Maximizing Your Tax Savings: Mastering The Personal Tax Planning Question Paper For Financial Success!

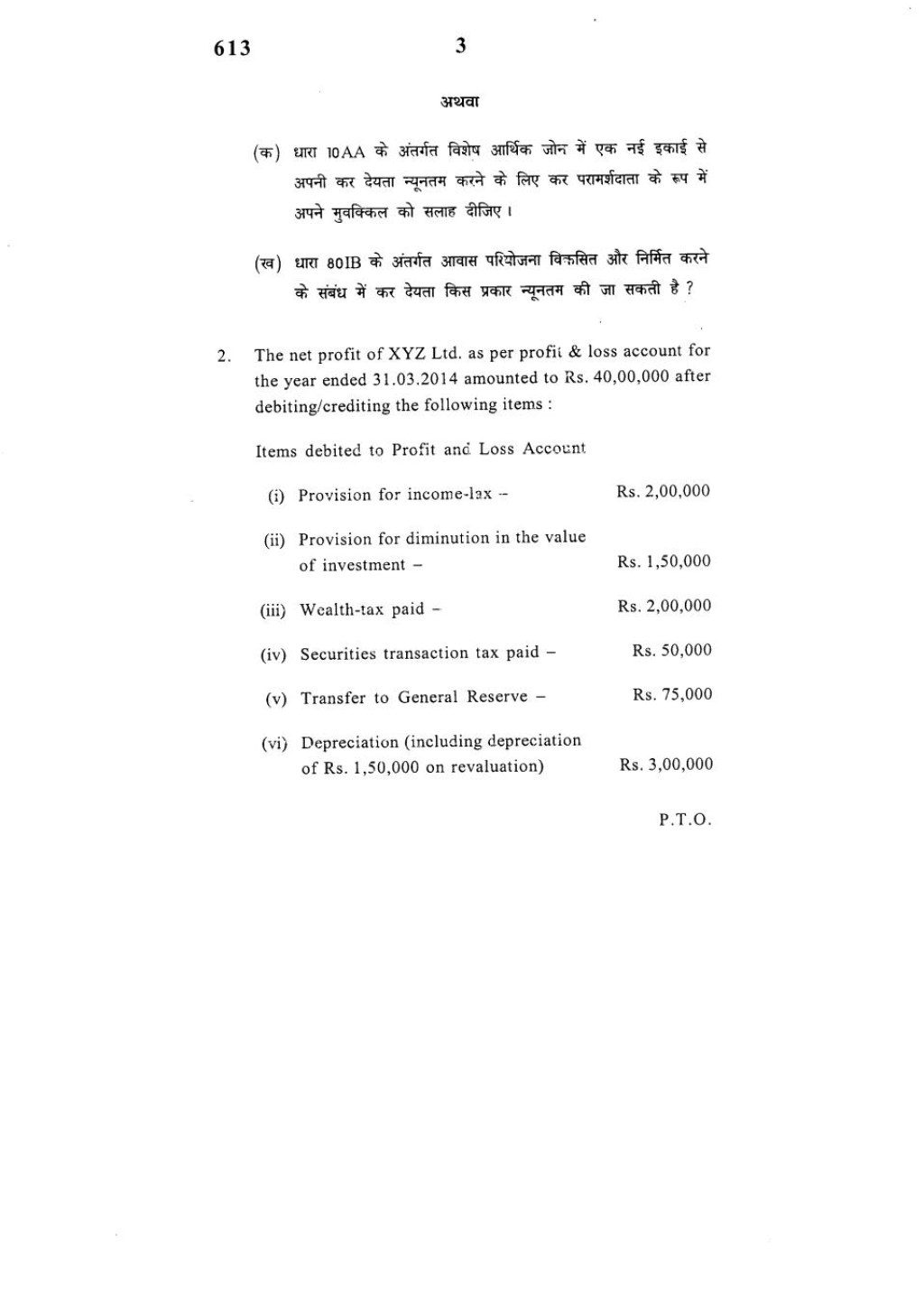

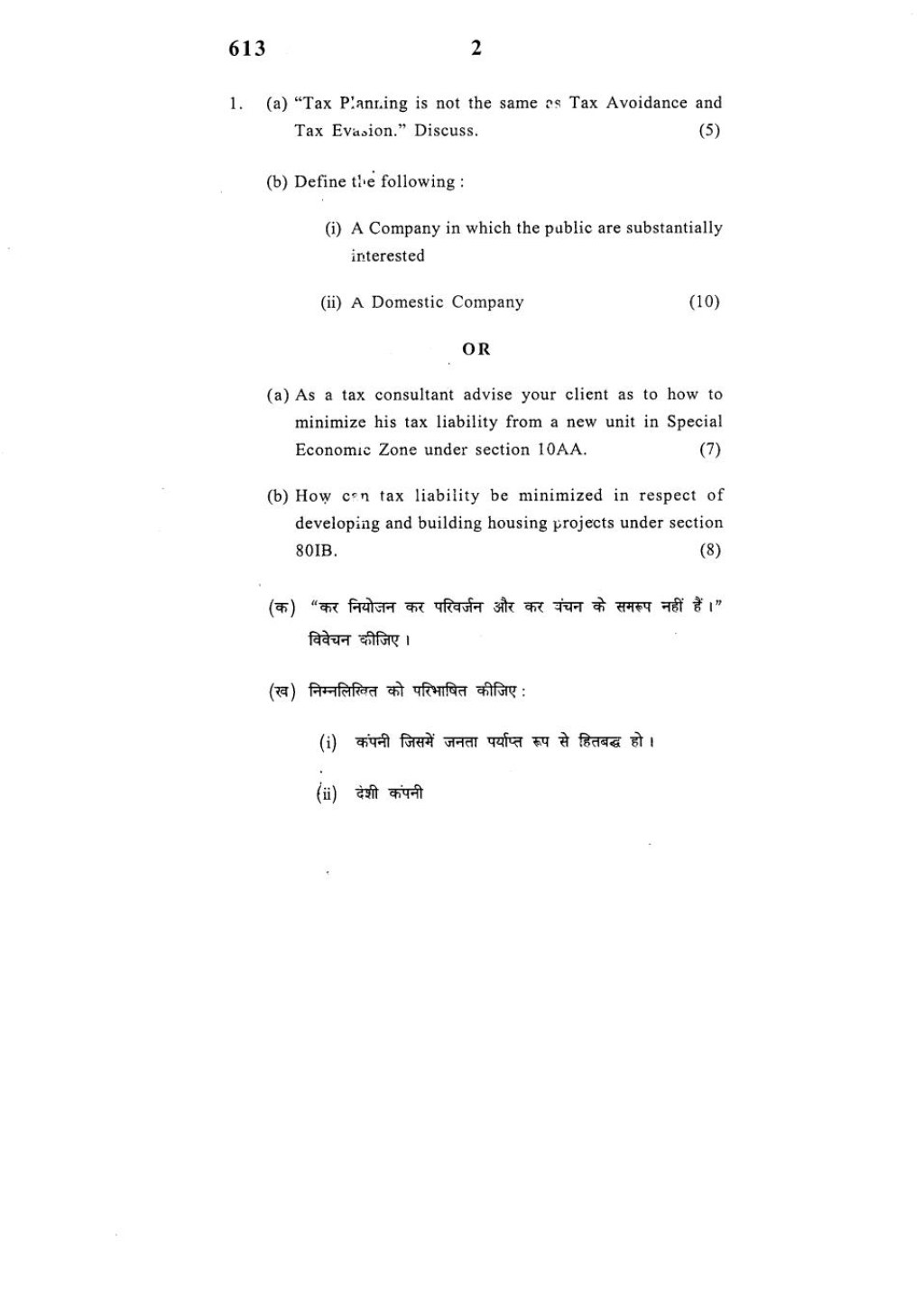

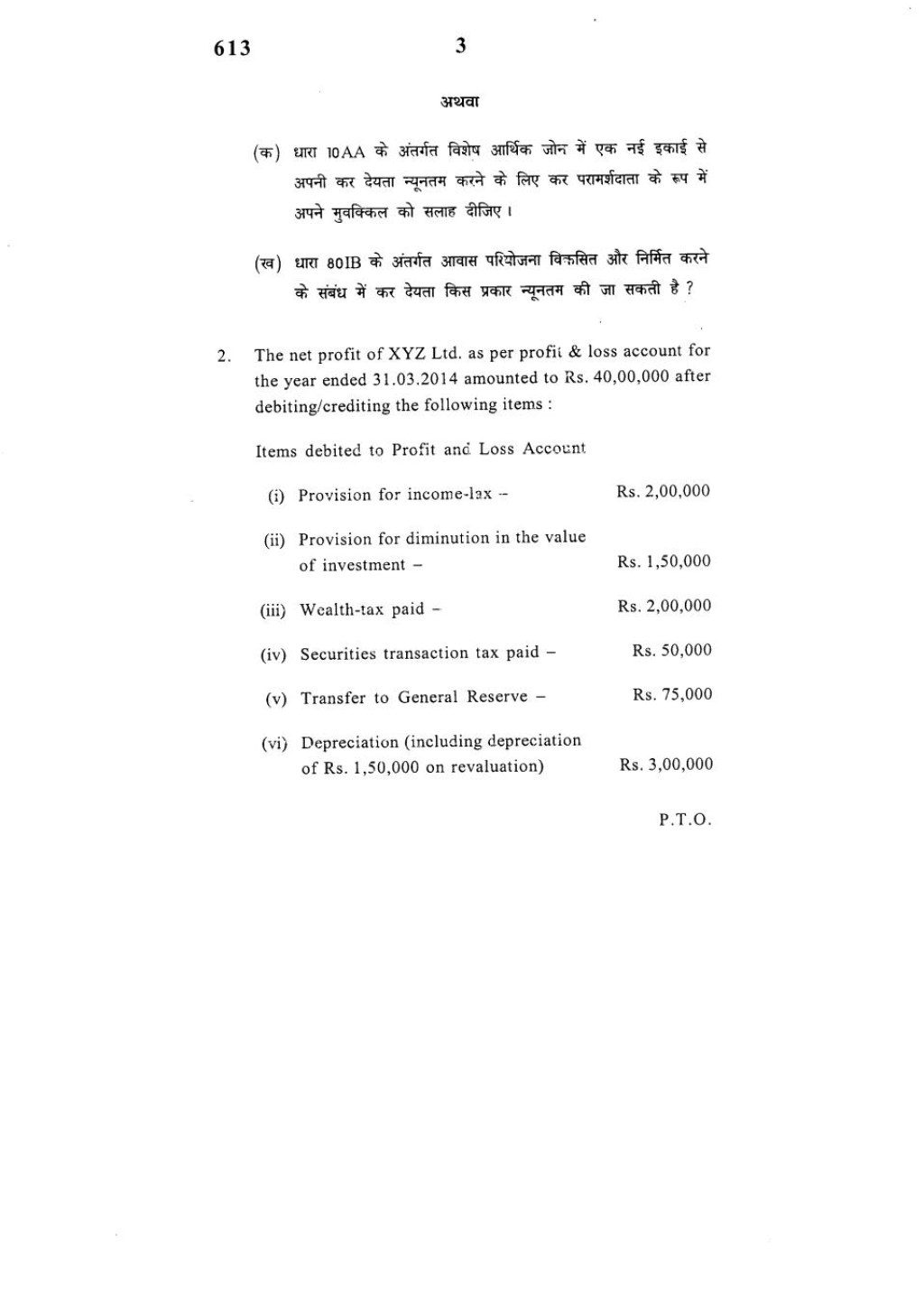

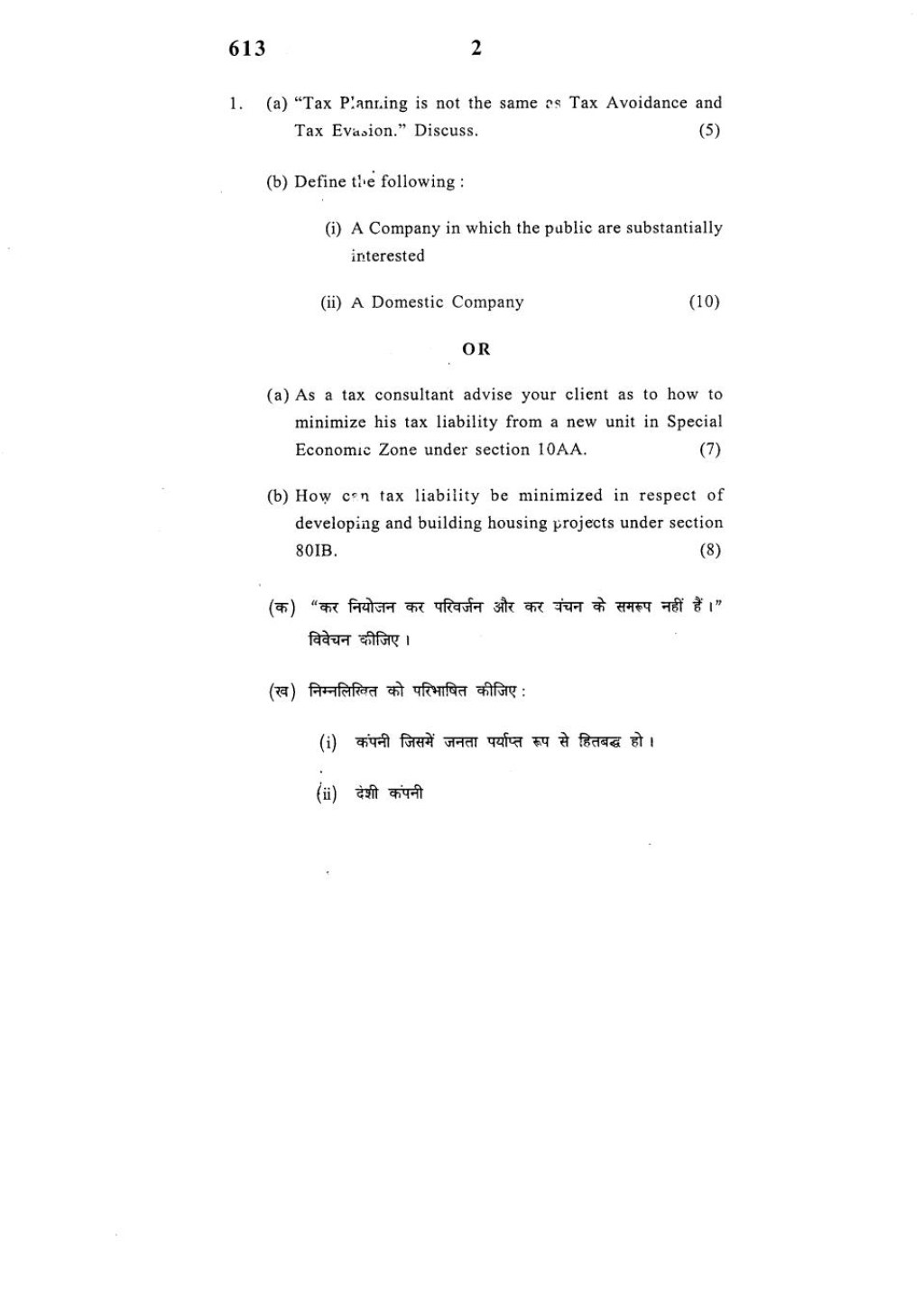

Personal Tax Planning Question Paper: A Comprehensive Guide

Greetings, readers! In this article, we will delve into the topic of personal tax planning question paper and provide you with valuable insights and information. As tax planning plays a crucial role in managing your finances and optimizing your tax liabilities, it is essential to understand the intricacies of this subject. So, let’s get started!

Introduction

2 Picture Gallery: Maximizing Your Tax Savings: Mastering The Personal Tax Planning Question Paper For Financial Success!

1. What is personal tax planning?

2. Why is personal tax planning important?

3. How does personal tax planning work?

4. Who can benefit from personal tax planning?

5. When should you start considering personal tax planning?

6. Where can you seek professional assistance for personal tax planning?

7. What are the key components of a personal tax planning question paper?

What is Personal Tax Planning?

To put it simply, personal tax planning refers to the process of organizing your financial affairs in a way that optimizes your tax liabilities. It involves analyzing your income, expenses, investments, and deductions to minimize the amount of tax you owe.

Why is Personal Tax Planning Important?

Image Source: aglasem.com

Emoji: 📊

Personal tax planning is crucial as it enables individuals to legally reduce their tax burden, maximize their tax refunds, and ensure compliance with tax laws. By implementing effective tax planning strategies, individuals can retain more of their hard-earned money and allocate it towards their financial goals.

How Does Personal Tax Planning Work?

Image Source: aglasem.com

Emoji: 🎯

Personal tax planning involves evaluating various tax-saving options and making informed decisions based on your financial situation. This may include optimizing deductions, utilizing tax credits, creating tax-efficient investment portfolios, and leveraging legal tax loopholes.

Who Can Benefit from Personal Tax Planning?

Emoji: 👨

Personal tax planning is beneficial for individuals of all income levels. Whether you are an employee, self-employed professional, or business owner, engaging in tax planning can help you effectively manage your tax liabilities and make the most of available tax-saving opportunities.

When Should You Start Considering Personal Tax Planning?

Emoji: 📝

It is never too early to start considering personal tax planning. As soon as you start earning income, you should be mindful of your tax obligations and explore ways to optimize your tax liabilities. Moreover, major life events such as marriage, buying a house, or starting a business can significantly impact your tax situation, making it crucial to plan accordingly.

Where Can You Seek Professional Assistance for Personal Tax Planning?

Emoji: 👤

Professional guidance plays a vital role in effective tax planning. You can seek assistance from qualified tax professionals, such as certified public accountants (CPAs) or tax consultants. These professionals possess the necessary expertise and knowledge to navigate complex tax regulations and help you develop a personalized tax planning strategy.

Key Components of a Personal Tax Planning Question Paper

Emoji: 📚

A comprehensive personal tax planning question paper typically includes sections such as income sources, deductions and exemptions, tax credits, investment income, retirement planning, education expenses, and tax compliance. These components provide a holistic view of an individual’s financial situation and aid in devising an effective tax planning strategy.

Advantages and Disadvantages of Personal Tax Planning

1. Advantages of Personal Tax Planning:

– Emoji: 👍

Personal tax planning offers numerous benefits, including reduced tax liabilities, increased tax refunds, improved financial management, enhanced cash flow, and greater control over your finances. It allows you to make informed decisions and optimize your tax position to achieve your financial goals.

2. Disadvantages of Personal Tax Planning:

– Emoji: 👎

While personal tax planning can be highly advantageous, it also has some drawbacks. These may include the complexity of tax laws, the need for professional assistance, potential changes in tax regulations, and the time and effort required to stay updated with tax-related information.

Frequently Asked Questions (FAQs)

1. What are the basic documents required for personal tax planning?

– Emoji: 📜

Answer: The basic documents required for personal tax planning include income statements, bank statements, investment and asset details, previous year’s tax returns, and relevant receipts and invoices.

2. Can personal tax planning help lower my overall tax burden?

– Emoji: 😎

Answer: Yes, personal tax planning can help lower your overall tax burden by utilizing deductions, exemptions, and tax credits. It enables you to legally minimize the amount of tax you owe, resulting in potential tax savings.

3. Is personal tax planning only for high-income individuals?

– Emoji: 😊

Answer: No, personal tax planning is beneficial for individuals of all income levels. It allows you to optimize your tax liabilities regardless of your income bracket, ensuring that you make the most of available tax-saving opportunities.

4. How often should I review and update my personal tax planning strategy?

– Emoji: 📋

Answer: It is recommended to review and update your personal tax planning strategy annually or whenever there are significant changes in your financial situation or tax laws. This ensures that your tax planning remains aligned with your current circumstances.

5. Can I do personal tax planning on my own, or do I need professional assistance?

– Emoji: 👨📚

Answer: While it is possible to do personal tax planning on your own, seeking professional assistance can greatly benefit you. Tax professionals possess the necessary expertise and knowledge to navigate complex tax regulations, identify tax-saving opportunities, and ensure compliance with tax laws.

Conclusion

In conclusion, personal tax planning is a crucial aspect of financial management. By understanding and implementing effective tax planning strategies, individuals can optimize their tax liabilities, maximize their tax refunds, and achieve their financial goals. So, take control of your tax situation, seek professional guidance if needed, and make informed decisions to secure a better financial future.

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as professional tax advice. Tax regulations and laws may vary based on your jurisdiction and individual circumstances. It is advisable to consult a qualified tax professional for personalized guidance and to ensure compliance with applicable tax regulations.

This post topic: Tax Planning