Maximize Your Savings With Expert Tax Planning On VRS – Click For Proven Strategies!

Tax Planning on VRS: An Overview

Introduction

Good day, Readers! Today, we will be diving into the world of tax planning on VRS (Voluntary Retirement Scheme) and exploring its benefits, drawbacks, and everything you need to know about it. Tax planning on VRS is a crucial aspect for individuals and companies alike, as it allows them to optimize their tax liabilities while ensuring compliance with the law. In this article, we will provide you with a comprehensive understanding of tax planning on VRS, its advantages and disadvantages, and answer some common questions that you might have. So, let’s get started!

What is Tax Planning on VRS?

Tax planning on VRS involves the strategic management of tax liabilities in the context of voluntary retirement schemes. VRS refers to a scheme wherein employees choose to retire voluntarily before their actual retirement age. By implementing effective tax planning strategies, individuals and companies can minimize their tax burdens and make the most of the benefits provided by the VRS. Let’s delve deeper into the details.

1 Picture Gallery: Maximize Your Savings With Expert Tax Planning On VRS – Click For Proven Strategies!

The Process of Tax Planning on VRS

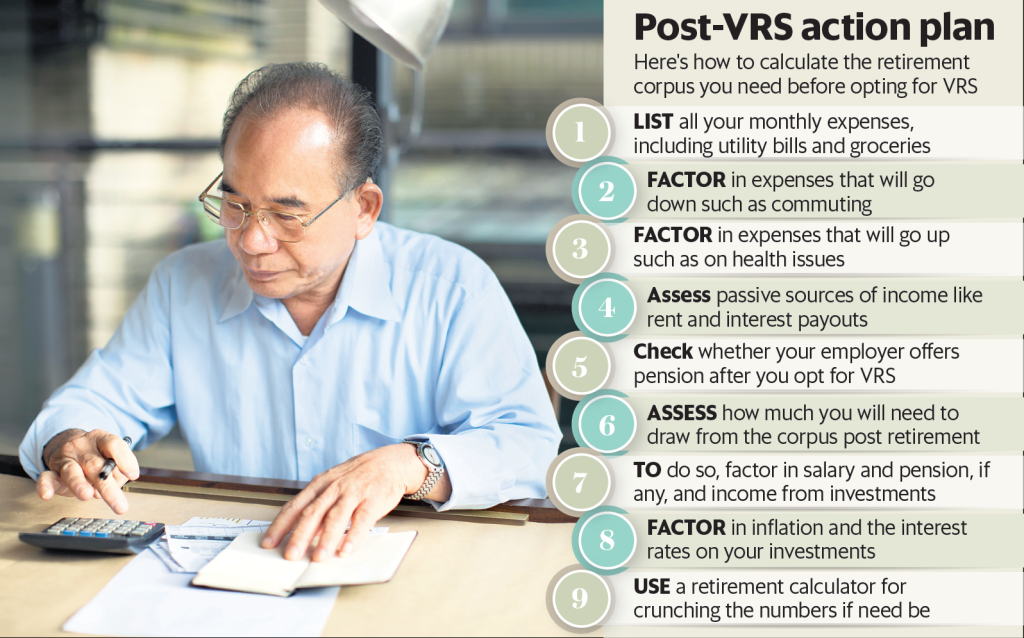

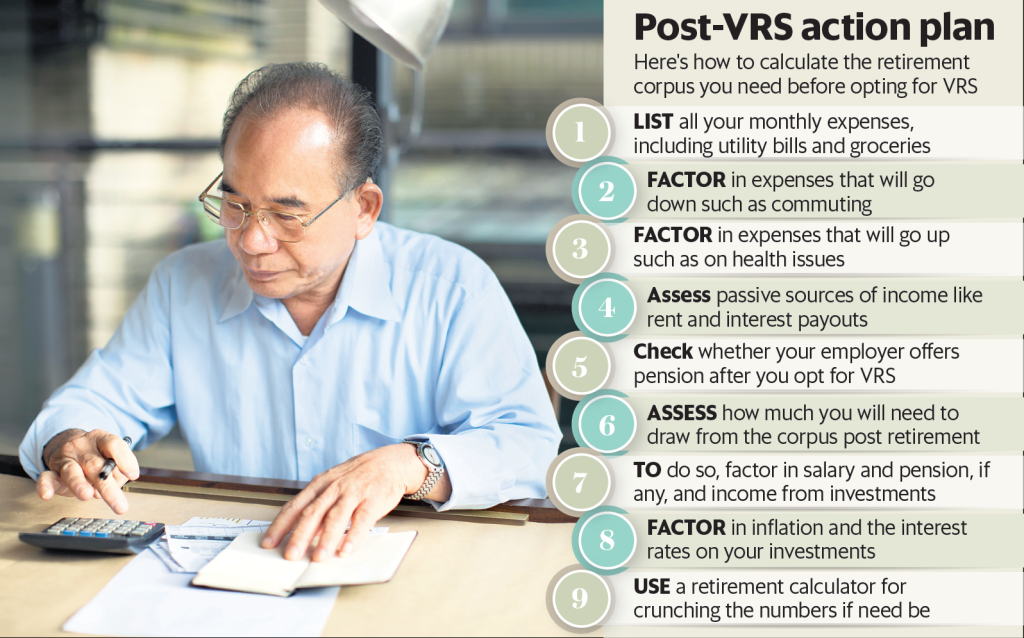

Before we proceed further, let’s understand the step-by-step process involved in tax planning on VRS:

Evaluating the eligibility criteria for VRS

Calculating the tax implications of VRS

Assessing the financial impact of VRS

Identifying tax planning opportunities

Implementing tax-saving strategies

Ensuring compliance with tax laws and regulations

Reviewing and optimizing tax planning strategies on an ongoing basis

Image Source: livemint.com

By following this process, individuals and companies can effectively manage their tax liabilities and maximize the benefits associated with VRS.

Who Can Benefit from Tax Planning on VRS?

Tax planning on VRS is beneficial for both employees and employers. Let’s take a closer look at how each party can benefit:

Employees

1. Tax Savings: By utilizing tax planning strategies, employees can significantly reduce their tax liabilities on the VRS benefits received.

2. Smooth Transition: Effective tax planning can help employees smoothly transition into retirement, ensuring financial stability and security.

3. Financial Flexibility: With reduced taxes, employees have more financial flexibility to invest or utilize their VRS benefits for other purposes.

4. Enhanced Retirement Corpus: By optimizing tax planning, employees can potentially increase their retirement corpus, providing a stronger financial foundation for the future.

5. Compliance with Regulations: Proper tax planning ensures that employees adhere to the tax laws and regulations while availing the benefits of VRS.

Employers

1. Cost Reduction: Effective tax planning allows employers to minimize the tax implications associated with VRS payments, leading to cost savings.

2. Employee Retention: Offering tax-efficient VRS options can incentivize employees to opt for voluntary retirement, facilitating workforce restructuring and cost optimization.

3. Compliance with Regulations: Employers can ensure compliance with tax laws and regulations by implementing proper tax planning strategies on VRS payments.

4. Improved Cash Flow: By optimizing tax planning, employers can manage their cash flow better, as reduced tax liabilities mean lower outflows.

5. Enhanced Reputation: Employers that prioritize tax planning on VRS demonstrate responsible financial management and build a positive reputation among employees and stakeholders.

When is Tax Planning on VRS Required?

Tax planning on VRS is required when individuals or companies opt for voluntary retirement schemes. Whether you are an employee considering VRS or an employer implementing a VRS policy, tax planning should be an integral part of the process. By incorporating tax planning strategies from the beginning, you can optimize your tax liabilities and ensure compliance with the applicable tax laws and regulations.

Where Can Tax Planning on VRS be Implemented?

Tax planning on VRS can be implemented in various jurisdictions where voluntary retirement schemes exist. The availability and specific rules regarding tax planning on VRS may vary from country to country, so it is essential to consult with tax professionals or experts who are well-versed in the tax laws of the respective jurisdiction.

Why Should You Consider Tax Planning on VRS?

There are several reasons why you should consider tax planning on VRS:

1. Tax Savings: Implementing effective tax planning strategies can help you save a significant amount of money by minimizing your tax liabilities on VRS benefits.

2. Financial Security: By optimizing tax planning, you can ensure a more secure financial future, especially during your retirement years.

3. Compliance: Proper tax planning ensures that you adhere to the tax laws and regulations while availing the benefits of VRS.

4. Efficient Resource Allocation: By minimizing tax burdens, you can allocate your resources more efficiently, whether it be for personal investments or business ventures.

5. Peace of Mind: Knowing that you have optimized your tax liabilities through proper planning provides peace of mind and financial stability.

How Can You Implement Tax Planning on VRS?

To implement tax planning on VRS effectively, consider the following strategies:

1. Seek Professional Guidance: Consult with experienced tax professionals who can provide expert advice tailored to your specific circumstances.

2. Understand the Tax Laws: Familiarize yourself with the tax laws and regulations related to VRS in your jurisdiction to ensure compliance.

3. Evaluate Tax-saving Options: Identify tax-saving options available to you, such as exemptions, deductions, or other incentives provided by the tax authorities.

4. Plan Ahead: Start tax planning on VRS well in advance to have sufficient time to analyze your options and make informed decisions.

5. Review Regularly: Keep track of any changes in tax laws or regulations that may impact your tax planning strategies and adjust them accordingly.

Advantages and Disadvantages of Tax Planning on VRS

Advantages of Tax Planning on VRS

1. Tax Savings: Effective tax planning can result in substantial tax savings on VRS benefits, providing individuals and companies with more financial flexibility.

2. Financial Security: By optimizing tax planning, individuals can ensure a more secure financial future during their retirement years.

3. Compliance: Proper tax planning ensures adherence to tax laws and regulations, avoiding any legal or financial implications.

4. Resource Optimization: Minimizing tax liabilities allows individuals and companies to allocate their resources more efficiently, leading to improved financial management.

5. Peace of Mind: Knowing that your tax liabilities are optimized provides peace of mind and reduces financial stress.

Disadvantages of Tax Planning on VRS

1. Complex Process: Tax planning on VRS involves intricate calculations and analysis, requiring knowledge of tax laws and regulations.

2. Time-consuming: Proper tax planning requires time and effort to evaluate various tax-saving options and implement effective strategies.

3. Changing Laws: Tax laws and regulations can change over time, necessitating continuous monitoring and adjustment of tax planning strategies.

4. Professional Fees: Seeking professional advice for tax planning may incur additional costs, which should be considered when assessing the overall benefits.

5. Regulatory Risks: Inaccurate or improper tax planning can lead to legal and financial risks, including penalties and reputational damage.

Frequently Asked Questions (FAQs)

1. Can tax planning on VRS completely eliminate tax liabilities?

No, tax planning on VRS aims to minimize tax liabilities within the legal framework. It cannot completely eliminate tax obligations.

2. Is tax planning on VRS only applicable to employees?

No, tax planning on VRS is relevant for both employees and employers, as it allows them to optimize their tax liabilities and make informed decisions.

3. Are there any specific documents required for tax planning on VRS?

The specific documents required for tax planning on VRS may vary depending on the jurisdiction and the nature of the voluntary retirement scheme. It is advisable to consult with tax professionals for a comprehensive list of required documents.

4. Can tax planning on VRS be implemented retroactively?

In most cases, tax planning on VRS should be implemented proactively, before the retirement scheme is initiated. Retroactive implementation may limit the available options and result in missed opportunities for tax optimization.

5. Is tax planning on VRS a one-time exercise?

No, tax planning on VRS should be an ongoing process, especially considering the dynamic nature of tax laws and regulations. Regular review and adjustment of tax planning strategies are essential to ensure continued compliance and optimization.

Conclusion

In conclusion, tax planning on VRS is a crucial aspect that individuals and companies should consider when opting for voluntary retirement schemes. By implementing effective tax planning strategies, one can minimize tax liabilities, ensure compliance with regulations, and optimize financial resources. However, tax planning on VRS requires careful consideration, professional guidance, and ongoing review to adapt to changing tax laws. So, whether you are an employee or an employer, make sure to incorporate tax planning into your VRS journey for a smoother transition and financial stability.

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute legal, financial, or tax advice. Readers are advised to consult with qualified professionals for personalized advice tailored to their specific circumstances.

This post topic: Tax Planning