Unlock The Power Of Tax Planning: Discover Effective Strategies In Hindi Mai!

Tax Planning Hindi Mai: A Comprehensive Guide to Tax Planning in Hindi

Greetings, Readers! In today’s article, we will delve into the world of tax planning in Hindi, providing you with a comprehensive guide to help you navigate the complexities of tax planning. Whether you are an individual taxpayer or a business owner, understanding tax planning can significantly impact your financial situation and ensure compliance with the law. So, let’s dive in and explore the intricacies of tax planning in Hindi!

Introduction

Tax planning, or टैक्स प्लानिंग in Hindi, refers to the strategic management of one’s finances to optimize tax liabilities within the legal framework. It involves analyzing and organizing your financial affairs in a way that takes advantage of various deductions, exemptions, and incentives offered by the tax laws. Effective tax planning not only helps minimize tax liability but also ensures financial stability and growth.

3 Picture Gallery: Unlock The Power Of Tax Planning: Discover Effective Strategies In Hindi Mai!

Understanding the fundamentals of tax planning is essential for individuals and businesses alike. By proactively managing your taxes, you can legally reduce your tax burden and maximize your financial resources. However, tax laws are complex and subject to regular changes, making it crucial to stay informed and adapt your tax planning strategies accordingly.

In this article, we will cover various aspects of tax planning in Hindi, including its purpose, beneficiaries, timing, geographical relevance, reasons behind its importance, and the steps involved in implementing effective tax planning strategies.

What is Tax Planning in Hindi?

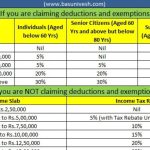

टैक्स प्लानिंग क्या है (What is Tax Planning in Hindi)? Tax planning refers to the process of managing your financial affairs in a way that minimizes your tax liability. It involves utilizing various tax incentives, exemptions, deductions, and tax-saving investments to legally reduce the amount of tax you owe to the government.

Image Source: ytimg.com

Effective tax planning involves a thorough analysis of your income, expenses, investments, and assets to identify opportunities for minimizing taxes. It requires careful strategizing and structuring of financial transactions to optimize tax benefits while remaining compliant with the tax laws.

Emoji: 💡

Who Can Benefit from Tax Planning in Hindi?

कौन कौन tax planning का लाभ उठा सकता है (Who Can Benefit from Tax Planning in Hindi)? Tax planning is relevant to individuals, businesses, and even non-profit organizations. Anyone who earns income or engages in financial transactions can benefit from tax planning strategies.

Whether you are a salaried individual, a self-employed professional, a business owner, or an investor, tax planning can help you optimize your tax liability and enhance your financial well-being. By understanding the tax laws and utilizing the available deductions, exemptions, and incentives, you can minimize your tax burden and retain a larger portion of your income.

Emoji: 💰

When Should You Consider Tax Planning in Hindi?

Image Source: ytimg.com

कब करें tax planning (When Should You Consider Tax Planning in Hindi)? Tax planning is an ongoing process that should be considered throughout the year. However, there are certain key moments or events when tax planning becomes particularly crucial.

These include:

At the beginning of every financial year

Before making any major financial decisions

When there are changes in income or expenses

Before investing in tax-saving instruments

Prior to retirement or succession planning

When starting a new business or expanding an existing one

Before selling assets or property

By considering tax planning at these critical junctures, you can make informed financial decisions and optimize your tax liability effectively.

Image Source: ytimg.com

This post topic: Tax Planning