The Ultimate Tax Game Plan: Take Charge And Win Big With Our Proven Strategies!

Tax Game Plan: Maximizing Your Savings and Minimizing Your Liabilities

Introduction

Dear Readers,

Welcome to our comprehensive guide on tax game plans – the ultimate strategy for maximizing savings and minimizing liabilities. In this article, we will delve into the intricacies of tax planning and provide you with valuable insights on how to optimize your tax position. Whether you are an individual taxpayer or a business owner, understanding tax game plans is crucial for your financial success.

2 Picture Gallery: The Ultimate Tax Game Plan: Take Charge And Win Big With Our Proven Strategies!

With the right tax game plan, you can legally optimize your tax position and take advantage of available deductions, exemptions, and credits. By strategically planning your taxes, you can ensure that you are not paying more than your fair share, freeing up more money for investments, savings, and achieving your financial goals.

In this article, we will discuss the fundamentals of tax game plans, including what they are, who can benefit from them, when and where they should be implemented, why they are important, and how to create your own personalized tax game plan.

So, let’s dive in and learn how to win the tax game!

Table of Contents

Image Source: ytimg.com

What is a Tax Game Plan?

Who Can Benefit from a Tax Game Plan?

When Should You Implement a Tax Game Plan?

Where Should You Implement Your Tax Game Plan?

Why Are Tax Game Plans Important?

How to Create Your Own Tax Game Plan?

Advantages and Disadvantages of Tax Game Plans

FAQs

Conclusion

Final Remarks

What is a Tax Game Plan? 🧩

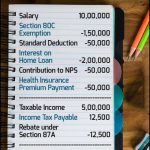

A tax game plan refers to a strategic approach towards managing your tax obligations to minimize your tax liabilities and maximize your savings. It involves analyzing your financial situation, understanding the tax laws, and taking advantage of available deductions, exemptions, and credits to legally reduce your tax burden.

A well-designed tax game plan takes into account various factors, such as your income, investments, deductions, and credits, to optimize your tax position. With a tax game plan, you can ensure that you are not paying more taxes than necessary, allowing you to retain more of your hard-earned money.

Why is tax planning important?

Tax planning is essential because it enables you to take advantage of tax incentives and minimize your tax liabilities. By implementing a tax game plan, you can legally reduce your tax burden, increase your savings, and achieve your financial goals more effectively.

Image Source: fbsbx.com

However, it is important to note that tax planning should always be done within the boundaries of the law. Engaging in illegal or unethical tax avoidance schemes can lead to severe consequences, including penalties and legal issues. Therefore, it is crucial to seek professional advice and ensure that your tax game plan complies with all applicable tax regulations.

Now, let’s explore who can benefit from implementing a tax game plan.

Who Can Benefit from a Tax Game Plan? 🎯

A tax game plan can benefit individuals, families, and businesses of all sizes. Whether you are a salaried employee, a self-employed professional, a small business owner, or a large corporation, implementing a tax game plan can help optimize your tax position and maximize your savings.

Here are some examples of individuals and entities that can benefit from a tax game plan:

1. Individuals and Families:

Image Source: tgpfirm.com

Individual taxpayers can benefit from tax game plans by taking advantage of deductions, exemptions, and credits available to them. By carefully analyzing their income, investments, and expenses, individuals and families can minimize their tax liabilities and maximize their savings.

2. Small Business Owners:

Small business owners can use tax game plans to optimize their tax position and reduce their tax liabilities. By properly structuring their business entities, deducting eligible business expenses, and taking advantage of available tax incentives, small business owners can significantly reduce their tax burden.

3. Corporations:

Large corporations can benefit from tax game plans by strategically planning their income, deductions, and credits. By utilizing international tax strategies, transfer pricing, and other tax planning techniques, corporations can legally minimize their global tax liabilities and maximize their profits.

Now that we have identified who can benefit from a tax game plan, let’s discuss when and where you should implement your tax strategies.

When Should You Implement a Tax Game Plan? ⌛

The ideal time to implement a tax game plan is before the start of the tax year. By planning ahead, you can take proactive steps to optimize your tax position and maximize your savings. However, tax planning is an ongoing process, and adjustments may be required throughout the year to adapt to changing circumstances.

Here are some key milestones when you should consider implementing your tax game plan:

1. New Year:

At the beginning of each year, review your financial goals and objectives, and assess your tax situation. Identify potential deductions, exemptions, and credits that you can take advantage of during the year.

2. Major Life Events:

Significant life events, such as marriage, divorce, birth of a child, or the purchase of a home, can impact your tax position. Consider how these events may affect your taxes and make necessary adjustments to your tax game plan.

3. Business Milestones:

If you own a business, key business milestones, such as the start of a new fiscal year, expansion, or acquisition, may require adjustments to your tax strategies. Consult with a tax professional to ensure that your tax game plan aligns with your business objectives.

Now that we have discussed when to implement a tax game plan, let’s explore where you should implement your tax strategies.

Where Should You Implement Your Tax Game Plan? 📍

The location where you implement your tax game plan depends on various factors, including your residency status, business operations, and the tax laws of different jurisdictions. Here are some key considerations:

1. Country of Residence:

Your country of residence will often be the primary jurisdiction where you implement your tax game plan. Understanding the tax laws and regulations of your country is crucial for optimizing your tax position and avoiding any non-compliance issues.

2. International Operations:

If you have international operations or investments, you may need to consider tax planning strategies that take into account the tax laws of multiple countries. Utilizing international tax treaties, transfer pricing, and other cross-border tax planning techniques can help minimize your global tax liabilities.

3. Tax-Free Zones and Incentive Programs:

In some cases, establishing your business in specific tax-free zones or taking advantage of government incentive programs can provide significant tax benefits. Research the available options and consult with tax advisors to determine if such opportunities align with your business objectives.

Now that we have discussed the importance of tax planning, who can benefit from a tax game plan, and when and where to implement your tax strategies, let’s explore why tax game plans are crucial.

Why Are Tax Game Plans Important? ❓

Tax game plans are important for several reasons:

1. Minimize Tax Liabilities:

By implementing a tax game plan, you can legally minimize your tax liabilities by taking advantage of available deductions, exemptions, and credits. This allows you to keep more of your hard-earned money and allocate it towards investments, savings, or other financial goals.

2. Optimize Savings:

Tax planning enables you to optimize your savings by identifying tax-efficient investment strategies and retirement plans. By strategically planning your contributions to retirement accounts, such as 401(k)s or IRAs, you can benefit from tax-deferred growth and potentially reduce your current tax liabilities.

3. Achieve Financial Goals:

Tax game plans align your tax strategies with your financial goals. Whether it is buying a home, funding your children’s education, or starting a business, tax planning can help you allocate your resources more effectively and achieve your long-term objectives.

4. Maintain Compliance:

Proper tax planning ensures that you are compliant with all applicable tax laws and regulations. By staying on top of your tax obligations, you can avoid penalties, fines, and legal issues that may arise from non-compliance.

How to Create Your Own Tax Game Plan? 🔧

Creating your own tax game plan involves the following steps:

1. Assess Your Financial Situation:

Analyze your income, investments, expenses, and other financial factors that impact your tax position. This will help you identify areas where you can optimize your tax strategies.

2. Research Tax Laws and Regulations:

Stay updated on the latest tax laws and regulations in your jurisdiction. Understand the available deductions, exemptions, and credits that you may qualify for.

3. Consult with Tax Professionals:

Seek advice from tax professionals or certified public accountants who specialize in tax planning. They can help you navigate complex tax laws and suggest strategies that align with your financial goals.

4. Develop a Tax Strategy:

Based on your financial situation and professional advice, develop a tax strategy that optimizes your tax position. Consider factors such as income timing, deductions, exemptions, and tax-efficient investment options.

5. Review and Adjust Regularly:

Regularly review and adjust your tax game plan to reflect changes in your financial situation and tax laws. Stay proactive and make necessary adjustments to ensure the effectiveness of your tax strategies.

With these steps in mind, you can create your own personalized tax game plan and optimize your tax position.

Advantages and Disadvantages of Tax Game Plans

Advantages of Tax Game Plans:

1. Minimize Tax Liabilities: Tax game plans allow you to legally minimize your tax liabilities by taking advantage of available deductions, exemptions, and credits.

2. Optimize Savings: By strategically planning your investments and retirement contributions, tax planning helps you optimize your savings and achieve your financial goals.

3. Increase Cash Flow: By reducing your tax burden, tax game plans free up more money that can be used for investments, savings, or other financial needs.

4. Maintain Compliance: Implementing a tax game plan ensures that you remain compliant with tax laws, reducing the risk of penalties and legal issues.

5. Long-Term Financial Success: By aligning your tax strategies with your financial goals, tax planning sets you on the path to long-term financial success and stability.

Disadvantages of Tax Game Plans:

1. Complexity: Tax laws and regulations can be complex, and implementing an effective tax game plan requires a deep understanding of these complexities.

2. Time-Consuming: Developing and managing a tax game plan requires time and effort, especially if you have a complex financial situation or multiple income sources.

3. Professional Fees: Seeking advice from tax professionals may incur additional costs, especially for complex tax planning strategies.

4. Changing Tax Laws: Tax laws and regulations are subject to change, and it is essential to stay updated and adjust your tax game plan accordingly.

5. Risk of Non-Compliance: Improper tax planning or engaging in illegal tax avoidance schemes can result in severe consequences, including penalties and legal issues.

FAQs (Frequently Asked Questions)

1. Can anyone create a tax game plan?

Yes, anyone can create a tax game plan. However, it is advisable to seek professional advice to ensure that your tax strategies are compliant and optimized for your unique financial situation.

2. Can a tax game plan help me save money?

Yes, a well-designed tax game plan can help you minimize your tax liabilities and increase your savings by taking advantage of available deductions, exemptions, and credits.

3. Is tax planning legal?

Yes, tax planning is legal. However, it is essential to distinguish between legal tax planning and illegal tax evasion. Engaging in illegal tax activities can lead to severe consequences.

4. How often should I review my tax game plan?

You should review your tax game plan regularly, ideally at least once a year or whenever there are significant changes in your financial situation or tax laws.

5. Can I implement a tax game plan for my small business?

Absolutely! A tax game plan can be beneficial for small business owners, helping them optimize their tax position and maximize their savings. Consulting with a tax professional specializing in small business tax planning is recommended.

Conclusion

In conclusion, implementing a tax game plan is essential for maximizing your savings and minimizing your tax liabilities. By strategically planning your taxes, you can legally optimize your tax position, take advantage of available deductions, exemptions, and credits, and achieve your financial goals more effectively. Whether you are an individual taxpayer or a business owner, understanding tax game plans is crucial for your financial success.

Remember, tax planning should always be done within the boundaries of the law, and seeking professional advice is highly recommended. So, take control of your taxes, create your personalized tax game plan,

This post topic: Tax Planning