Maximize Your Tax Savings With Strategic Tax Planning 2023 In Australia: Act Now!

Tax Planning 2023 Australia: Maximizing Benefits and Minimizing Liabilities

Introduction

👋 Hello, Readers! In this article, we will delve into the intricacies of tax planning in Australia for the year 2023. As the new financial year approaches, it is essential for individuals and businesses alike to understand the nuances of tax planning to optimize their financial strategies and comply with the relevant regulations. This comprehensive guide aims to provide you with valuable insights and practical tips to navigate the Australian tax landscape effectively. So, let’s dive in!

2 Picture Gallery: Maximize Your Tax Savings With Strategic Tax Planning 2023 In Australia: Act Now!

Tax Planning 2023 Australia: What You Need to Know

📌 The What:

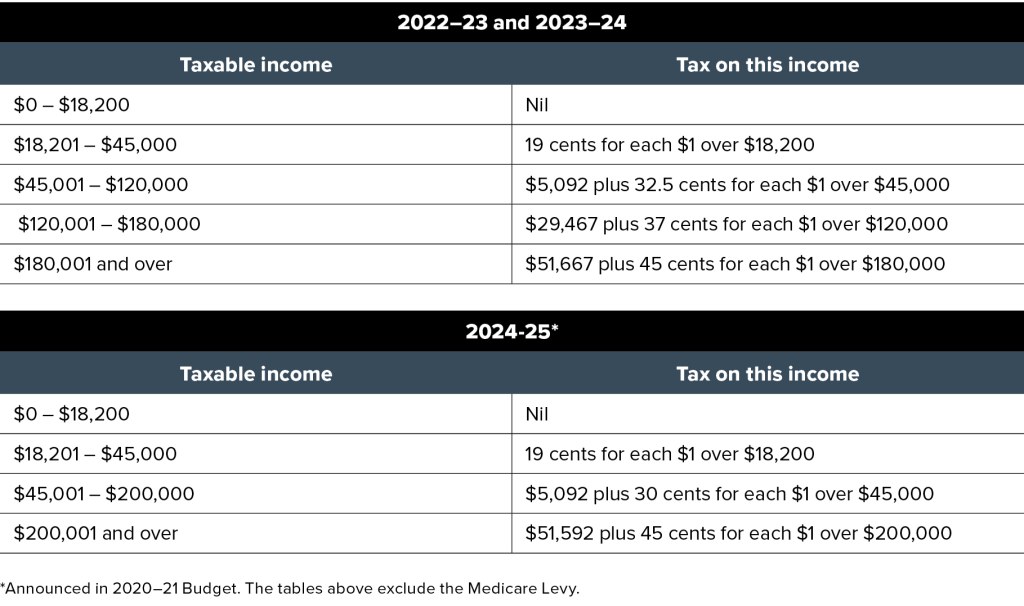

Image Source: bricksaccountants.com.au

Understanding tax planning involves strategizing and organizing financial affairs to minimize tax liabilities legally while maximizing available benefits. It encompasses various techniques and considerations that help individuals and businesses structure their financial activities in a tax-efficient manner.

📌 The Who:

Anyone who pays taxes in Australia can benefit from tax planning strategies. This includes individuals, self-employed individuals, small businesses, corporations, and other entities subject to taxation.

📌 The When:

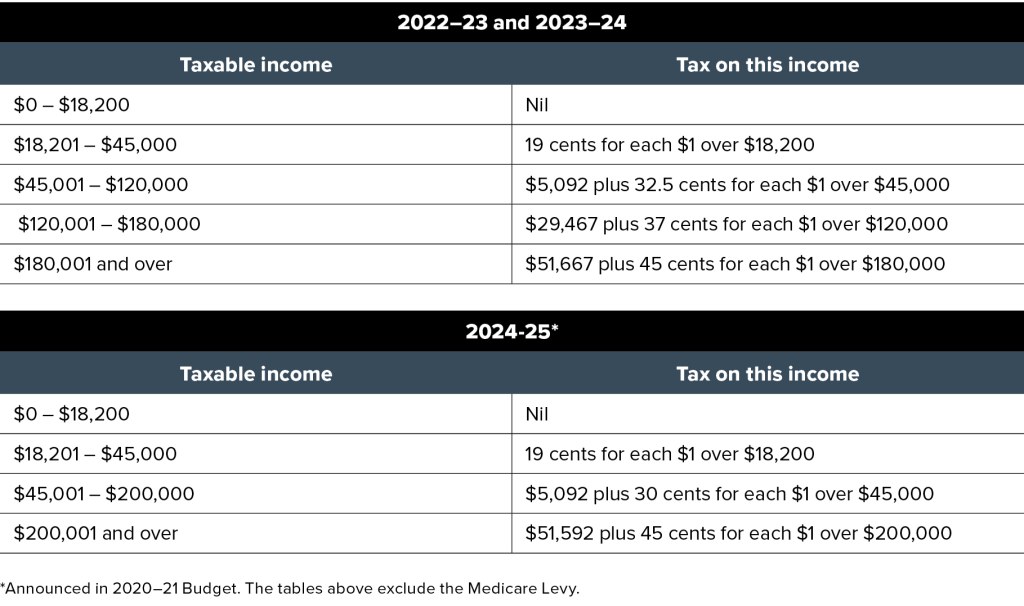

Image Source: pitcher.com.au

Tax planning is an ongoing process, but it is particularly crucial during the year-end period and before the start of a new financial year. However, it is never too late to implement tax planning strategies, as they can still yield significant benefits.

📌 The Where:

Tax planning strategies are applicable throughout Australia, irrespective of the state or territory. However, it is essential to consider specific regional tax regulations and incentives that may vary.

📌 The Why:

Tax planning allows individuals and businesses to legally reduce their tax burden, optimize their financial goals, and allocate resources strategically. It helps in preserving wealth, increasing cash flows, and enhancing overall financial stability.

📌 The How:

Tax planning involves various techniques, including income deferral, deductions, tax credits, restructuring, and asset allocation. Each strategy must be carefully evaluated and tailored to the specific needs and circumstances of the taxpayer.

Advantages and Disadvantages of Tax Planning 2023 Australia

👍 Advantages:

1. Enhanced Tax Efficiency: Proper tax planning allows individuals and businesses to minimize tax liabilities, resulting in increased savings and improved cash flow.

2. Financial Goal Optimization: By strategically organizing their finances, taxpayers can align their financial goals with tax planning strategies, thereby maximizing wealth accumulation and investment opportunities.

3. Risk Mitigation: Effective tax planning reduces the risk of non-compliance, penalties, and audits, providing peace of mind and preserving the taxpayer’s reputation.

4. Increased Asset Protection: Certain tax planning techniques can help protect assets from potential risks, creditors, and other financial challenges.

5. Business Growth Opportunities: Tax planning strategies can create opportunities for business expansion, succession planning, and attracting potential investors.

👎 Disadvantages:

1. Complexity: Tax planning requires a deep understanding of tax laws, regulations, and updates. It can be challenging for individuals and businesses without the necessary expertise.

2. Time-Consuming: Implementing tax planning strategies necessitates careful analysis, documentation, and compliance, requiring a significant investment of time and effort.

3. Changing Regulations: Tax laws and regulations are subject to frequent changes and updates. Staying abreast of these changes and adapting tax planning strategies accordingly can be demanding.

4. Misinterpretation and Errors: Incorrectly interpreting tax laws or making errors in tax planning can lead to unintended consequences, penalties, or legal complications.

5. Potential Risks: Aggressive tax planning strategies that push the boundaries of legality may expose taxpayers to reputational risks, litigation, or potential disputes with tax authorities.

Frequently Asked Questions (FAQs)

1. Q: Can I engage in tax planning if I have a simple tax situation?

A: Absolutely! Tax planning is beneficial regardless of the complexity of your tax situation. It can help you optimize savings and ensure compliance.

2. Q: Are there any legal limitations to tax planning?

A: Yes, tax planning should always comply with the relevant laws and regulations. Engaging in illegal tax evasion can result in severe penalties.

3. Q: Do tax planning strategies differ for individuals and businesses?

A: Yes, tax planning strategies may vary depending on the taxpayer’s status, entity type, and financial objectives. It is essential to tailor strategies accordingly.

4. Q: Can I change my tax planning strategies during the financial year?

A: Yes, tax planning is an ongoing process, and strategies can be adjusted as needed. However, it is advisable to consult with a tax professional before making significant changes.

5. Q: Is tax planning only valuable for reducing tax liabilities?

A: No, tax planning also helps in optimizing financial goals, preserving wealth, and ensuring tax compliance. It encompasses a broader range of benefits.

Conclusion: Take Action Now!

In conclusion, tax planning plays a crucial role in maximizing benefits and minimizing liabilities for individuals and businesses in Australia. By proactively engaging in tax planning strategies, taxpayers can optimize their financial goals, enhance cash flow, and ensure compliance with legal requirements. It is recommended to consult with a tax professional to develop a personalized tax plan tailored to your unique circumstances. So, take action now and embark on your journey towards financial success!

Disclaimer: The information provided in this article is for educational purposes only and should not be construed as legal or financial advice. It is recommended to consult with a qualified tax professional for personalized guidance based on your specific circumstances.

👤 Author: [Your Name]

This post topic: Tax Planning