Maximize Your Savings With Effective 80C Tax Planning: Unlock Financial Benefits Now!

Tax Planning Under 80C: Maximizing Savings and Reducing Tax Liability

Greetings, Readers! Today, we will be diving into the world of tax planning under Section 80C of the Income Tax Act. This article aims to provide you with comprehensive information about the various aspects of tax planning under 80C, ensuring that you can make informed decisions to optimize your savings and minimize your tax liability. So, let’s get started!

Table of Contents

Introduction

What is Tax Planning Under 80C?

Who Can Benefit From Tax Planning Under 80C?

When Should You Consider Tax Planning Under 80C?

Where Can You Invest Under 80C?

Why Is Tax Planning Under 80C Important?

How Can You Optimize Your Tax Planning Under 80C?

Advantages and Disadvantages of Tax Planning Under 80C

Frequently Asked Questions (FAQ)

Conclusion

Final Remarks

1 Picture Gallery: Maximize Your Savings With Effective 80C Tax Planning: Unlock Financial Benefits Now!

1. What is Tax Planning Under 80C?

🔍 Tax planning under Section 80C of the Income Tax Act refers to the strategic and lawful allocation of funds in eligible investment avenues to reduce an individual’s tax liability. This section allows individuals to claim deductions from their taxable income by investing in specified financial instruments, subject to a maximum limit of ₹1.5 lakhs. By utilizing the provisions under 80C, taxpayers can effectively lower their tax burden while simultaneously saving for their future financial goals.

1.1 Understanding Eligible Investments

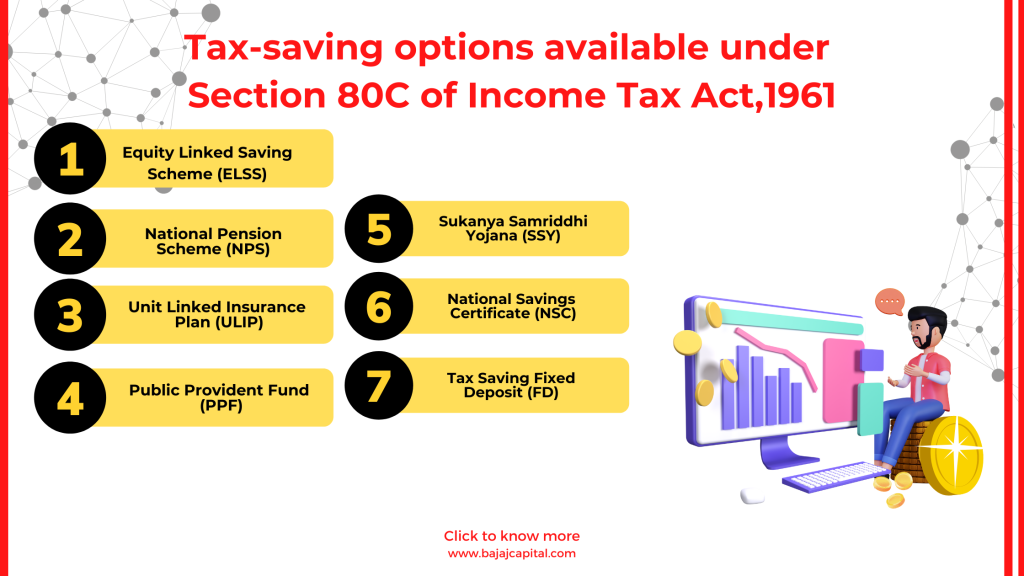

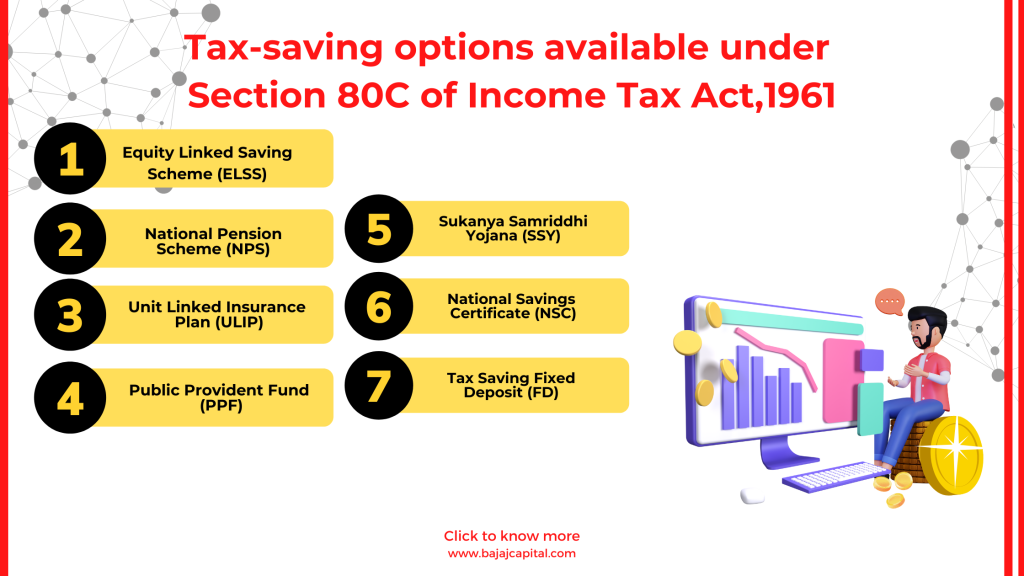

Image Source: bajajcapitalone.com

📝 Section 80C encompasses a wide range of investment options, each with its own set of rules and benefits. Some of the popular investment choices under 80C include Equity-Linked Savings Scheme (ELSS), Public Provident Fund (PPF), National Savings Certificate (NSC), Tax-Saver Fixed Deposits, and Life Insurance Premiums, among others. It is crucial to understand the terms and conditions associated with each investment avenue to make an informed decision that suits your financial objectives and risk tolerance.

1.2 The Lock-in Period

⏳ One important aspect to consider when planning your taxes under 80C is the lock-in period associated with certain investment options. Different investments have varying lock-in periods, ranging from a few years to several decades. It is essential to be aware of these lock-in periods as premature withdrawals or exits can lead to penalties and loss of tax benefits.

1.3 Tax Savings Calculation

✏️ Calculating the tax savings achieved through investments under Section 80C requires a good understanding of the tax slab you fall under and the applicable deductions. By correctly assessing your taxable income, deductions, and investments, you can determine the amount of tax saved. It is advisable to consult a tax professional or use online tax calculators to accurately compute your tax savings.

1.4 Important Considerations

🔎 Before embarking on your tax planning journey under 80C, it is essential to consider factors such as risk appetite, financial goals, and liquidity needs. Each investment option has its own risk profile and potential returns. Analyzing these factors will help you make informed decisions that align with your financial objectives.

1.5 Documentation and Compliance

📑 To avail the benefits of tax planning under 80C, maintaining proper documentation is crucial. It is advisable to keep records of investments, receipts, and other relevant documents to substantiate your claims during tax assessment. Additionally, staying updated with the latest tax laws and regulations is essential to ensure compliance and avoid any penalties.

1.6 Seeking Professional Advice

💼 Tax planning can be a complex process, and seeking professional advice from financial planners, tax consultants, or chartered accountants can provide valuable insights and guidance. These experts can help you devise a personalized tax planning strategy tailored to your unique financial circumstances.

1.7 Monitoring and Reviewing Your Investments

📊 Lastly, it is important to continuously monitor and review your investments made under 80C. Market conditions, changing tax laws, and evolving financial goals may necessitate adjustments to your investment portfolio. Regularly assessing your investments will ensure that you are maximizing your tax savings and optimizing your returns.

2. Who Can Benefit From Tax Planning Under 80C?

🎯 Tax planning under Section 80C is open to all individual taxpayers, whether salaried or self-employed. This provision allows individuals to reduce their taxable income by investing in eligible avenues, making it an attractive option for anyone seeking to lower their tax liability. However, it is important to note that the benefits under 80C are subject to certain restrictions and conditions, which vary depending on the specific investment option chosen.

2.1 Salaried Individuals

👔 Salaried individuals can greatly benefit from tax planning under 80C as it provides them with an opportunity to reduce their tax liability while simultaneously planning for their future financial goals. By making prudent investment choices, salaried individuals can optimize their tax savings and ensure a secure financial future.

2.2 Self-Employed Individuals

👨💼 For self-employed individuals, tax planning under 80C can be a valuable tool to minimize their tax burden. By carefully considering their investment options and aligning them with their financial objectives, self-employed individuals can achieve significant tax savings and reap the benefits of long-term wealth creation.

2.3 Senior Citizens

🧓 Senior citizens can also avail the benefits of tax planning under 80C by investing in eligible avenues. This allows them to reduce their taxable income, thereby lowering their tax liability. Investing in senior citizen-specific schemes such as Senior Citizen Savings Scheme (SCSS) can provide additional benefits to this demographic.

2.4 HUFs and NRIs

🏠 Hindu Undivided Families (HUFs) and Non-Resident Indians (NRIs) are also eligible to utilize the provisions under Section 80C to optimize their tax planning. However, it is important to note that certain investment options may have specific rules and restrictions for HUFs and NRIs.

2.5 Income Tax Slabs and Deductions

💰 It is imperative to consider the applicable income tax slabs and deductions while planning your taxes under 80C. The tax benefits derived from investments under 80C can vary depending on the income tax slab you fall under. Analyzing these slabs and deductions will enable you to make informed decisions and maximize your tax savings.

2.6 Financial Planning for All

💼 Tax planning under 80C not only provides tax benefits but also offers an avenue for individuals to embark on a disciplined approach to financial planning. By investing in long-term wealth-building instruments, individuals can secure their future financial goals while enjoying tax advantages.

3. When Should You Consider Tax Planning Under 80C?

⌛ Tax planning under Section 80C should ideally be considered at the beginning of each financial year. By starting early, you have the advantage of planning your investments strategically and maximizing your savings. Moreover, initiating tax planning early also allows you to spread your investments over the year, minimizing the financial strain of investing a lump sum amount at the last minute.

3.1 Investment Lock-in Period

⏳ As mentioned earlier, some investment options under 80C come with a lock-in period. Considering this, it is important to plan your investments well in advance to ensure that you can meet your financial goals without any liquidity constraints. By starting early, you can align your investments with your desired lock-in periods and optimize your tax planning accordingly.

3.2 Prioritizing Financial Goals

🎯 Planning your tax-saving investments under 80C allows you to prioritize your financial goals. By identifying your short-term and long-term objectives, such as retirement planning, children’s education, or buying a house, you can choose investment avenues that align with these goals. Starting early gives you the advantage of time, enabling you to accumulate wealth and meet your objectives.

3.3 Assessing Risk and Returns

📈 Each investment option under 80C carries its own risk profile and potential returns. By evaluating your risk appetite and return expectations, you can select investments that suit your financial requirements. Starting early provides you with ample time to ride out market fluctuations and maximize your returns.

3.4 Tax Planning During Major Life Events

🎉 Major life events such as marriage, childbirth, or buying a new home often come with additional financial responsibilities. Planning your taxes under 80C during these times can help you optimize your savings and manage your expenses effectively. By considering the available deductions and exemptions, you can make sound financial decisions that cater to the changing circumstances.

3.5 Regular Assessment of Financial Health

📊 Tax planning under 80C necessitates regular assessment of your financial health. By reviewing your income, expenses, and savings periodically, you can ensure that your tax planning strategy remains aligned with your financial goals. It also allows you to make any necessary adjustments or reallocations to optimize your tax savings.

3.6 Retirement Planning

🏖️ Retirement planning is an important aspect of tax planning under 80C. By investing in pension plans or other retirement-focused schemes, you can secure your financial future and enjoy a comfortable retirement. Starting early in your career enables you to accumulate a substantial corpus, ensuring a stress-free retired life.

3.7 Seeking Professional Advice

💼 For individuals with complex financial situations or limited knowledge about tax planning, seeking professional advice is highly recommended. Financial planners or tax consultants can help you devise a tax planning strategy that is tailored to your specific needs and goals. They can guide you through the various investment options available under 80C and help you make informed decisions.

4. Where Can You Invest Under 80C?

🌐 Tax planning under 80C offers a plethora of investment avenues for individuals to choose from. It is important to understand the features, benefits, and risks associated with each option before making a decision. Here are some popular investment avenues that qualify under 80C:

4.1 Equity-Linked Savings Scheme (ELSS)

📈 ELSS is a type of mutual fund that invests predominantly in equities. It offers the dual benefit of long-term wealth creation and tax savings. ELSS funds have a lock-in period of three years and potentially higher returns compared to other fixed income instruments. However, they come with market-related risks and volatility.

4.2 Public Provident Fund (PPF)

🏦 PPF is a government-backed savings scheme that offers guaranteed returns and tax-free interest. It has a lock-in period of 15 years, making it suitable for long-term goals such as retirement planning or children’s education. PPF accounts can be opened at designated banks or post offices.

4.3 National Savings Certificate (NSC)

📜 NSC is a fixed income savings instrument offered by the Indian government. It comes with a lock-in period of five years and offers competitive interest rates. NSC provides individuals with a low-risk investment option and can be availed at post offices.

4.4 Tax-Saver Fixed Deposits

💰 Tax-Saver Fixed Deposits are fixed deposit schemes offered by banks with a lock-in period of five years. These fixed deposits provide tax benefits under 80C and offer stable returns. However, the interest earned is subject to taxation.

4.5 Life Insurance Premiums

🏥 Premiums paid towards life insurance policies, whether traditional or unit-linked, are eligible for tax benefits under 80C. Life insurance not only provides financial protection but also offers long-term savings and investment options.

4.6 Sukanya Samriddhi Yojana (SSY)

👧 SSY is a government scheme aimed at promoting the welfare of the girl child. It offers tax benefits and a high interest rate. The funds deposited in an SSY account can be utilized for the education and marriage expenses of the girl child.

4.7 Employee Provident Fund (EPF)

👷 EPF is a retirement savings scheme provided by employers to their employees. It offers tax benefits under 80C and ensures long-term savings for retirement. Contributions made by the employee and employer are eligible for tax exemptions.

4.8 NPS Tier 1 Account

🌐 National Pension System (NPS) is a voluntary retirement savings scheme regulated by the Pension Fund Regulatory and Development Authority (PFRDA). Contributions to the NPS Tier 1 account are eligible for tax benefits under 80C, with an additional deduction available under 80CCD(1B).

4.9 Senior Citizen Savings Scheme (SCSS)

🧓 SCSS is a government scheme designed specifically for senior citizens. It offers attractive interest rates and tax benefits to individuals aged 60 years and above. The scheme has a lock-in period of five years and can be

This post topic: Tax Planning