Mastering Tax Planning For New Business Success: Unlock Your Financial Potential Now!

Tax Planning of New Business

Introduction

Dear Readers,

1 Picture Gallery: Mastering Tax Planning For New Business Success: Unlock Your Financial Potential Now!

Welcome to our informative article on tax planning for new businesses. Starting a new business can be an exciting endeavor filled with endless possibilities. However, it is essential to understand the importance of tax planning to ensure the financial success and sustainability of your venture. In this article, we will explore the key aspects of tax planning for new businesses and provide you with valuable insights to navigate this complex process effectively.

Image Source: scribdassets.com

Let’s dive into the world of tax planning for new businesses and discover how you can optimize your tax strategy for maximum benefits and compliance.

Table of Contents

What is tax planning?

Who needs tax planning for their new business?

When should tax planning be implemented?

Where to seek professional assistance?

Why is tax planning crucial for new businesses?

How to develop an effective tax planning strategy?

Advantages and disadvantages of tax planning

FAQs

Conclusion

Final Remarks

What is Tax Planning?

📋 Tax planning refers to the strategic arrangement of a business’s financial affairs to minimize tax liabilities while remaining compliant with the tax laws and regulations. It involves anticipating the tax implications of business decisions and implementing strategies to optimize tax benefits. Effective tax planning can contribute significantly to a new business’s financial success and sustainability.

Who Needs Tax Planning for Their New Business?

📋 All new businesses, regardless of their size or industry, can benefit from tax planning. Whether you are a sole proprietor, partnership, or corporation, understanding and implementing tax planning strategies can help you reduce tax burdens, enhance cash flow, and allocate resources efficiently. Engaging in tax planning from the inception of your new business can set a solid foundation for long-term financial growth.

When Should Tax Planning Be Implemented?

📋 Tax planning should be implemented as early as possible when starting a new business. By incorporating tax considerations into your initial business plan, you can make informed decisions regarding the legal structure, location, and financing of your venture. It is crucial to consult with a tax professional or advisor before making significant financial decisions to ensure compliance and maximize tax benefits.

Where to Seek Professional Assistance?

📋 Tax planning for new businesses can be complex, and seeking professional assistance is highly recommended. Tax accountants, certified public accountants (CPAs), and tax attorneys specialize in tax planning and can provide expert guidance tailored to your specific business needs. They can help you navigate the intricacies of tax laws, identify available deductions, and ensure compliance with regulations.

Why is Tax Planning Crucial for New Businesses?

📋 Tax planning is crucial for new businesses due to several reasons. Firstly, it allows businesses to minimize tax liabilities, thereby optimizing their cash flow and profitability. Secondly, proper tax planning ensures compliance with tax laws, reducing the risk of penalties and legal issues. Lastly, effective tax planning enables businesses to allocate resources efficiently, contributing to long-term financial stability and growth.

How to Develop an Effective Tax Planning Strategy?

📋 Developing an effective tax planning strategy requires careful consideration of various factors. It involves analyzing your business’s financial goals, understanding applicable tax laws, and identifying available deductions and credits. Additionally, you should evaluate the potential tax implications of business decisions, such as investments, asset acquisitions, and employee compensation. Collaborating with a tax professional can help you devise a comprehensive tax planning strategy aligned with your business objectives.

Advantages and Disadvantages of Tax Planning

📋 Tax planning offers several advantages for new businesses. It allows you to minimize tax liabilities, increase cash flow, and reinvest savings into business growth. Furthermore, effective tax planning can enhance your competitiveness in the market and improve your overall financial performance. However, it is essential to consider the potential disadvantages, such as the complexity of tax laws and the need for ongoing monitoring and adjustments. Striking a balance between tax optimization and compliance is crucial.

FAQs (Frequently Asked Questions)

Q: Can tax planning benefit small businesses?

A: Yes, tax planning is equally beneficial for small businesses as it allows them to optimize their tax burdens and enhance their financial position.

Q: Is it necessary to hire a tax professional for tax planning?

A: While it is not mandatory, hiring a tax professional can provide valuable expertise and ensure that you navigate the complexities of tax planning effectively.

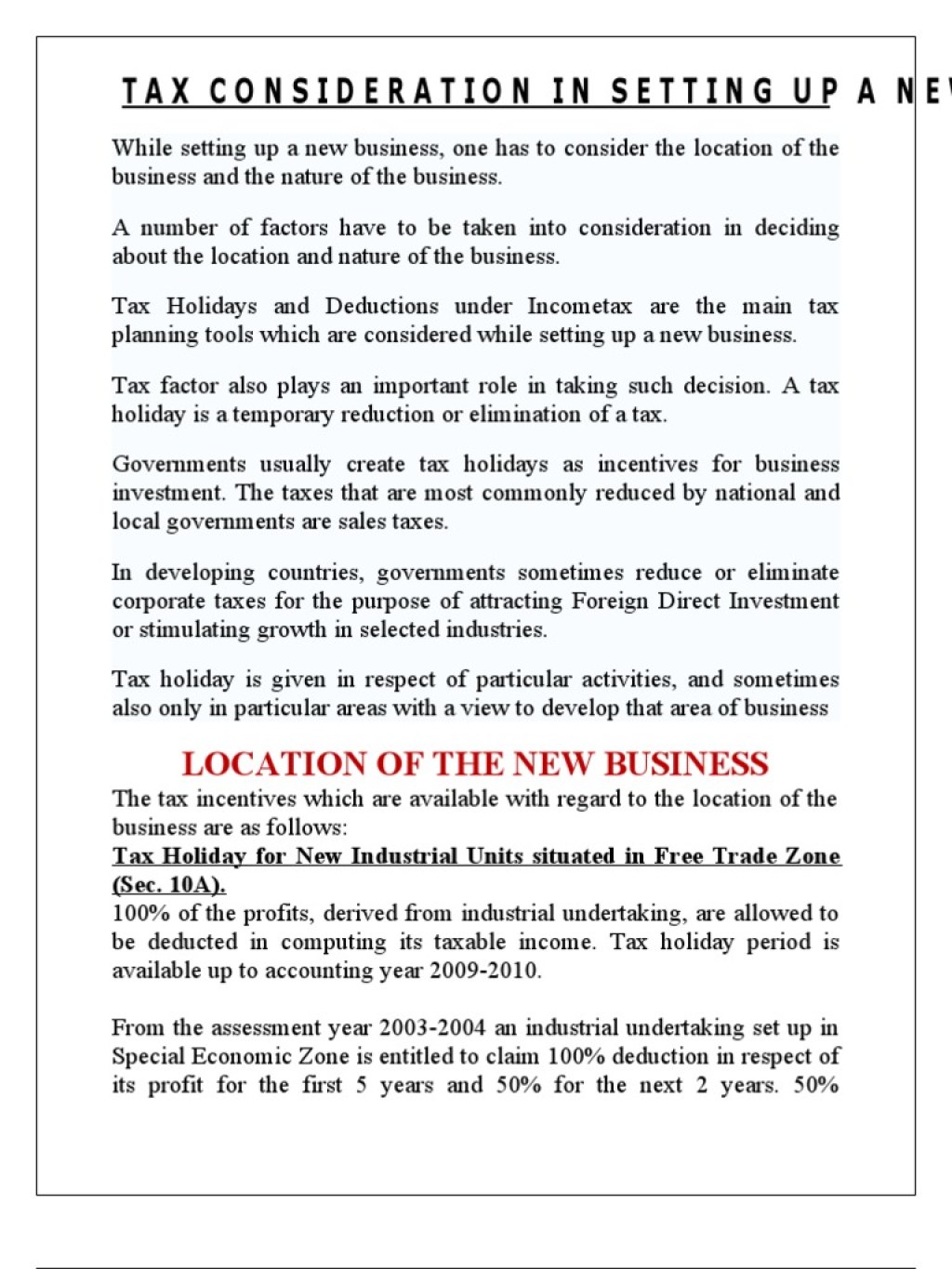

Q: Are there any specific tax incentives for new businesses?

A: Yes, many jurisdictions offer tax incentives, such as tax credits or exemptions, to encourage the growth and development of new businesses.

Q: How often should tax planning be reviewed and updated?

A: Tax planning should be reviewed and updated annually or whenever significant changes occur in your business or the tax laws.

Q: Can tax planning help mitigate tax risks for international businesses?

A: Yes, tax planning can assist international businesses in managing tax risks associated with cross-border transactions, transfer pricing, and foreign tax credits.

Conclusion

In conclusion, tax planning is a crucial aspect of starting and operating a new business. By implementing effective tax planning strategies, you can minimize tax liabilities, optimize cash flow, and ensure compliance with tax laws. Seeking professional guidance and staying proactive in your tax planning efforts will contribute to the long-term financial success and sustainability of your new business. Remember, proper tax planning is a key ingredient in unlocking the full potential of your entrepreneurial journey.

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be construed as legal or financial advice. Tax laws and regulations may vary depending on your jurisdiction, and it is essential to consult with a qualified professional before making any decisions related to tax planning for your new business.

This post topic: Tax Planning