Maximize Your Gains: Unveiling The Power Of Tax Planning Implications – Take Action Now!

Tax Planning Implications: Understanding the Impact on Your Finances

Introduction

Greetings, readers! Today, we delve into the world of tax planning implications and how they can greatly affect your financial situation. In this article, we will explore the various aspects of tax planning, its advantages and disadvantages, and provide answers to frequently asked questions. So, let’s get started and gain a comprehensive understanding of tax planning implications!

3 Picture Gallery: Maximize Your Gains: Unveiling The Power Of Tax Planning Implications – Take Action Now!

What are Tax Planning Implications? 🧐

Tax planning implications refer to the effects and consequences of strategically organizing your financial affairs to minimize tax liabilities. By understanding the tax laws and regulations, individuals and businesses can make informed decisions to optimize their tax positions, ultimately leading to significant savings. It is crucial to consider these implications to ensure compliance and achieve financial goals.

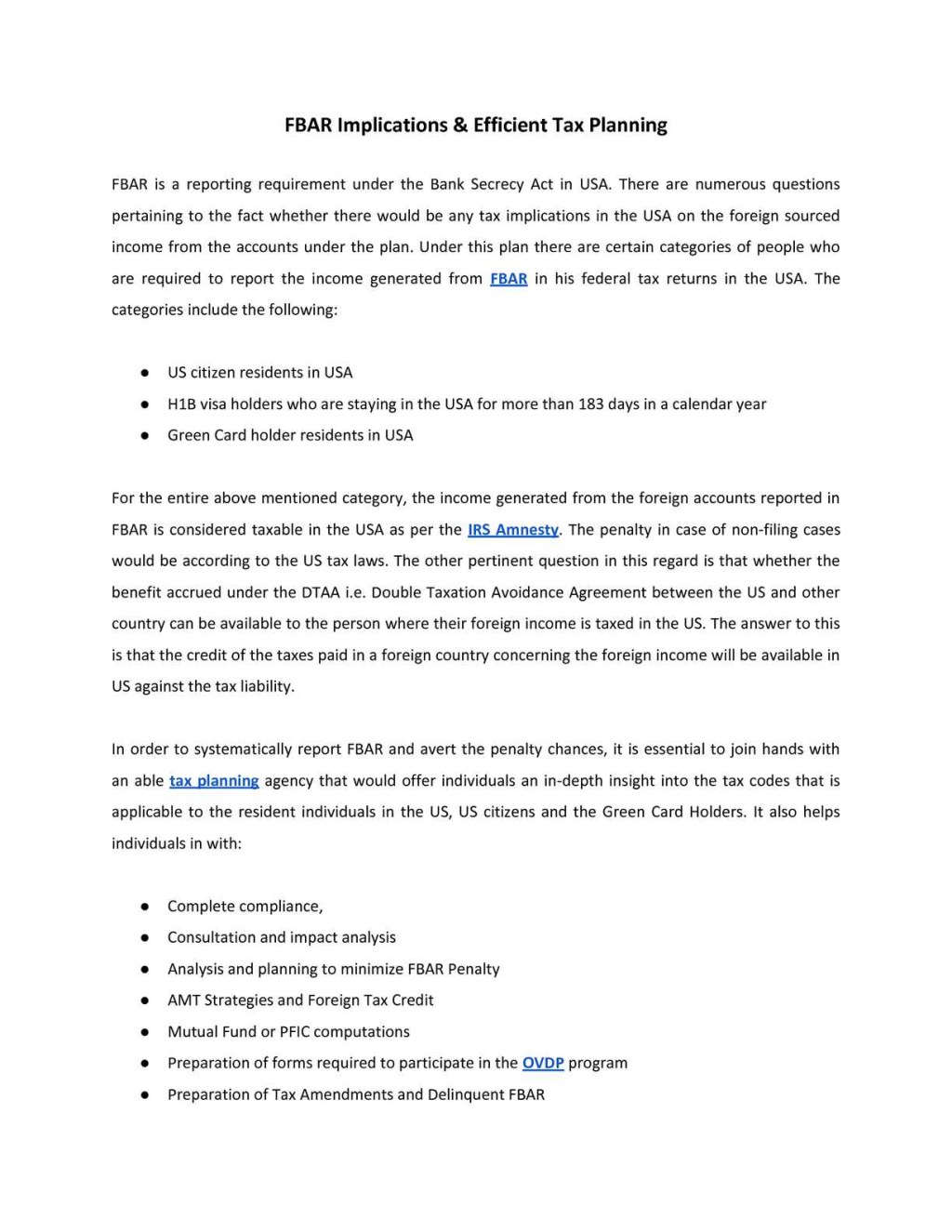

Strategies for Effective Tax Planning 📝

Image Source: calameoassets.com

1. Understanding Tax Laws and Regulations: Familiarize yourself with the ever-changing tax laws and regulations to stay informed and make informed decisions.

2. Timing of Income and Expenses: Properly timing when you receive income or incur expenses can impact your tax liabilities. Consider deferring income or accelerating expenses to minimize your taxable income.

3. Utilizing Tax-Deductible Expenses: Identify and maximize deductions available to you, such as mortgage interest, medical expenses, or business-related costs. These deductions can significantly reduce your tax burden.

Image Source: github.io

4. Investment Strategies: Evaluate tax-efficient investment options to optimize your tax liabilities. Utilize tax-advantaged accounts, such as Individual Retirement Accounts (IRAs) or 401(k) plans, to grow your wealth while minimizing taxes.

5. Incorporation and Entity Structure: Choosing the appropriate business structure can have significant tax implications. Consult with professionals to determine if forming a corporation or an LLC could benefit your tax position.

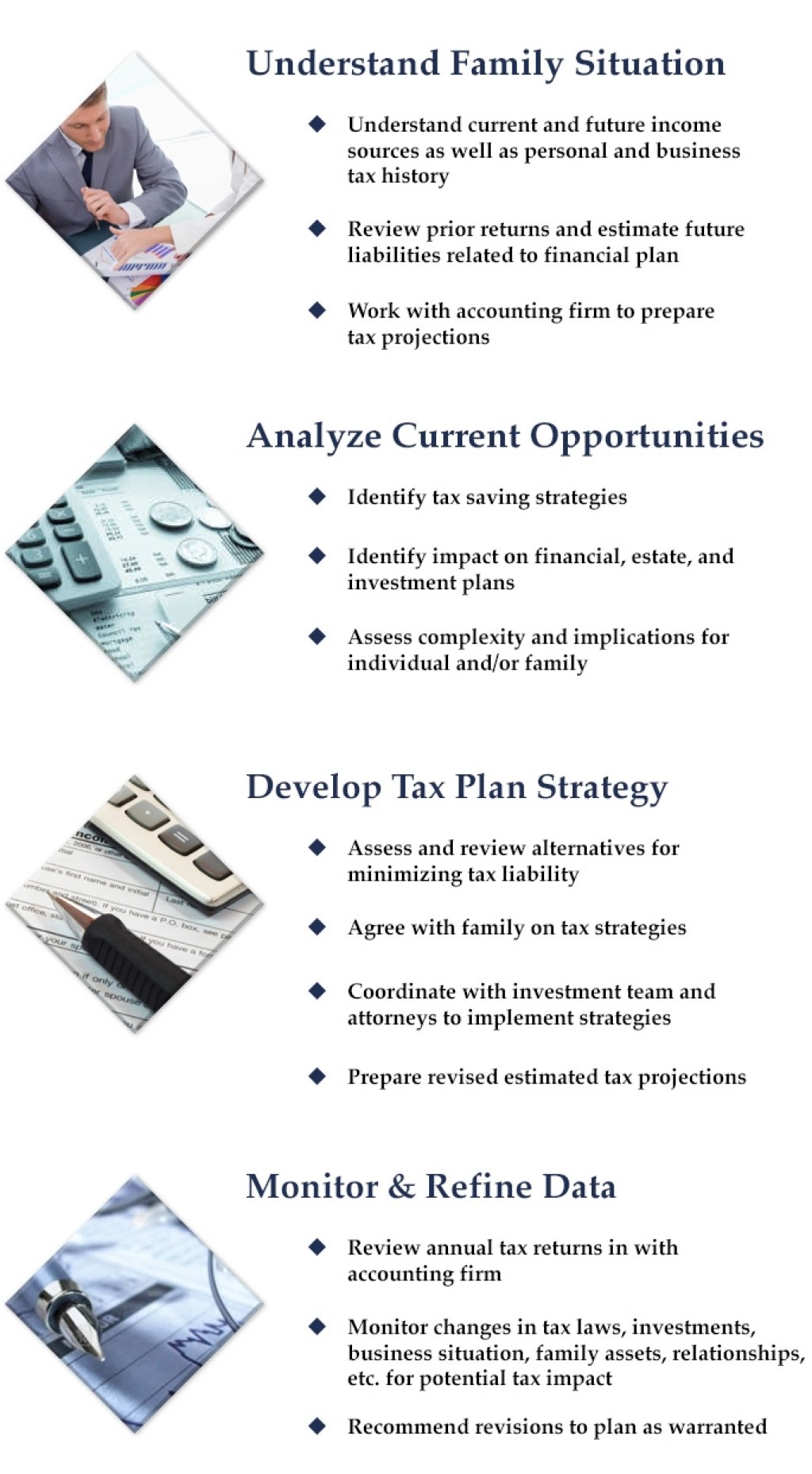

Image Source: fmgsuite.com

6. Charitable Contributions: Making charitable donations can result in tax deductions. Consider supporting causes you care about while reducing your tax liabilities.

7. Estate Planning: Proper estate planning can minimize estate taxes and ensure the smooth transfer of assets to beneficiaries. Consult with an estate planning attorney to develop a comprehensive plan.

Who Needs to Consider Tax Planning Implications? 🤔

Tax planning implications are relevant to individuals, families, and businesses of all sizes. Whether you are an employee, self-employed, a small business owner, or a multinational corporation, understanding and implementing effective tax planning strategies can have a significant impact on your financial situation.

Individuals:

Individuals with various sources of income, investments, or high net worth can benefit from tax planning to minimize their tax liabilities and maximize their savings. It is crucial to optimize deductions, take advantage of tax credits, and strategically manage investments to achieve financial goals.

Small Business Owners:

Small business owners can utilize tax planning to optimize their business structure, employee benefits, and deductions. Proper tax planning can help reduce the tax burden, improve cash flow, and create opportunities for business growth.

Corporations:

Large corporations with complex operations and multinational businesses face unique tax challenges. Effective tax planning enables them to navigate international tax laws, transfer pricing regulations, and tax treaties, ensuring compliance while minimizing global tax liabilities.

When Should You Consider Tax Planning Implications? 📅

Tax planning implications should be considered throughout the year, rather than just during the tax filing season. By proactively implementing tax strategies, you can optimize your financial position and minimize surprises when preparing your tax return. It is recommended to start tax planning as early as possible to maximize the benefits.

Where Can You Implement Tax Planning Strategies? 🌍

Tax planning strategies can be implemented in various areas, including:

– Personal finances and investments

– Real estate transactions

– Retirement planning

– Business operations and structure

– Estate and gift planning

– International tax planning

Consult with a qualified tax advisor or accountant to identify areas where tax planning can be beneficial based on your specific circumstances.

Why Should You Consider Tax Planning Implications? 🤷♂️

Implementing effective tax planning strategies can bring numerous benefits, including:

Maximized Savings:

By minimizing tax liabilities, individuals and businesses can retain more of their hard-earned money, allowing for increased savings, investments, and growth opportunities.

Improved Cash Flow:

Reducing tax payments through proper planning can enhance cash flow, providing individuals and businesses with additional resources for daily operations, expansions, or personal expenses.

Compliance and Risk Management:

Tax planning ensures compliance with applicable tax laws and regulations, reducing the risk of penalties, audits, and legal issues. It allows for peace of mind and financial stability.

Increased Financial Security:

Proper tax planning can contribute to long-term financial security by optimizing investments, retirement savings, and estate planning. It helps individuals and families achieve their financial goals and establish a solid foundation for the future.

How Can You Implement Tax Planning Strategies? 📚

Effective tax planning requires careful consideration and professional guidance. Here are some steps to implement tax planning strategies:

1. Evaluate Your Financial Situation:

Assess your income, expenses, investments, and business operations to identify potential areas for tax planning. Understand your short-term and long-term financial goals.

2. Consult with a Tax Advisor:

Seek guidance from a qualified tax advisor or accountant who can help analyze your financial situation, identify tax-saving opportunities, and develop a personalized tax plan.

3. Stay Up-to-Date:

Keep yourself informed about tax laws, regulations, and changes that may impact your financial situation. Regularly review your tax plan to ensure it aligns with any updates.

4. Record Keeping:

Maintain accurate and organized financial records, including receipts, invoices, and tax-related documents. This documentation is essential for claiming deductions and credits.

5. Review and Adjust:

Regularly review your tax plan, especially when significant life events occur, such as marriage, birth of a child, or starting a business. Adjust your tax strategies as needed to adapt to changing circumstances.

Advantages and Disadvantages of Tax Planning Implications

Advantages:

1. Tax Savings: Proper tax planning can lead to significant tax savings, allowing individuals and businesses to keep more of their earnings.

2. Improved Financial Management: By strategically organizing finances, individuals and businesses can gain better control over their financial situation and plan for future growth.

3. Increased Compliance: Effective tax planning ensures compliance with tax laws, reducing the risk of penalties, audits, and legal issues.

4. Enhanced Retirement Savings: By utilizing tax-advantaged retirement accounts and strategies, individuals can maximize their retirement savings and achieve long-term financial security.

5. Business Growth Opportunities: Tax planning enables businesses to allocate resources more efficiently, fostering growth, and expanding operations.

Disadvantages:

1. Complex Regulations: Tax laws and regulations can be complex and continuously evolving, making tax planning a challenging task that requires professional expertise.

2. Time-Consuming: Developing and implementing effective tax planning strategies can be time-consuming, requiring thorough research and analysis.

3. Costs: Hiring tax professionals to assist with tax planning may incur additional costs. However, the potential tax savings often outweigh these expenses.

4. Risk of Non-Compliance: Improper tax planning can lead to non-compliance, resulting in penalties, audits, and legal consequences.

5. Lack of Flexibility: Tax planning strategies may require individuals and businesses to make certain financial decisions that may limit flexibility in the short term.

Frequently Asked Questions (FAQs)

1. Can I engage in aggressive tax planning to minimize my tax liabilities?

No, engaging in aggressive tax planning schemes that violate tax laws or lack economic substance can lead to severe consequences, including penalties and legal issues. It is essential to engage in legitimate tax planning strategies within the boundaries of the law.

2. Is tax planning only relevant for high-income individuals or businesses?

No, tax planning is relevant for individuals and businesses of all income levels and sizes. Everyone can benefit from optimizing their tax position and minimizing tax liabilities based on their specific circumstances.

3. How often should I review my tax plan?

It is recommended to review your tax plan annually or whenever significant life events occur, such as marriage, birth of a child, or starting a business. Regular reviews ensure that your tax strategies remain aligned with your financial goals and evolving tax laws.

4. Can tax planning help me save for retirement?

Yes, tax planning can help you maximize your retirement savings. By utilizing tax-advantaged retirement accounts, such as IRAs or 401(k) plans, and taking advantage of applicable tax deductions, you can grow your retirement funds while reducing your tax burden.

5. Is tax planning only relevant for domestic taxation?

No, tax planning is crucial for both domestic and international taxation. Multinational businesses and individuals with international investments or income sources must consider international tax laws, treaties, and transfer pricing regulations to optimize their tax position while ensuring compliance.

Conclusion: Take Action Now and Optimize Your Tax Position

Understanding tax planning implications is essential for individuals and businesses alike. By implementing effective tax planning strategies, you can maximize savings, improve cash flow, ensure compliance, and achieve long-term financial security. Consult with a qualified tax advisor or accountant to develop a personalized tax plan that aligns with your goals. Start taking action today and unlock the benefits of tax planning!

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as professional tax advice. Tax laws and regulations vary by jurisdiction, and it is crucial to consult with a qualified tax advisor or accountant to address your specific tax planning needs. Remember to keep accurate and organized records, stay informed about changing tax laws, and regularly review your tax plan to ensure compliance and maximize benefits.

This post topic: Tax Planning