Unlocking Lucrative Investment Options In NPS: Your Pathway To Financial Growth And Security!

Investment Options in NPS

Introduction

Dear Readers,

2 Picture Gallery: Unlocking Lucrative Investment Options In NPS: Your Pathway To Financial Growth And Security!

Welcome to our comprehensive guide on investment options in the National Pension Scheme (NPS). In this article, we will explore the various investment choices available within NPS, a government-sponsored retirement savings scheme in India.

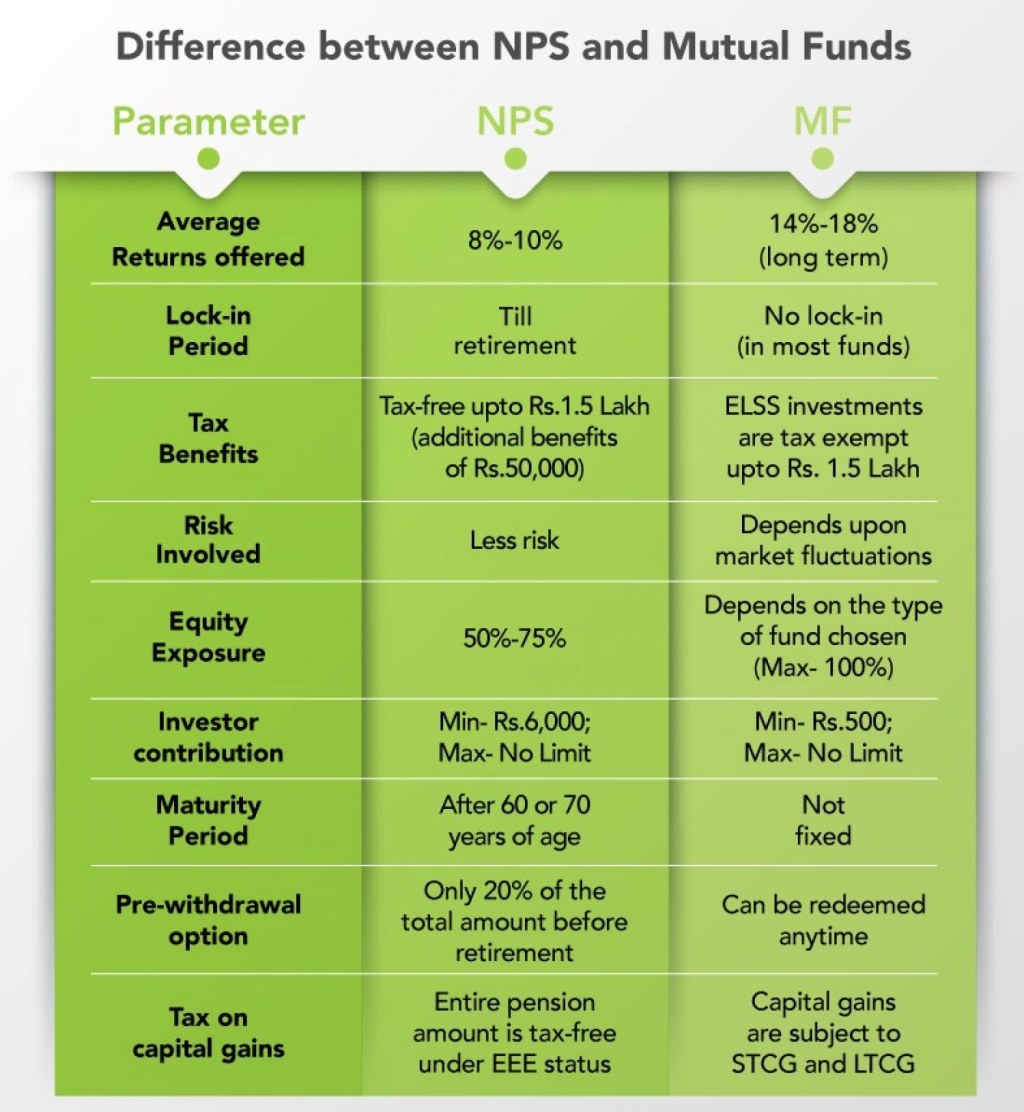

Image Source: carajput.com

Before we delve into the details, let’s first understand what NPS is and how it works.

NPS is a voluntary pension scheme that aims to provide financial security for individuals after retirement. It is regulated by the Pension Fund Regulatory and Development Authority (PFRDA) and offers multiple investment options to suit the risk appetite and financial goals of investors.

Now, let’s take a closer look at the investment options in NPS:

1. Equity Funds 📈

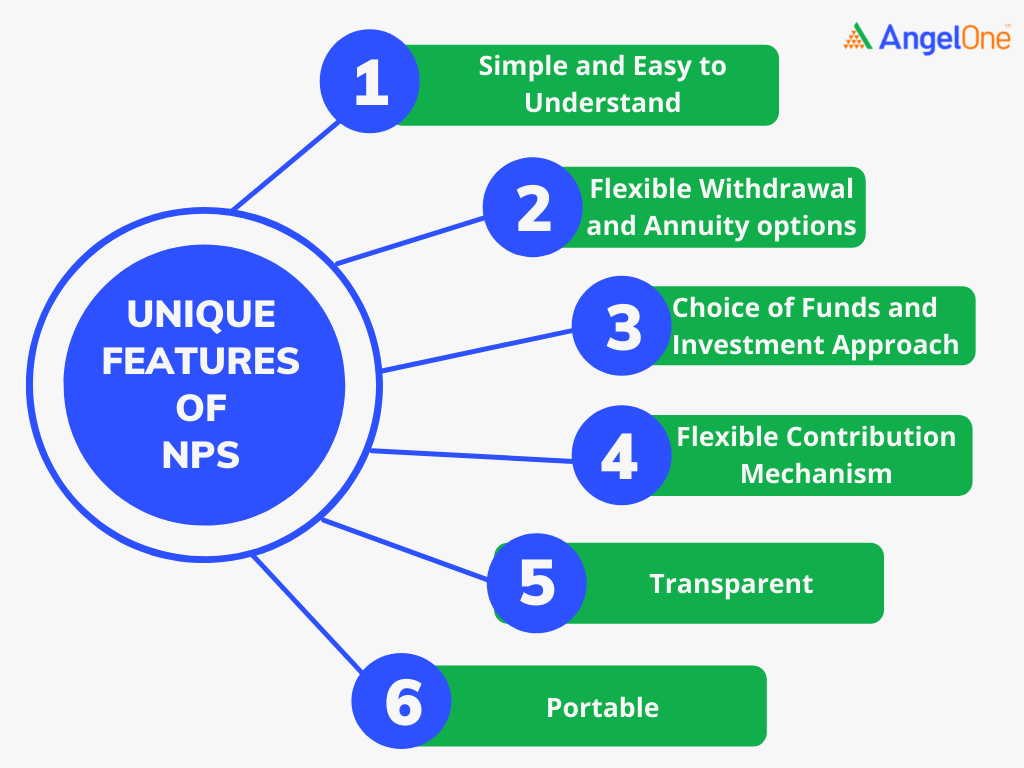

Image Source: angelone.in

Equity funds in NPS invest predominantly in stocks and equity-related instruments. These funds have the potential to deliver higher returns over the long term, but they also come with higher volatility and risk. It is suitable for investors with a higher risk appetite and a long-term investment horizon.

2. Corporate Bonds 📄

Corporate bond funds in NPS invest in debt securities issued by companies. These funds provide stable returns with relatively lower risk compared to equity funds. They are ideal for conservative investors looking for regular income and capital preservation.

3. Government Securities 🏦

Government security funds in NPS invest in debt instruments issued by the government, such as treasury bills, bonds, and securities. These funds offer a high level of safety and are suitable for risk-averse investors looking for stable returns.

4. Alternative Investment Funds 🚀

Alternative investment funds in NPS include investments in assets other than traditional stocks and bonds. These can include real estate investment trusts (REITs), infrastructure investment trusts (InvITs), and other alternative investment options. They offer diversification and potential for higher returns but come with higher risk.

5. Tier I and Tier II Accounts 📊

NPS offers two types of accounts: Tier I and Tier II. Tier I accounts are mandatory and have certain restrictions on withdrawals. Tier II accounts are voluntary and allow investors to withdraw their funds anytime. Both accounts offer the same investment options mentioned above.

6. Active and Auto Choice 🔄

NPS offers two investment choices: active and auto choice. In active choice, investors have the freedom to allocate their funds across different asset classes based on their risk profile. In auto choice, the asset allocation is based on the investor’s age, with a higher equity allocation for younger individuals and a gradual shift towards more conservative investments as they approach retirement.

What are Investment Options in NPS? 🤔

The investment options in NPS refer to the various choices available for investors to allocate their funds within the pension scheme. These options include equity funds, corporate bonds, government securities, alternative investment funds, and the choice between Tier I and Tier II accounts.

Who Can Invest in NPS? 🤷♂️

NPS is open to both Indian citizens and non-resident Indians (NRIs) aged between 18 and 65 years. It is suitable for individuals who wish to plan for their retirement and enjoy the benefits of a pension income after they stop working.

When Should You Invest in NPS? 🕒

It is advisable to start investing in NPS as early as possible to maximize the benefits of compounding. The sooner you start, the more time your investments will have to grow. However, it is never too late to start investing in NPS, and even small contributions can make a significant difference in the long run.

Where Can You Invest in NPS? 🌍

NPS can be accessed through various intermediaries such as banks, pension funds, and other authorized entities called Point of Presence (PoP). These intermediaries facilitate the opening of NPS accounts and provide assistance in managing investments.

Why Should You Invest in NPS? 🤔

Investing in NPS offers several advantages. Firstly, it provides a tax benefit under Section 80C of the Income Tax Act, allowing investors to claim deductions on their contributions. Additionally, NPS offers a flexible investment structure, choice of investment options, and potential for market-linked returns.

How to Invest in NPS? 🤝

To invest in NPS, you need to follow a few simple steps. Firstly, choose a suitable intermediary or PoP to open your NPS account. Then, complete the necessary documentation and submit the required identification and address proof. Finally, contribute regularly to your NPS account and monitor the performance of your chosen investment options.

Advantages and Disadvantages of NPS Investment Options

Advantages:

1. Potential for higher returns in equity funds and alternative investment funds.

2. Tax benefits on contributions under Section 80C.

3. Flexibility to choose between different investment options based on risk profile and financial goals.

4. Safety and stability in government security and corporate bond funds.

5. Tier II accounts offer liquidity and easy access to funds.

Disadvantages:

1. Risk of volatility and potential losses in equity and alternative investment funds.

2. Restrictions on withdrawals from Tier I accounts until retirement age.

3. Market-related risks in all investment options.

4. Potential for lower returns in debt-focused funds during periods of low interest rates.

5. Lack of guaranteed returns, as the performance of the investments is subject to market fluctuations.

Frequently Asked Questions (FAQs)

1. Can I withdraw my NPS funds before retirement?

No, you can only make partial withdrawals from your Tier I NPS account under specific circumstances like higher education, medical emergencies, or purchasing a residential property. Complete withdrawals are only allowed at the time of retirement.

2. Is NPS suitable for self-employed individuals?

Yes, NPS is an excellent retirement planning option for self-employed individuals as it offers tax benefits, flexible contributions, and the potential for long-term wealth creation.

3. Can I switch between investment options in NPS?

Yes, you can switch between different investment options and asset allocations within NPS. However, switching may be subject to certain restrictions and charges imposed by the pension fund managers.

4. What happens to my NPS account if I change jobs?

If you change jobs, you can choose to continue your NPS account or withdraw the accumulated funds. You can also transfer your NPS account to the new employer if they offer NPS benefits.

5. How can I track the performance of my NPS investments?

You can track the performance of your NPS investments through the online portal provided by the pension fund managers. The portal allows you to view your account balance, contributions, and investment returns.

Conclusion

In conclusion, investment options in NPS offer a range of choices to investors for planning their retirement savings. Whether you are looking for high returns, stability, or flexibility, NPS has options to suit your needs. It is important to carefully consider your risk appetite, financial goals, and time horizon before selecting the investment options within NPS.

So, don’t wait any longer. Start exploring the investment options in NPS and take a step towards securing your future!

Final Remarks

Dear Readers,

Investing in NPS can be an excellent way to plan for your retirement and ensure a financially secure future. However, it is crucial to remember that investing involves risks and market fluctuations that can impact the performance of your investments. It is advisable to consult with a financial advisor or conduct thorough research before making any investment decisions.

Remember, the key to successful investing lies in understanding your financial goals, diversifying your portfolio, and staying informed about the market trends. With the right approach and discipline, you can make the most of the investment options in NPS and enjoy a comfortable retirement.

This post topic: Tax Planning