The Ultimate Tax Plan 2023 Netherlands: Unlock Savings And Thrive!

Tax Plan 2023 Netherlands: Implications and Analysis

Introduction

Dear Readers,

2 Picture Gallery: The Ultimate Tax Plan 2023 Netherlands: Unlock Savings And Thrive!

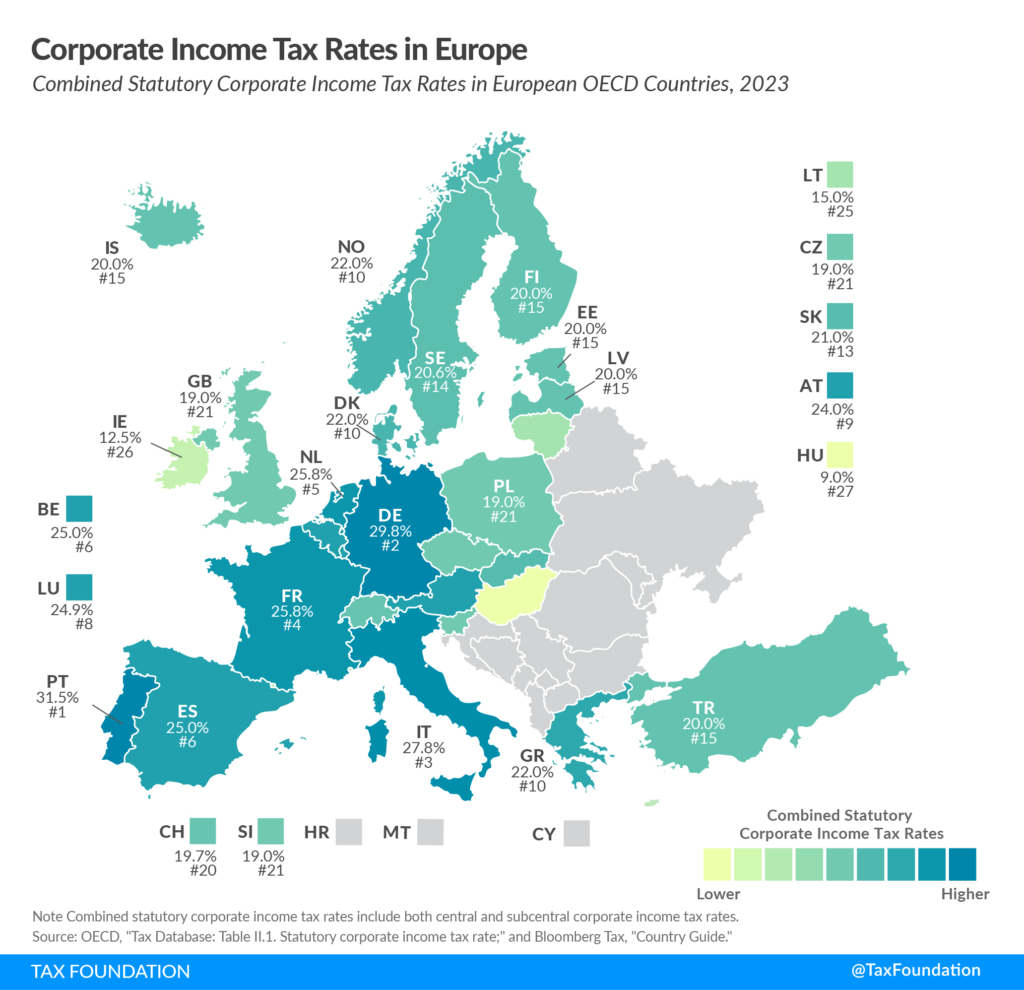

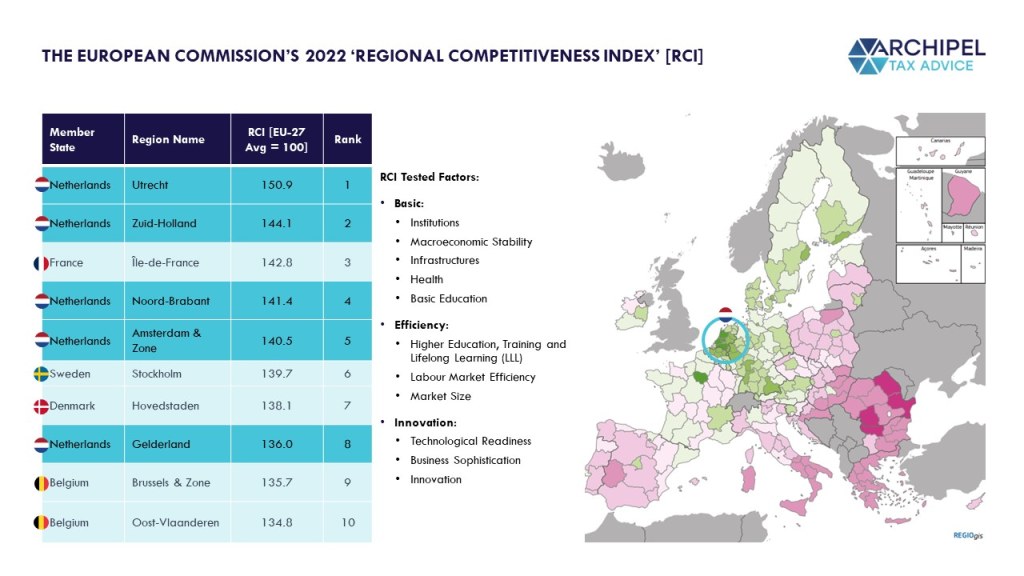

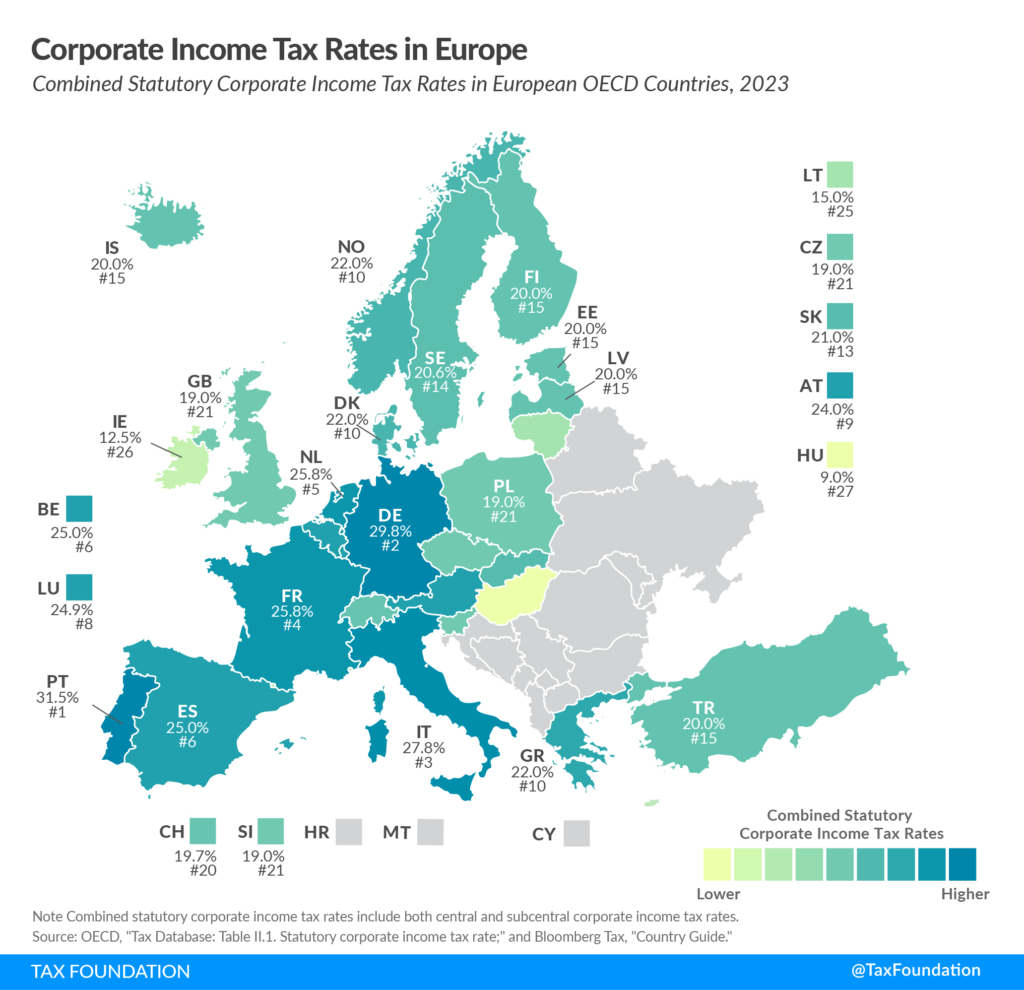

Welcome to our comprehensive analysis of the tax plan for the year 2023 in the Netherlands. In this article, we will delve into the intricacies of the tax reforms proposed by the government, their impact on businesses and individuals, and the overall implications for the economy. Understanding the tax plan is crucial for taxpayers to adequately plan their financial strategies and optimize their tax liabilities. So, let’s dive into the details and explore the key aspects of the tax plan for 2023 in the Netherlands.

Overview of the Tax Plan 2023

Image Source: nordichq.com

The tax plan for 2023 in the Netherlands encompasses a series of reforms aimed at stimulating economic growth, promoting sustainability, and ensuring a fair distribution of tax burdens. It introduces changes to various tax provisions, including income tax, corporate tax, VAT, and environmental taxes. Additionally, it outlines measures to tackle tax evasion and improve tax administration efficiency.

Key Points of the Tax Plan 2023

🔹 What are the main objectives of the tax plan 2023? 🎯

The tax plan 2023 aims to achieve several key objectives, including:

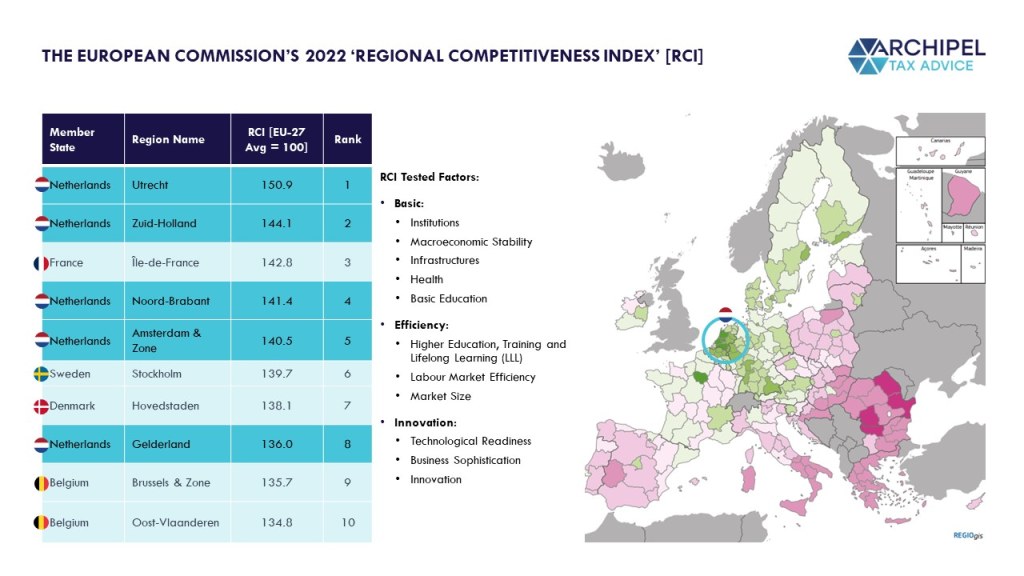

Image Source: archipeltaxadvice.nl

1️⃣ Promoting economic growth and investment.

2️⃣ Increasing tax fairness and reducing income inequality.

3️⃣ Stimulating innovation and sustainability.

4️⃣ Strengthening tax administration and combating tax evasion.

5️⃣ Enhancing international competitiveness.

Let’s take a closer look at each of these objectives and understand how they are addressed in the tax plan.

🔹 Who will be affected by the tax plan 2023? 🧑💼

The tax plan 2023 will impact various stakeholders, including:

1️⃣ Individuals and households.

2️⃣ Small, medium, and large businesses.

3️⃣ International corporations operating in the Netherlands.

4️⃣ Investors and entrepreneurs.

The extent of the impact will depend on the specific provisions applicable to each category. Let’s explore how the tax plan affects these stakeholders.

🔹 When will the tax plan 2023 come into effect? ⏰

The tax plan 2023 is scheduled to come into effect on January 1st, 2023. It is essential for taxpayers to be aware of the changes and plan their financial strategies accordingly. Let’s examine the timeline and implementation of the tax plan.

🔹 Where can taxpayers find more information about the tax plan 2023? 📚

For detailed information about the tax plan 2023, taxpayers can refer to the official website of the Dutch Tax Administration, consult tax professionals, or access relevant government publications. It is important to stay updated with the latest updates and guidelines.

🔹 Why was the tax plan 2023 introduced? 🤔

The tax plan 2023 addresses several economic challenges and policy objectives. It aims to:

1️⃣ Enhance tax fairness by redistributing the tax burden.

2️⃣ Encourage sustainable business practices and technologies.

3️⃣ Attract foreign investments and boost international competitiveness.

4️⃣ Simplify tax rules and improve administrative efficiency.

By understanding the underlying reasons behind the tax plan, taxpayers can better comprehend its implications and adapt accordingly.

🔹 How will the tax plan 2023 be implemented? 📋

The tax plan 2023 will be implemented through legislative changes and amendments to the existing tax framework. It will involve modifications to tax rates, deductions, allowances, and reporting requirements. Let’s explore the implementation process and its implications.

Advantages and Disadvantages of the Tax Plan 2023

🔹 Advantages of the Tax Plan 2023 ✅

The tax plan 2023 offers several benefits, such as:

1️⃣ Lower tax rates for individuals and businesses.

2️⃣ Increased tax deductions and allowances.

3️⃣ Incentives for sustainable investments and innovations.

4️⃣ Simplified tax rules and compliance procedures.

5️⃣ Improved tax administration and transparency.

Let’s dive deeper into these advantages and understand how they can positively impact taxpayers.

🔹 Disadvantages of the Tax Plan 2023 ❌

While the tax plan 2023 offers numerous benefits, it also presents certain challenges and drawbacks:

1️⃣ Reduction in tax revenue for the government.

2️⃣ Potential loss of tax incentives for specific industries.

3️⃣ Complexity in adapting to new tax regulations.

4️⃣ Increased compliance costs for businesses.

5️⃣ Adjustments in financial planning for individuals.

It is essential for taxpayers to consider these disadvantages and devise appropriate strategies to mitigate any potential negative consequences.

Frequently Asked Questions (FAQs)

1️⃣ What are the changes in personal income tax rates under the tax plan 2023?

Answer: The tax plan introduces progressive tax rate reductions, resulting in lower tax liabilities for individuals across different income brackets.

2️⃣ How does the tax plan 2023 incentivize sustainable investments?

Answer: The tax plan offers tax deductions and allowances for businesses investing in sustainable technologies and environmentally friendly practices.

3️⃣ Will the tax plan affect international corporations operating in the Netherlands?

Answer: Yes, the tax plan includes measures to attract foreign investments, enhance international competitiveness, and address tax avoidance by multinational corporations.

4️⃣ Are there any changes in VAT rates under the tax plan 2023?

Answer: The tax plan does not introduce any changes in the standard VAT rate, which remains at 21%. However, certain goods and services may be subject to specific VAT adjustments.

5️⃣ How can individuals and businesses prepare for the implementation of the tax plan 2023?

Answer: To prepare for the tax plan 2023, individuals and businesses should stay updated with the latest guidelines, consult tax professionals, and review their financial strategies to optimize tax benefits.

Conclusion

In conclusion, the tax plan 2023 in the Netherlands brings forth significant changes that will impact various stakeholders. By understanding the objectives, implications, and key provisions of the tax plan, taxpayers can navigate the evolving tax landscape and make informed financial decisions. It is crucial for individuals and businesses to adapt their strategies to leverage the advantages and mitigate the disadvantages of the tax plan. Stay informed, seek professional advice, and proactively plan your finances to optimize your tax position in light of the tax plan 2023.

Sincerely,

Your Tax Insights Team

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be construed as professional tax advice. Each taxpayer’s circumstances are unique, and it is recommended to consult with a qualified tax professional to understand how the tax plan 2023 specifically applies to your situation. We do not assume any liability for actions taken based on the information provided in this article.

This post topic: Tax Planning