Master The Art Of Tax Planning Designations: Unleash Your Financial Potential Today!

Tax Planning Designations: Maximizing Financial Strategies for Individuals and Businesses

Introduction

Dear Readers,

3 Picture Gallery: Master The Art Of Tax Planning Designations: Unleash Your Financial Potential Today!

Welcome to an in-depth exploration of tax planning designations. In this article, we will delve into the intricacies of these designations, their importance, and how they can benefit individuals and businesses in optimizing their financial strategies.

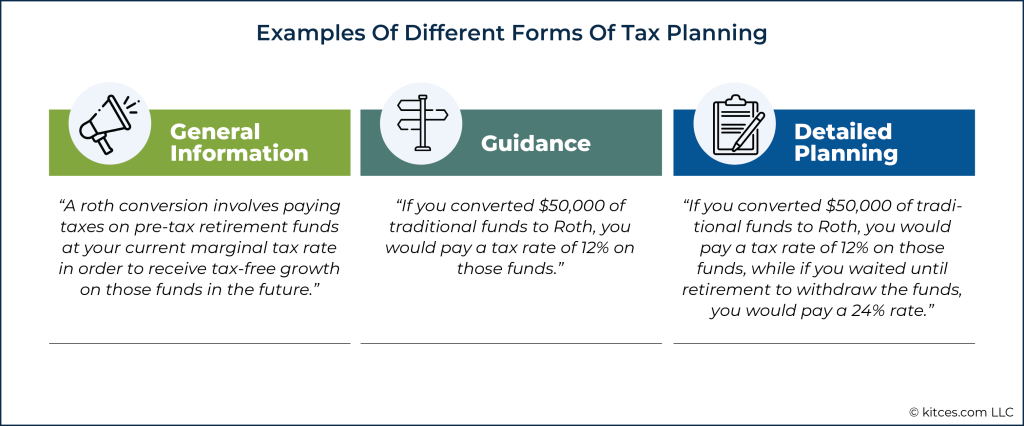

Image Source: kitces.com

So, what exactly are tax planning designations? Let’s find out!

What are Tax Planning Designations? 🧐

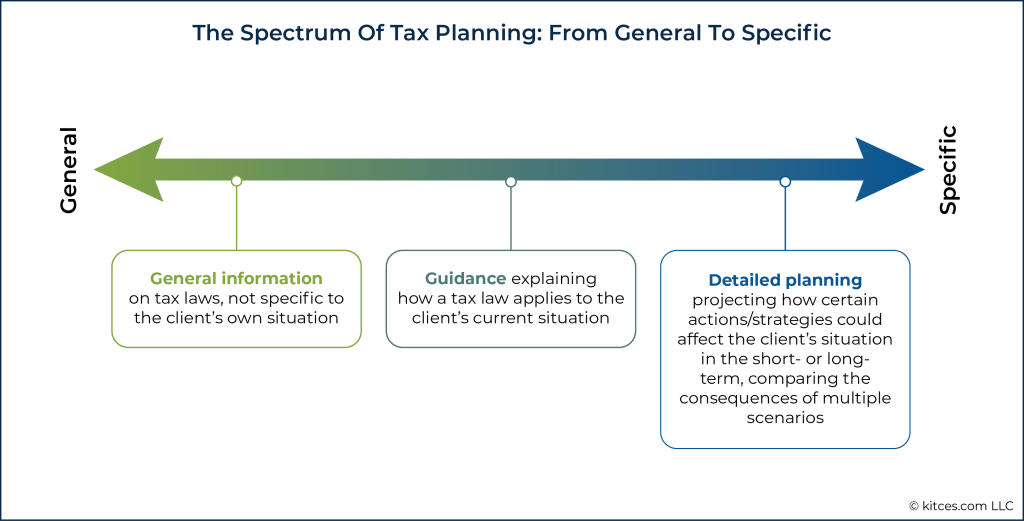

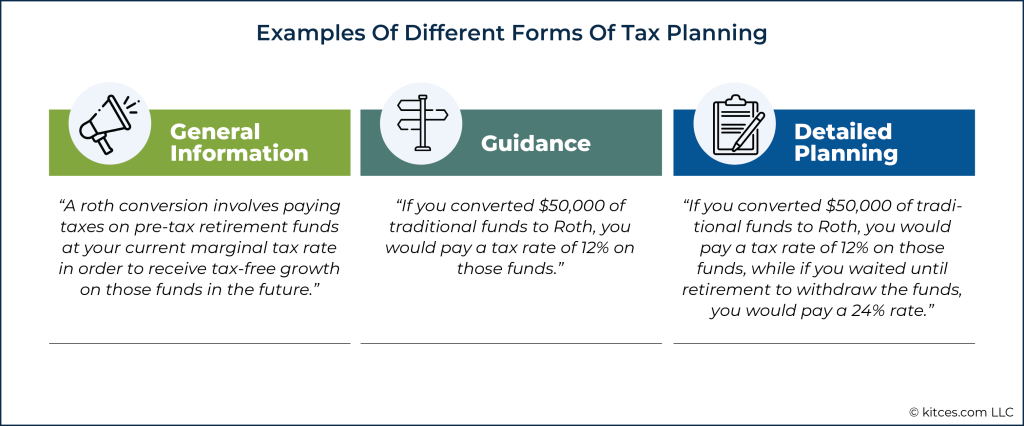

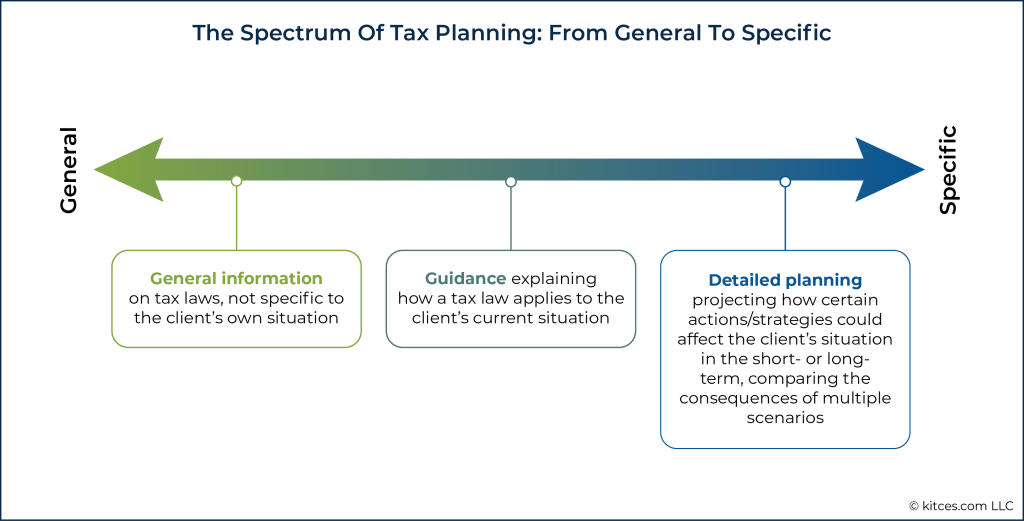

Tax planning designations refer to professional certifications and qualifications that individuals acquire to specialize in tax planning and advisory services. These designations provide practitioners with in-depth knowledge and expertise in various tax-related areas, enabling them to assist clients in legally minimizing their tax liabilities while maximizing their financial gains.

Who can obtain these designations? 🤔

Who Can Obtain Tax Planning Designations? 👩💼👨💼

Image Source: kitces.com

Tax planning designations are typically pursued by professionals in the financial industry, including accountants, tax consultants, financial advisors, and attorneys. These individuals seek to enhance their skills and expand their expertise in tax planning, enabling them to offer comprehensive and effective financial guidance to their clients.

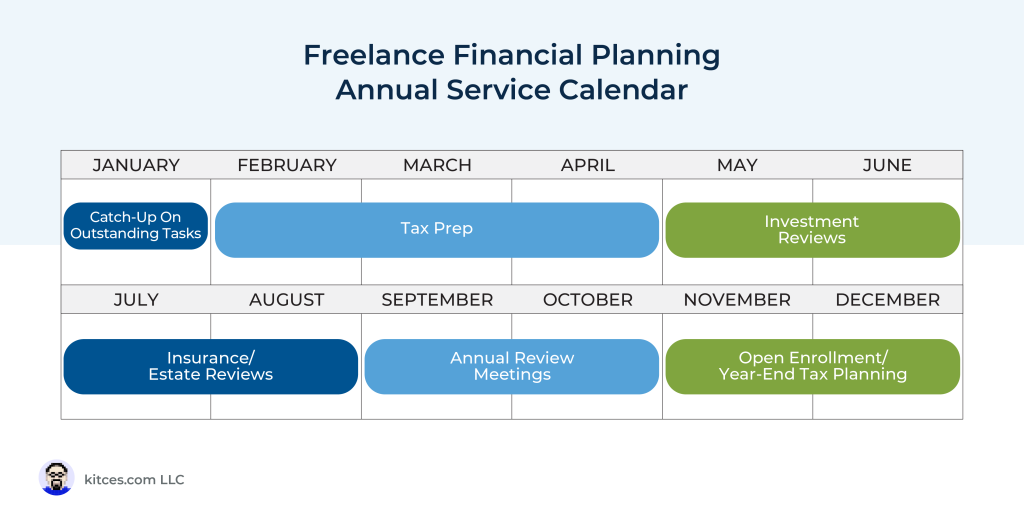

When should you consider consulting professionals with tax planning designations? 📅

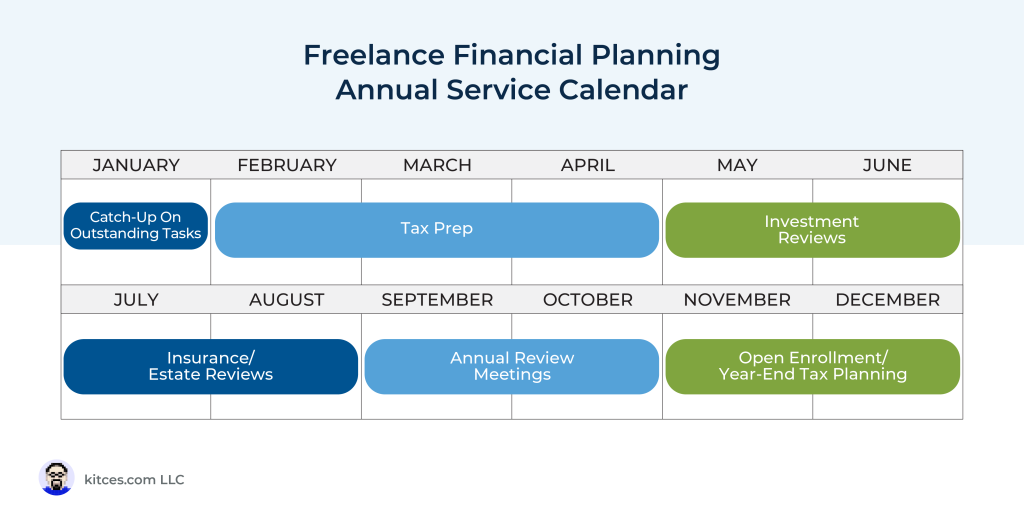

When to Consult Professionals with Tax Planning Designations? ⏰

Image Source: kitces.com

It is advisable to engage professionals with tax planning designations when you require expert guidance in structuring your financial affairs to minimize tax burdens and optimize your overall financial position. Whether you are an individual taxpayer, a small business owner, or a corporate entity, seeking the assistance of these professionals can provide immense value in navigating complex tax regulations.

Where can you find professionals with tax planning designations? 📍

Where to Find Professionals with Tax Planning Designations? 🌍

Professionals with tax planning designations can be found in various financial institutions, including accounting firms, law firms, financial advisory firms, and tax consulting companies. Additionally, many individual practitioners offer their specialized services to cater to the specific needs of clients seeking tax planning expertise.

Why are tax planning designations important? ❓

Why are Tax Planning Designations Important? ❗️

Tax planning designations are crucial for several reasons. Firstly, they demonstrate the expertise and competence of professionals in the tax planning field, assuring clients of their capability to provide accurate and reliable advice. Secondly, these designations signify a commitment to upholding professional ethics and standards, ensuring that practitioners adhere to the highest levels of integrity and compliance. Lastly, professionals with tax planning designations stay updated with the latest tax laws and regulations, allowing them to offer relevant and effective strategies to clients.

How can tax planning designations benefit individuals and businesses? 🤝

How Can Tax Planning Designations Benefit Individuals and Businesses? 💼

By consulting professionals with tax planning designations, individuals and businesses can reap numerous advantages. These include:

📈 Maximizing Tax Savings: Professionals with tax planning designations possess extensive knowledge of tax laws and regulations. They can identify and implement strategies that legally minimize tax liabilities, resulting in significant savings for individuals and businesses alike.

🔒 Ensuring Compliance: Tax planning designations emphasize the importance of compliance with tax laws. Professionals with these designations can ensure that individuals and businesses adhere to all relevant regulations, mitigating the risk of penalties, audits, and legal complications.

💡 Offering Tailored Solutions: Tax planning designations equip professionals with the expertise to understand the unique financial situations of individuals and businesses. They can develop customized strategies that align with specific goals and circumstances, maximizing the benefits for clients.

🌐 Navigating Complexities: Tax laws are continually evolving, and staying updated can be challenging for individuals and businesses. Professionals with tax planning designations dedicate significant time and effort to remain well-informed, enabling them to navigate complex tax regulations effectively.

🔍 Identifying Opportunities: Tax planning designations empower professionals to identify potential tax-saving opportunities that individuals and businesses may not be aware of. By leveraging their expertise, these professionals can uncover deductions, credits, and incentives that can significantly impact clients’ financial positions.

Advantages and Disadvantages of Tax Planning Designations

While tax planning designations offer numerous benefits, it is essential to acknowledge the potential drawbacks as well. Let’s explore the advantages and disadvantages:

Advantages of Tax Planning Designations ✅

📚 Enhanced Expertise: Tax planning designations provide professionals with specialized knowledge, enabling them to offer comprehensive tax planning services to clients.

🏢 Credibility and Trust: These designations instill confidence in clients, assuring them that the professionals they consult are qualified and competent in tax planning.

💼 Expanded Career Opportunities: Individuals with tax planning designations have a competitive edge in the job market and can pursue various lucrative career paths.

Disadvantages of Tax Planning Designations ❌

📅 Time and Commitment: Earning tax planning designations requires significant time and dedication, as individuals must complete rigorous coursework and examinations.

💰 Financial Investment: Pursuing tax planning designations may involve costs such as tuition fees, study materials, and ongoing professional education requirements.

📚 Continuous Learning: To maintain their designations, professionals must engage in continuous learning and stay updated with evolving tax laws and regulations.

Frequently Asked Questions (FAQs) about Tax Planning Designations 🙋♀️🙋♂️

1. What are the most recognized tax planning designations?

Answer: Some of the most recognized tax planning designations include Certified Public Accountant (CPA), Enrolled Agent (EA), and Certified Financial Planner (CFP).

2. How long does it take to obtain a tax planning designation?

Answer: The time required to obtain a tax planning designation varies depending on the specific designation and the individual’s prior education and experience. It can range from several months to several years.

3. Are tax planning designations recognized globally?

Answer: While some tax planning designations are recognized globally, others are specific to certain countries or regions. It is essential to research the recognition and relevance of a particular designation in your desired jurisdiction.

4. Can individuals without tax planning designations still engage in tax planning?

Answer: Yes, individuals without tax planning designations can engage in tax planning to a certain extent. However, seeking professional advice from experts with these designations can provide more comprehensive and reliable strategies.

5. How often should individuals review their tax planning strategies?

Answer: It is recommended to review tax planning strategies annually or whenever significant life events occur, such as marriage, the birth of a child, or starting a new business venture.

Conclusion: Taking Action for Financial Success 💪

In conclusion, tax planning designations play a vital role in optimizing financial strategies for individuals and businesses. By consulting professionals with these designations, you can unlock the full potential of tax planning, minimize liabilities, and maximize savings. Remember, the right tax planning strategy can have a significant impact on your overall financial success. Take action today and embark on a journey towards financial prosperity!

Final Remarks: Empowering You for Financial Confidence and Success

Dear Readers,

We hope this comprehensive article on tax planning designations has provided you with valuable insights and guidance. It is important to note that while the information presented here is accurate and up-to-date to the best of our knowledge, tax laws and regulations are subject to change. Therefore, we recommend consulting professionals with tax planning designations for personalized advice tailored to your specific circumstances.

Remember, a well-executed tax planning strategy can have a transformative impact on your financial well-being. Empower yourself with knowledge, seek expert advice, and take proactive steps towards achieving your financial goals. Wishing you all the best on your journey to financial confidence and success!

This post topic: Tax Planning