Mastering Tax Planning For Individuals: Your Ultimate Guide In PDF Format

Tax Planning for Individuals PDF: Maximizing Financial Benefits

Greetings, readers! In today’s article, we will delve into the world of tax planning for individuals and explore the benefits of utilizing PDF resources in this regard. Tax planning plays a crucial role in managing personal finances and ensuring compliance with applicable tax laws. By optimizing your tax strategy, you can minimize your tax liability and maximize your financial benefits. The availability of tax planning resources in PDF format further enhances accessibility and convenience for individuals seeking to navigate the complex world of taxation. Let’s explore the ins and outs of tax planning for individuals PDF and learn how it can be advantageous for you.

Introduction

Tax planning for individuals involves strategizing and organizing financial affairs in a manner that legally minimizes tax liability. It encompasses various techniques, tools, and resources that individuals can utilize to optimize their tax position and maximize their after-tax income. In the digital age, PDF files have become a popular format for sharing tax planning information due to their compatibility, ease of access, and ability to preserve document formatting. These PDF resources cover a wide range of tax planning topics, including deductions, credits, investments, retirement planning, and more.

3 Picture Gallery: Mastering Tax Planning For Individuals: Your Ultimate Guide In PDF Format

In this article, we will explore the various aspects of tax planning for individuals PDF, including its definition, benefits, key considerations, and frequently asked questions. By the end of this article, you will have a comprehensive understanding of how tax planning PDFs can empower you to make informed financial decisions and optimize your tax situation.

What is Tax Planning for Individuals PDF?

📚 Tax planning for individuals PDF refers to the use of portable document format (PDF) files to provide individuals with comprehensive information and guidance on tax planning strategies. These PDF resources serve as educational tools that enable individuals to understand and implement effective tax planning techniques.

📚 The availability of tax planning resources in PDF format allows individuals to access detailed information, explanations, examples, and case studies at their convenience. This format ensures that the information is presented consistently, preserving the document’s formatting regardless of the device or operating system used to view it.

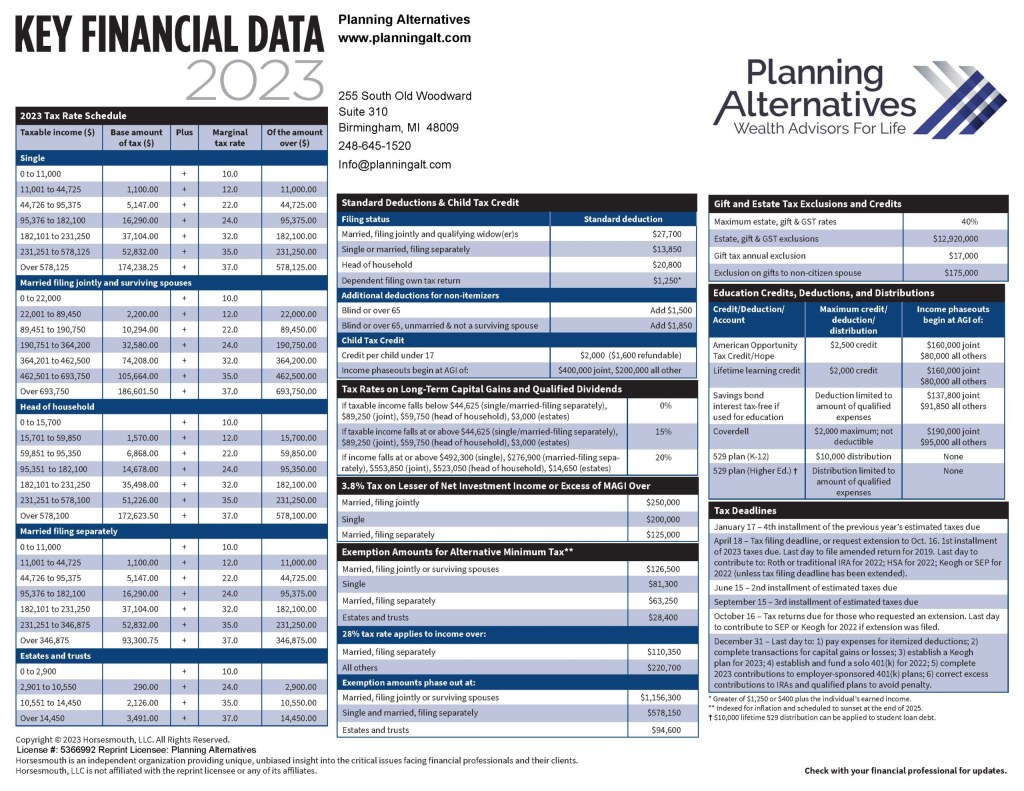

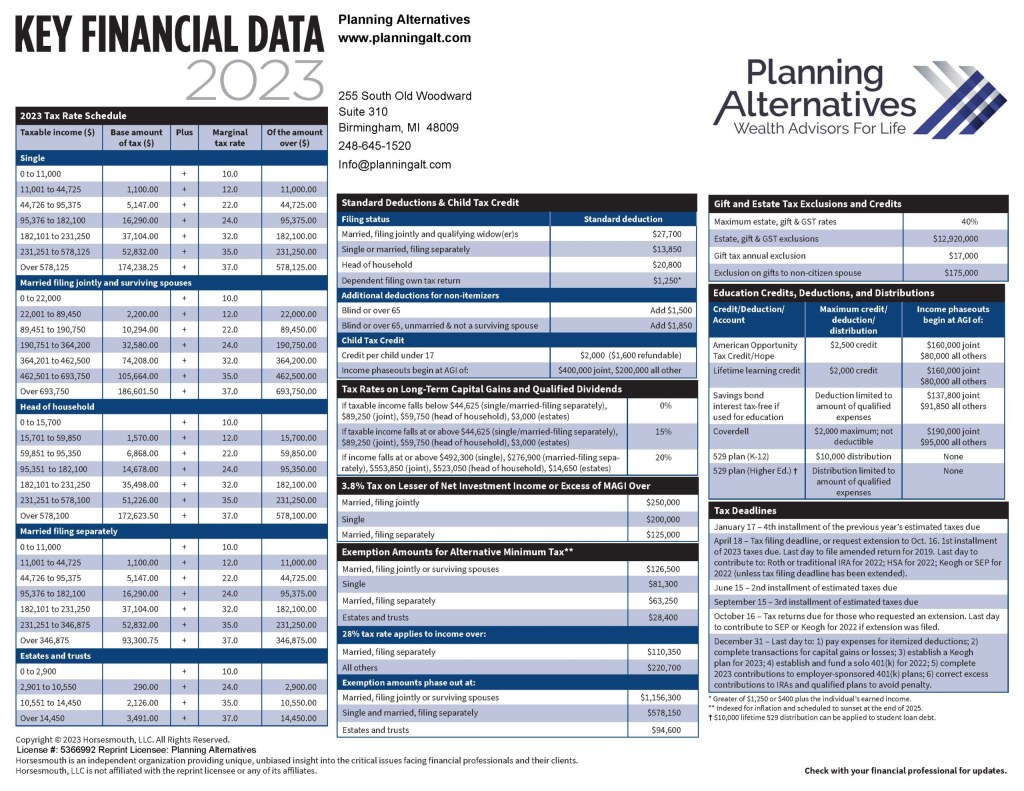

Image Source: planningalt.com

📚 Tax planning PDFs often cover a wide range of topics, including income tax planning, investment strategies, estate planning, retirement planning, deductions, credits, and more. These resources cater to individuals at different stages of their lives and financial journeys, providing them with the knowledge and tools necessary to make informed decisions and minimize their tax liability.

Benefits of Tax Planning for Individuals PDF

📚1. Accessibility: Tax planning PDFs can be accessed anytime, anywhere, as long as you have a device with a PDF reader installed. This accessibility allows individuals to refer to these resources whenever they need assistance in optimizing their tax position.

📚2. Comprehensive Information: Tax planning PDFs often provide detailed explanations, examples, and case studies to help individuals understand complex tax concepts and strategies. These resources cover a wide range of topics, ensuring that individuals have access to comprehensive information on various aspects of tax planning.

📚3. Convenience: PDF files are easy to navigate and search, allowing individuals to quickly find the specific information they need. This convenience saves time and effort in researching and understanding tax planning concepts.

📚4. Portability: Tax planning PDFs can be stored and accessed on various devices, such as smartphones, tablets, and laptops. This portability ensures that individuals can carry their tax planning resources with them and refer to them whenever necessary, even on the go.

Image Source: scribdassets.com

📚5. Document Preservation: PDF files preserve the formatting and layout of the original document, ensuring that the information is presented as intended. This feature is particularly important when dealing with complex tax planning concepts that require visual representation or precise formatting.

Disadvantages of Tax Planning for Individuals PDF

📚1. Lack of Personalization: Tax planning PDFs provide general information and guidance that may not cater to an individual’s specific circumstances. Personalized advice from a tax professional may be necessary to optimize tax planning strategies based on unique financial situations.

📚2. Potential Outdated Information: Tax laws and regulations are subject to change over time. PDF resources may not always reflect the most current tax laws, which could lead to outdated information and potentially incorrect advice.

📚3. Limited Interactivity: PDF files are static documents, limiting interactive elements such as calculators or real-time updates. Individuals may miss out on dynamic features that could enhance their tax planning experience.

📚4. Overwhelming Amount of Information: Some tax planning PDFs may contain extensive information, which can be overwhelming for individuals who are not familiar with tax concepts. It’s important to approach these resources with a clear understanding of your own knowledge and seek professional advice if needed.

Image Source: scribdassets.com

📚5. Lack of Customization: While tax planning PDFs offer comprehensive information, they may not provide customized solutions tailored to an individual’s specific financial goals and circumstances. Personalized advice from a tax professional can address specific needs and optimize tax planning strategies accordingly.

Frequently Asked Questions (FAQs)

1. Is tax planning legal?

Tax planning is legal as long as it adheres to the tax laws and regulations in your jurisdiction. It involves utilizing legal strategies and incentives provided by tax authorities to minimize tax liability.

2. When should I start tax planning?

Ideally, tax planning should start as early as possible to maximize the benefits. However, it’s never too late to implement tax planning strategies and optimize your tax position.

3. Can I do tax planning on my own?

While individuals can engage in basic tax planning on their own, complex tax situations may require professional guidance. Consulting a tax advisor or accountant can ensure that you are maximizing your tax benefits and complying with applicable tax laws.

4. What documents do I need for tax planning?

Documents required for tax planning may vary depending on your specific circumstances. Generally, you will need records of your income, expenses, investments, assets, and liabilities. Consult a tax professional for a comprehensive list of documents relevant to your tax planning.

5. How often should I review my tax plan?

It is recommended to review your tax plan annually or whenever significant life changes occur, such as marriage, divorce, birth of a child, or retirement. Regular review ensures that your tax plan remains relevant and aligned with your financial goals.

Conclusion

In conclusion, tax planning for individuals PDF offers a convenient and accessible means of acquiring comprehensive information and guidance on tax planning strategies. By leveraging these resources, individuals can optimize their tax position, minimize tax liability, and maximize their financial benefits. While tax planning PDFs provide valuable insights, it’s important to seek personalized advice from a tax professional to ensure that your tax planning strategies align with your unique financial goals and circumstances. Start exploring tax planning PDFs today and take control of your financial future!

Disclaimer: This article is for informational purposes only and should not be construed as legal or financial advice. Consult with a qualified professional for personalized tax planning guidance.

This post topic: Tax Planning