Maximize Your Wealth With Individual Tax Planning: Take Control Of Your Financial Future Now!

Tax Planning of Individual: Maximizing Efficiency and Minimizing Liability

Greetings, Readers! Today, we delve into the world of tax planning for individuals. As tax regulations continue to evolve, it becomes increasingly crucial for individuals to understand the ins and outs of tax planning to optimize their financial situations. In this article, we will explore the concept of tax planning, its benefits, and how it can be effectively implemented. So, let’s dive in!

Introduction

Before we delve into the specifics, let’s start with a brief overview of tax planning. Tax planning refers to the systematic arrangement of one’s financial affairs to minimize tax liability and maximize after-tax income. It involves understanding the tax laws, utilizing various strategies, and making informed decisions to optimize tax outcomes. Effective tax planning can result in significant savings and financial advantages for individuals.

2 Picture Gallery: Maximize Your Wealth With Individual Tax Planning: Take Control Of Your Financial Future Now!

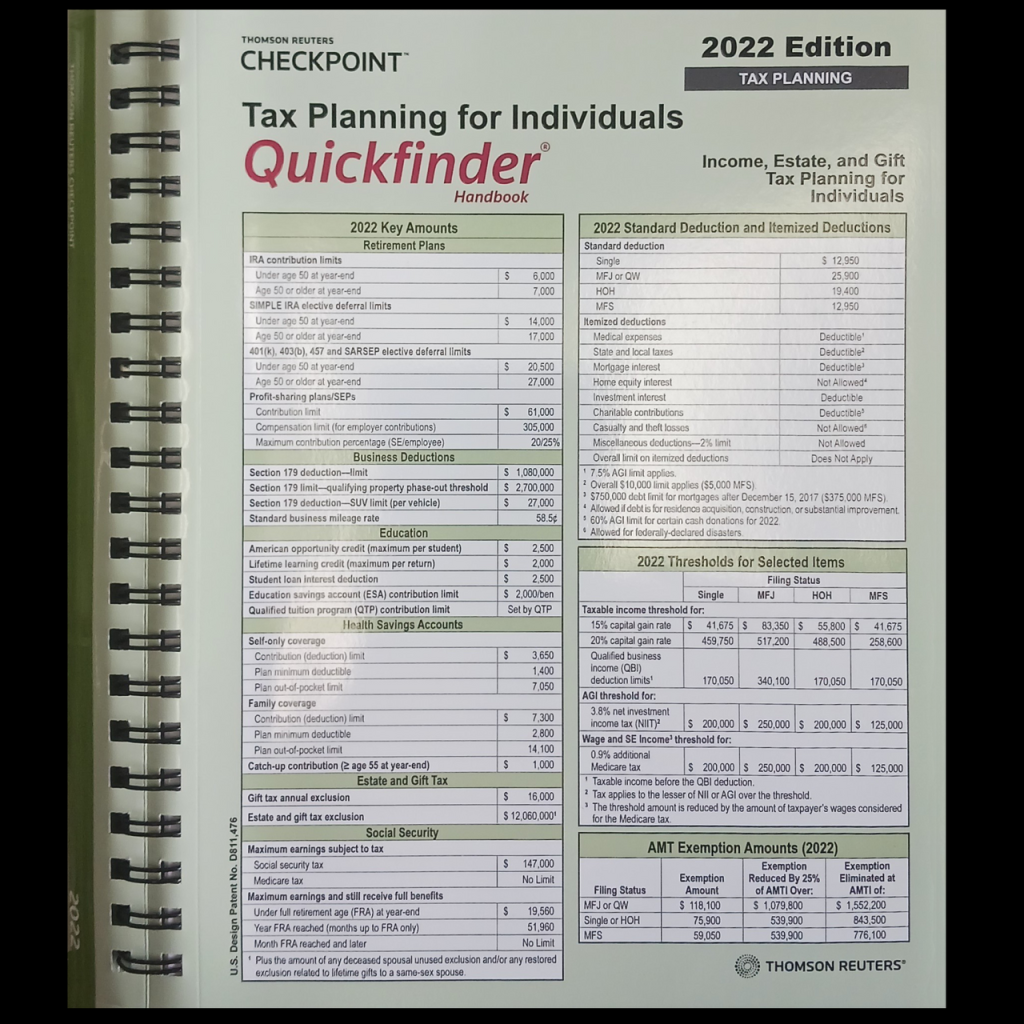

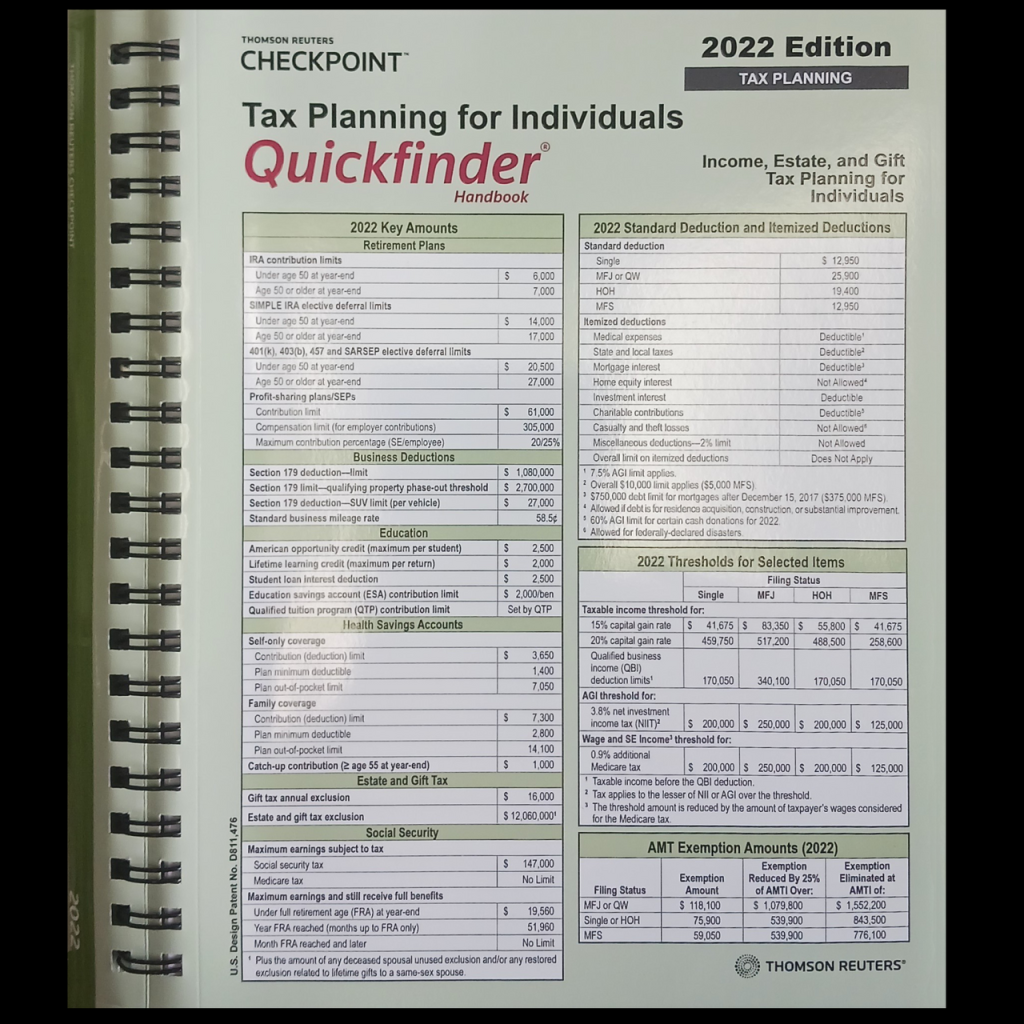

In this table, you will find a comprehensive breakdown of all the necessary information about tax planning of individuals:

| Tax Planning of Individual Table |

|———————————-|

| – Definition |

| – Importance |

| – Process |

| – Strategies |

| – Common Mistakes |

| – Legal Considerations |

| – Professional Assistance |

What is Tax Planning of Individual? 🧐

Tax planning of individuals involves the proactive management of one’s financial affairs to legally minimize tax liability. It entails understanding the tax laws and using specific strategies to optimize tax outcomes. By strategically planning their income, deductions, and investments, individuals can minimize their tax burden and retain a larger portion of their earnings.

Image Source: bigcommerce.com

To achieve effective tax planning, individuals must have a comprehensive understanding of the tax code and stay updated with changes in legislation. Additionally, seeking professional assistance from tax advisors or accountants can ensure accurate and efficient tax planning.

Understanding Tax Laws and Regulations 📚

A crucial aspect of tax planning is having a solid understanding of tax laws and regulations. Tax laws can be complex and subject to frequent changes, making it essential for individuals to stay up-to-date with the latest developments. This knowledge allows individuals to identify potential tax-saving opportunities and make informed decisions regarding their financial matters.

Utilizing Tax Deductions and Credits 💸

One of the primary strategies in tax planning is maximizing tax deductions and credits. Deductions, such as those for mortgage interest, education expenses, and charitable donations, reduce the taxable income. Credits, on the other hand, directly reduce the tax liability. By taking advantage of these deductions and credits, individuals can lower their overall tax obligation.

Considering the Tax Implications of Investments 📈

Investments can have significant tax implications, both positive and negative. By strategically planning their investments, individuals can minimize their tax liability. For instance, investing in tax-efficient instruments like tax-free bonds or tax-advantaged retirement accounts can help individuals reduce their tax burden. On the other hand, understanding the tax consequences of capital gains and losses is crucial to making informed investment decisions.

Timing Income and Expenses ⏰

The timing of income and expenses can play a vital role in tax planning. By deferring income to a subsequent tax year or accelerating deductions into the current year, individuals can manage their taxable income effectively. This strategy is particularly useful when individuals expect a change in income levels or tax rates in the future.

Optimizing Retirement Contributions 🏦

Image Source: bizlatinhub.com

Retirement planning is an integral part of tax planning for individuals. By maximizing contributions to retirement accounts like 401(k)s or IRAs, individuals can lower their taxable income while simultaneously saving for their future. Additionally, taking advantage of employer-matching contributions can further enhance the tax benefits of retirement accounts.

Seeking Professional Assistance 🤝

While individuals can undertake tax planning on their own, seeking professional assistance from tax advisors or accountants can be highly beneficial. Tax professionals have in-depth knowledge of tax laws and regulations, enabling them to identify personalized tax-saving strategies based on an individual’s unique circumstances. Their expertise can ensure accurate tax planning and minimize the risk of errors or audits.

This post topic: Tax Planning