Unveiling The Power Of Tax Planning: Exploring Merits And Demerits For Optimal Financial Growth

Sep

3rd

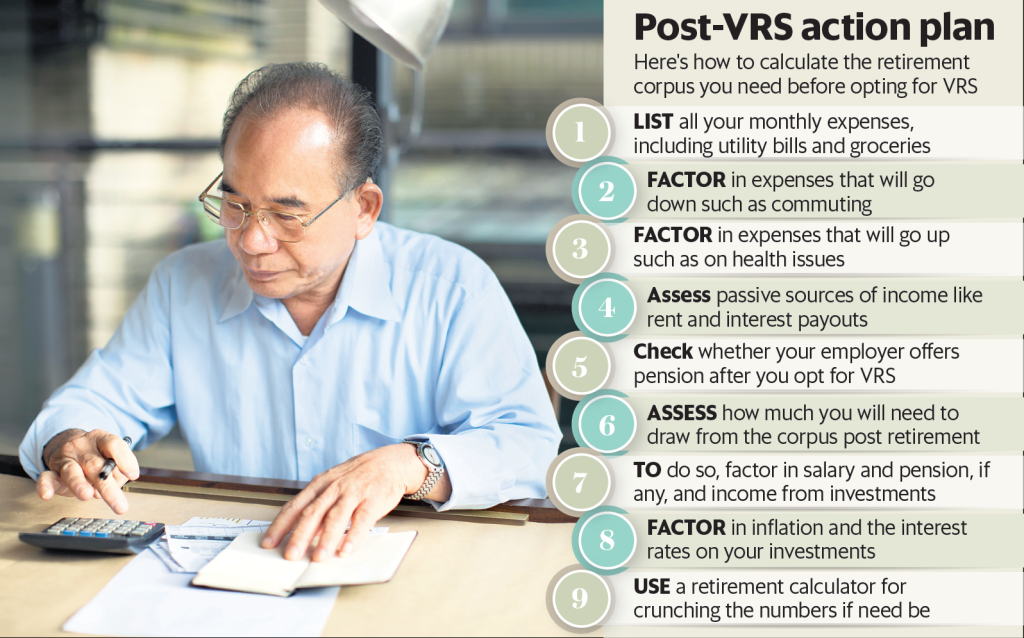

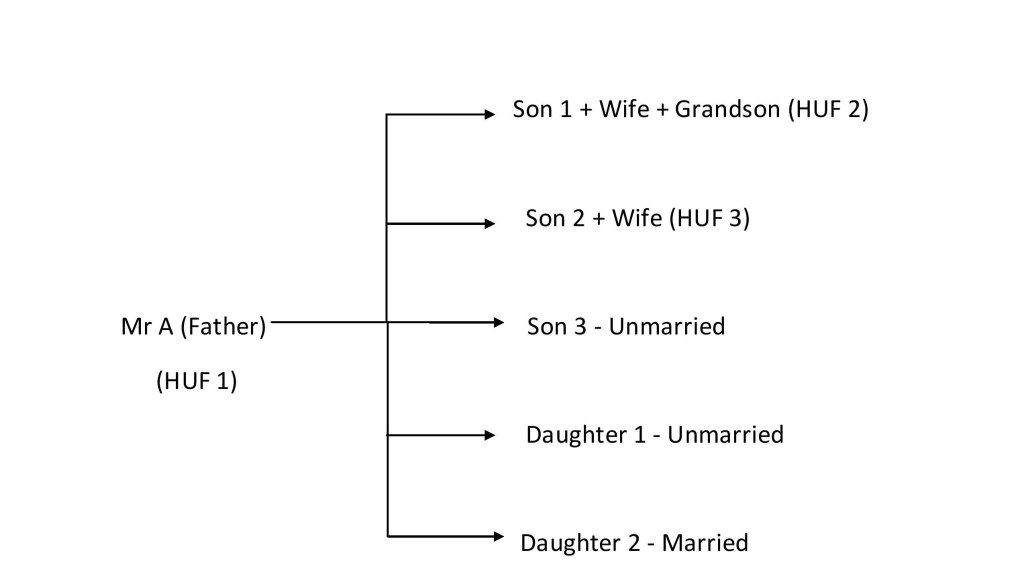

Tax Planning Merits and Demerits Introduction Hello Readers, Welcome to this informative article on tax planning merits and demerits. In today’s complex financial landscape, tax planning plays a crucial role in optimizing financial strategies for individuals and businesses alike. By carefully analyzing and strategizing one’s tax obligations, it is possible to minimize tax liabilities and maximize tax benefits. However, it…