Unlocking The Powerful Benefits Of Tax Planning: Understanding The Meaning, Need, And Limitations

Tax Planning: Meaning, Need, and Limitations

Greetings, Readers!

Welcome to our informative article on tax planning. In this piece, we will delve into the meaning, need, and limitations of tax planning. Understanding these aspects will help you make informed decisions and optimize your tax obligations. So, let’s get started!

2 Picture Gallery: Unlocking The Powerful Benefits Of Tax Planning: Understanding The Meaning, Need, And Limitations

Introduction

Tax planning is a strategic approach employed by individuals and businesses to minimize their tax liabilities within the bounds of the law. It involves analyzing financial situations, identifying applicable tax laws, and leveraging legal methods to reduce tax payments.

In this section, we will explore seven key points to provide you with a comprehensive understanding of tax planning:

1. What is Tax Planning?

Tax planning refers to the process of organizing financial affairs in a manner that legally reduces tax burdens. It involves studying tax laws, exemptions, deductions, and credits to optimize tax obligations.

2. Who Benefits from Tax Planning?

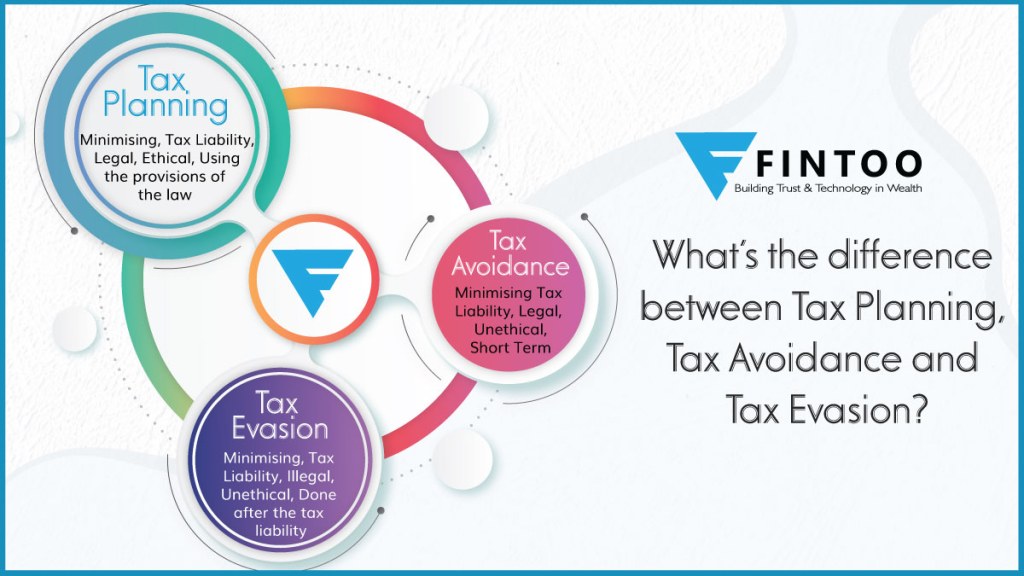

Image Source: fintoo.in

Tax planning is beneficial for individuals, businesses, and organizations of all sizes. Whether you are a salaried individual, a small business owner, or a multinational corporation, tax planning can help you navigate the complex tax landscape and minimize your tax liabilities.

3. When Should Tax Planning be Implemented?

Tax planning should ideally be an ongoing process rather than a last-minute endeavor. By incorporating tax planning throughout the year, individuals and businesses can identify opportunities to optimize their tax obligations and avoid unnecessary penalties.

4. Where Does Tax Planning Apply?

Tax planning applies to various aspects of financial activities, including income tax, capital gains tax, property tax, estate tax, and more. It is applicable in different jurisdictions and countries, each with its own set of tax laws and regulations.

5. Why is Tax Planning Important?

Tax planning is important for several reasons. It helps individuals and businesses reduce tax liabilities, increase tax efficiency, and ensure compliance with tax laws. By minimizing tax payments, taxpayers can allocate more resources towards their financial goals and wealth creation.

6. How Does Tax Planning Work?

Tax planning involves a systematic approach comprising various strategies such as income deferral, expense deductions, tax-efficient investments, and charitable contributions. These strategies are implemented based on individual circumstances and financial goals to achieve optimal tax outcomes.

Advantages and Disadvantages of Tax Planning

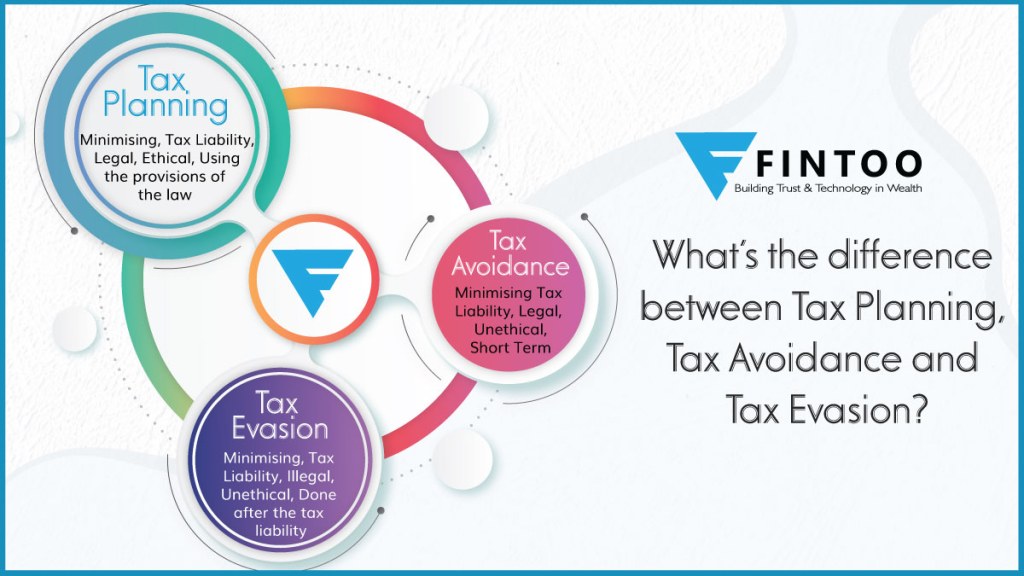

Image Source: ytimg.com

Like any financial strategy, tax planning has its pros and cons. Let’s explore them in detail:

Advantages:

1. Tax Savings: Effective tax planning can lead to significant savings by leveraging tax benefits, deductions, and credits.

2. Increased Cash Flow: By minimizing tax liabilities, individuals and businesses can retain more cash, which can be reinvested or used for growth.

3. Compliance: Tax planning ensures compliance with tax laws, reducing the risk of penalties and legal issues.

4. Financial Goal Alignment: Tax planning aligns with financial goals, enabling individuals and businesses to allocate resources efficiently.

5. Risk Management: By staying updated on tax laws and regulations, tax planning helps mitigate risks associated with non-compliance.

Disadvantages:

1. Complexity: Tax planning can be complex, requiring knowledge of tax laws and continuous monitoring of changing regulations.

2. Time-Consuming: Implementing effective tax planning strategies may require significant time and effort, especially for complex financial situations.

3. Costly Mistakes: Errors in tax planning can have financial consequences, including penalties, audits, and reputational damage.

4. Limited Scope: Tax planning has its limitations, and not all financial activities can be optimized for tax benefits.

5. Ethical Considerations: Tax planning should adhere to legal and ethical boundaries, avoiding aggressive tax avoidance schemes.

FAQs (Frequently Asked Questions)

1. Is tax planning legal?

Yes, tax planning is legal as long as it complies with tax laws and regulations. Engaging in illegal tax evasion activities is strictly prohibited.

2. Can tax planning help save money?

Yes, tax planning can lead to substantial savings by optimizing tax obligations and leveraging available deductions, exemptions, and credits.

3. Is tax planning only for the wealthy?

No, tax planning is beneficial for individuals and businesses of all income levels. It helps optimize tax liabilities based on individual circumstances.

4. How often should tax planning be reviewed?

Tax planning should be reviewed annually and whenever significant financial changes occur, such as marriage, divorce, starting a business, or buying/selling property.

5. Should I hire a professional for tax planning?

While individuals can handle basic tax planning, complex financial situations often require the expertise of tax professionals to ensure optimal outcomes and compliance.

Conclusion

In conclusion, tax planning plays a crucial role in optimizing tax obligations for individuals and businesses. By understanding the meaning, need, and limitations of tax planning, readers can make informed financial decisions and minimize tax burdens. Remember to seek professional advice and stay updated on tax laws to maximize the benefits of tax planning.

Final Remarks

It is important to note that the information provided in this article is for informational purposes only and should not be considered as professional tax advice. Tax laws and regulations vary across jurisdictions, and individual circumstances may require personalized tax planning strategies. Therefore, readers are advised to consult qualified tax professionals to tailor tax planning strategies based on their specific needs and local regulations.

This post topic: Tax Planning