Maximize Your Savings With Tax Plan 1: Unlock Hidden Opportunities Now!

Tax Plan 1: A Comprehensive Guide to Understanding the New Tax Scheme

Welcome, Readers!

In this article, we will provide you with a comprehensive overview of Tax Plan 1, a new tax scheme that has recently been implemented. Tax Plan 1 aims to streamline the tax system and introduce several changes to benefit both individuals and businesses. We will delve into the details of this plan, including its objectives, key features, advantages, disadvantages, and frequently asked questions. By the end of this article, you will have a clear understanding of Tax Plan 1 and its implications.

3 Picture Gallery: Maximize Your Savings With Tax Plan 1: Unlock Hidden Opportunities Now!

Table of Contents

Introduction

What is Tax Plan 1?

Who does it apply to?

When was it implemented?

Where is it applicable?

Why was Tax Plan 1 introduced?

How does it work?

Advantages of Tax Plan 1

Disadvantages of Tax Plan 1

Frequently Asked Questions

Conclusion

Final Remarks

Introduction

The introduction of Tax Plan 1 marks a significant change in the tax landscape. This new tax scheme aims to simplify the existing tax system and create a fairer and more efficient framework for individuals and businesses alike. In the following paragraphs, we will explore the key aspects of Tax Plan 1 and its implications for taxpayers.

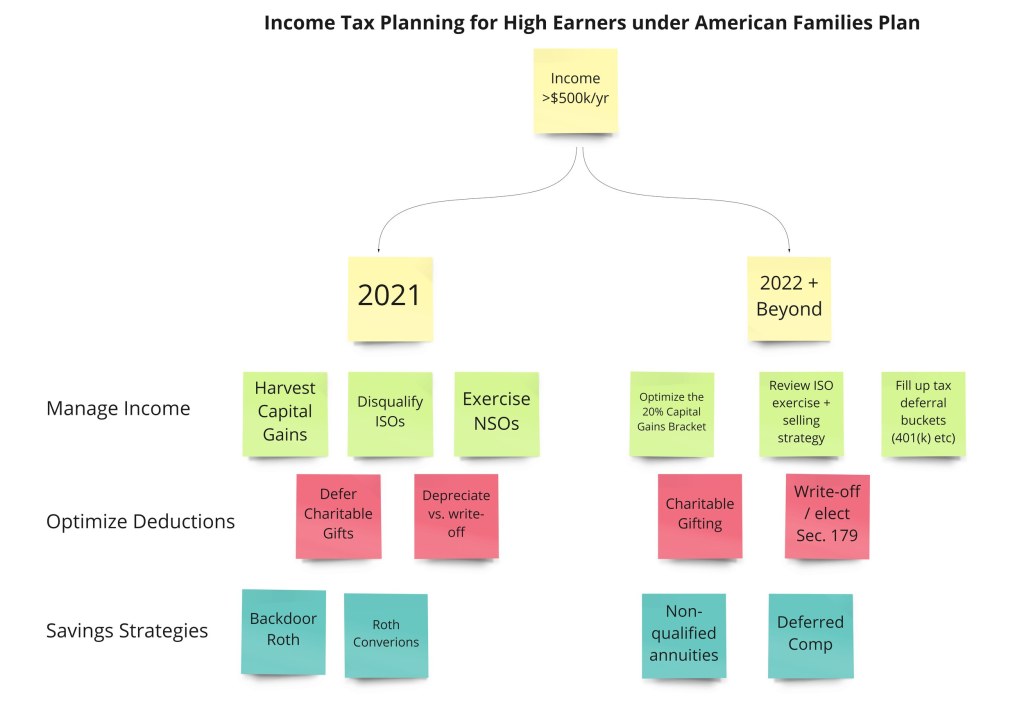

Image Source: squarespace-cdn.com

1. What is Tax Plan 1?

Tax Plan 1 is a comprehensive tax reform initiative that seeks to overhaul the current tax system. It introduces several changes to tax rates, deductions, and exemptions, with the aim of promoting economic growth and reducing tax burdens on individuals and businesses.

2. Who does it apply to?

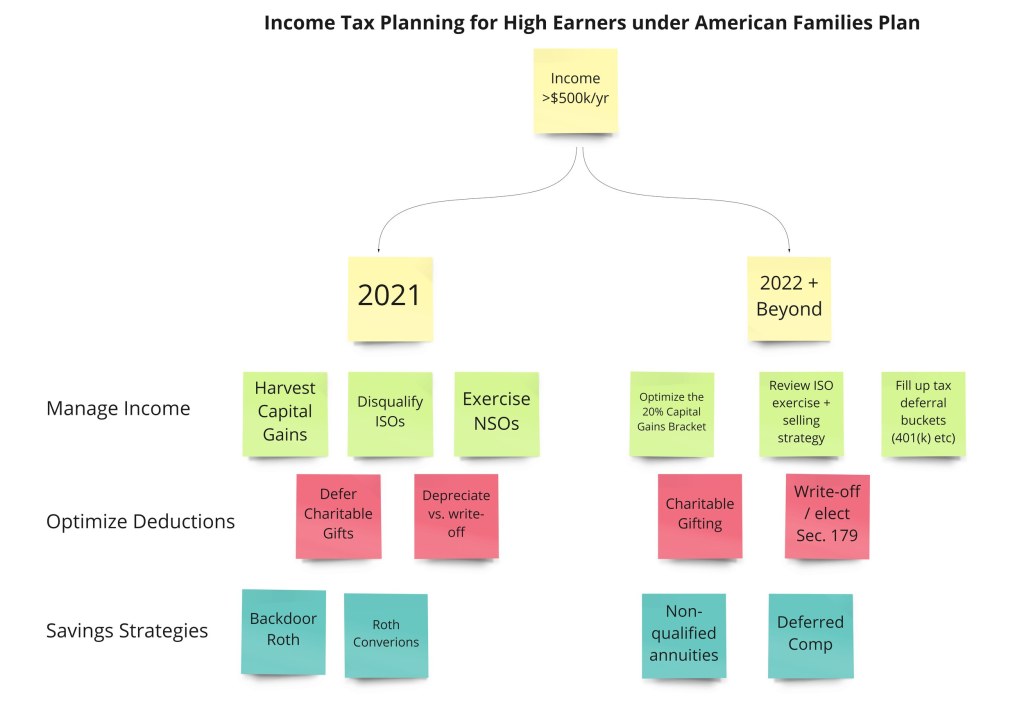

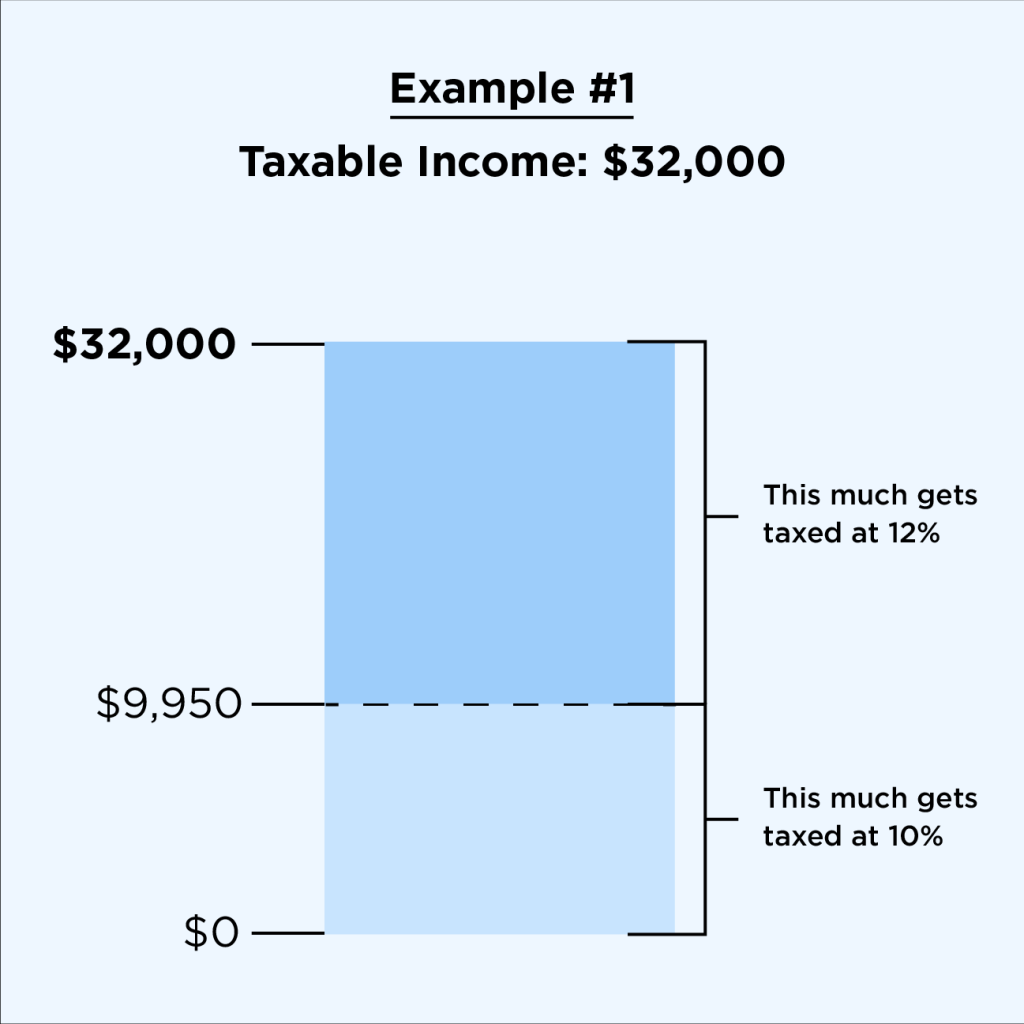

Image Source: nerdwallet.com

Tax Plan 1 applies to all individuals and businesses that are subject to taxation. It encompasses both personal income tax and corporate tax, affecting a wide range of taxpayers across various income brackets.

3. When was it implemented?

Tax Plan 1 was officially implemented on January 1st of this year. The government provided a transition period for taxpayers to familiarize themselves with the new tax rules and make necessary adjustments to their financial planning.

4. Where is it applicable?

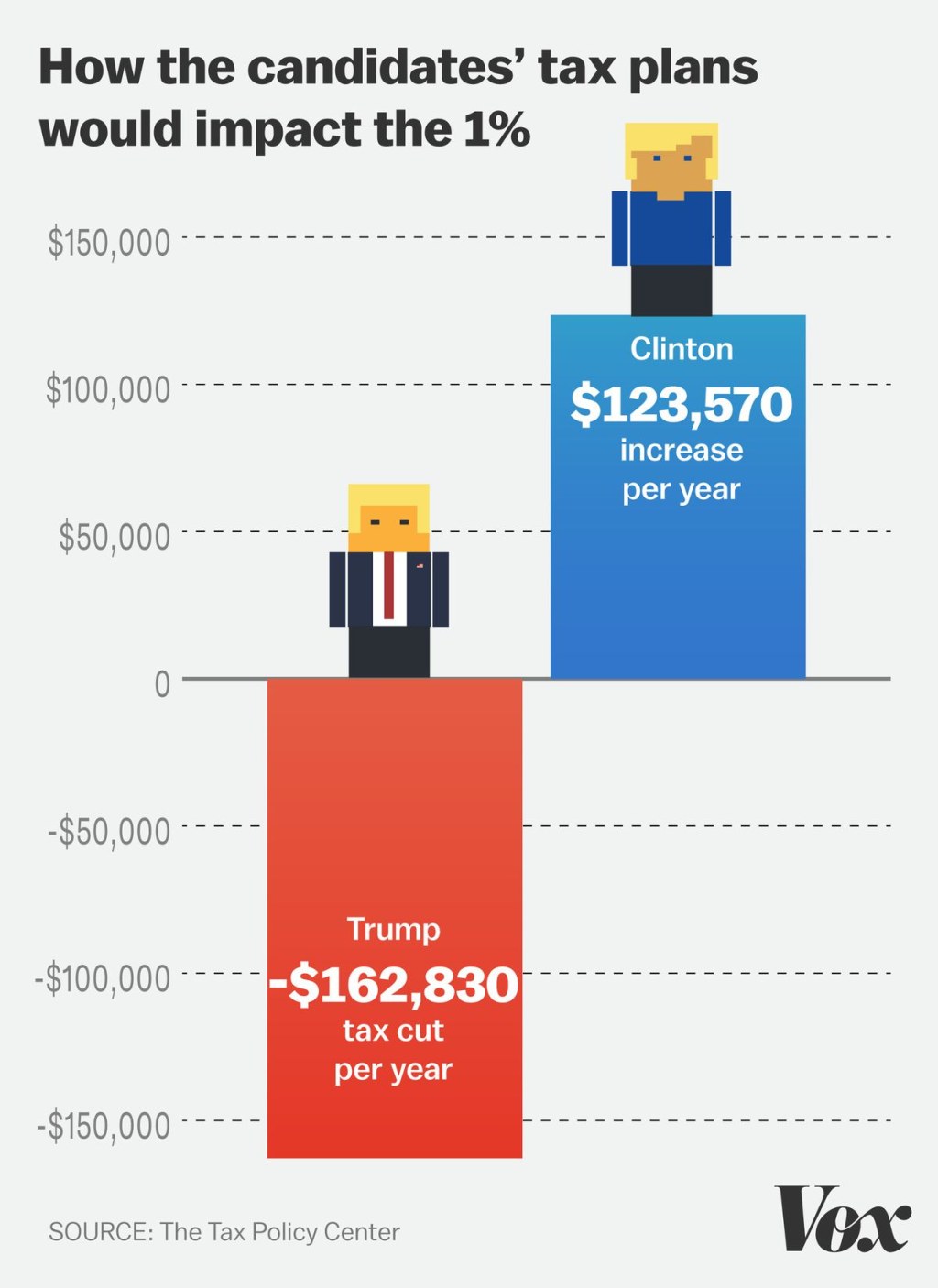

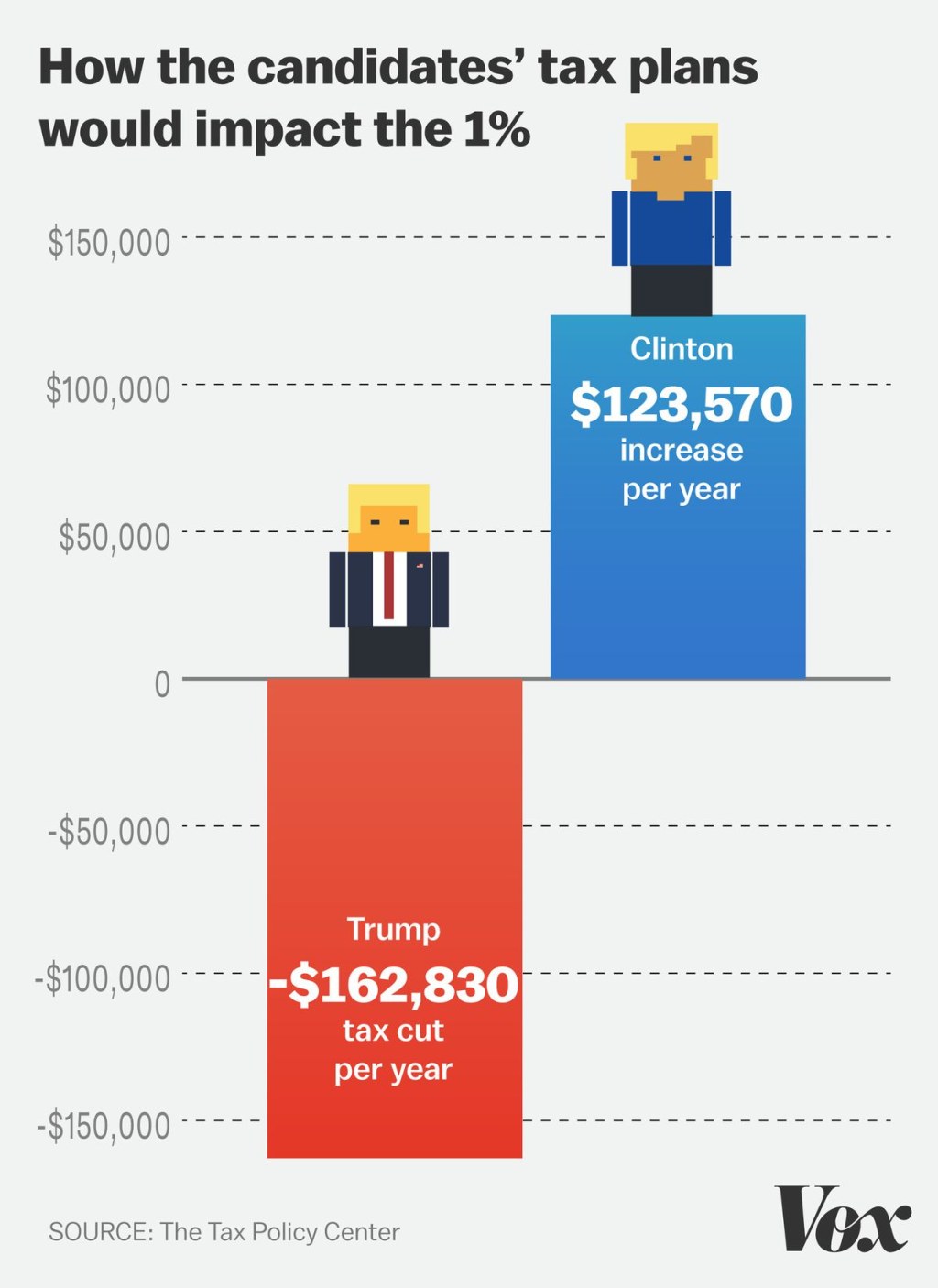

Image Source: vox-cdn.com

Tax Plan 1 is applicable nationwide, covering all regions and jurisdictions within the country. However, certain aspects of the plan may vary depending on regional regulations and specific tax incentives provided by local authorities.

5. Why was Tax Plan 1 introduced?

The introduction of Tax Plan 1 was driven by the need to simplify the tax system and create a more equitable framework. The previous tax regime was deemed complex and burdensome, hindering economic growth and discouraging compliance. Tax Plan 1 aims to address these issues and foster a more conducive environment for businesses.

6. How does it work?

Under Tax Plan 1, tax rates have been adjusted to ensure a fair distribution of tax burdens. Deductions and exemptions have also been revised, providing individuals and businesses with more opportunities to reduce their taxable income. The plan introduces online filing systems and streamlined processes to enhance efficiency and compliance.

Advantages of Tax Plan 1

1. Increased simplicity: Tax Plan 1 simplifies the tax system, making it easier for taxpayers to understand and comply with their obligations. This reduces the need for professional assistance and lowers the compliance costs for individuals and small businesses.

2. Lower tax rates: The revised tax rates introduced by Tax Plan 1 result in a lower overall tax burden for many individuals and businesses. This provides them with more disposable income to invest, save, or stimulate economic activity.

3. Enhanced tax incentives: Tax Plan 1 introduces new incentives and deductions to encourage specific activities such as investment in research and development, environmental conservation, and job creation. These incentives aim to boost economic growth and innovation.

4. Improved compliance: With the introduction of online filing systems and simplified processes, Tax Plan 1 streamlines tax compliance procedures. This reduces the likelihood of errors and improves overall compliance rates.

5. Transparency and accountability: Tax Plan 1 increases transparency in the tax system by introducing measures to combat tax evasion and avoidance. This ensures that all taxpayers contribute their fair share and promotes public trust in the tax administration.

Disadvantages of Tax Plan 1

1. Initial adjustment challenges: The implementation of Tax Plan 1 may pose initial challenges for taxpayers as they adapt to the new tax rules and regulations. This may require additional effort and resources to ensure compliance.

2. Impact on certain industries: Tax Plan 1 may have varying effects on different industries, particularly those that were previously benefiting from specific tax concessions. Some sectors may face increased tax liabilities, which could impact their profitability and competitiveness.

3. Limited immediate benefits: While Tax Plan 1 aims to stimulate economic growth in the long run, the immediate benefits for individuals and businesses may be limited. It may take time for the positive effects of the plan to materialize.

4. Increased scrutiny and reporting requirements: With the focus on transparency and accountability, Tax Plan 1 may impose additional reporting requirements on taxpayers. This could increase administrative burdens, particularly for businesses.

5. Possible unintended consequences: As with any major tax reform, Tax Plan 1 may have unintended consequences that were not anticipated during the planning phase. These consequences may emerge over time and require further adjustments to ensure the effectiveness of the plan.

Frequently Asked Questions

1. Can I still claim the same deductions under Tax Plan 1?

Yes, Tax Plan 1 maintains several common deductions. However, certain deductions have been revised or eliminated, so it is essential to familiarize yourself with the updated rules.

2. How do the new tax rates affect my tax liability?

The new tax rates introduced by Tax Plan 1 may result in a lower overall tax liability for many taxpayers. However, the specific impact depends on individual circumstances, such as income level and applicable deductions.

3. Are there any new tax incentives for small businesses?

Yes, Tax Plan 1 introduces new tax incentives specifically designed to support small businesses. These incentives aim to stimulate growth, innovation, and job creation within the small business sector.

4. Will Tax Plan 1 affect my tax refund?

Tax Plan 1 may impact the calculation of your tax refund. Changes in tax rates and deductions could alter the refund amount, so it is advisable to review your tax situation carefully.

5. Where can I find more information about Tax Plan 1?

For more detailed information about Tax Plan 1, you can visit the official government website or consult a tax professional who is well-versed in the new tax scheme.

Conclusion

In conclusion, Tax Plan 1 represents a significant step towards a more efficient and equitable tax system. By simplifying the tax regime, reducing tax burdens, and introducing new incentives, Tax Plan 1 aims to foster economic growth and encourage compliance. While there may be initial challenges and potential disadvantages, the long-term benefits outweigh these concerns. It is crucial for taxpayers to familiarize themselves with the new rules and seek professional advice if necessary to ensure a smooth transition.

Final Remarks

It is important to note that the information provided in this article is for general informational purposes only and should not be considered as professional tax advice. Tax laws and regulations may vary based on your specific circumstances, and it is advisable to consult a qualified tax professional or the relevant tax authorities for personalized guidance. The accuracy and completeness of the information presented in this article are subject to change, as tax laws and regulations are continuously evolving.

This post topic: Tax Planning