Maximize Your Savings With Expert Tax Planning For 30 Slab – Unlock Your Financial Potential Today!

Tax Planning for 30 Slab

Introduction

Dear Readers,

Welcome to our comprehensive guide on tax planning for the 30 slab. In this article, we will provide you with valuable insights and strategies to optimize your tax planning and maximize your savings within the 30% tax bracket. Understanding how to effectively plan your taxes is crucial for individuals and businesses alike, and we are here to help you navigate through this complex process.

1 Picture Gallery: Maximize Your Savings With Expert Tax Planning For 30 Slab – Unlock Your Financial Potential Today!

Tax planning for the 30 slab refers to the strategies and techniques employed to minimize tax liability for individuals falling within the 30% tax bracket. It involves legally organizing your financial affairs to take advantage of deductions, exemptions, and credits provided by the tax laws.

By implementing effective tax planning strategies, you can not only reduce your tax burden but also optimize your financial situation by utilizing various investment opportunities. It is important to note that tax planning should be done in compliance with the tax laws of your jurisdiction.

In this article, we will provide you with a detailed overview of tax planning for the 30 slab, including what it entails, who can benefit from it, when to start planning, where to seek professional assistance, why it is important, and how to effectively implement tax planning strategies.

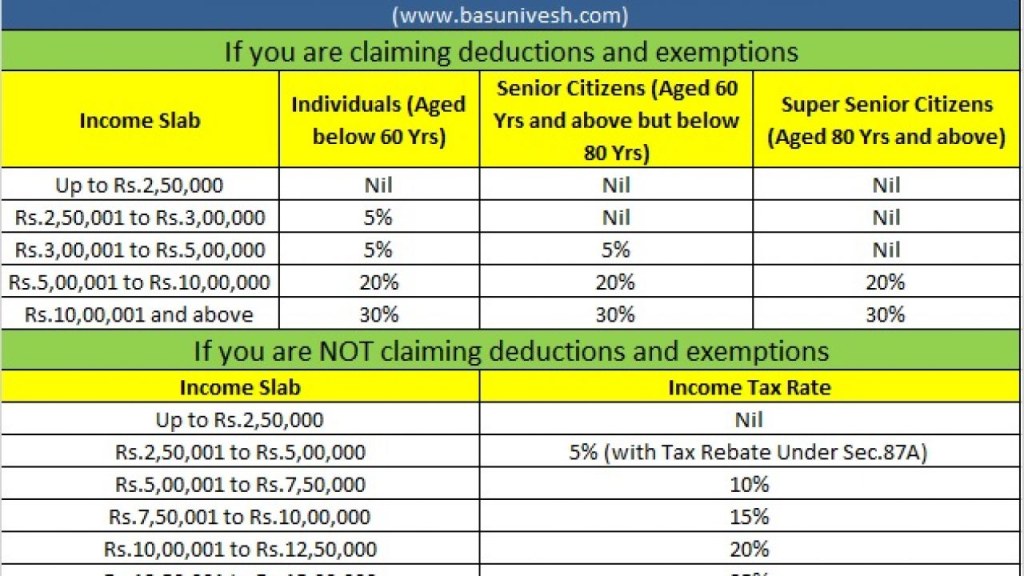

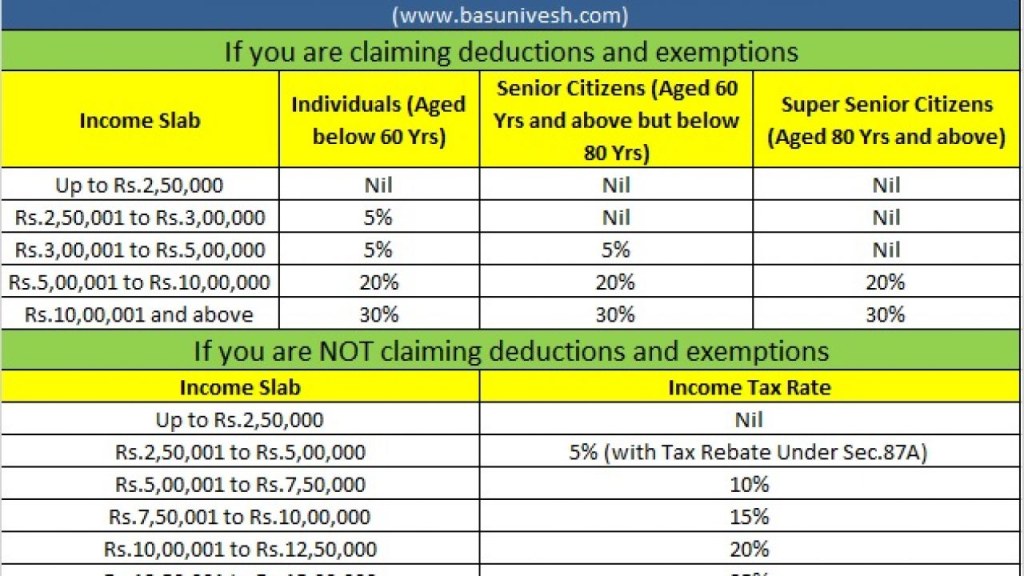

What is Tax Planning for 30 Slab? 😄

Image Source: basunivesh.com

Tax planning for the 30 slab involves the process of organizing your finances and utilizing legal deductions, exemptions, and credits to minimize your tax liability within the 30% tax bracket. It aims to optimize your tax situation while ensuring compliance with the tax laws.

Effective tax planning within the 30 slab can help individuals and businesses reduce their tax burden, increase their savings, and improve their overall financial well-being. By understanding the tax laws and implementing appropriate strategies, you can strategically manage your income, investments, and expenses to minimize your tax liability.

It is important to note that tax planning should be done in a proactive manner, considering the long-term financial goals and objectives of the taxpayer. By planning ahead and making informed decisions, you can legally minimize your tax liability while maximizing your savings and investments.

Who Can Benefit from Tax Planning for 30 Slab? 🤔

Tax planning for the 30 slab can benefit individuals, professionals, and businesses falling within the 30% tax bracket. It is especially relevant for those seeking to optimize their tax situation and maximize their savings within this tax bracket.

Individuals with higher incomes, entrepreneurs, and self-employed professionals often find themselves in the 30% tax bracket. By effectively planning their taxes, they can reduce their tax liability and retain a larger portion of their income for future investments or personal use.

Small businesses and corporations operating within the 30 slab can also benefit from tax planning strategies. By optimizing their tax structure, they can minimize the impact of taxes on their profits and improve their financial stability and growth prospects.

When to Start Tax Planning for 30 Slab? ⌛

The ideal time to start tax planning for the 30 slab is at the beginning of the financial year. By starting early, you can take advantage of various tax-saving opportunities and ensure compliance with the tax laws throughout the year.

Proactive tax planning allows individuals and businesses to analyze their financial situation, identify potential deductions and exemptions, and take necessary steps to optimize their tax liability. By planning ahead, you can make informed decisions regarding your investments, expenses, and financial transactions to minimize your tax burden.

It is important to note that tax planning is an ongoing process and should be reviewed periodically to account for changes in income, tax laws, and financial goals. By staying updated and adapting your tax planning strategies accordingly, you can ensure maximum tax efficiency and savings.

Where to Seek Professional Assistance for Tax Planning? 🏢

Tax planning for the 30 slab can be complex, and seeking professional assistance is highly recommended. Tax consultants, chartered accountants, and financial advisors with expertise in taxation can provide valuable guidance and help you navigate through the intricacies of tax planning.

Professional tax planners can assist you in analyzing your financial situation, identifying tax-saving opportunities, and developing customized strategies to optimize your tax liability within the 30% tax bracket. They can also ensure compliance with the tax laws and help you stay updated with any changes or amendments that may affect your tax planning strategies.

Why is Tax Planning for 30 Slab Important? 🤷♂️

Tax planning for the 30 slab is important for several reasons:

Minimizing tax liability: By effectively planning your taxes, you can minimize your tax burden within the 30% tax bracket, allowing you to retain a larger portion of your income.

Optimizing savings: By reducing your tax liability, you can increase your savings and allocate more funds towards investments, retirement planning, or other financial goals.

Ensuring compliance: By engaging in tax planning, you can ensure compliance with the tax laws of your jurisdiction, avoiding penalties or legal issues.

Maximizing deductions and exemptions: Tax planning allows you to take advantage of various deductions, exemptions, and credits provided by the tax laws, optimizing your tax situation.

Improving financial stability: By effectively managing your tax liability, you can improve your overall financial stability and ensure a stronger financial future.

How to Implement Effective Tax Planning Strategies? 📝

To implement effective tax planning strategies within the 30 slab, consider the following:

Educate yourself: Understand the tax laws and provisions applicable to the 30% tax bracket. Stay updated with any changes or amendments that may affect your tax planning strategies.

Analyze your financial situation: Assess your income, expenses, and investments to identify potential deductions, exemptions, and credits that can be utilized to optimize your tax liability.

Utilize tax-saving investments: Explore investment options such as tax-saving fixed deposits, mutual funds, or life insurance policies that offer tax benefits within the 30 slab.

Maximize deductions: Take advantage of deductions available for expenses such as home loans, medical expenses, education expenses, and charitable donations.

Plan capital gains: If you have capital gains, consider utilizing exemptions and deductions available under the tax laws to minimize your tax liability.

Keep proper documentation: Maintain accurate records and documentation of all financial transactions, investments, and expenses to ensure compliance with the tax laws and facilitate tax planning.

Seek professional advice: Consult with tax consultants, chartered accountants, or financial advisors specializing in taxation to develop customized tax planning strategies based on your specific financial goals and objectives.

Advantages and Disadvantages of Tax Planning for 30 Slab

Advantages:

Reduced tax liability within the 30% tax bracket.

Increased savings and investment opportunities.

Improved financial stability and future planning.

Optimized utilization of deductions, exemptions, and credits.

Compliance with tax laws and avoidance of penalties.

Disadvantages:

Complexity of tax laws and regulations.

Need for expert knowledge and professional assistance.

Continuous monitoring and review of tax planning strategies.

Potential changes in tax laws affecting existing strategies.

Time and effort required for proper documentation and record-keeping.

Frequently Asked Questions (FAQs)

1. Is tax planning legal?

Yes, tax planning is legal as long as it is done in compliance with the tax laws and regulations of your jurisdiction. It involves utilizing legal provisions and strategies to minimize tax liability.

2. Can tax planning reduce my tax liability within the 30 slab?

Yes, tax planning can help reduce your tax liability within the 30 slab by maximizing deductions, exemptions, and credits provided by the tax laws. It allows you to optimize your tax situation while staying compliant.

3. Do I need professional assistance for tax planning?

While tax planning can be done individually, seeking professional assistance from tax consultants, chartered accountants, or financial advisors can provide valuable guidance and ensure the effectiveness of your tax planning strategies.

4. Can I change my tax planning strategies during the financial year?

Yes, tax planning strategies can be adjusted and modified during the financial year to account for changes in income, tax laws, or financial goals. It is important to review your strategies periodically and make necessary adjustments when needed.

5. How can tax planning within the 30 slab benefit small businesses?

Tax planning within the 30 slab can help small businesses optimize their tax structure, reduce their tax liability, and improve their financial stability and growth prospects. It allows businesses to retain more profits and allocate funds towards expansion or other business needs.

Conclusion

In conclusion, tax planning for the 30 slab is a crucial aspect of financial management for individuals and businesses falling within this tax bracket. By implementing effective tax planning strategies, you can minimize your tax liability, increase your savings, and optimize your overall financial situation.

Remember to start tax planning early, seek professional assistance if needed, and stay updated with the latest tax laws and provisions. By making informed decisions and taking advantage of available deductions and exemptions, you can strategically manage your finances and pave the way for a stronger financial future.

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as professional tax advice. Tax laws and regulations may vary depending on your jurisdiction, and it is recommended to consult with a qualified tax professional for personalized guidance.

This post topic: Tax Planning