Maximizing Your Savings: Unraveling The Power Of Taxation 529 Plan Withdrawals – Act Now!

Taxation 529 Plan Withdrawals: Maximizing Your Savings for Education

Introduction

Dear Readers,

1 Picture Gallery: Maximizing Your Savings: Unraveling The Power Of Taxation 529 Plan Withdrawals – Act Now!

Welcome to our comprehensive guide on taxation 529 plan withdrawals. As education costs continue to rise, it has become crucial for families to plan ahead and explore the various options available to save for their children’s education. A 529 plan is a popular choice, providing tax advantages and flexibility. In this article, we will delve into the details of taxation 529 plan withdrawals, helping you understand how to make the most of your savings. Let’s get started!

The Basics: What Are Taxation 529 Plan Withdrawals?

Image Source: fmgsuite.com

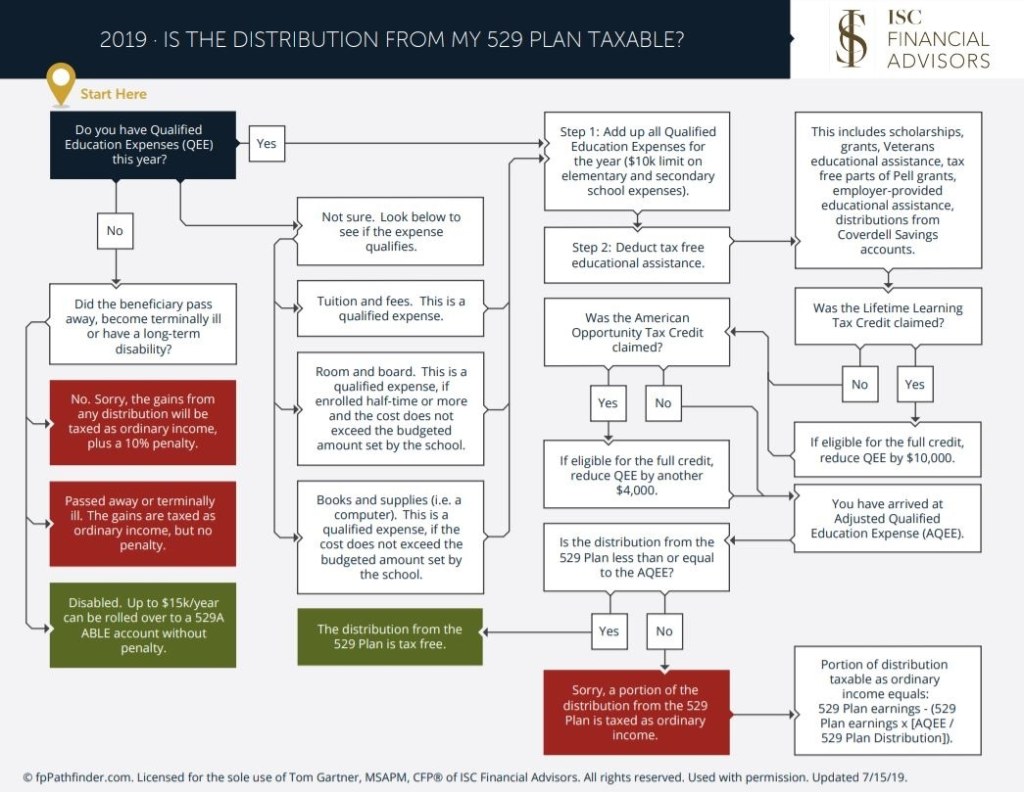

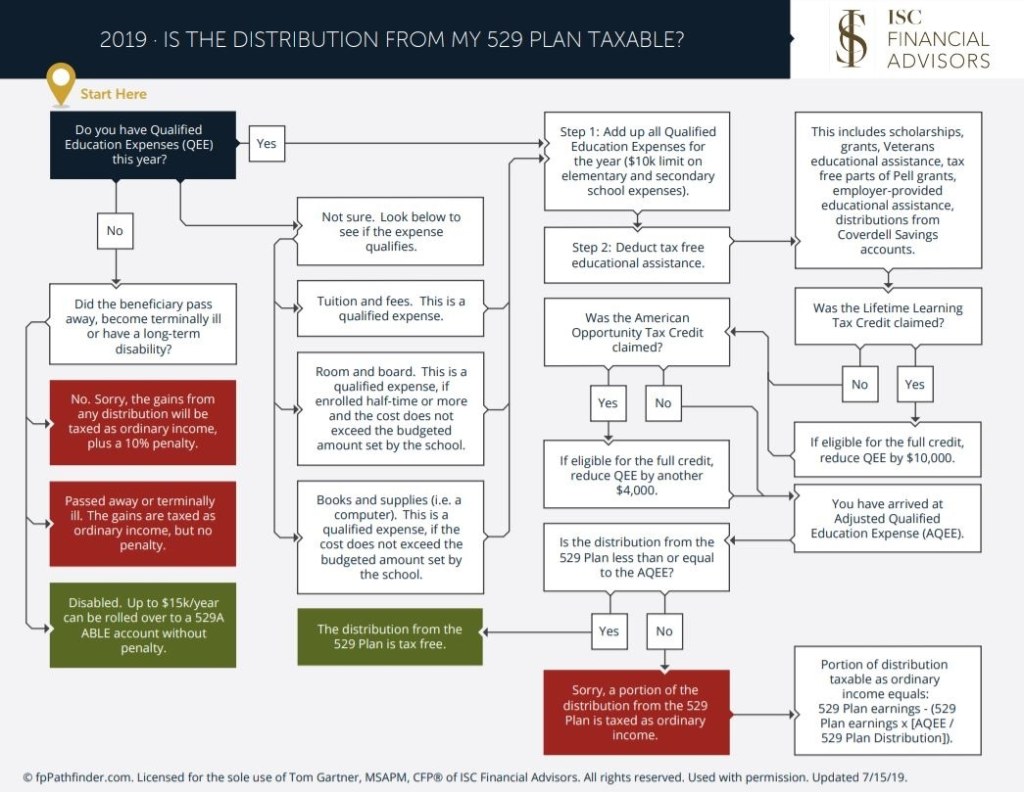

📚 Before we dive into the details, let’s first understand what taxation 529 plan withdrawals are. A 529 plan is a state-sponsored education savings plan that allows individuals to save for qualified education expenses. Withdrawals from these plans are generally tax-free if used for eligible expenses, such as tuition, books, and room and board.

📚 Who can benefit from taxation 529 plan withdrawals? The answer is simple – anyone looking to save for education expenses. Whether you are a parent, grandparent, or even a student planning to fund your own education, a 529 plan can be a valuable tool.

📚 When can you make taxation 529 plan withdrawals? Withdrawals can be made at any time, as long as they are used for qualified education expenses. However, it’s important to be aware of the rules surrounding withdrawals to avoid potential penalties or taxes.

📚 Where can you use taxation 529 plan withdrawals? One of the greatest advantages of 529 plans is their flexibility. Withdrawals can be used at eligible educational institutions throughout the United States and even some international institutions.

📚 Why should you consider taxation 529 plan withdrawals? The benefits are numerous. From tax advantages to investment growth potential, utilizing a 529 plan can help you maximize your savings and minimize the financial burden of education expenses.

📚 How can you make taxation 529 plan withdrawals? The process is relatively straightforward. By following the plan’s guidelines and keeping track of your qualified expenses, you can easily access your funds when needed.

Advantages and Disadvantages of Taxation 529 Plan Withdrawals

🌟 Advantages:

1. Tax Benefits: One of the biggest advantages of 529 plans is the potential for tax-free withdrawals when used for qualified education expenses.

2. Higher Contribution Limits: Unlike some other education savings options, 529 plans often have higher contribution limits, allowing you to save more for your child’s education.

3. Investment Options: 529 plans offer a range of investment options, allowing you to choose an investment strategy that aligns with your financial goals and risk tolerance.

4. Flexibility: Funds can be used at eligible institutions nationwide, providing flexibility in choosing the right educational path for your child.

5. Gift and Estate Tax Benefits: By contributing to a 529 plan, you may also be eligible for gift and estate tax benefits, making it a valuable tool for estate planning.

🌟 Disadvantages:

1. Limited Use of Funds: While 529 plans are primarily designed for education expenses, there are limitations on how funds can be used. Non-qualified withdrawals may be subject to taxes and penalties.

2. Impact on Financial Aid: It’s important to consider the potential impact of 529 plan withdrawals on financial aid eligibility, as they may be considered as assets.

3. State Tax Considerations: While federal tax benefits are consistent across all 529 plans, state tax treatment may vary. It’s important to understand your state’s rules and regulations.

4. Investment Risk: As with any investment, there is always a level of risk involved. It’s important to carefully consider your investment options and consult with a financial advisor if needed.

5. Lack of Control: Once funds are contributed to a 529 plan, the account owner has limited control over how the funds are invested.

Frequently Asked Questions (FAQ)

1. Can I use taxation 529 plan withdrawals for K-12 education?

Yes, recent changes to the tax law now allow for limited use of 529 plan withdrawals for K-12 education expenses. However, there are certain restrictions and limitations to be aware of.

2. What happens if my child doesn’t pursue higher education?

If your child decides not to pursue higher education, you have several options. You can change the beneficiary to another family member, use the funds for qualified education expenses in the future, or withdraw the funds with potential tax implications.

3. Are there income limitations for contributing to a 529 plan?

No, there are no income limitations for contributing to a 529 plan. Anyone can contribute, regardless of their income level.

4. Can I contribute to a 529 plan in addition to other education savings options?

Yes, you can contribute to a 529 plan along with other education savings options, such as Coverdell Education Savings Accounts or custodial accounts. However, it’s important to be aware of contribution limits and potential tax implications.

5. Can I have multiple 529 plans for the same beneficiary?

Yes, you can have multiple 529 plans for the same beneficiary. However, it’s important to keep track of your contributions to ensure you stay within the overall contribution limits.

Conclusion

In conclusion, taxation 529 plan withdrawals provide a valuable opportunity to save for education expenses while minimizing the tax burden. By understanding the basics, advantages, and potential disadvantages, you can make informed decisions to maximize your savings. Remember to consult with a financial advisor to ensure your plan aligns with your specific financial goals and needs. Start planning today and secure a bright future for your loved ones!

Final Remarks

📚 In this article, we have explored the intricacies of taxation 529 plan withdrawals. It’s important to note that tax laws and regulations may change over time, so it’s always advisable to consult with a tax professional or financial advisor for the most up-to-date information. While we strive to provide accurate and reliable information, this article should not be considered as specific financial or tax advice. We hope you found this guide helpful and informative. Best of luck on your educational savings journey!

This post topic: Tax Planning