Maximize Your Returns With Expert Tax Planning In Income Tax: Unlock Financial Opportunities Today!

Tax Planning in Income Tax

Introduction

Welcome, Readers, to our comprehensive guide on tax planning in income tax. In this article, we will explore the various aspects of tax planning and how it can benefit individuals and businesses alike. Tax planning is a crucial strategy that helps minimize tax liabilities while maximizing savings and investments. By understanding the intricacies of tax planning, you can effectively navigate the complexities of the income tax system and optimize your financial position. Let’s delve into the world of tax planning and discover its significance in today’s tax landscape.

2 Picture Gallery: Maximize Your Returns With Expert Tax Planning In Income Tax: Unlock Financial Opportunities Today!

What is Tax Planning in Income Tax? 🧐

Tax planning in income tax refers to the strategic management of finances to minimize tax liabilities within the legal framework. It involves various techniques and strategies that enable taxpayers to structure their income, deductions, and investments in a manner that results in lower tax obligations. Through careful planning, individuals and businesses can take advantage of deductions, exemptions, credits, and other provisions provided by the tax laws to optimize their tax positions and reduce their overall tax burden.

Who Needs Tax Planning? 🤷♂️

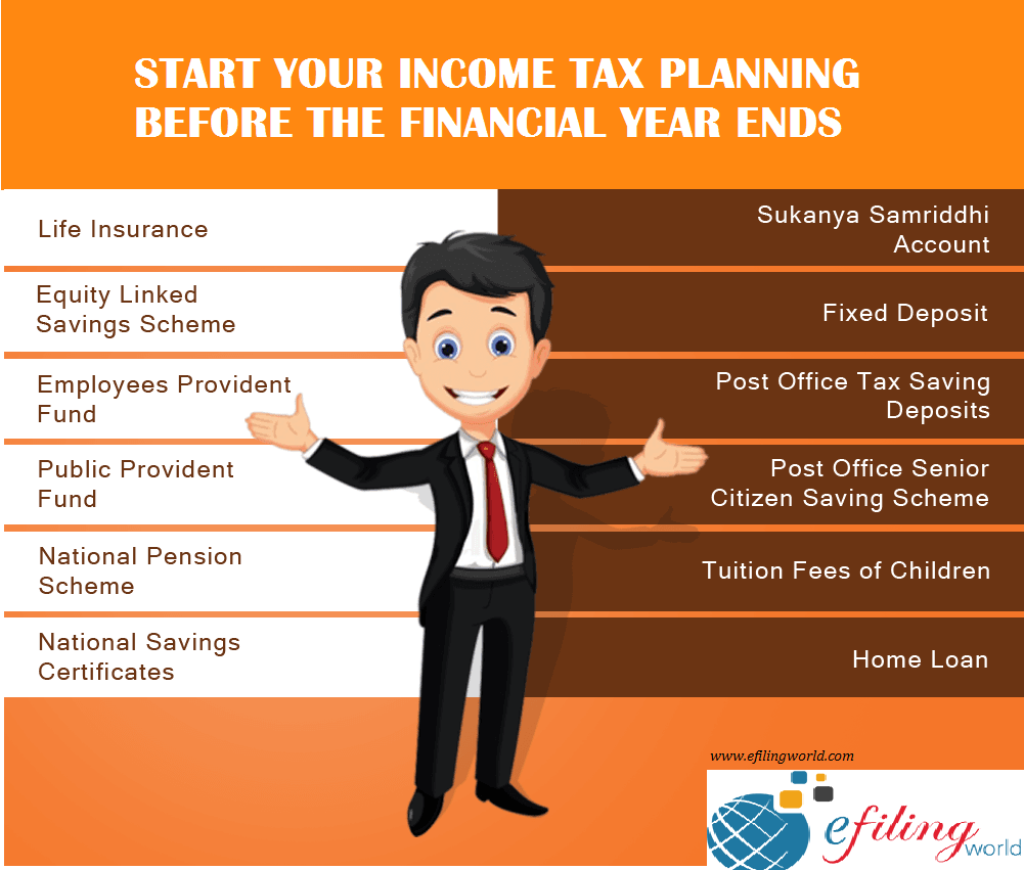

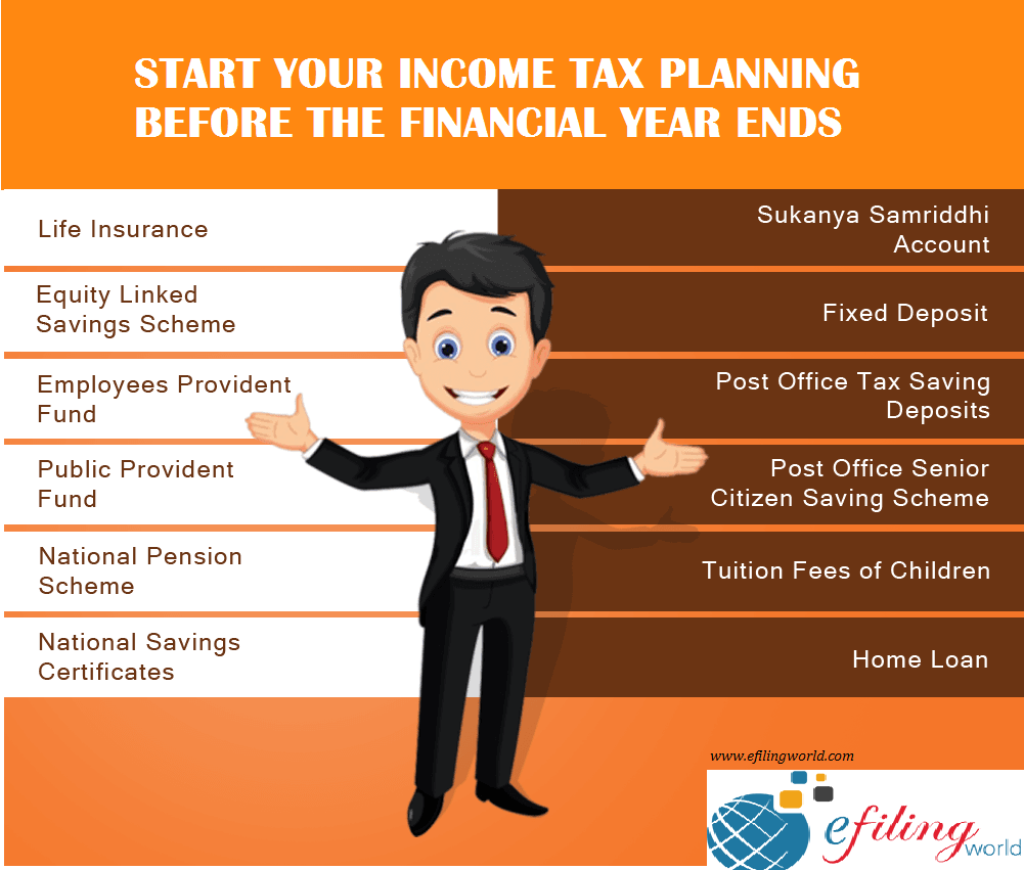

Image Source: efilingworld.com

Tax planning is essential for individuals, salaried employees, self-employed professionals, business owners, and organizations of all sizes. Regardless of your income level, engaging in tax planning can help you maximize your savings and investments while minimizing your tax liabilities. Whether you’re a high-net-worth individual or a small business owner, having a well-thought-out tax planning strategy can make a significant difference in your financial well-being.

When Should You Engage in Tax Planning? ⏰

Tax planning should ideally be an ongoing process throughout the year. However, it becomes especially crucial during key financial events and milestones such as starting a new job, getting married, buying a house, starting a business, or nearing retirement. By proactively planning your taxes and considering the implications of financial decisions, you can optimize your tax position and avoid any last-minute rush during the tax filing season.

Where Can Tax Planning be Implemented? 🌍

Tax planning strategies can be implemented in various areas, including income, investments, deductions, and credits. By carefully structuring your income sources and investments, you can take advantage of favorable tax rates and exemptions. Additionally, identifying and utilizing eligible deductions and credits can further reduce your taxable income. Tax planning can be implemented at both the federal and state levels, considering the specific tax laws and regulations applicable in your jurisdiction.

Why is Tax Planning Important? 🤔

Image Source: media-amazon.com

Tax planning is essential for several reasons. Firstly, it helps individuals and businesses optimize their tax positions, resulting in significant tax savings. Furthermore, it allows taxpayers to comply with relevant tax laws and regulations while minimizing tax disputes and legal issues. Additionally, effective tax planning can provide individuals with more financial stability and resources to pursue their financial goals, such as retirement planning, education savings, or investments in property and assets.

How to Implement Tax Planning? 📝

The process of implementing tax planning involves several steps. Firstly, you need to assess your financial situation, including income sources, investments, and expenses. Next, analyze the tax laws and regulations applicable to your jurisdiction and identify potential deductions, exemptions, and credits that you may be eligible for. It’s crucial to stay updated with changes in tax laws to ensure the effectiveness of your tax planning strategy. Finally, consult with a qualified tax professional or advisor who can provide guidance and help you navigate the complexities of tax planning.

Advantages and Disadvantages of Tax Planning 📊

Advantages of Tax Planning:

Tax savings and reduced tax liabilities.

Increased cash flow and financial flexibility.

Opportunities for wealth accumulation and asset growth.

Effective retirement planning and savings.

Legal compliance and reduced risk of tax disputes.

Disadvantages of Tax Planning:

Complexity and time-consuming nature of tax planning.

Need for in-depth knowledge of tax laws and regulations.

Potential for errors and mistakes if not done correctly.

Dependency on external tax professionals for guidance.

Possibility of changes in tax laws impacting the effectiveness of planning strategies.

Frequently Asked Questions (FAQs) 💡

1. Can tax planning help me reduce my tax liabilities as an individual?

Yes, tax planning can help you identify deductions, exemptions, and credits that can lower your taxable income and reduce your tax liabilities.

2. Is tax planning only for high-income individuals?

No, tax planning is beneficial for individuals across income levels. It can help optimize your tax position regardless of your income bracket.

3. Can tax planning strategies be implemented by businesses?

Absolutely! Tax planning is equally important for businesses, as it can help minimize corporate tax liabilities and optimize cash flow.

4. Is tax planning legal?

Yes, tax planning involves utilizing legal provisions and strategies provided by tax laws to minimize tax obligations. However, it’s crucial to ensure compliance with relevant regulations.

5. Is tax planning a one-time process?

No, tax planning should be an ongoing process, considering changes in your financial situation, tax laws, and regulations.

Conclusion

In conclusion, tax planning in income tax plays a vital role in optimizing tax positions and reducing tax liabilities for individuals and businesses. By engaging in strategic tax planning, taxpayers can take advantage of various deductions, exemptions, and credits to minimize their tax obligations. However, it’s crucial to stay updated with changes in tax laws and consult with qualified professionals for personalized advice. Implementing effective tax planning can result in significant tax savings, increased financial flexibility, and better long-term financial stability. Start planning your taxes today and reap the benefits of a well-structured tax strategy.

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as legal, tax, or financial advice. It’s always recommended to consult with qualified professionals for personalized guidance based on your specific circumstances and jurisdiction. Every individual or business’s tax situation is unique, and tax planning strategies should be tailored accordingly. Remember to stay updated with changes in tax laws and regulations to ensure the effectiveness of your tax planning strategy.

This post topic: Tax Planning