Boost Your Tax Planning Qualifications: Unleash The Power Of Strategic Financial Management!

Tax Planning Qualifications

Greetings, Readers! In this article, we will delve into the world of tax planning qualifications. Tax planning is an essential aspect of financial management for both individuals and businesses alike. By strategically managing one’s taxes, individuals and companies can minimize their tax liability and maximize their savings. However, tax planning requires a certain level of expertise and knowledge. Let’s explore the qualifications necessary for becoming a tax planning professional.

Introduction

1. What are tax planning qualifications?

2 Picture Gallery: Boost Your Tax Planning Qualifications: Unleash The Power Of Strategic Financial Management!

2. Who needs tax planning qualifications?

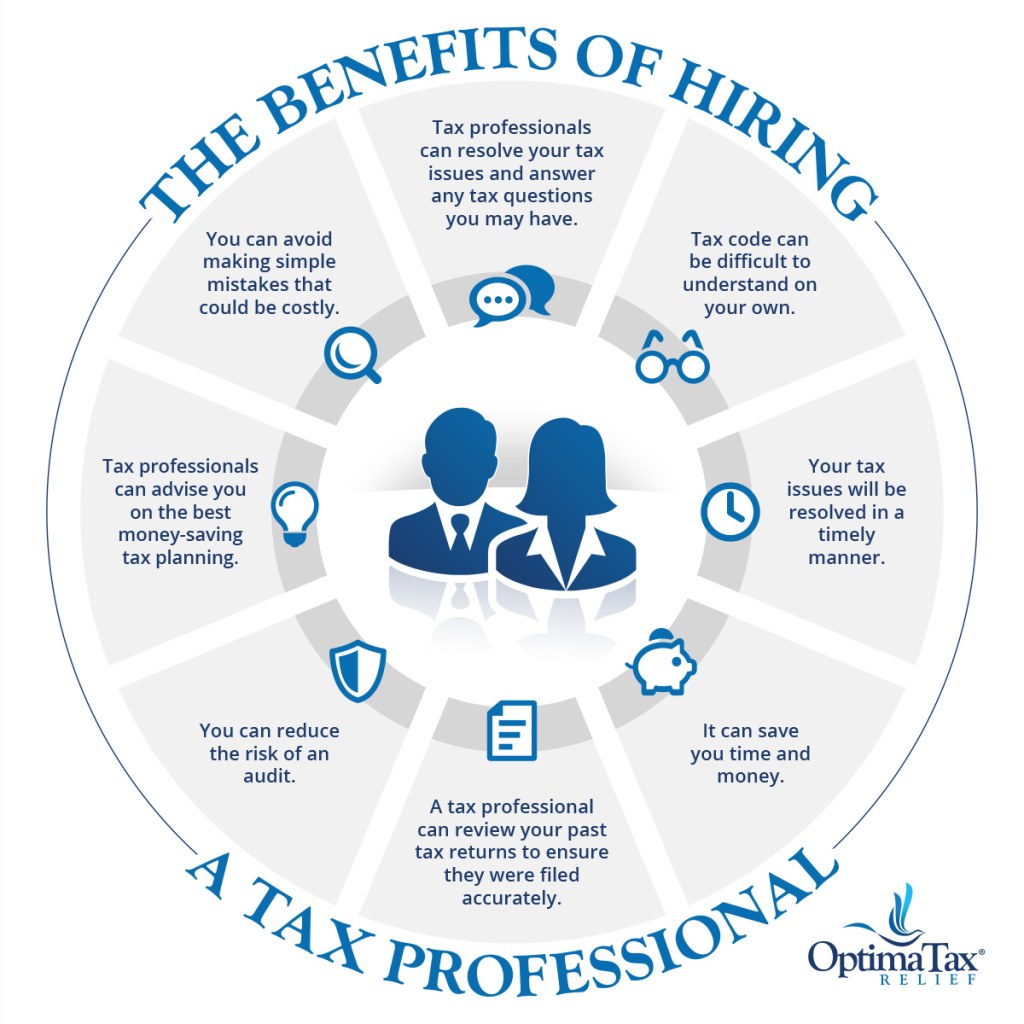

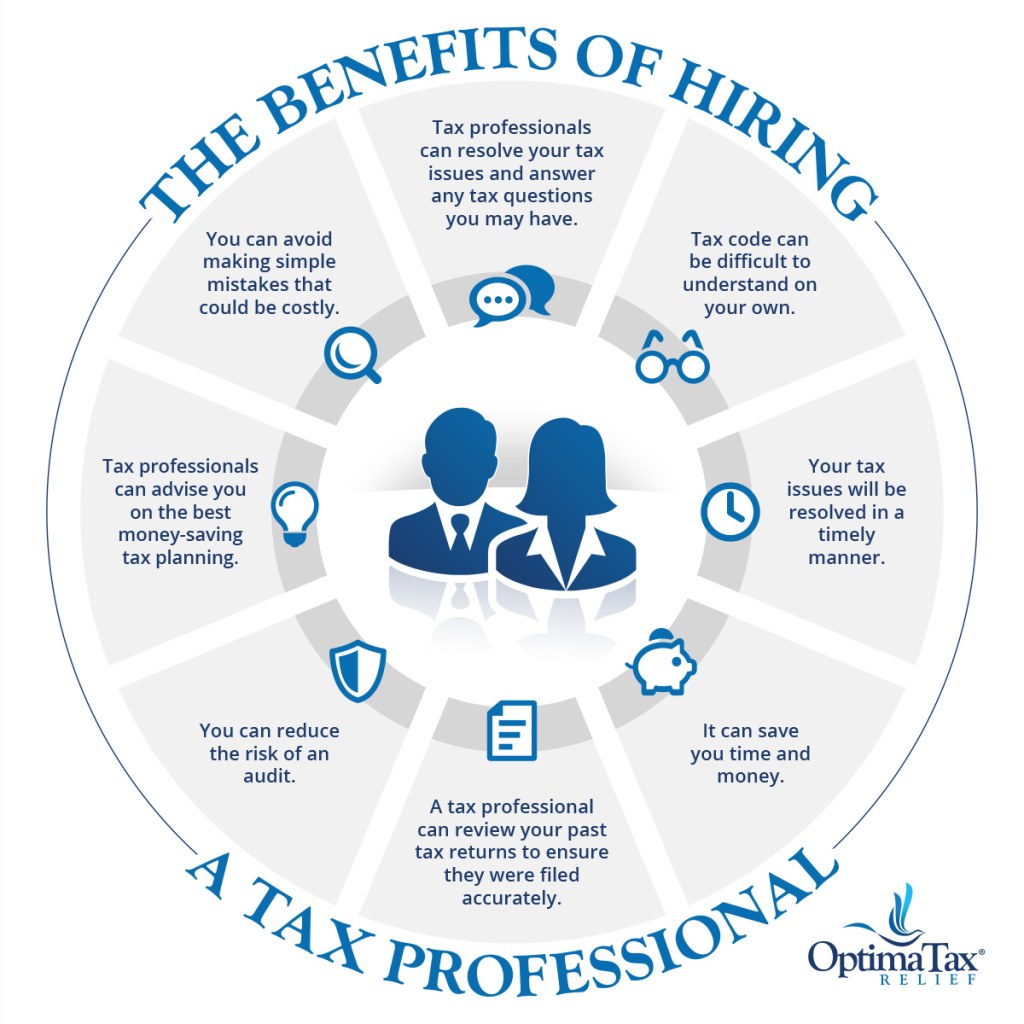

Image Source: optimataxrelief.com

3. When should one consider obtaining tax planning qualifications?

4. Where can one acquire tax planning qualifications?

5. Why are tax planning qualifications important?

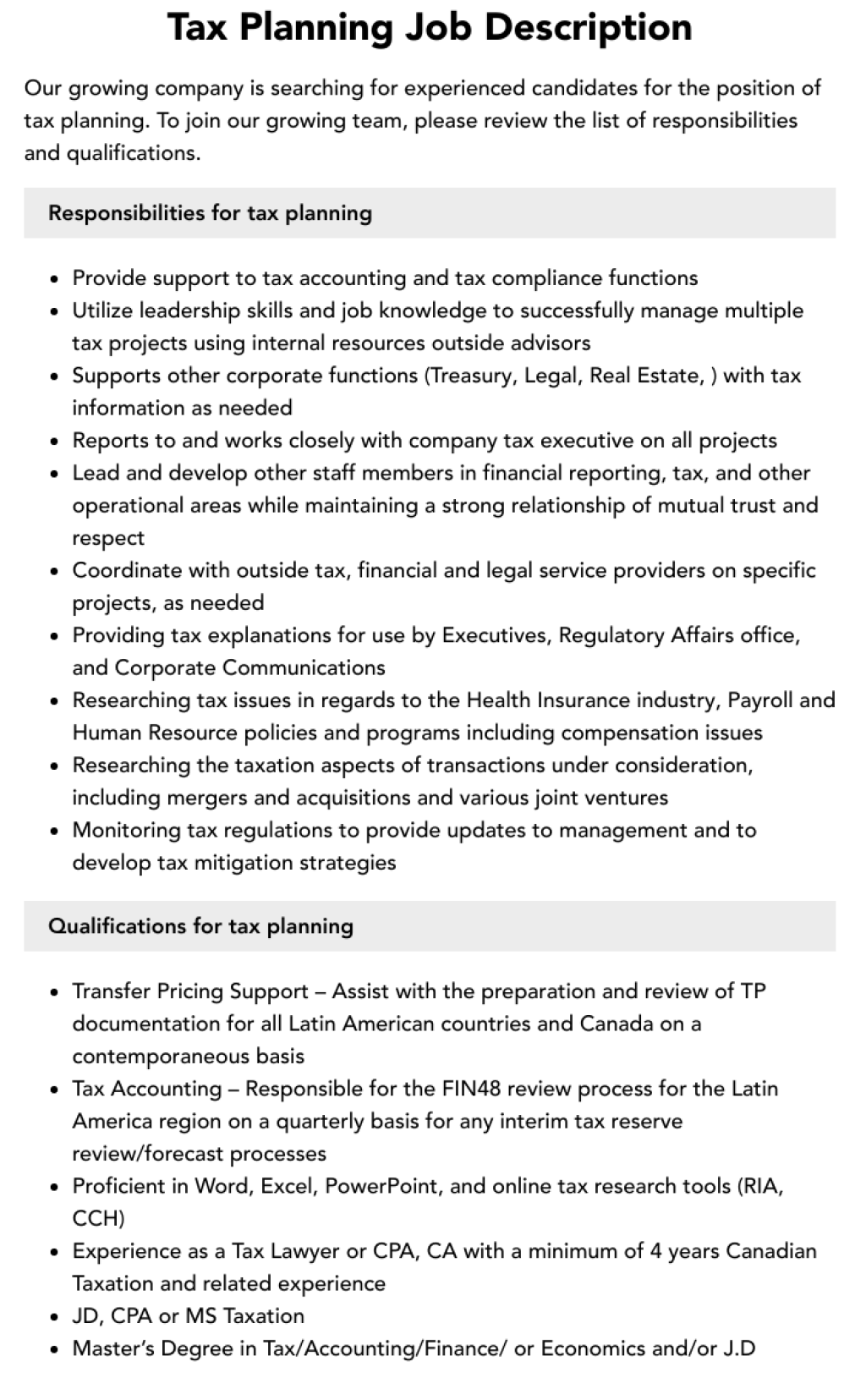

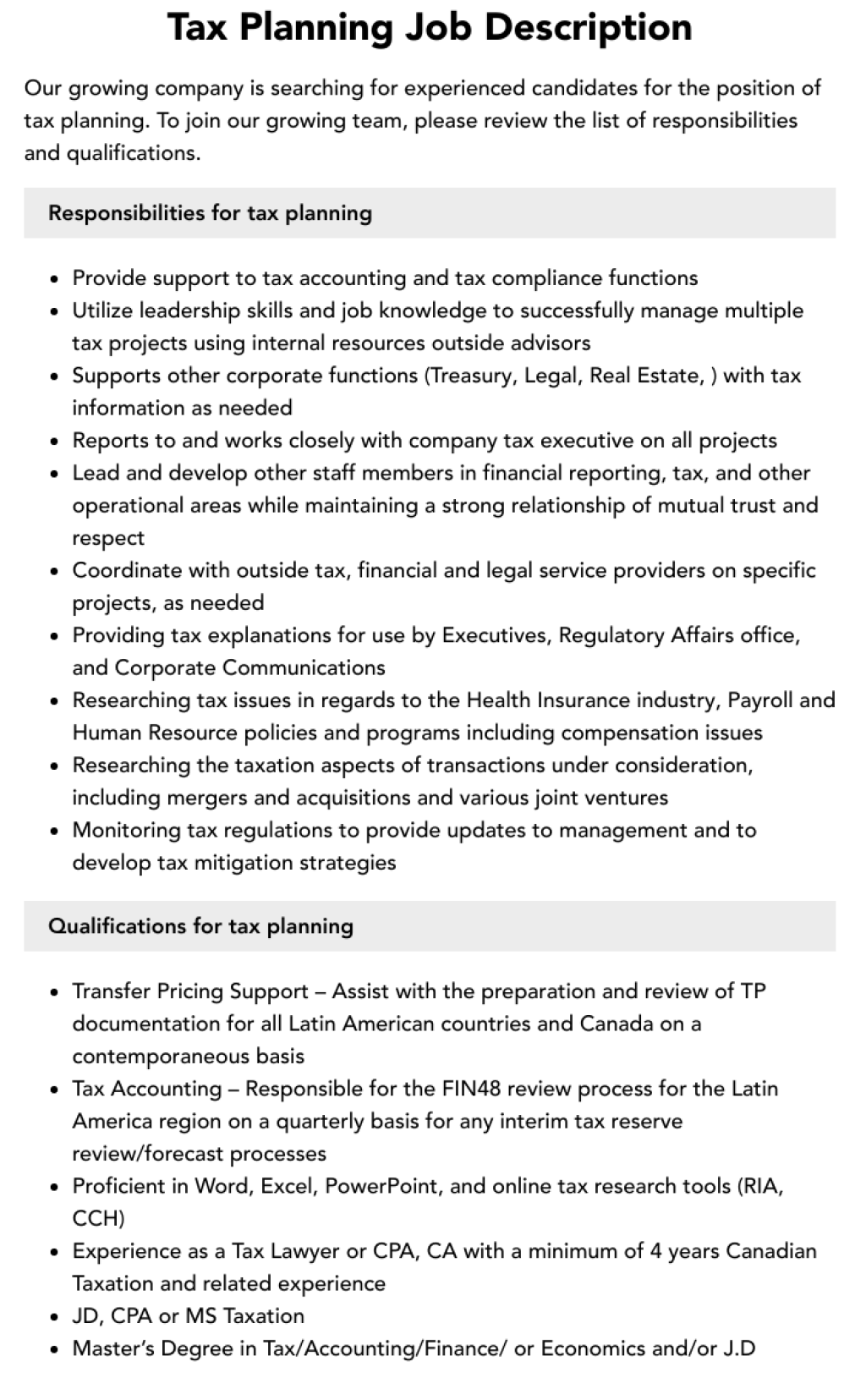

Image Source: velvetjobs.com

6. How can one obtain tax planning qualifications?

Tax planning qualifications refer to the certifications, skills, and expertise required to effectively navigate the complexities of tax planning. These qualifications are essential for individuals who wish to pursue a career in tax planning or for business owners who want to manage their taxes efficiently. Obtaining these qualifications enhances one’s understanding of the tax system, enables them to provide valuable advice to clients, and ensures compliance with tax laws and regulations.

Anyone who is involved in financial management, whether on a personal or professional level, can benefit from tax planning qualifications. This includes individuals who want to optimize their personal finances, entrepreneurs who want to minimize their business taxes, and professionals working in accounting and finance who want to expand their expertise.

The ideal time to consider obtaining tax planning qualifications is when you have a basic understanding of financial management and are looking to specialize in tax planning. Whether you are starting a career in the finance industry or already working in a related field, acquiring tax planning qualifications can provide you with a competitive edge and open up new opportunities.

There are various institutions and organizations that offer tax planning qualifications. These include universities, colleges, professional associations, and online platforms. It is important to choose a reputable and recognized institution to ensure the quality and relevance of the qualifications obtained.

Tax planning qualifications are important for several reasons. Firstly, they equip individuals with the knowledge and skills necessary to navigate the complex tax landscape. This ensures that individuals can maximize their tax savings, minimize their tax liability, and remain compliant with tax laws. Additionally, tax planning qualifications establish credibility and trust, allowing individuals to provide professional advice and services to clients confidently.

To obtain tax planning qualifications, individuals can pursue formal education programs, such as bachelor’s or master’s degrees in accounting, finance, or taxation. Additionally, there are professional certifications available, such as Certified Public Accountant (CPA), Enrolled Agent (EA), or Certified Financial Planner (CFP). These certifications often require passing rigorous exams and fulfilling specific experience requirements.

Advantages and Disadvantages of Tax Planning Qualifications

1. Advantages of tax planning qualifications

2. Disadvantages of tax planning qualifications

Advantages:

✅ Enhanced knowledge and expertise in tax planning

✅ Greater career opportunities and earning potential

✅ Ability to provide valuable tax advice and services to clients

✅ Increased credibility and trustworthiness in the industry

✅ Stay up-to-date with changing tax laws and regulations

Disadvantages:

❌ Time and financial investment required to obtain qualifications

❌ Ongoing commitment to continuing education and professional development

❌ Competitive job market for tax planning professionals

❌ Potential for increased liability and responsibility

❌ Need for continuous learning to keep up with evolving tax regulations

Frequently Asked Questions (FAQs)

1. What are the primary tax planning qualifications?

The primary tax planning qualifications include certifications such as CPA, EA, or CFP, as well as relevant academic degrees in accounting, finance, or taxation.

2. How long does it take to obtain tax planning qualifications?

The time required to obtain tax planning qualifications varies depending on the chosen path. Academic degrees typically take several years, while professional certifications may require months of preparation and study.

3. Are tax planning qualifications recognized internationally?

Yes, many tax planning qualifications are recognized internationally. However, it is important to research and ensure that the qualifications obtained are relevant in the desired location.

4. Can tax planning qualifications be obtained through online courses?

Yes, there are online platforms that offer tax planning qualifications. However, it is advisable to choose reputable platforms and ensure the credibility of the qualifications.

5. How can tax planning qualifications benefit individuals and businesses?

Tax planning qualifications enable individuals and businesses to optimize their tax savings, minimize their tax liability, and ensure compliance with tax laws. They also provide the necessary knowledge and expertise to provide valuable tax advice and services.

Conclusion

In conclusion, tax planning qualifications are essential for individuals and businesses seeking to navigate the complexities of tax planning. These qualifications provide the necessary knowledge, skills, and credibility to optimize tax savings, minimize tax liability, and remain compliant with tax laws. Whether through formal education programs or professional certifications, obtaining tax planning qualifications can open up new career opportunities and enhance financial management skills.

We encourage you to explore the various tax planning qualifications available and choose the path that aligns with your goals and aspirations. By investing in your tax planning expertise, you can contribute to the financial success of individuals and businesses while advancing your own professional growth.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as professional tax advice. It is recommended to consult with a certified tax professional for personalized guidance based on your specific circumstances.

This post topic: Tax Planning