Unveiling The Power Of Tax Planning Diagram: Unlock Your Financial Potential Now!

Tax Planning Diagram: Maximizing Your Financial Strategy

Greetings, Readers! In today’s article, we will delve into the concept of tax planning diagrams and how they can help you optimize your financial strategy. As taxes play a significant role in our lives, it is crucial to understand how to navigate the complex landscape of tax planning effectively. Let’s explore the ins and outs of tax planning diagrams and discover how they can benefit you.

Introduction

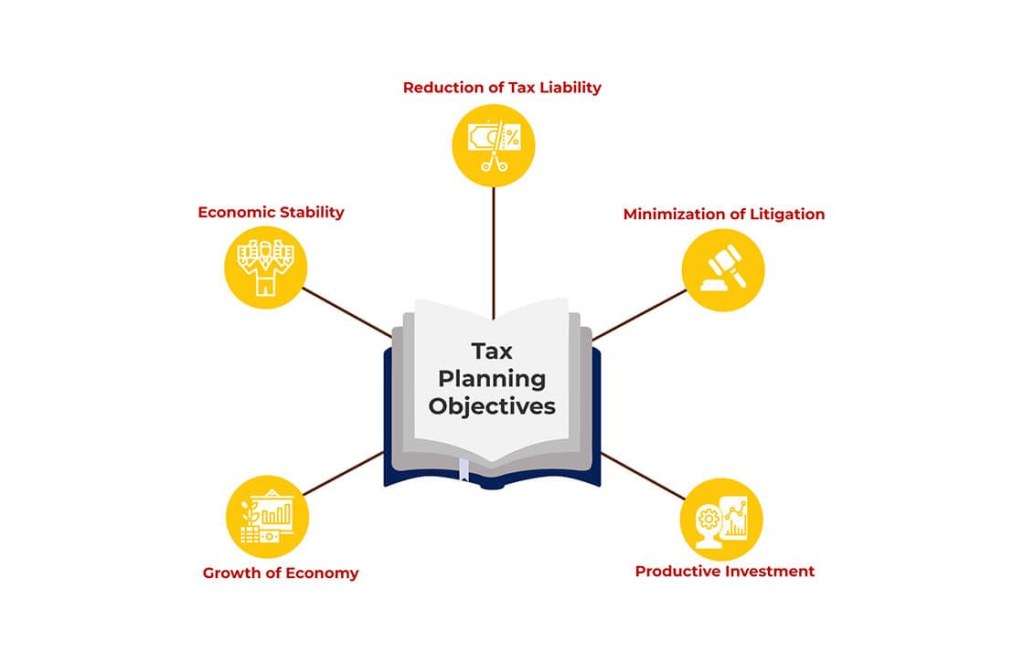

1. What is Tax Planning Diagram?

3 Picture Gallery: Unveiling The Power Of Tax Planning Diagram: Unlock Your Financial Potential Now!

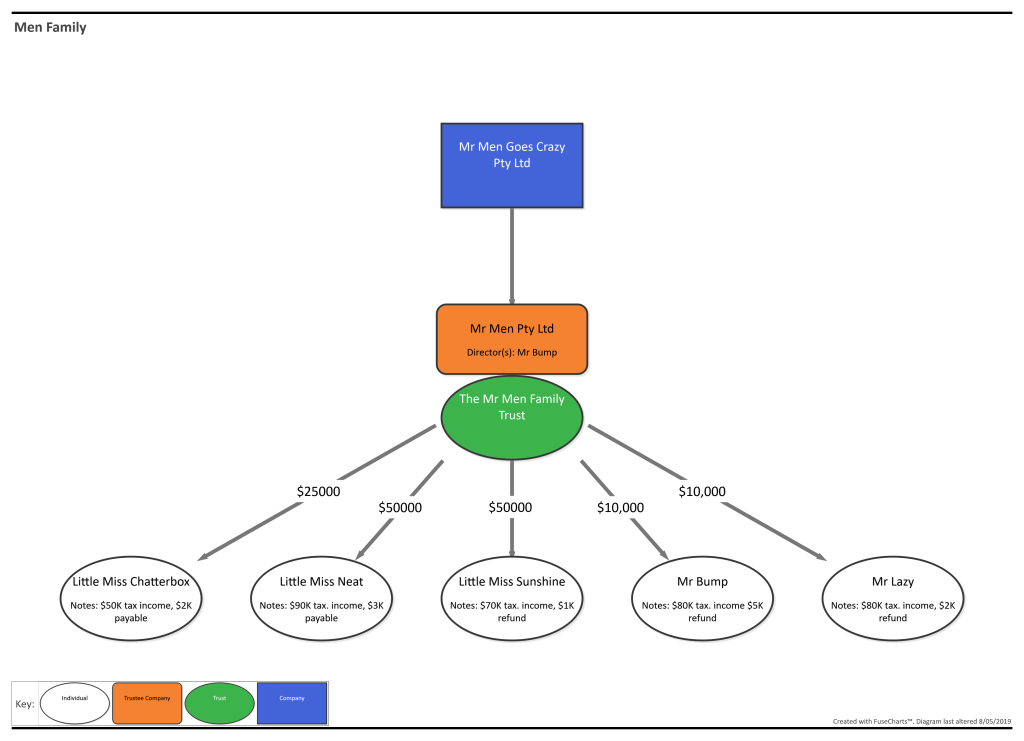

Tax planning diagram is a visual representation of various tax strategies and techniques that individuals and businesses can employ to minimize their tax liabilities and maximize their financial resources.

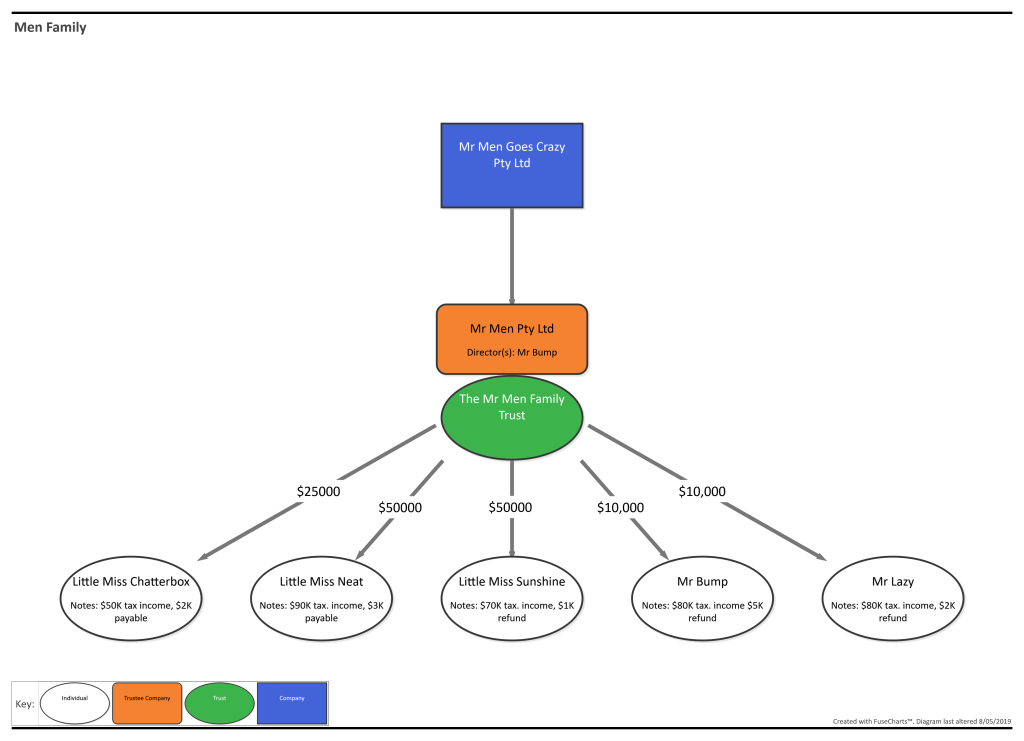

2. Who Can Benefit from Tax Planning Diagram?

Image Source: alamy.com

Tax planning diagrams are beneficial for individuals, entrepreneurs, and businesses of all sizes. Regardless of your financial situation, tax planning diagrams can help you make informed decisions and take advantage of available tax-saving opportunities.

3. When Should You Implement Tax Planning Diagrams?

It is advisable to implement tax planning diagrams throughout the fiscal year. By starting early, you can identify potential tax implications and structure your financial activities accordingly.

Image Source: nitrocdn.com

4. Where Can You Access Tax Planning Diagrams?

Tax planning diagrams are readily available online, through financial advisors, or by utilizing specialized tax planning software. These resources offer comprehensive guidance and customizable solutions based on your specific needs.

5. Why is Tax Planning Diagram Important?

Image Source: foraccountants.com.au

Tax planning diagrams are essential for proactive financial management. They allow individuals and businesses to minimize tax liabilities, identify potential tax-saving opportunities, and optimize their financial strategies to achieve long-term financial goals.

6. How Can You Implement Tax Planning Diagrams?

Implementing tax planning diagrams involves analyzing your financial situation, understanding current tax laws and regulations, and strategically utilizing various tax-saving techniques such as deductions, credits, deferrals, and exemptions.

Advantages and Disadvantages of Tax Planning Diagram

1. Advantages of Tax Planning Diagram

✅ Enhanced Tax Efficiency: Tax planning diagrams enable individuals and businesses to strategically reduce their tax liabilities, resulting in increased overall tax efficiency.

✅ Financial Optimization: By implementing effective tax planning diagrams, individuals and businesses can optimize their financial resources, improve cash flow, and enhance investment opportunities.

✅ Compliance with Tax Laws: Tax planning diagrams ensure that individuals and businesses comply with relevant tax laws and regulations, minimizing the risk of penalties or legal issues.

✅ Long-Term Financial Planning: Tax planning diagrams facilitate long-term financial planning by considering factors such as retirement, estate planning, and business succession.

✅ Competitive Advantage: Businesses that utilize tax planning diagrams gain a competitive edge by minimizing tax burdens and allocating additional resources towards growth and innovation.

2. Disadvantages of Tax Planning Diagram

❌ Complexity: Tax planning diagrams can be complex, requiring a thorough understanding of tax laws, regulations, and financial intricacies.

❌ Time-Consuming: Implementing tax planning diagrams involves significant time and effort to analyze financial data, identify tax-saving opportunities, and make informed decisions.

❌ Changing Tax Laws: Tax laws and regulations are subject to change, which may necessitate adapting tax planning diagrams to remain compliant and effective.

❌ Limitations: Tax planning diagrams have limitations and may not be suitable for every financial situation. Individual circumstances, business structures, and other factors need to be considered.

❌ Professional Expertise: To fully benefit from tax planning diagrams, individuals and businesses may require the assistance of professional tax advisors or financial planners.

Frequently Asked Questions (FAQ)

1. Is tax planning legal?

Yes, tax planning is legal. It involves utilizing legitimate strategies and techniques to minimize tax liabilities within the boundaries of applicable tax laws and regulations.

2. Can tax planning diagrams be used for personal finances?

Absolutely! Tax planning diagrams can be utilized for personal finances, allowing individuals to optimize their tax position, maximize savings, and achieve their financial goals.

3. Are tax planning diagrams applicable to all businesses?

Yes, tax planning diagrams are applicable to businesses of all sizes and structures. Whether you operate as a sole proprietorship, partnership, or corporation, tax planning diagrams offer valuable insights and opportunities for tax optimization.

4. Are tax planning diagrams beneficial for high-net-worth individuals?

Yes, tax planning diagrams are especially beneficial for high-net-worth individuals as they provide comprehensive strategies to minimize tax liabilities, preserve wealth, and maximize financial resources.

5. Can tax planning diagrams help reduce estate taxes?

Yes, tax planning diagrams can assist in reducing estate taxes by employing strategies such as gifting, establishing trusts, or utilizing exemptions to transfer assets efficiently.

Conclusion

In conclusion, tax planning diagrams serve as powerful tools for individuals and businesses alike to navigate the complexities of tax planning. By leveraging these diagrams, individuals can minimize tax burdens, optimize financial strategies, and achieve long-term financial goals. It is essential to stay informed about changing tax laws and seek professional guidance to fully benefit from tax planning diagrams. Take control of your financial future and embark on a journey towards financial prosperity with tax planning diagrams!

Disclaimer: The information provided in this article is for educational purposes only and should not be construed as professional tax advice. Consult with a qualified tax advisor for personalized guidance tailored to your specific financial circumstances.

This post topic: Tax Planning