Maximize Your Savings With The Taxation 529 Plan: Secure Your Future Today!

Taxation 529 Plan

Introduction

Greetings, Readers! Today, we will delve into the world of taxation 529 plans. In this article, we aim to provide you with a comprehensive understanding of what a taxation 529 plan is, who can benefit from it, when and where it can be utilized, why it is important, and how it works. So, let’s get started!

3 Picture Gallery: Maximize Your Savings With The Taxation 529 Plan: Secure Your Future Today!

What is a Taxation 529 Plan?

🔍 A taxation 529 plan, also known as a qualified tuition program, is a tax-advantaged savings plan designed to encourage individuals and families to save for future education expenses. These plans are sponsored by states, state agencies, or educational institutions, and they offer various investment options to help grow the funds over time.

Explanation:

Image Source: districtcapitalmanagement.com

A taxation 529 plan allows you to save and invest money for educational purposes, such as college tuition, fees, and other qualified expenses. The funds held in these plans can grow tax-free, and when used for qualified expenses, they can be withdrawn without incurring federal taxes.

Who Can Benefit from a Taxation 529 Plan?

🔍 Taxation 529 plans can benefit a wide range of individuals, including parents, grandparents, and anyone interested in saving for education expenses. These plans are especially advantageous for those who have children or grandchildren planning to pursue higher education in the future. However, it’s important to note that anyone can contribute to a taxation 529 plan, regardless of their relationship to the beneficiary.

Explanation:

Taxation 529 plans provide flexibility and accessibility to individuals who want to save for education expenses. Whether you are a parent looking to secure your child’s future, a grandparent wishing to support your grandchild’s education, or even a student saving for your own education, a taxation 529 plan can be a valuable tool for achieving your goals.

When Can You Utilize a Taxation 529 Plan?

Image Source: investopedia.com

🔍 A taxation 529 plan can be utilized at any time when education expenses arise. This includes expenses related to K-12 education, college tuition, fees, books, supplies, and even certain room and board costs. It’s important to familiarize yourself with the specific rules and regulations of the plan you choose, as they may vary.

Explanation:

By starting a taxation 529 plan early, you can take advantage of compound interest and help maximize your savings. Additionally, having a taxation 529 plan in place allows you to be better prepared when educational expenses arise, ensuring that you can provide the necessary funds without jeopardizing your financial stability.

Where Can You Establish a Taxation 529 Plan?

Image Source: googleusercontent.com

🔍 Taxation 529 plans are established and sponsored by individual states, state agencies, or educational institutions. Each state has its own plan, and you are not limited to choosing the plan offered by the state you reside in. You have the freedom to select any plan that best suits your needs, regardless of your residency.

Explanation:

Choosing the right state-sponsored plan requires careful consideration. Factors such as investment options, fees, tax advantages, and state-specific benefits should be taken into account. It’s recommended to research and compare different plans before making a decision to ensure that you choose the most suitable option for your circumstances.

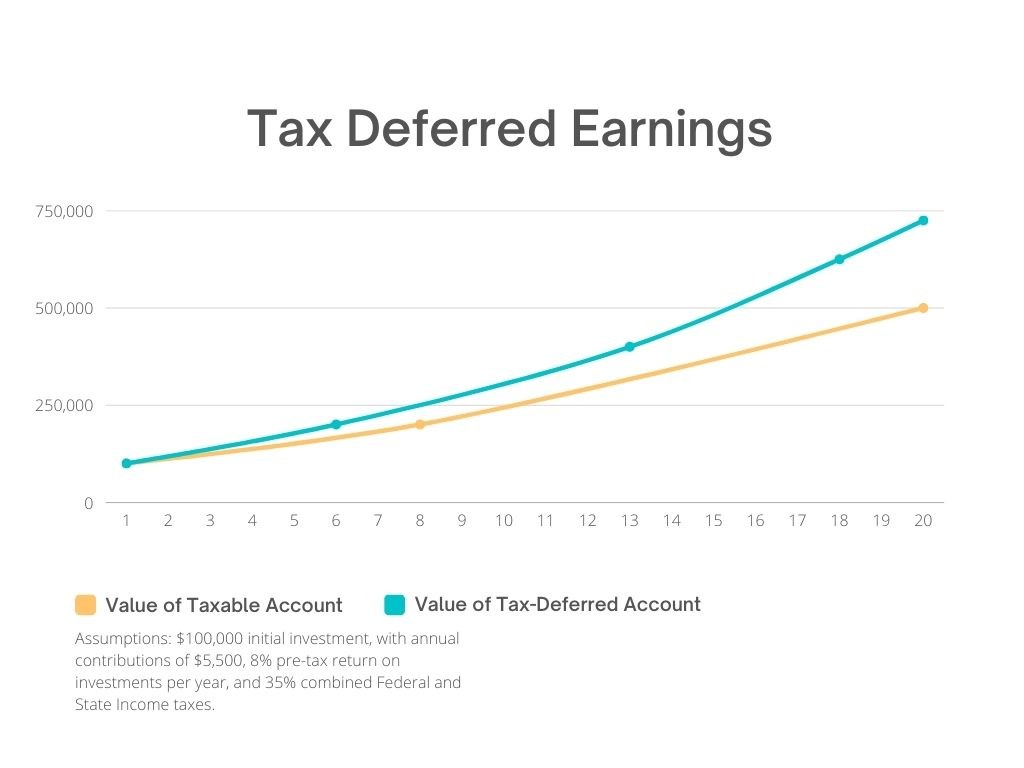

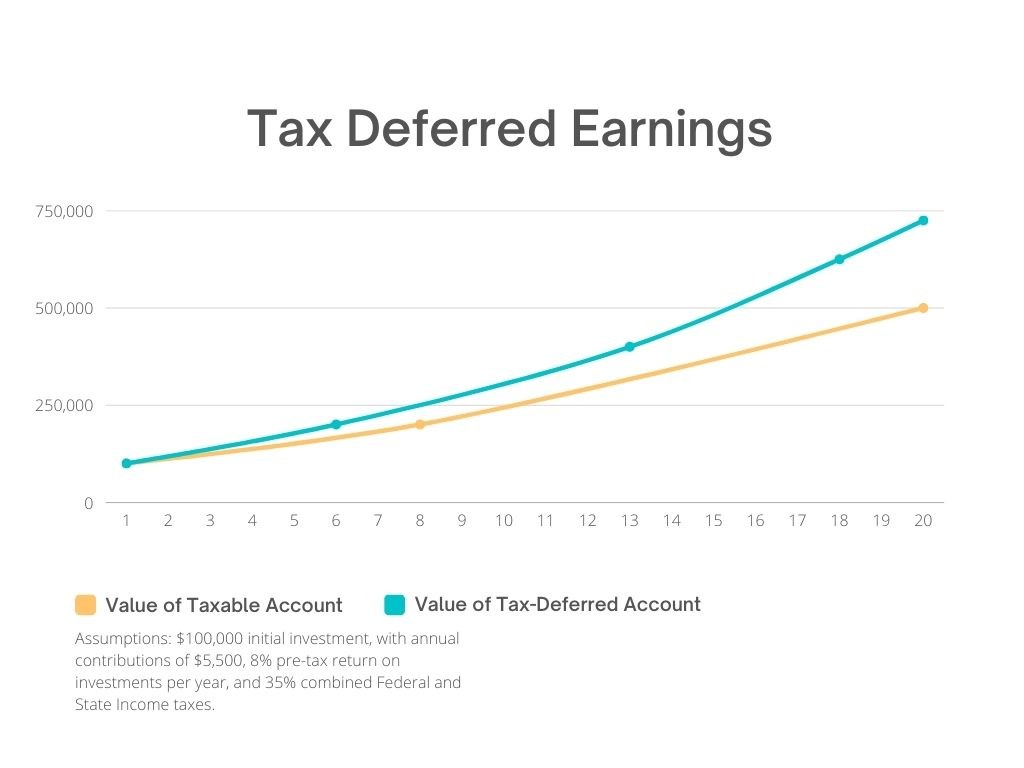

Why is a Taxation 529 Plan Important?

🔍 A taxation 529 plan plays a crucial role in easing the financial burden of education expenses and making higher education more accessible to individuals and families. It offers tax advantages, encourages long-term savings, and provides a dedicated fund specifically for education purposes.

Explanation:

Education is a significant investment, and having a taxation 529 plan enables you to save and grow the necessary funds efficiently. By taking advantage of the tax benefits and carefully planning for education expenses, you can better secure your financial future and ensure that you or your loved ones have the means to pursue higher education without excessive financial strain.

How Does a Taxation 529 Plan Work?

🔍 A taxation 529 plan operates similarly to a savings account. You contribute funds to the plan, and these funds are then invested based on your chosen investment options. Over time, the funds have the potential to grow, and when it is time to pay for qualified education expenses, you can withdraw the funds without incurring federal taxes.

Explanation:

When you open a taxation 529 plan, you will need to select an investment option based on your risk tolerance and financial goals. These options can range from conservative to aggressive, allowing you to align your investments with your preferences. The earnings from your investments grow tax-free, and when you withdraw the funds for qualified expenses, they are exempt from federal taxes.

Advantages and Disadvantages of a Taxation 529 Plan

🔍 Like any financial tool, taxation 529 plans have their advantages and disadvantages. Here are some key points to consider:

Advantages:

1. 🔍 Tax Benefits: Earnings grow tax-free, and withdrawals for qualified expenses are tax-free at the federal level. Some states also offer additional tax incentives.

2. 🔍 Flexibility: Funds can be used for various education expenses, including K-12 and college expenses.

3. 🔍 Potential for Growth: By investing the funds, you have the opportunity to potentially grow your savings over time.

4. 🔍 Accessibility: Taxation 529 plans are widely accessible, and anyone can contribute, regardless of their relationship to the beneficiary.

5. 🔍 Contribution Limits: Most plans have high contribution limits, allowing you to save a significant amount for education expenses.

Disadvantages:

1. 🔍 Limited Investment Options: Some plans have limited investment options, which may not align with your preferences or financial goals.

2. 🔍 Potential Penalties: If the funds are not used for qualified expenses, withdrawals may be subject to taxes and penalties.

3. 🔍 Impact on Financial Aid: The funds held in a taxation 529 plan may affect the beneficiary’s eligibility for need-based financial aid.

4. 🔍 State-Specific Benefits: Each state’s plan offers different benefits, and choosing the right plan requires careful consideration.

5. 🔍 Restrictions on Fund Usage: Funds can only be used for qualified education expenses, and using them for other purposes may result in penalties.

Frequently Asked Questions (FAQ)

1. 🔍 Q: Can I use a taxation 529 plan for expenses other than tuition and fees?

A: Yes, taxation 529 plans can cover various education-related expenses, including books, supplies, and even certain room and board costs.

2. 🔍 Q: Can I change the beneficiary of a taxation 529 plan?

A: Yes, you can change the beneficiary of a taxation 529 plan to another eligible family member without incurring taxes or penalties.

3. 🔍 Q: What happens if my child does not pursue higher education?

A: If the original beneficiary does not use the funds for qualified expenses, you can change the beneficiary to another eligible family member or withdraw the funds, subject to taxes and penalties.

4. 🔍 Q: Can I have multiple taxation 529 plans?

A: Yes, you can have multiple taxation 529 plans, but it’s important to consider the contribution limits and potential impact on financial aid eligibility.

5. 🔍 Q: Can I use a taxation 529 plan from one state in another state?

A: Yes, you can use a taxation 529 plan from one state to pay for education expenses in another state without any restrictions.

Conclusion

In conclusion, taxation 529 plans provide individuals and families with an effective means of saving and investing for education expenses. By taking advantage of the tax benefits, flexibility, and growth potential offered by these plans, you can better prepare for future educational needs. Remember to carefully research and compare different plans to choose the one that best suits your financial goals and circumstances. Start planning today and secure a brighter future for yourself or your loved ones!

Final Remarks

🔍 Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial or tax advice. It is always recommended to consult with a qualified financial advisor or tax professional to determine the best course of action for your specific situation. Additionally, tax laws and regulations may vary, so it’s essential to stay informed about the latest updates and changes in your jurisdiction.

This post topic: Tax Planning