Maximize Your Savings With Effective Tax Planning HUF: Take Charge Of Your Financial Future!

Tax Planning HUF: Maximizing Tax Benefits and Minimizing Liabilities

Greetings, Readers! Today, we delve into the world of tax planning HUF (Hindu Undivided Family). As tax planning plays a crucial role in managing finances and maximizing savings, understanding the intricacies of tax planning HUF can prove to be incredibly beneficial. In this article, we will explore the concept of tax planning HUF, its advantages and disadvantages, and provide you with valuable insights on how to make the most of this strategy. So, let’s dive in!

Introduction

Tax planning HUF refers to the process of utilizing the legal provisions available under the Indian Income Tax Act, 1961, to minimize tax liabilities and maximize tax benefits for a Hindu Undivided Family. HUF is recognized as a separate entity for tax purposes, distinct from its members, and can avail various deductions, exemptions, and tax benefits. It offers a unique way to manage wealth and maintain continuity across generations. However, it is important to understand the various aspects of tax planning HUF before implementing it.

2 Picture Gallery: Maximize Your Savings With Effective Tax Planning HUF: Take Charge Of Your Financial Future!

In this article, we will explore the key points related to tax planning HUF, including its definition, eligibility criteria, tax implications, advantages, disadvantages, frequently asked questions, and more. So, keep reading to gain a comprehensive understanding of tax planning HUF and how it can benefit you and your family.

What is Tax Planning HUF?

🔑 Tax planning HUF involves creating and maintaining a Hindu Undivided Family as a separate tax entity to avail tax benefits and deductions under the Indian Income Tax Act, 1961. It allows the pooling of family income and assets, making it an effective wealth management and tax optimization strategy.

A Hindu Undivided Family consists of all persons lineally descended from a common ancestor and includes their wives and unmarried daughters. Creating an HUF entails the process of partitioning the family’s assets and creating a separate entity for tax purposes.

Key points:

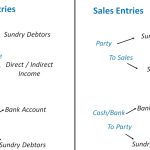

Image Source: ytimg.com

1. HUF is recognized as a separate tax entity distinct from its members.

2. It allows pooling of family income and assets.

3. Creation of an HUF involves partitioning of assets.

Image Source: itrtoday.com

4. HUF can avail various deductions, exemptions, and tax benefits.

Now that we have a basic understanding of tax planning HUF, let us explore who is eligible to create an HUF.

Who is Eligible to Create a Tax Planning HUF?

🔑 To create a tax planning HUF, you need to meet certain eligibility criteria:

1. You must belong to the Hindu, Sikh, Jain, or Buddhist religion, as HUF is not applicable to other religions.

2. You must have a family that includes at least two members.

3. You must have a common ancestor from whom all the members are lineally descended.

4. All members of the family, including the common ancestor, should be Indian citizens.

If you meet these eligibility criteria, you can create an HUF and begin benefiting from the various tax advantages it offers. Now, let’s move on to understanding when tax planning HUF becomes relevant.

When is Tax Planning HUF Relevant?

🔑 Tax planning HUF becomes relevant in the following scenarios:

1. When you have a family business or ancestral property: An HUF can be beneficial in managing and passing on family businesses and ancestral properties while maximizing tax benefits.

2. When you want to avail tax deductions and exemptions: HUF can avail deductions and exemptions available under the Indian Income Tax Act, 1961, which can significantly reduce the overall tax liability.

3. When you want to create a separate legal entity: HUF provides a legal framework to separate family income and assets from individual income and assets, ensuring better management and protection.

Understanding when tax planning HUF becomes relevant allows you to make informed decisions and take advantage of the available benefits. Now, let’s explore where tax planning HUF holds significance.

Where Does Tax Planning HUF Hold Significance?

🔑 Tax planning HUF holds significance in the following areas:

1. Wealth management and continuity: Creating an HUF enables effective wealth management and ensures continuity across generations by pooling family income and assets.

2. Tax optimization: HUF allows for the utilization of various deductions, exemptions, and tax benefits, thereby minimizing the overall tax liability.

3. Business succession planning: HUF facilitates seamless business succession planning by providing a legal framework for the transfer of family businesses and ancestral properties.

Understanding where tax planning HUF holds significance helps you identify the areas where you can leverage its benefits. Now, let’s explore why tax planning HUF is a popular strategy.

Why is Tax Planning HUF a Popular Strategy?

🔑 Tax planning HUF is a popular strategy due to the following reasons:

1. Tax benefits and deductions: HUF can avail various tax benefits and deductions available under the Indian Income Tax Act, 1961, which can result in significant tax savings.

2. Wealth creation and preservation: By pooling family income and assets, HUF aids in effective wealth creation and preservation, ensuring financial security for future generations.

3. Business succession planning: HUF provides a legal framework for seamless business succession planning, allowing for the smooth transfer of family businesses and ancestral properties.

Understanding why tax planning HUF is a popular strategy allows you to appreciate its potential benefits and make an informed decision. Now, let’s move on to understanding how tax planning HUF works.

How Does Tax Planning HUF Work?

🔑 Tax planning HUF works through the following steps:

1. Creation of HUF: The first step is to create an HUF by partitioning the family’s assets and creating a separate entity for tax purposes.

2. Obtaining a PAN: Once the HUF is created, you need to obtain a separate PAN (Permanent Account Number) for the HUF to file income tax returns.

3. Pooling of income and assets: All income and assets belonging to the family members are pooled under the HUF, and the HUF files a separate income tax return.

4. Availing tax benefits: HUF can avail various tax benefits, deductions, and exemptions available under the Indian Income Tax Act, 1961, to minimize tax liabilities.

5. Compliance with tax regulations: It is essential to comply with all tax regulations and maintain proper documentation to ensure the legality and effectiveness of tax planning HUF.

By following these steps, you can make tax planning HUF work to your advantage. Now, let’s explore the advantages and disadvantages of tax planning HUF.

Advantages and Disadvantages of Tax Planning HUF

Advantages:

1. 🌟 Tax benefits: HUF offers various tax benefits, deductions, and exemptions, resulting in significant tax savings for the family.

2. 🌟 Wealth creation and preservation: By pooling family income and assets, HUF facilitates effective wealth creation and preservation, ensuring financial security for future generations.

3. 🌟 Business succession planning: HUF provides a legal framework for seamless business succession planning, enabling the transfer of family businesses and ancestral properties.

Disadvantages:

1. ⚠️ Complicated legal formalities: Setting up and maintaining an HUF involves various legal formalities and compliances, which can be complex and time-consuming.

2. ⚠️ Limited applicability: HUF is applicable only to Hindu, Sikh, Jain, and Buddhist families, excluding individuals from other religions.

3. ⚠️ Risk of disputes: In case of disagreements or disputes among family members, the management and distribution of HUF assets can become challenging.

Understanding the advantages and disadvantages of tax planning HUF helps you assess whether it is the right strategy for your family. Now, let’s address some frequently asked questions related to tax planning HUF.

Frequently Asked Questions (FAQs)

1. Can a married daughter be a member of an HUF?

Yes, a married daughter can be a member of an HUF if she is living in a joint family and meets the eligibility criteria.

2. Can an HUF claim deductions and exemptions available to individuals?

No, an HUF cannot claim deductions and exemptions available to individuals. It can only avail deductions and exemptions specific to HUFs.

3. Can income from property be treated as HUF income?

Yes, income from property owned by the HUF can be treated as HUF income and taxed accordingly.

4. Can an HUF open a bank account?

Yes, an HUF can open a bank account in its name using the PAN obtained for the HUF.

5. Can an HUF own shares in a company?

Yes, an HUF can own shares in a company and receive dividends on those shares as HUF income.

Now that we have addressed some commonly asked questions, let’s move on to the conclusion.

Conclusion

In conclusion, tax planning HUF offers a valuable strategy to minimize tax liabilities and maximize tax benefits for Hindu Undivided Families. By creating a separate tax entity, pooling family income and assets, and availing various tax deductions and exemptions, HUF facilitates effective wealth management, business succession planning, and financial security for future generations. However, it is important to consider the legal formalities, limited applicability, and potential disputes associated with HUF. We hope this article has provided you with valuable insights into tax planning HUF and its potential benefits. So, take advantage of this powerful tax planning tool and ensure a brighter financial future for your family!

Final Remarks

📢 Disclaimer: The information provided in this article is for informational purposes only and should not be considered as legal, financial, or tax advice. It is always recommended to consult with a qualified professional before making any financial or tax-related decisions.

Thank you for reading, and we hope you found this article informative and useful. If you have any further questions or require clarification, please feel free to reach out. Happy tax planning, friends!

This post topic: Tax Planning