Uncover The Perfect Account For Your Investment: Where Does It Come Under?

Investment Comes Under Which Account: Exploring the Options

Introduction

Dear Readers,

Welcome to our informative article on the topic of investment comes under which account. In this piece, we will delve into the various account options available for investments and help you understand which ones may be suitable for your financial goals. Investing is a crucial aspect of wealth management, and knowing the right account to use can make a significant difference in maximizing your returns. So, let’s get started and explore the world of investment accounts!

3 Picture Gallery: Uncover The Perfect Account For Your Investment: Where Does It Come Under?

Before we dive into the details, let’s first understand what investment accounts are and why they are essential. Investment accounts are specialized financial accounts that allow individuals to invest their money in various assets such as stocks, bonds, mutual funds, and more. These accounts offer unique features and tax advantages, making them attractive options for individuals looking to grow their wealth over time.

In this article, we will cover the following topics:

1. What is an Investment Account?

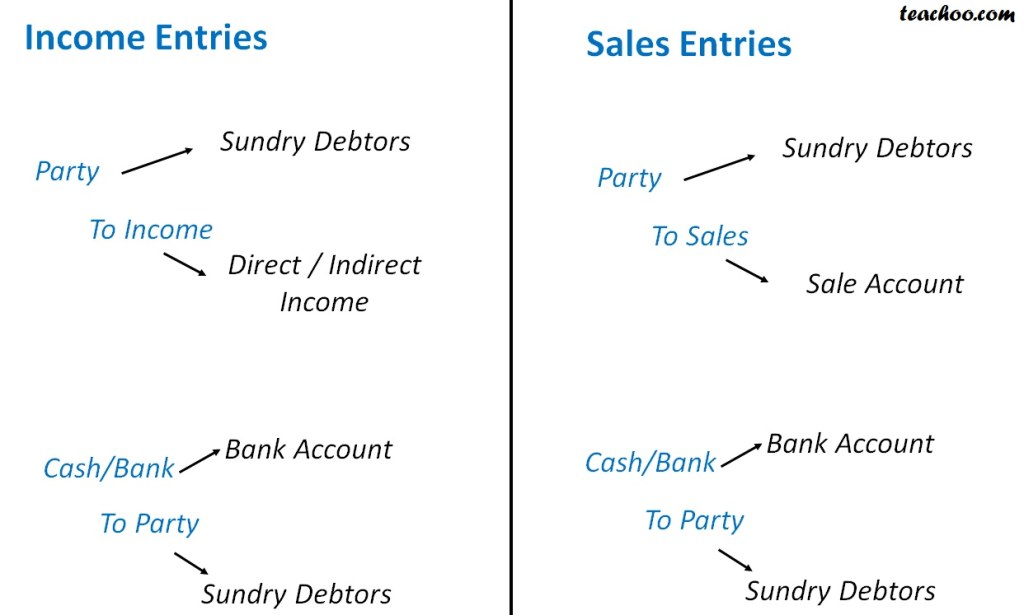

Image Source: cloudfront.net

🔍

An investment account refers to a financial account specifically designed for the purpose of buying and selling various financial instruments, such as stocks, bonds, and mutual funds. It provides individuals with the opportunity to grow their wealth by investing in different asset classes. These accounts are typically offered by financial institutions, including banks, brokerage firms, and investment companies.

2. Who Can Open an Investment Account?

🔍

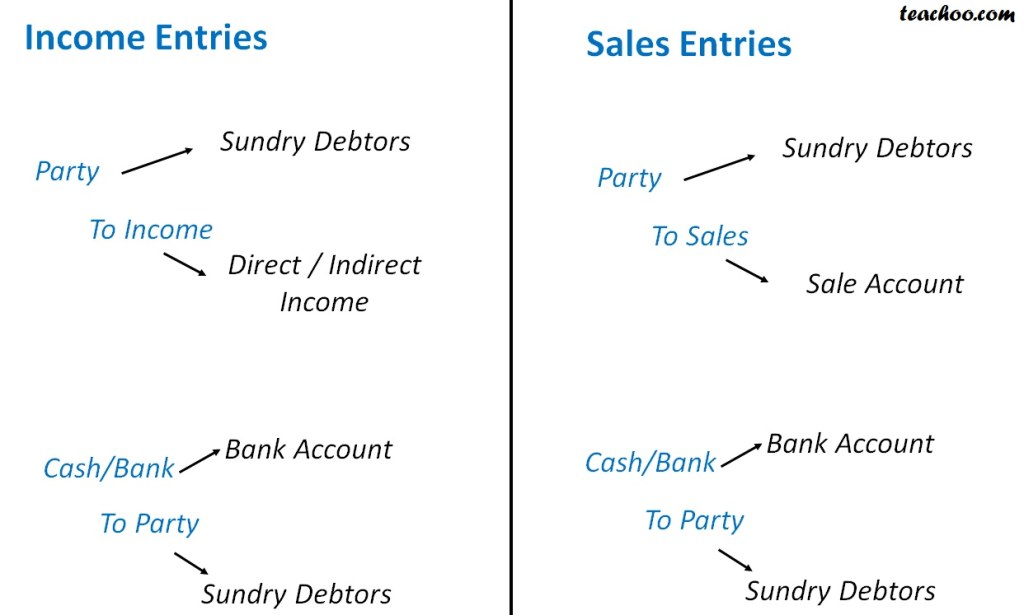

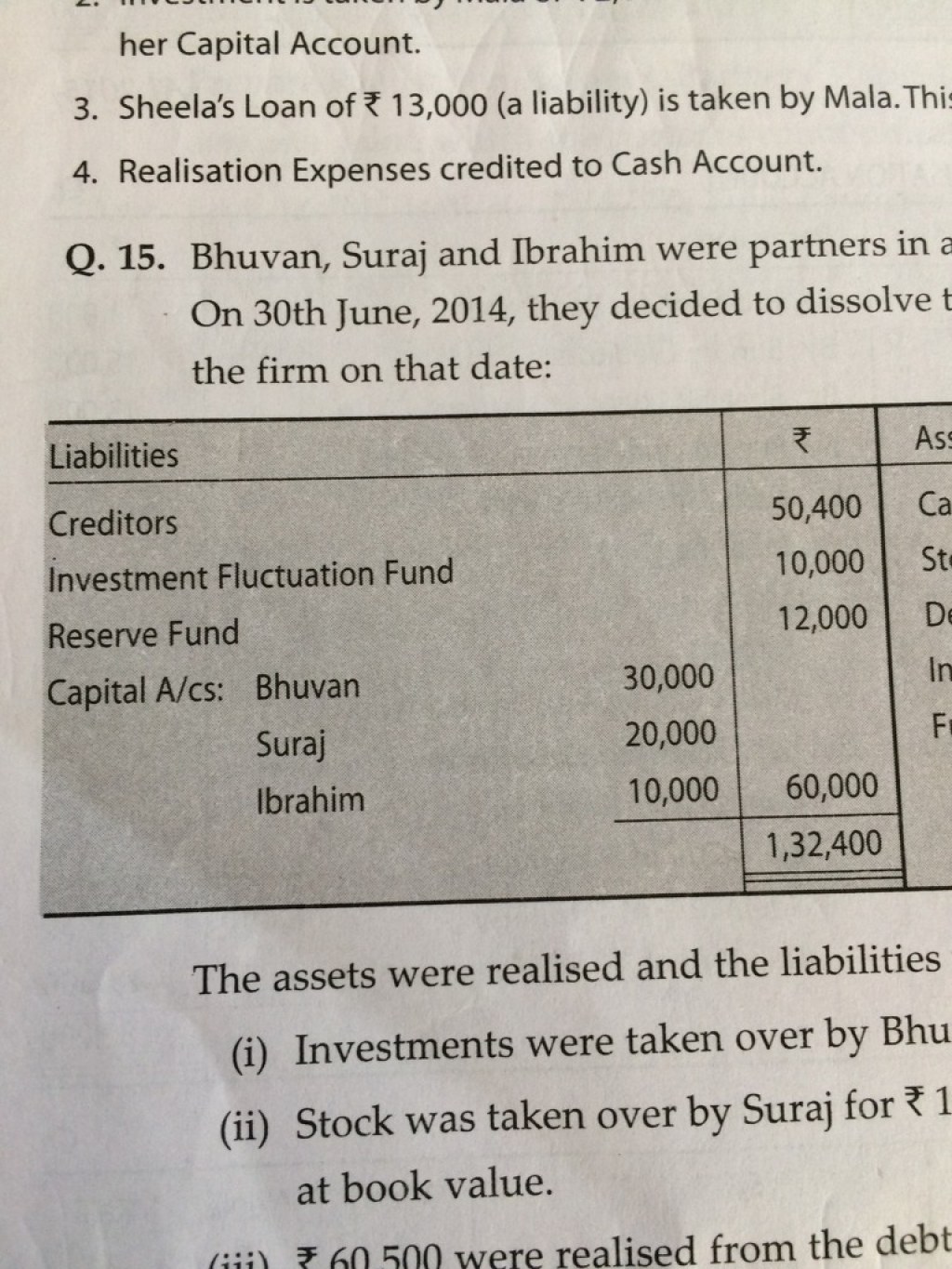

Image Source: mnimgs.com

Investment accounts can be opened by individuals who meet certain eligibility criteria set by the financial institution. Generally, anyone who is of legal age and has the necessary identification documents can open an investment account. However, some financial institutions may have additional requirements, such as a minimum initial deposit or a certain level of financial literacy.

3. When Should You Consider Opening an Investment Account?

🔍

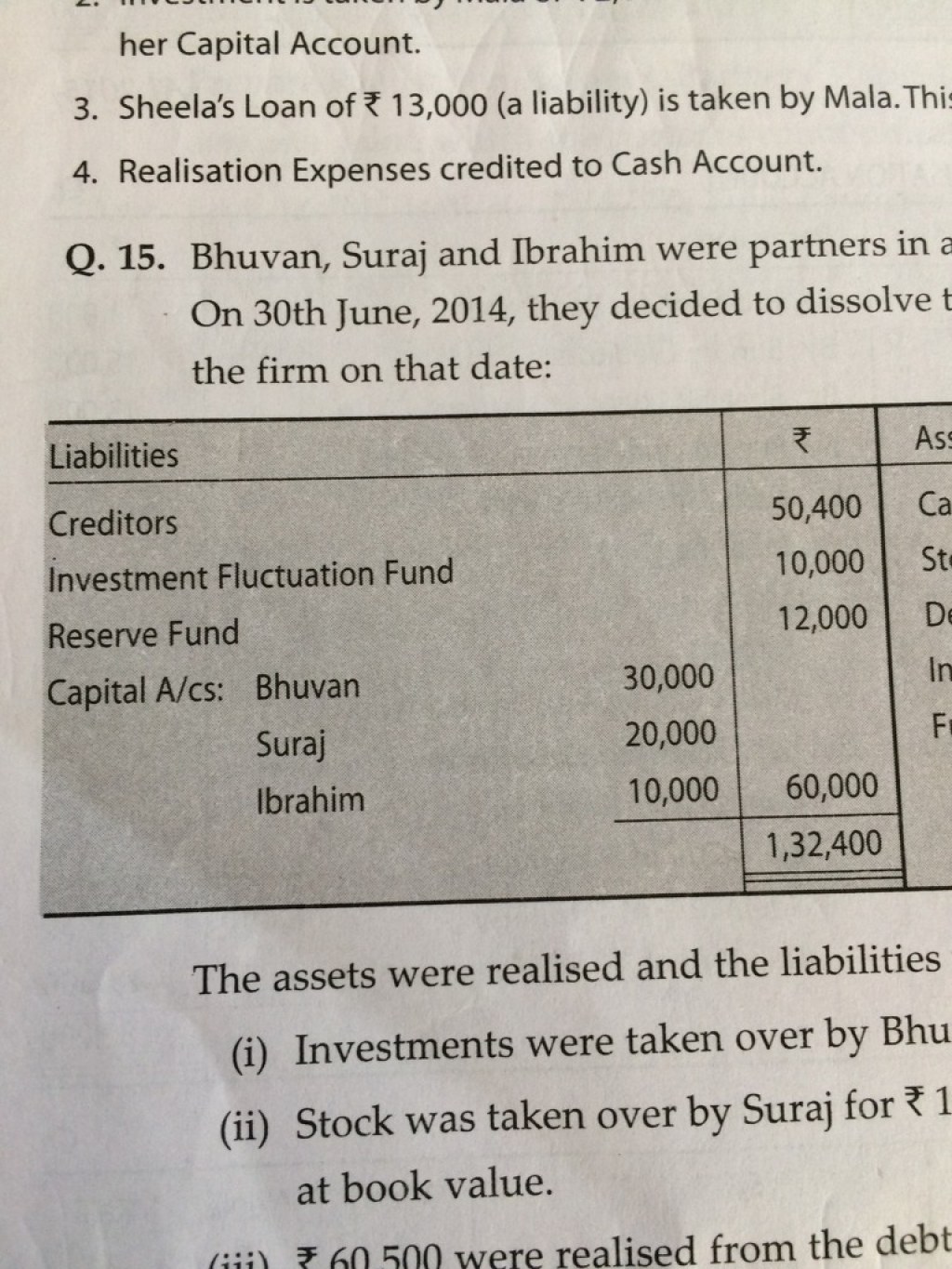

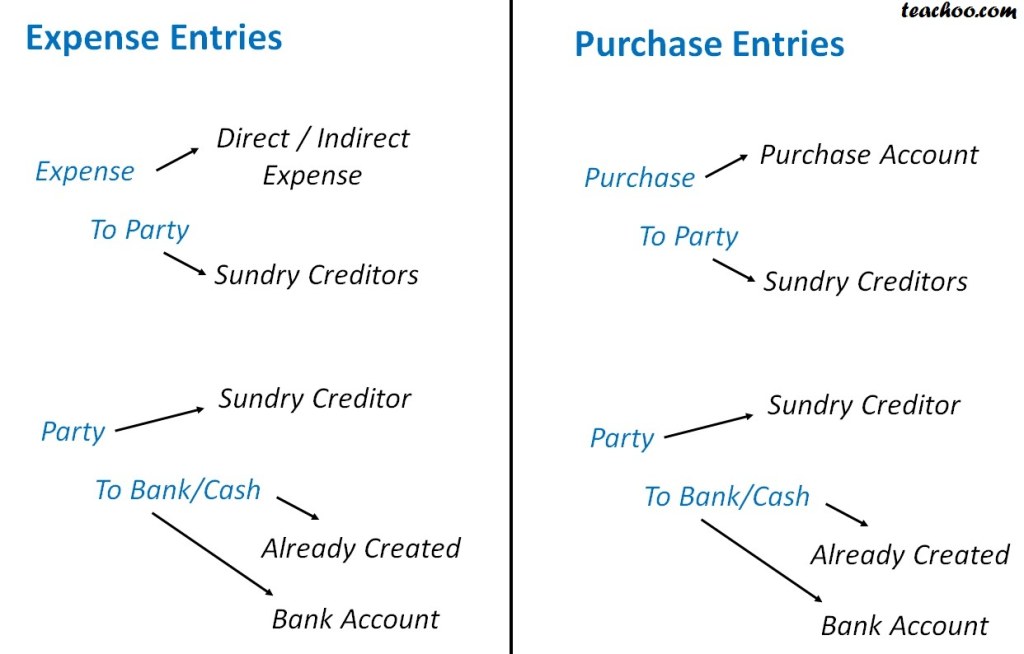

Image Source: cloudfront.net

Opening an investment account can be a wise decision if you have long-term financial goals and are willing to take on some degree of risk. These accounts are suitable for individuals who have a surplus of funds that they do not need in the short term and are looking to grow their wealth over an extended period. It is important to note that investments come with risks, and the value of your investments can fluctuate.

4. Where Can You Open an Investment Account?

🔍

Investment accounts can be opened at various financial institutions, including banks, brokerage firms, and investment companies. It is essential to choose a reputable institution that offers a wide range of investment options and has a track record of good customer service. Research and compare different institutions to find the one that best suits your investment needs.

5. Why Should You Consider Opening an Investment Account?

🔍

Opening an investment account offers several benefits, including the potential for higher returns compared to traditional savings accounts. By investing in different asset classes, you can diversify your portfolio and reduce the risk of losing all your investment in case one asset performs poorly. Additionally, some investment accounts offer tax advantages, such as tax-deferred growth or tax-free withdrawals in certain circumstances.

6. How Can You Open an Investment Account?

🔍

To open an investment account, you will need to follow a few simple steps. Firstly, research and choose a financial institution that aligns with your investment goals. Next, gather the necessary identification documents, including proof of identity and address. Then, complete the account application form provided by the institution and submit it along with the required documents. Once your application is approved, you can fund your investment account and start investing!

Advantages and Disadvantages of Investment Accounts

📊

Now that we have a better understanding of investment accounts, let’s explore the advantages and disadvantages they offer.

Advantages of Investment Accounts

👍

1. Potential for higher returns compared to traditional savings accounts.

2. Diversification opportunities to reduce risk.

3. Tax advantages such as tax-deferred growth or tax-free withdrawals.

4. Access to a wide range of investment options.

5. Flexibility to choose investment strategies that align with your financial goals.

Disadvantages of Investment Accounts

👎

1. Risk of losing money due to market fluctuations.

2. Potential for higher fees and expenses associated with managing investment accounts.

3. Requires time and effort to research and monitor investments.

4. Possible lack of guaranteed returns compared to traditional savings accounts.

5. Complexities involved, especially for novice investors.

Frequently Asked Questions (FAQs)

1. Can I open an investment account if I have little to no investment knowledge?

🔍

Yes, you can open an investment account even if you have limited investment knowledge. Many financial institutions offer investment advisory services to assist individuals in making informed investment decisions. It is recommended to seek professional guidance or educate yourself about investment basics before making investment decisions.

2. Are investment accounts insured?

🔍

Unlike traditional savings accounts, investment accounts are not typically insured by government-backed programs such as the Federal Deposit Insurance Corporation (FDIC). However, some investment accounts may be protected by the Securities Investor Protection Corporation (SIPC), which provides limited coverage in case of brokerage firm failures.

3. Can I withdraw money from my investment account anytime?

🔍

Generally, you can withdraw money from your investment account at any time. However, some investment accounts may have restrictions or penalties for early withdrawals. It is essential to review the terms and conditions of your specific investment account to understand any potential limitations.

4. Are investment accounts suitable for short-term financial goals?

🔍

Investment accounts are primarily designed for long-term financial goals. If you have short-term financial goals, such as saving for a vacation or down payment, it is generally recommended to consider other options, such as high-yield savings accounts or certificates of deposit (CDs), which offer more stability and liquidity.

5. How often should I review my investment account?

🔍

Regularly reviewing your investment account is crucial to ensure that your investments align with your financial goals and risk tolerance. It is recommended to review your investment account at least once a year or when significant life events occur, such as marriage, birth of a child, or retirement.

Conclusion

📌

Investment accounts provide individuals with the opportunity to grow their wealth and achieve their long-term financial goals. By understanding the different types of investment accounts available and their respective advantages and disadvantages, you can make informed decisions that align with your financial objectives. Remember to consult with financial professionals and conduct thorough research before opening an investment account. Start investing wisely and secure your financial future!

Final Remarks

📝

Investing in various financial assets through the right investment account can be a game-changer in building wealth. However, it is crucial to note that investments come with risks, and past performance is not indicative of future results. While this article aims to provide useful information, it should not be considered as financial advice. It is always recommended to consult with a qualified financial advisor before making any investment decisions. Happy investing!

This post topic: Tax Planning