Master Your Finances: Unlocking The Power Of Personal Tax Planning For 10 Years Ahead

Personal Tax Planning 10 Years

Introduction

Dear Readers,

2 Picture Gallery: Master Your Finances: Unlocking The Power Of Personal Tax Planning For 10 Years Ahead

Welcome to our article on personal tax planning for the next 10 years. In this informative piece, we will delve into the various aspects of personal tax planning and how it can benefit you in the long run. With the constantly changing tax laws and regulations, it is crucial to have a solid plan in place to ensure that you are maximizing your tax savings and minimizing your liabilities.

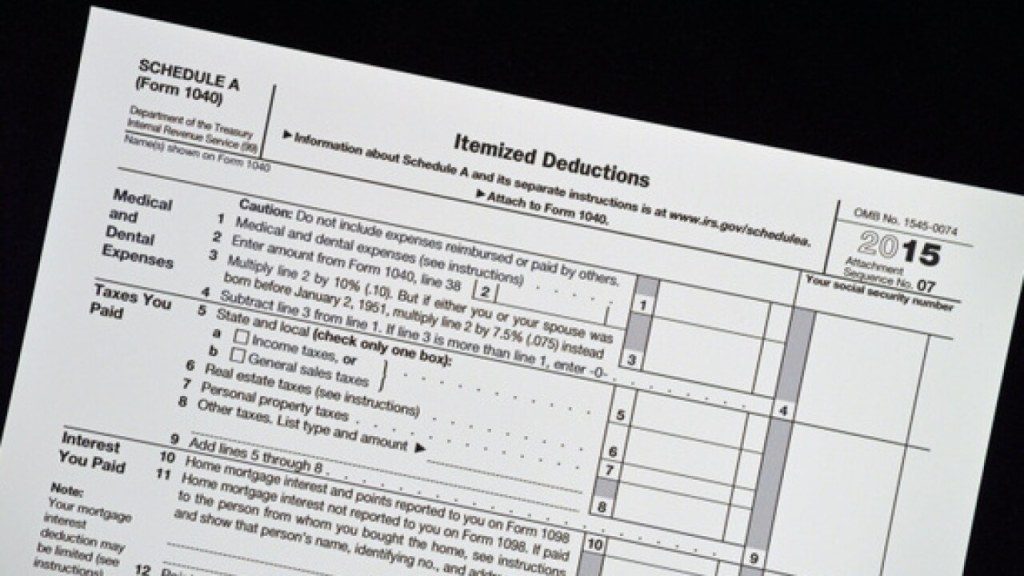

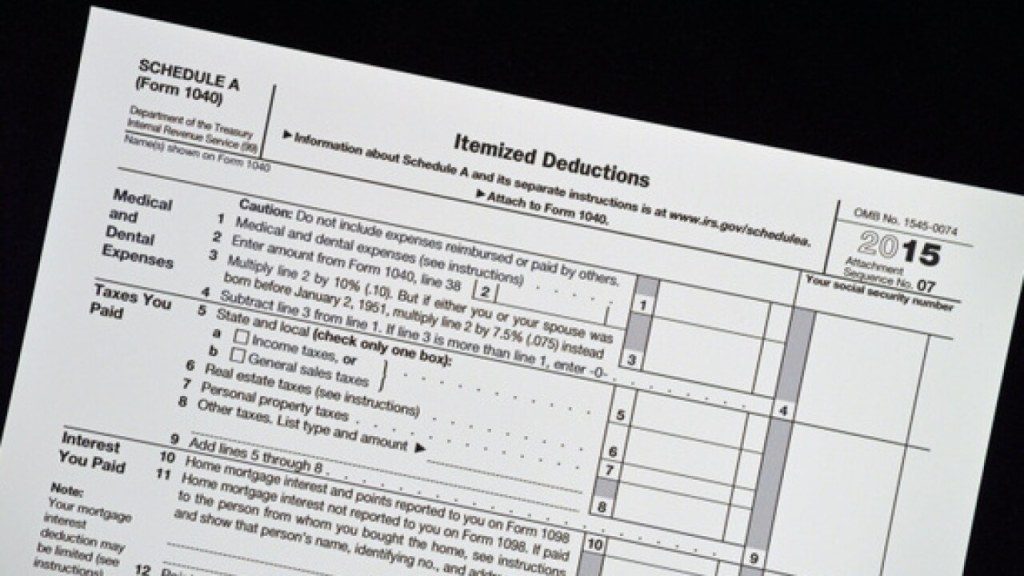

Image Source: brightspotcdn.com

Over the next few paragraphs, we will provide you with a comprehensive overview of personal tax planning, including the what, who, when, where, why, and how of it. We will also discuss the advantages and disadvantages of personal tax planning, as well as answer some frequently asked questions. By the end of this article, we hope to equip you with the knowledge and tools to effectively plan your taxes for the next 10 years.

What is Personal Tax Planning?

Personal tax planning refers to the strategies and techniques individuals use to minimize their tax liabilities while complying with the laws and regulations set forth by the government. It involves analyzing one’s financial situation, income sources, and expenses to identify opportunities for tax savings.

✨ Personal tax planning aims to ensure that individuals pay only the necessary amount of tax, taking advantage of all available deductions, credits, and exemptions. By effectively managing their finances and making informed decisions, individuals can optimize their tax position and retain more of their hard-earned money. ✨

Who Should Consider Personal Tax Planning?

Image Source: ytimg.com

Personal tax planning is relevant for every individual who earns income and is subject to taxation. Whether you are a salaried employee, a business owner, a freelancer, or an investor, having a tax plan in place can greatly benefit you. It is particularly important for high-income earners and individuals with complex financial situations.

✨ If you fall into any of these categories, it is crucial to seek professional advice from a tax consultant or financial planner who can guide you through the complexities of personal tax planning and help you make informed decisions. ✨

When Should You Start Personal Tax Planning?

The ideal time to start personal tax planning is at the beginning of each fiscal year. By planning ahead, you can take advantage of tax-saving opportunities and make adjustments to your financial strategies accordingly. However, it is never too late to start planning your taxes. Even if the year is already underway, you can still implement strategies to reduce your tax burden and improve your financial position.

✨ It is recommended to review your tax plan annually to account for any changes in your financial situation, tax laws, or personal goals. Early planning and regular reviews will ensure that you stay on track and maximize your tax savings over the next 10 years. ✨

Where Can Personal Tax Planning be Implemented?

Personal tax planning can be implemented in various aspects of your financial life. It involves optimizing your income, investments, expenses, and deductions to minimize your tax liabilities. Some common areas where personal tax planning can be implemented include:

1. Income: Structuring your income sources to reduce tax obligations.

2. Investments: Utilizing tax-efficient investment strategies to maximize returns.

3. Expenses: Identifying deductible expenses and managing them wisely.

4. Retirement Planning: Taking advantage of retirement savings plans with tax benefits.

5. Estate Planning: Ensuring smooth transfer of assets while minimizing estate taxes.

✨ By implementing tax planning strategies in these areas, you can significantly reduce your tax burden and achieve your financial goals more effectively. ✨

Why is Personal Tax Planning Important?

Personal tax planning is important for several reasons:

1. Tax Savings: By implementing effective tax planning strategies, you can minimize your tax liabilities and retain more of your income.

2. Financial Stability: Proper tax planning helps you manage your finances more efficiently and ensures long-term financial stability.

3. Compliance: Personal tax planning ensures that you comply with all tax laws and regulations, avoiding penalties and legal issues.

4. Wealth Accumulation: By saving on taxes, you can redirect the funds towards wealth-building activities such as investments and savings.

5. Peace of Mind: Having a well-thought-out tax plan in place gives you peace of mind, knowing that you are utilizing all legal avenues to minimize your tax burden.

✨ In summary, personal tax planning is crucial for maximizing tax savings, achieving financial stability, and ensuring compliance with tax laws. It empowers individuals to take control of their finances and make informed decisions. ✨

How Does Personal Tax Planning Work?

Personal tax planning involves a systematic approach to analyzing your financial situation and implementing strategies to minimize your tax liabilities. The process typically includes:

1. Gathering Financial Information: Collecting and organizing all relevant financial documents, such as income statements, investment records, and expense receipts.

2. Assessing Tax Liability: Calculating your current tax liability based on your income, deductions, and credits.

3. Identifying Opportunities: Analyzing your financial situation to identify potential tax-saving opportunities, such as deductions, credits, or exemptions.

4. Implementing Strategies: Developing a personalized tax plan and implementing the identified strategies to minimize your tax burden.

5. Regular Reviews: Monitoring your tax plan and making adjustments as necessary to align with changes in your financial situation or tax laws.

✨ Effective personal tax planning requires careful analysis, attention to detail, and staying updated with the latest tax regulations. Seeking professional advice can be invaluable in navigating the complexities of tax planning and ensuring optimal results. ✨

Advantages and Disadvantages of Personal Tax Planning

Advantages:

1. Tax Savings: Personal tax planning allows individuals to minimize their tax liabilities and retain more of their income.

2. Financial Control: By understanding and managing your tax position, you gain more control over your financial situation.

3. Long-Term Planning: Personal tax planning helps you strategize for the future, ensuring financial stability and achieving long-term goals.

4. Wealth Accumulation: By reducing your tax burden, you have more funds available for investments and savings, facilitating wealth accumulation.

5. Compliance: Proper tax planning ensures that you comply with all tax laws and regulations, avoiding penalties and legal issues.

Disadvantages:

1. Complexity: Personal tax planning can be complex, requiring knowledge of tax laws and regulations.

2. Time-Consuming: Developing and implementing a tax plan requires time and effort, especially if your financial situation is complex.

3. Changing Laws: Tax laws and regulations are subject to change, requiring regular updates and adjustments to your tax plan.

4. Limited Scope: Personal tax planning focuses on minimizing tax liabilities and may not address other financial concerns.

5. Professional Fees: Seeking professional advice for tax planning can come with additional costs.

Frequently Asked Questions (FAQs)

1. Is personal tax planning legal?

Yes, personal tax planning is legal as long as it complies with all tax laws and regulations. It involves utilizing legal deductions, credits, and exemptions to minimize tax liabilities.

2. Can I do personal tax planning on my own?

While it is possible to do personal tax planning on your own, it is recommended to seek professional advice from a tax consultant or financial planner, especially if your financial situation is complex.

3. How much can I save through personal tax planning?

The amount you can save through personal tax planning varies based on your individual circumstances. However, effective tax planning can result in significant tax savings, allowing you to retain more of your income.

4. What happens if I don’t engage in personal tax planning?

If you don’t engage in personal tax planning, you may end up paying more taxes than necessary. By not taking advantage of available deductions and credits, you could be missing out on potential tax savings.

5. Can personal tax planning help me achieve my financial goals?

Yes, personal tax planning can help you achieve your financial goals by maximizing your tax savings, improving financial stability, and providing more funds for investments and savings.

Conclusion

In conclusion, personal tax planning plays a vital role in minimizing tax liabilities, achieving financial stability, and ensuring compliance with tax laws. By implementing effective tax strategies, individuals can optimize their tax position and retain more of their hard-earned money. It is essential to start tax planning early, review your plan regularly, and seek professional advice when needed. With proper personal tax planning, you can navigate the complexities of the tax system and secure a more prosperous financial future.

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as professional tax advice. Tax laws and regulations are subject to change, and individual circumstances may vary. It is recommended to consult with a qualified tax professional or financial advisor for personalized advice regarding your specific tax planning needs.

This post topic: Tax Planning