Maximize Your Savings With The 2023 Tax Planning Calculator: Start Planning Today!

Tax Planning Calculator 2023: Maximizing Savings and Minimizing Liabilities

Welcome, Readers! In today’s article, we will delve into the world of tax planning and introduce you to an invaluable tool for the year 2023 – the Tax Planning Calculator. Designed to simplify the complex process of tax planning, this calculator provides individuals and businesses with an efficient way to optimize their financial strategies while remaining compliant with the tax laws. Let’s explore the features and benefits of this powerful tool that can help you make informed financial decisions.

Introduction

Tax planning is an essential aspect of financial management. It involves analyzing your income, expenses, and investments to strategically minimize your tax liabilities. By taking advantage of available deductions, exemptions, and credits, taxpayers can significantly reduce the amount of taxes they owe. However, navigating the intricate landscape of tax laws and regulations can be overwhelming. That’s where the Tax Planning Calculator steps in.

3 Picture Gallery: Maximize Your Savings With The 2023 Tax Planning Calculator: Start Planning Today!

Designed specifically for the year 2023, this calculator incorporates the latest tax laws and rates to provide accurate calculations and projections. It empowers individuals and businesses to make informed decisions by simulating different scenarios and identifying the most tax-efficient strategies.

Now, let’s take a closer look at the key aspects of the Tax Planning Calculator 2023:

What is the Tax Planning Calculator?

The Tax Planning Calculator is a user-friendly online tool that allows individuals and businesses to determine their tax liabilities and optimize their financial planning. It takes into account various factors such as income, deductions, exemptions, and credits to provide accurate calculations and projections.

How does it work?

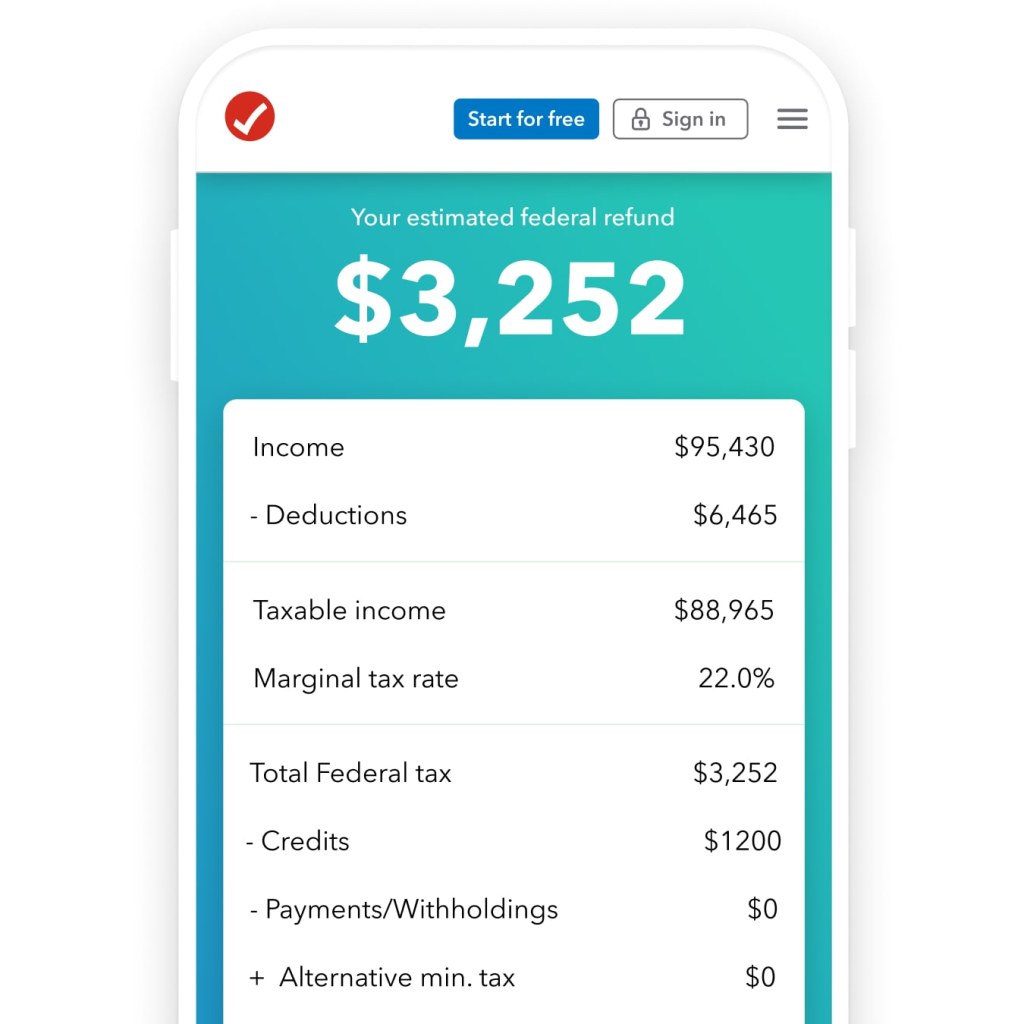

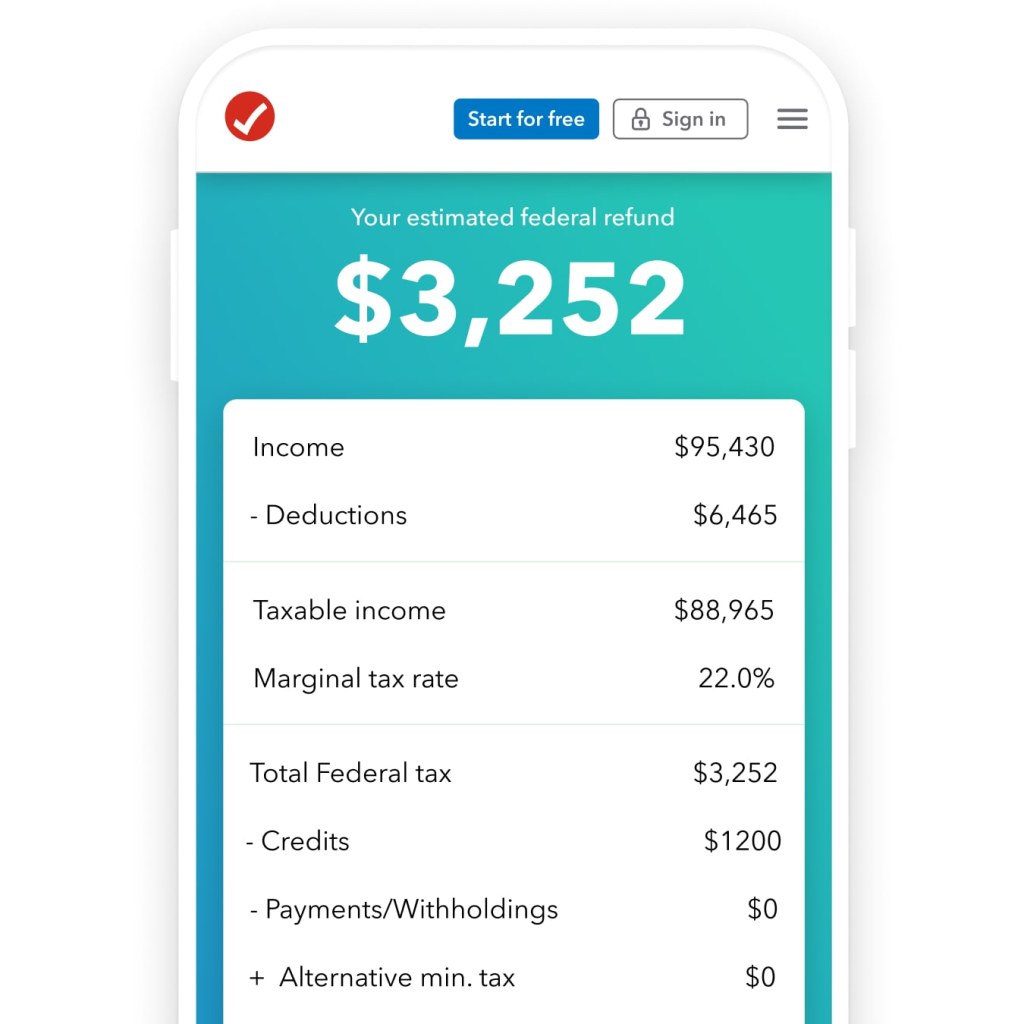

Image Source: intuit.com

The calculator prompts users to input their financial information, including income from various sources, deductible expenses, and eligible tax credits. Using this data, the calculator applies the relevant tax rules and rates to provide an estimate of the tax liabilities for the year 2023. Users can experiment with different scenarios, such as increasing retirement contributions or exploring tax-efficient investments, to observe the impact on their overall tax burden.

Who can benefit from it?

The Tax Planning Calculator is beneficial for individuals and businesses of all sizes. Whether you are a salaried employee, a self-employed professional, or a business owner, this tool can help you optimize your tax planning strategies. By understanding the potential tax implications of various financial decisions, you can make informed choices that align with your long-term financial goals.

When should you use it?

It is recommended to use the Tax Planning Calculator at the beginning of the year or whenever significant financial changes occur. By proactively planning your taxes, you can ensure that you are taking advantage of all available deductions and credits. Regularly reviewing your financial situation and adjusting your tax strategies accordingly can help you maximize savings and minimize liabilities.

Where can you access it?

The Tax Planning Calculator is easily accessible online, allowing users to conveniently perform tax calculations from the comfort of their homes or offices. Various reputable financial websites and tax agencies offer this tool for free, ensuring widespread accessibility and usability.

Why is it essential for your financial planning?

Integrating tax planning into your overall financial strategy is crucial for several reasons. Firstly, it helps you minimize your tax liabilities, freeing up funds that can be utilized for other purposes such as investments or debt reduction. Secondly, it enables you to take advantage of available tax incentives and credits, maximizing your overall savings. Lastly, staying updated with the latest tax laws and regulations through the Tax Planning Calculator ensures compliance and mitigates the risk of penalties or audits.

How can it simplify your tax planning process?

Image Source: i0.wp.com

The Tax Planning Calculator simplifies the tax planning process by automating complex calculations and providing real-time projections. It eliminates the need for manual computations and minimizes the chances of errors. Additionally, it allows users to compare different scenarios and instantly assess the impact of various financial decisions on their tax liabilities. This empowers individuals and businesses to make informed choices and optimize their tax planning strategies.

Advantages and Disadvantages of the Tax Planning Calculator 2023

Like any tool or technology, the Tax Planning Calculator comes with its own set of advantages and disadvantages. Let’s explore both sides of the coin:

Advantages of the Tax Planning Calculator 2023

1. Accuracy: The calculator utilizes the latest tax laws and rates, ensuring accurate calculations and projections.

2. Time-saving: By automating complex calculations, the calculator eliminates the need for manual computations, saving time and effort.

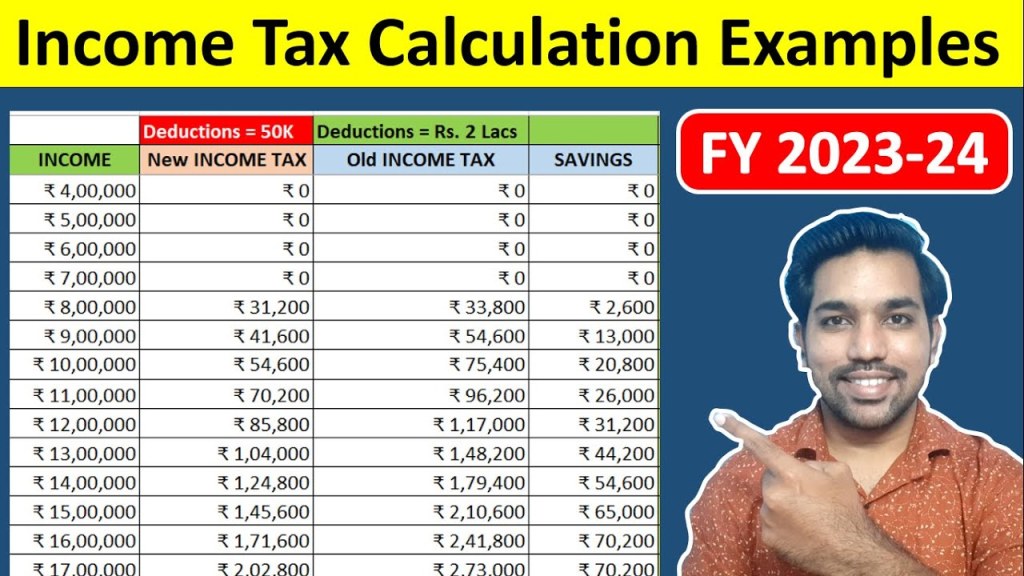

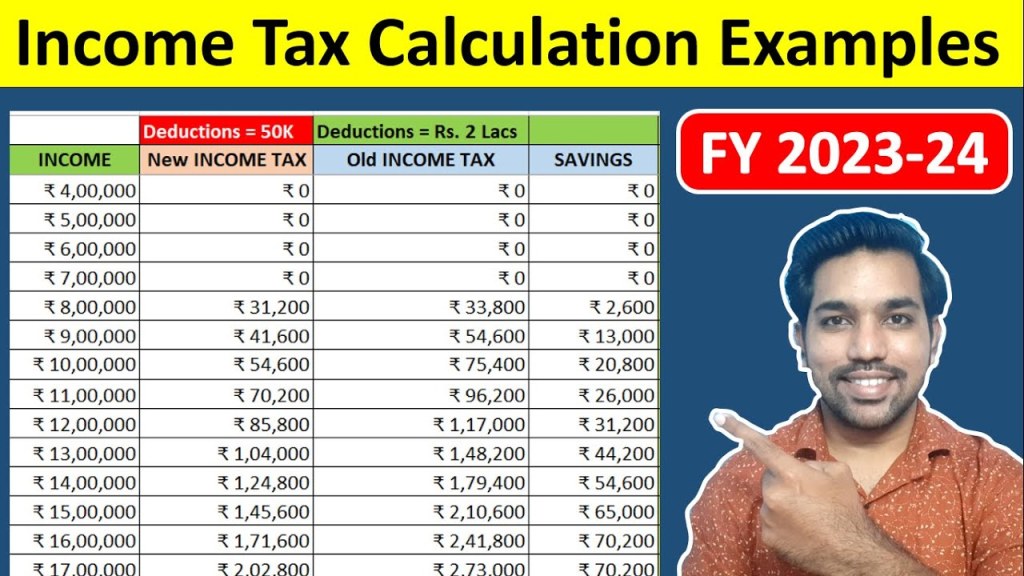

Image Source: ytimg.com

3. Informed decision-making: The ability to simulate different scenarios empowers users to make informed choices and optimize their financial strategies.

4. Comprehensive analysis: The calculator considers multiple factors such as income, deductions, exemptions, and credits to provide a holistic view of the tax implications.

5. User-friendly interface: The intuitive interface makes it easy for individuals with limited tax knowledge to navigate and utilize the calculator effectively.

Disadvantages of the Tax Planning Calculator 2023

1. Complex tax situations: The calculator may not cater to extremely intricate tax scenarios that require specialized knowledge or professional assistance.

2. Assumptions and estimates: The calculator relies on the accuracy of the information provided by the user, which may vary from the actual figures.

3. Limited personalization: While the calculator offers flexibility, it may not accommodate unique financial situations that require customized tax planning strategies.

4. Reliance on user input: The accuracy of the results depends on the accurate input of financial information by the user.

5. Constant updates: As tax laws and regulations evolve, the calculator requires regular updates to ensure compliance and accuracy.

Frequently Asked Questions (FAQs)

1. Can the Tax Planning Calculator be used for both personal and business tax planning?

Yes, the Tax Planning Calculator is suitable for both personal and business tax planning. It takes into account the specific financial information provided by the user to provide accurate calculations and projections.

2. Is the Tax Planning Calculator free to use?

Yes, many financial websites and tax agencies offer the Tax Planning Calculator for free, allowing individuals and businesses to access this valuable tool without any cost.

3. Can I save the results generated by the Tax Planning Calculator for future reference?

Most Tax Planning Calculators allow users to save or print the results for future reference. However, it is recommended to consult with a tax professional before implementing any tax planning strategies based on the calculator’s results.

4. Does the Tax Planning Calculator provide personalized tax advice?

No, the Tax Planning Calculator provides general calculations and projections based on the user’s input. For personalized tax advice tailored to your specific financial situation, it is advisable to consult with a qualified tax professional.

5. Is the Tax Planning Calculator available in multiple languages?

While English is the dominant language for most Tax Planning Calculators, some platforms may offer translations or versions in other languages. It is essential to ensure the accuracy and reliability of the translated versions before utilizing them.

Conclusion

In conclusion, the Tax Planning Calculator 2023 is a powerful tool that simplifies the tax planning process and enables individuals and businesses to make informed financial decisions. By taking advantage of its accurate calculations and projections, users can optimize their tax planning strategies, maximize savings, and minimize liabilities. However, it is crucial to remember that the calculator is a tool and should be used in conjunction with professional advice to ensure compliance and suitability for specific situations. Take control of your financial future by incorporating the Tax Planning Calculator into your financial planning arsenal and unlock the potential for significant tax savings.

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as legal, tax, or financial advice. Always consult with a qualified professional before making any financial decisions or implementing tax planning strategies. The accuracy and applicability of the Tax Planning Calculator may vary based on individual circumstances, and it is advisable to use it in conjunction with professional guidance and expertise.

This post topic: Tax Planning