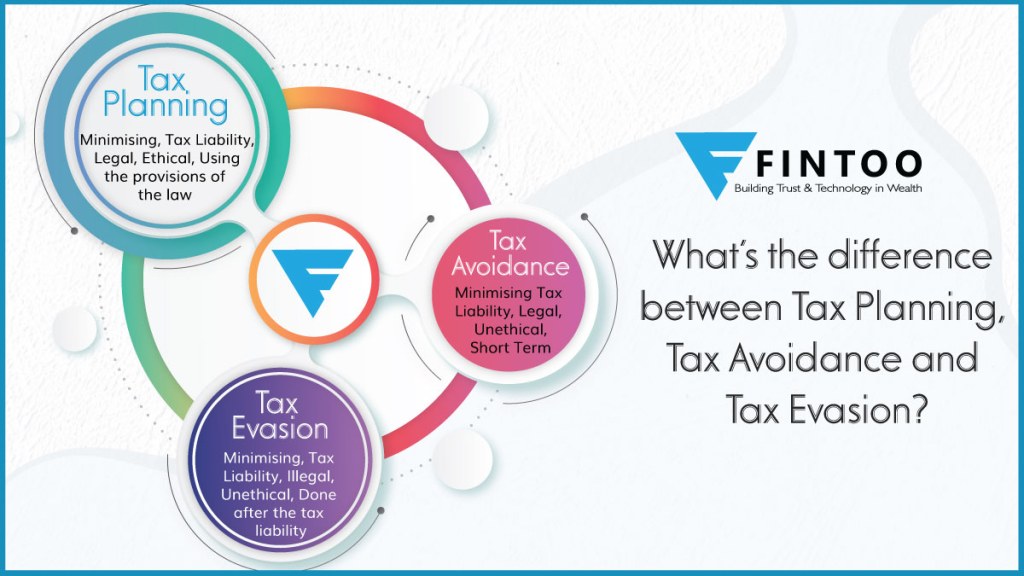

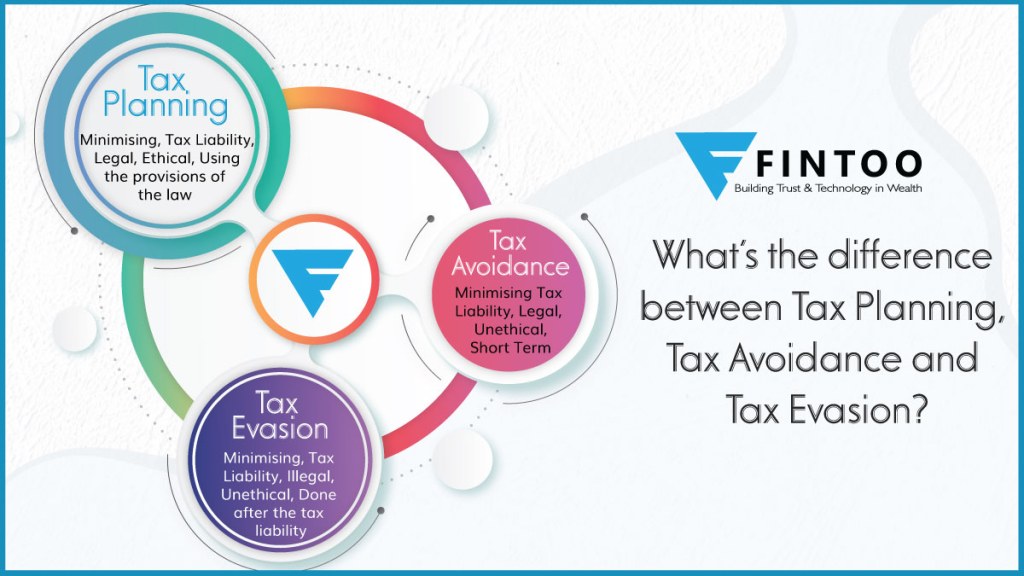

Image Source: fintoo.in

🔍 Tax planning is relevant to individuals, businesses, and organizations of all sizes. Individuals with high incomes, self-employed individuals, and business owners often engage in tax planning to optimize their tax positions.

🔍 Large corporations with complex financial structures also employ tax planning strategies to minimize their tax liabilities legally.

🔍 Even non-profit organizations and charitable institutions can benefit from tax planning by taking advantage of tax incentives provided by the government.

When Should Tax Planning be Done?

🔍 Tax planning should ideally be an ongoing process. It is beneficial to engage in tax planning throughout the year rather than waiting until the tax filing season approaches.

🔍 Early tax planning allows individuals and businesses to make informed financial decisions and implement strategies to minimize tax liabilities.

🔍 However, even if you have missed the opportunity for early tax planning, it is still possible to engage in tax planning during the tax filing season.

Where Does Tax Planning Apply?

🔍 Tax planning applies to the taxation systems of various countries around the world.

🔍 Each country has its own tax laws and regulations, which govern the tax planning strategies that can be employed.

🔍 It is necessary to understand the specific tax laws of the country in which you reside or operate your business to ensure compliance with legal tax planning practices.

Why is Tax Planning Important?

🔍 Tax planning is important for several reasons. It allows individuals and businesses to manage their finances efficiently and legally minimize their tax burdens.

🔍 By engaging in tax planning, individuals can take advantage of various tax incentives, deductions, and credits offered by the government. This can result in significant tax savings.

🔍 Additionally, tax planning enables businesses to allocate resources effectively and make informed financial decisions, thus enhancing their overall profitability.

How Does Tax Planning Work?

🔍 Tax planning involves a systematic approach to managing finances. It begins with evaluating the current financial situation and identifying potential tax-saving opportunities.

🔍 Strategies such as income shifting, capital gains planning, and retirement planning can be employed to legally minimize tax liabilities.

🔍 Effective tax planning requires a thorough understanding of the tax laws and regulations, as well as careful financial analysis and forecasting.

Advantages and Disadvantages of Tax Planning

Advantages:

1. ✅ Reduced Tax Liabilities: Proper tax planning can result in significant tax savings for individuals and businesses.

2. ✅ Financial Efficiency: Tax planning allows for efficient allocation of resources, leading to improved financial management.

3. ✅ Compliance with the Law: By engaging in legal tax planning, individuals and businesses can ensure compliance with tax laws and regulations.

4. ✅ Improved Profitability: Effective tax planning strategies can enhance the profitability of businesses by optimizing tax positions.

5. ✅ Financial Security: Tax planning can provide individuals and businesses with financial security by minimizing the risk of tax-related issues.

Disadvantages:

1. ❌ Complexity: Tax planning can be complex and require professional expertise, especially for individuals with complex financial structures.

2. ❌ Changing Tax Laws: Tax laws and regulations are subject to change, which may impact the effectiveness of tax planning strategies.

3. ❌ Ethical Concerns: Certain tax planning practices may raise ethical concerns, even if they are legal. It is essential to consider ethical implications when engaging in tax planning.

4. ❌ Increased Scrutiny: Aggressive tax planning practices may attract increased scrutiny from tax authorities and could lead to legal consequences.

5. ❌ Potential Mistakes: Improper tax planning or incorrect interpretation of tax laws can result in penalties and additional tax liabilities.

Frequently Asked Questions (FAQs)

Q1: Is tax planning illegal?

A1: No, tax planning is not illegal. It is a legal practice that allows individuals and businesses to minimize their tax liabilities within the bounds of the law.

Q2: Can everyone engage in tax planning?

A2: Yes, tax planning is relevant to individuals, businesses, and organizations of all sizes. However, the complexity of tax planning may vary based on individual circumstances.

Q3: What are the potential consequences of illegal tax planning?

A3: Engaging in illegal tax planning can result in severe penalties, fines, and legal consequences. It is essential to adhere to the tax laws and regulations to avoid such consequences.

Q4: Is tax avoidance the same as tax evasion?

A4: No, tax avoidance and tax evasion are different. Tax avoidance is the legal practice of minimizing tax liabilities, while tax evasion involves illegal activities to evade paying taxes.

Q5: Should I consult a tax professional for tax planning?

A5: It is advisable to consult a tax professional or financial advisor to ensure effective tax planning and compliance with tax laws. They can provide expert guidance based on your specific financial situation.

Conclusion

In conclusion, tax planning is a legal and valuable practice that allows individuals and businesses to optimize their tax positions. By strategically managing finances and taking advantage of tax incentives, individuals and businesses can minimize their tax liabilities while complying with tax laws. However, it is crucial to approach tax planning ethically and seek professional advice when necessary. So, start exploring tax planning strategies and take control of your financial future!

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as legal or financial advice. Tax laws and regulations may vary, and it is advisable to consult a tax professional or financial advisor for personalized guidance. The authors and publishers of this article are not responsible for any actions taken based on the information provided.

This post topic: Tax Planning