Unveiling The Power Of Tax Planning O Que é: Unlock Financial Success Today!

Tax Planning O Que É: Everything You Need to Know

Welcome, Readers! Today, we will delve into the world of tax planning and explore what it is and how it can benefit you. Tax planning, a crucial aspect of financial management, involves analyzing your financial situation to maximize tax efficiency and minimize tax liabilities. In this article, we will provide you with a comprehensive overview of tax planning, its importance, and how it can help you optimize your tax obligations.

Introduction

In this section, we will provide an in-depth explanation of tax planning, its purpose, and its significance in overall financial planning.

2 Picture Gallery: Unveiling The Power Of Tax Planning O Que é: Unlock Financial Success Today!

1. What is Tax Planning? 🧐

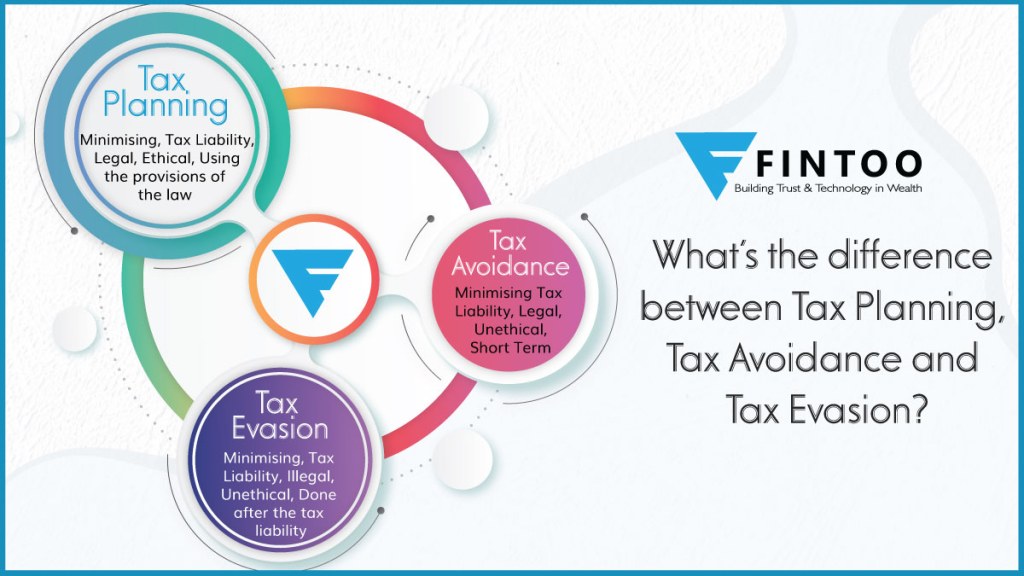

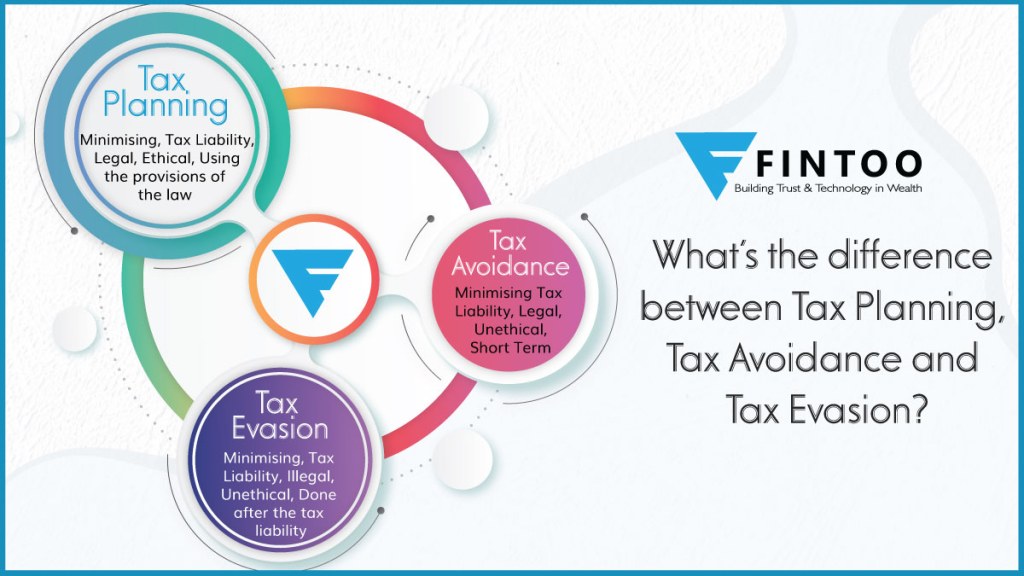

Tax planning is the process of organizing your financial affairs in a way that legally minimizes your tax burden. It involves proactive decision-making and strategic financial management to optimize tax efficiency. By analyzing your income, expenses, deductions, and credits, tax planning aims to reduce your tax liability while remaining compliant with tax laws.

2. Who Can Benefit from Tax Planning? 🤔

Image Source: fintoo.in

Tax planning is beneficial for individuals, families, and businesses of all sizes. It allows individuals to take advantage of tax deductions and credits, while businesses can optimize their tax strategies to maximize profitability. Tax planning is particularly important for high-income earners, entrepreneurs, and companies with complex financial structures.

3. When Should Tax Planning Be Done? 🗓️

Tax planning should ideally be an ongoing process and not just a year-end activity. It is best to start tax planning at the beginning of each financial year to ensure ample time for strategic decision-making and implementation of tax-saving strategies. However, tax planning can be done at any time, considering your financial circumstances and upcoming tax obligations.

4. Where Does Tax Planning Apply? 🌍

Tax planning applies in various jurisdictions around the world, as tax laws and regulations differ between countries. The principles of tax planning remain the same, but the specific strategies and deductions may vary depending on the tax framework of each country. It is crucial to consult with tax professionals who are well-versed in the tax laws of your specific jurisdiction.

Image Source: bizlatinhub.com

5. Why is Tax Planning Important? 💼

Tax planning is essential for individuals and businesses alike due to the following reasons:

– Minimize Tax Liability: By strategically utilizing deductions and credits, tax planning helps minimize the amount of tax you owe, increasing your disposable income.

– Avoid Penalties: Accurate tax planning ensures compliance with tax laws, reducing the risk of penalties, fines, or audits.

– Optimize Financial Resources: By minimizing tax obligations, you can allocate more resources towards savings, investments, or business development, promoting financial growth.

– Strategic Decision-Making: Tax planning allows individuals and businesses to make informed financial decisions, taking into account the tax implications.

– Future Planning: By analyzing your financial situation, tax planning helps you plan for future expenses, investments, and retirement, ensuring long-term financial security.

6. How Does Tax Planning Work? 📊

Tax planning involves several steps, including:

– Assessing your financial situation, including income, expenses, and deductions.

– Identifying potential tax-saving opportunities, such as deductions, credits, and exemptions.

– Developing a tax strategy tailored to your specific circumstances.

– Implementing the tax-saving strategies, such as adjusting investments, utilizing retirement accounts, or restructuring business operations.

– Monitoring and reviewing your tax plan regularly to adapt to changing tax laws and financial circumstances.

Advantages and Disadvantages of Tax Planning

In this section, we will explore the pros and cons of tax planning.

Advantages: 👍

1. Increased Savings: Effective tax planning allows individuals and businesses to save money by reducing tax liabilities.

2. Improved Financial Management: By analyzing your income and expenses, tax planning promotes better financial management and decision-making.

3. Enhanced Profitability: Businesses can optimize their tax strategies to increase profitability by reducing tax burdens.

4. Retirement Planning: Tax planning helps individuals plan for retirement by utilizing retirement accounts and tax-efficient investment strategies.

5. Legal Compliance: Proper tax planning ensures compliance with tax laws and reduces the risk of penalties or audits.

Disadvantages: 👎

1. Complex Procedures: Tax planning can involve complex procedures and calculations, requiring professional assistance.

2. Time-Consuming: Proper tax planning requires time and effort to analyze financial data, research tax laws, and implement strategies.

3. Changing Tax Laws: Tax laws are subject to change, making it necessary to regularly review and update tax planning strategies.

4. Professional Fees: Consulting tax professionals for expert advice may involve additional costs.

5. Ethical Considerations: While tax planning is legal, some strategies may raise ethical concerns, requiring careful evaluation.

Frequently Asked Questions (FAQs)

In this section, we will address some common questions related to tax planning.

1. Is tax planning legal?

Yes, tax planning is legal as long as it is done within the framework of tax laws and regulations. It involves maximizing deductions and credits while remaining compliant with tax legislation.

2. Are there specific tax planning strategies for businesses?

Yes, businesses can employ various strategies, such as utilizing tax deductions and credits, implementing tax-efficient employee benefit plans, and structuring transactions to optimize tax benefits.

3. Can individuals without high incomes benefit from tax planning?

Absolutely! Tax planning is beneficial for individuals of all income levels. By identifying deductions and credits, individuals can minimize their tax liability and maximize their disposable income.

4. How often should tax planning be reviewed?

Tax planning should be reviewed annually or whenever there are significant changes in your financial situation, such as marriage, the birth of a child, starting a business, or retirement.

5. Can tax planning reduce the risk of audits?

While tax planning cannot guarantee the prevention of audits, proper tax planning reduces the likelihood of errors or inconsistencies that may trigger an audit. By ensuring compliance with tax laws, tax planning minimizes the risk of audits.

Conclusion

In conclusion, tax planning is an essential aspect of financial management that allows individuals and businesses to optimize their tax obligations while remaining compliant with tax laws. By strategizing deductions, credits, and exemptions, tax planning helps minimize tax liabilities and increase financial resources for savings, investments, and future planning. To ensure the best tax planning results, it is advisable to consult with tax professionals who can provide expert advice tailored to your specific circumstances.

Final Remarks

We hope this article has provided you with valuable insights into tax planning and its benefits. While tax planning can be complex, it is crucial for maximizing financial resources and optimizing tax efficiency. Remember to consult with tax professionals or financial advisors to develop a tax plan that suits your specific needs and goals. Stay informed about changes in tax laws and review your tax plan regularly to adapt to evolving financial circumstances. Happy tax planning!

This post topic: Tax Planning