Unlock Your Wealth With Expert Taxation Planning Questions: Take Action Now!

Taxation Planning Questions: A Comprehensive Guide for Effective Financial Planning

Welcome, readers! In today’s article, we will delve into the intricacies of taxation planning questions and provide you with valuable insights to optimize your financial strategies. With the ever-evolving tax landscape, staying informed about taxation planning is crucial for individuals and businesses alike. Let’s explore the key aspects and considerations surrounding taxation planning.

Introduction

The realm of taxation planning encompasses a wide range of crucial questions that individuals and businesses face when navigating the complex world of taxes. In this introduction, we will address seven fundamental questions to lay the foundation for a comprehensive understanding of taxation planning.

3 Picture Gallery: Unlock Your Wealth With Expert Taxation Planning Questions: Take Action Now!

1. What is taxation planning? 🤔

Taxation planning refers to the strategic management of an individual’s or a business’s financial affairs to minimize tax liabilities while maximizing savings and compliance with tax laws. It involves making informed decisions regarding income, expenses, investments, and various tax-saving opportunities.

2. Who needs taxation planning? 🧐

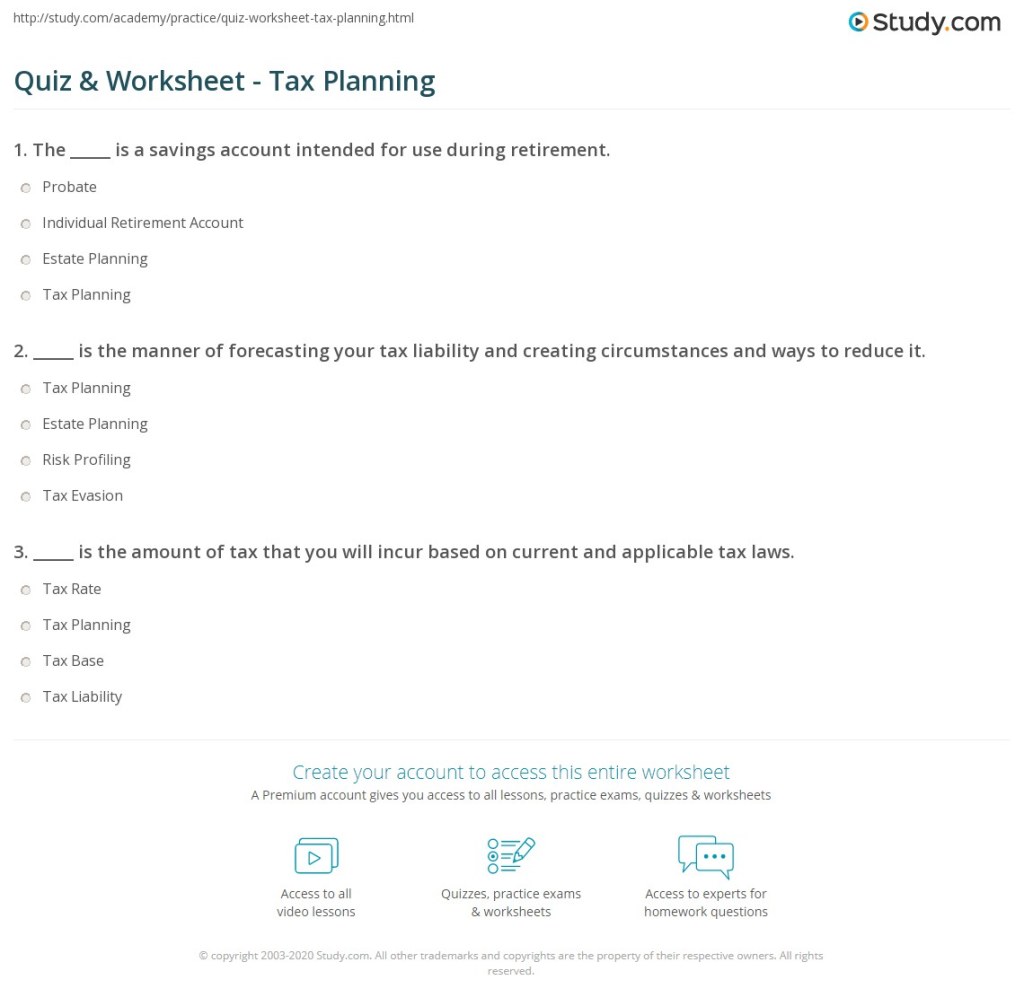

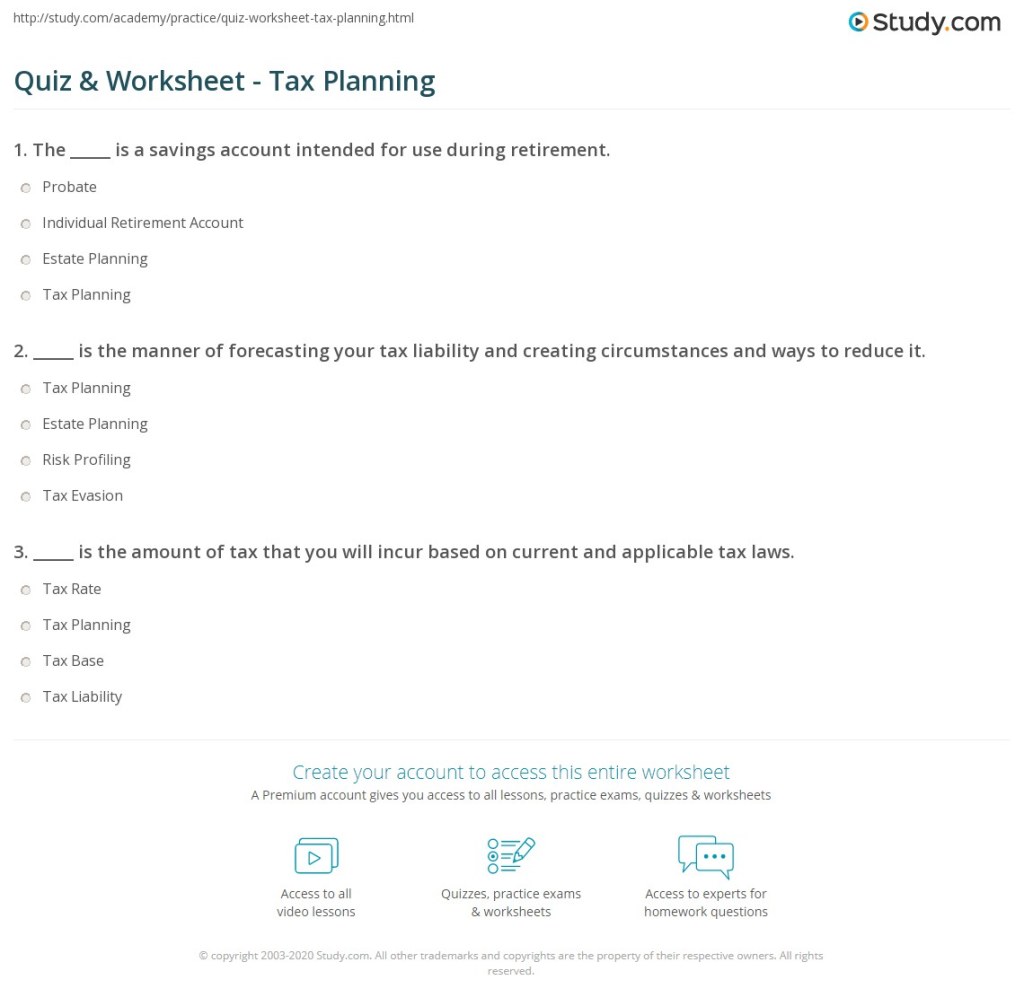

Image Source: study.com

Every individual and business, regardless of their income level or industry, can benefit from taxation planning. Whether you are an employee, a freelancer, a small business owner, or a multinational corporation, understanding taxation planning principles is crucial for optimizing your financial outcomes.

3. When should taxation planning be considered? ⏰

Taxation planning should be an ongoing process, integrated into your financial decisions throughout the year. However, it is particularly crucial during major life events such as marriage, starting a business, buying a property, or planning for retirement. Proactive taxation planning can help you achieve long-term financial goals efficiently.

4. Where can taxation planning strategies be applied? 🌍

Taxation planning strategies can be applied across various financial domains, including personal income, business profits, investments, estate planning, and international transactions. Each aspect requires careful analysis and tailored strategies to optimize tax efficiency.

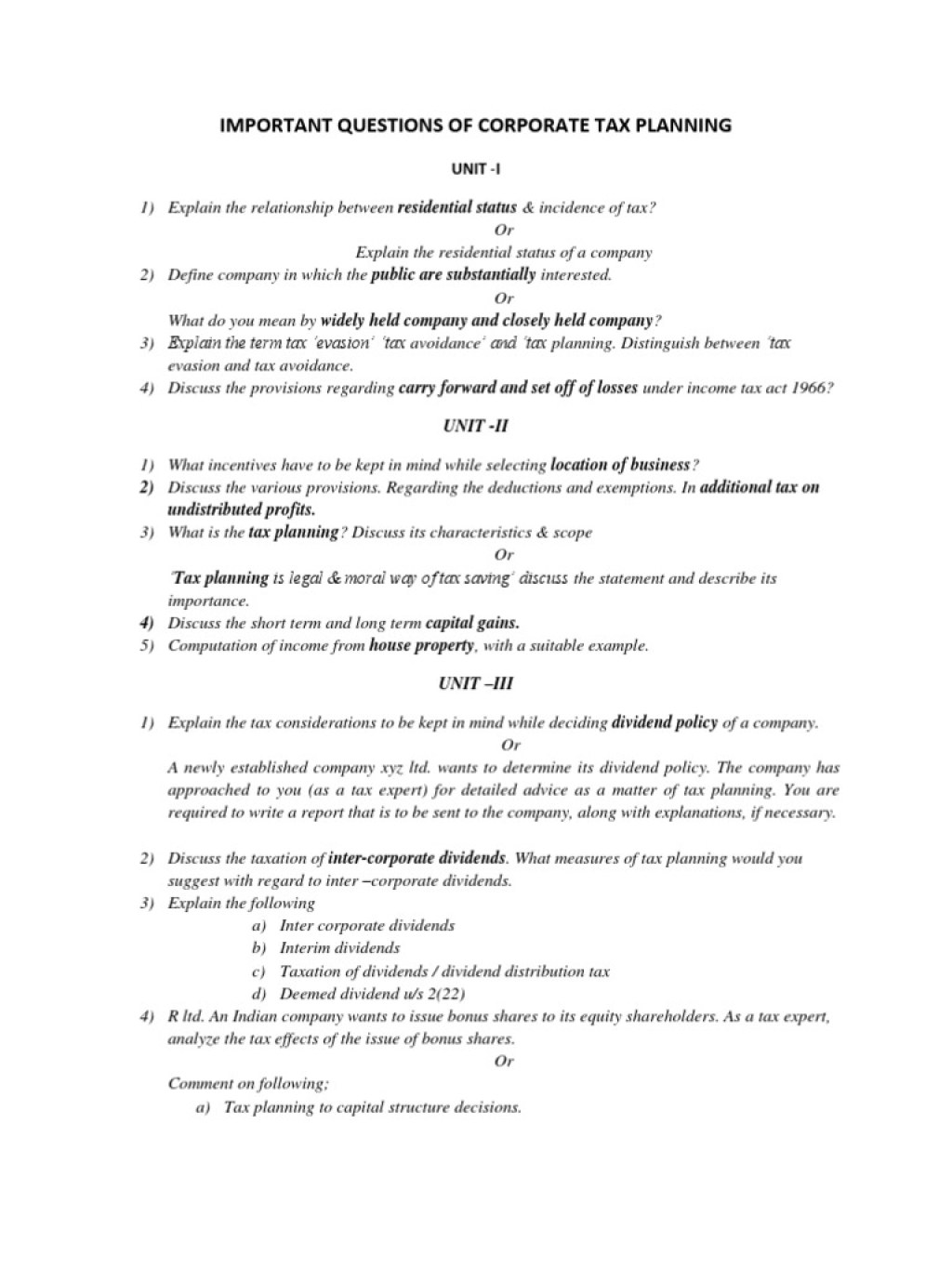

Image Source: scribdassets.com

5. Why is taxation planning important? 🤷♂️

Effective taxation planning allows individuals and businesses to legally minimize their tax burdens, resulting in significant savings. It provides a competitive advantage, enhances financial stability, and enables individuals to allocate resources for other financial goals such as investments, education, or philanthropy.

6. How can one navigate taxation planning effectively? 🚀

Navigating taxation planning effectively requires a comprehensive understanding of tax laws, regular updates on regulatory changes, and sound financial advice from experts. Collaborating with tax professionals can help you evaluate your financial situation, identify tax-saving opportunities, and develop personalized strategies aligned with your goals.

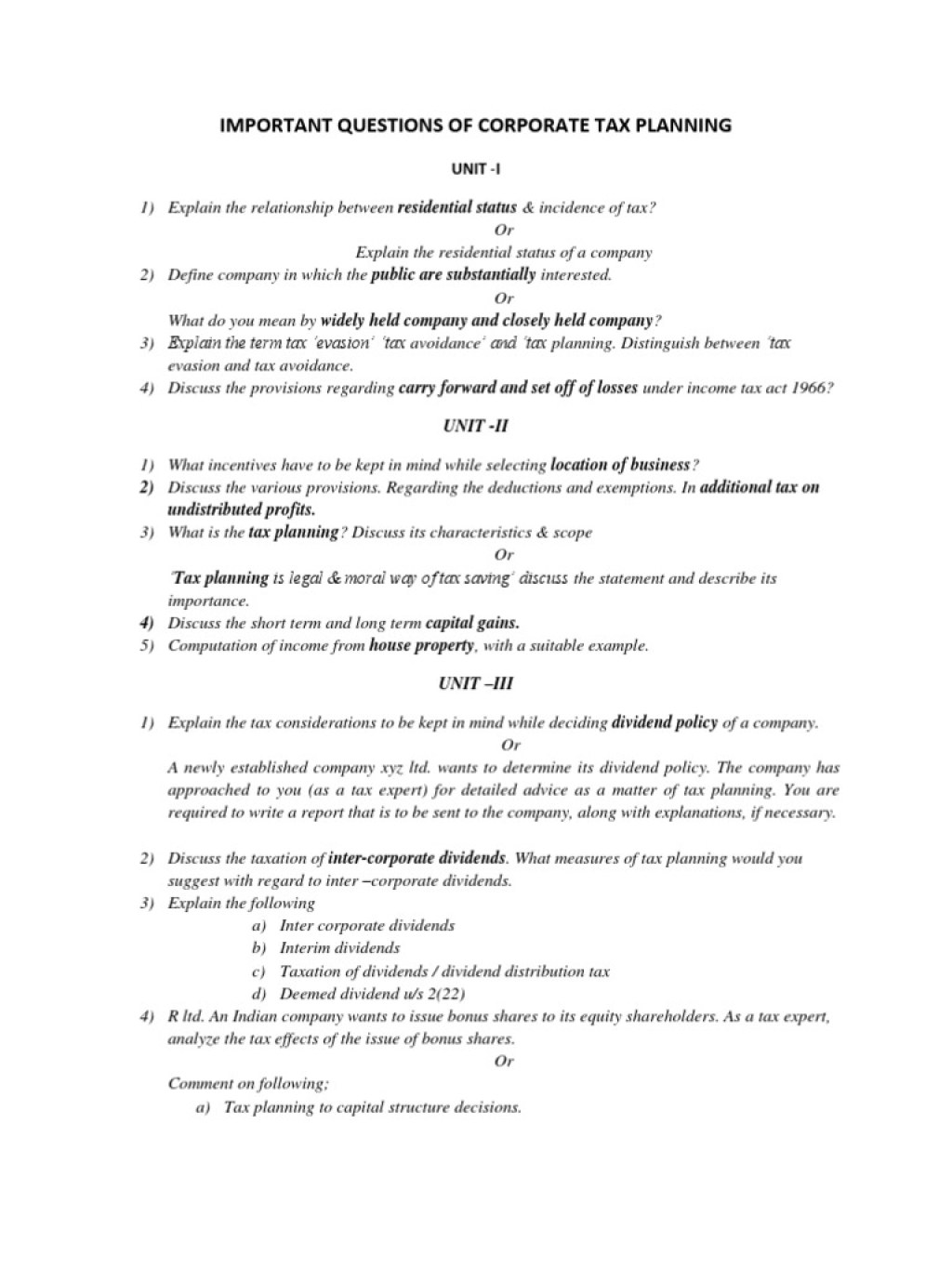

Top Taxation Planning Questions

1. What are the key components of effective taxation planning? 📝

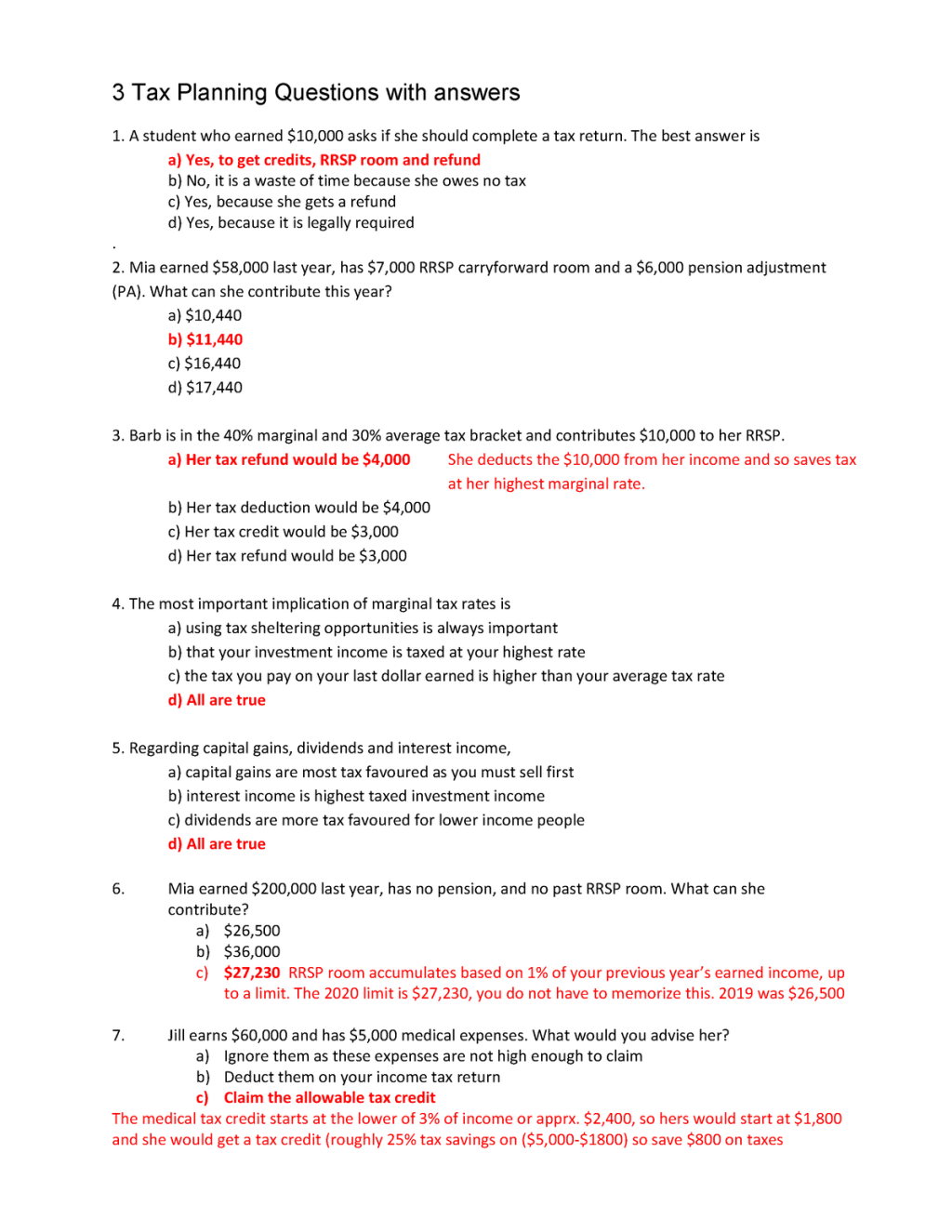

Image Source: cloudfront.net

Effective taxation planning involves meticulous analysis of income sources, deductions, credits, and exemptions. It requires a thorough understanding of tax laws, annual tax return filing obligations, and proactive decision-making regarding investments, pensions, and other financial matters.

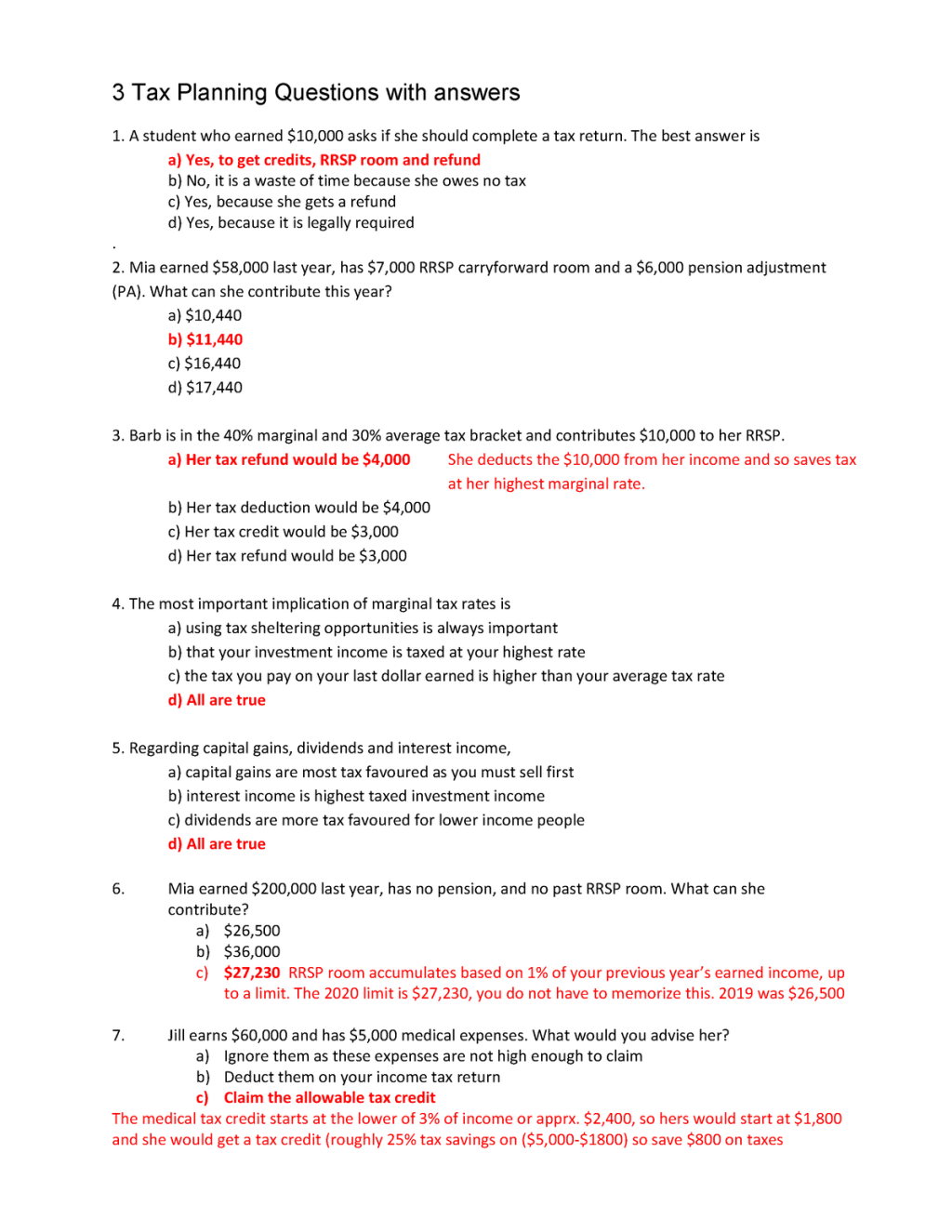

2. How can I optimize my deductions and credits? 💡

To optimize deductions and credits, you need to keep accurate records of all eligible expenses and claim them appropriately. Additionally, staying informed about available credits such as the Child Tax Credit, Earned Income Credit, or education-related credits can significantly reduce your overall tax liability.

3. What are the tax implications of different investment strategies? 💰

Investment strategies can have varying tax implications, depending on factors such as capital gains, dividends, or interest income. Understanding the tax consequences of different investment vehicles, such as stocks, bonds, real estate, or retirement accounts, is essential for making informed investment decisions.

4. How can I navigate international taxation planning? 🌐

When engaging in international transactions or investments, tax considerations become more complex. Factors such as double taxation, foreign tax credits, transfer pricing, and tax treaties need to be carefully assessed to ensure compliance with both domestic and international tax regulations.

5. How can I plan for estate taxes and wealth transfer? 🏰

Estate planning involves devising strategies to minimize estate taxes upon wealth transfer to future generations. Techniques such as trusts, gifting, charitable contributions, and life insurance can be employed to preserve wealth and minimize tax burdens.

6. What are the tax implications for small businesses? 👨💼👩💼

Small businesses face unique tax considerations, including the choice of business structure, payroll taxes, self-employment taxes, and deductible expenses. Familiarizing yourself with small business tax laws and seeking professional guidance can ensure compliance and maximize tax advantages.

By addressing these questions, we have laid the groundwork for a comprehensive understanding of taxation planning. In the following sections, we will explore the advantages and disadvantages of taxation planning, answer frequently asked questions, and conclude with actionable steps to enhance your financial planning.

Advantages and Disadvantages of Taxation Planning

Advantages of Taxation Planning 🌟

1. Minimization of tax liabilities: By implementing effective taxation planning strategies, individuals and businesses can significantly reduce their tax burden, allowing for more substantial savings and increased financial stability.

2. Improved financial planning: Taxation planning provides a holistic approach to financial decision-making, encouraging individuals and businesses to consider the tax implications of their actions. This results in more informed and strategic financial planning.

3. Enhanced compliance: By staying up-to-date with tax laws, regulations, and filing obligations, taxation planning ensures compliance and minimizes the risk of penalties or legal issues.

4. Increased wealth accumulation: Optimizing tax efficiency allows individuals and businesses to allocate resources towards wealth accumulation, investments, or other financial goals.

5. Competitive advantage: Businesses that engage in effective taxation planning gain a competitive edge by reducing costs, maximizing profits, and improving overall financial performance.

Disadvantages of Taxation Planning 🌪️

1. Complexity: Taxation planning involves navigating a complex and ever-changing landscape of tax laws, regulations, and exemptions. This complexity can make it challenging for individuals and businesses to stay informed and make optimal decisions.

2. Time-consuming: Implementing effective taxation planning strategies requires substantial time and effort, especially for individuals and businesses with complex financial situations. This can be a burden for those lacking the necessary expertise or resources.

3. Need for professional guidance: Taxation planning often requires expert advice or assistance, which can come with additional costs. Relying solely on one’s own knowledge may result in missed opportunities or non-compliance with tax regulations.

4. Potential risks: In some cases, aggressive tax planning strategies may raise red flags with tax authorities and lead to audits or legal issues. It is crucial to balance tax optimization with ethical and legal considerations.

5. Constant regulatory changes: Tax laws and regulations are subject to frequent updates and amendments, making it essential for individuals and businesses to stay informed and adapt their taxation planning strategies accordingly.

Frequently Asked Questions (FAQ)

1. How can I find a reliable tax professional to assist with taxation planning?

It is recommended to seek referrals from trusted sources, such as friends, family, or professional networks. Additionally, researching the credentials, experience, and reputation of potential tax professionals can help ensure you find a reliable and knowledgeable advisor.

2. Can I engage in taxation planning if I have a modest income?

Absolutely! Taxation planning is beneficial for individuals of all income levels. By optimizing deductions, credits, and tax-saving opportunities, even those with modest incomes can reduce their tax liabilities and increase their savings.

3. What are some common mistakes to avoid in taxation planning?

Common mistakes in taxation planning include inaccurate record-keeping, failure to stay informed about tax law changes, overlooking available deductions or credits, and relying solely on generic tax advice without considering individual circumstances.

4. Are there specific taxation planning strategies for self-employed individuals?

Self-employed individuals can benefit from various taxation planning strategies, including proper classification of business expenses, maximizing deductions for home offices or equipment, and utilizing retirement plans tailored for self-employed individuals, such as SEP-IRAs or Solo 401(k)s.

5. How can taxation planning help me prepare for retirement?

Taxation planning can help individuals allocate resources towards retirement plans, such as IRAs, 401(k)s, or annuities, while maximizing tax advantages. Additionally, distribution strategies during retirement can be optimized to minimize tax consequences.

Conclusion: Taking Action for Tax Optimization

As we conclude our exploration of taxation planning questions, it is crucial to emphasize the importance of taking action to optimize your tax efficiency. By staying informed, seeking professional guidance, and implementing tailored strategies, you can minimize tax liabilities, enhance financial stability, and work towards your long-term financial goals.

Now is the time to review your financial situation, assess potential tax-saving opportunities, and proactively engage in taxation planning. By doing so, you can unlock the benefits of tax optimization and pave the way for a prosperous financial future.

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as professional advice. Taxation planning involves complex considerations, and individual circumstances may vary. It is recommended to consult with a qualified tax professional or financial advisor for personalized guidance tailored to your specific needs and objectives.

This post topic: Tax Planning