Unlocking Lucrative Investment Options In NPS: Your Pathway To Financial Growth And Security!

Sep

27th

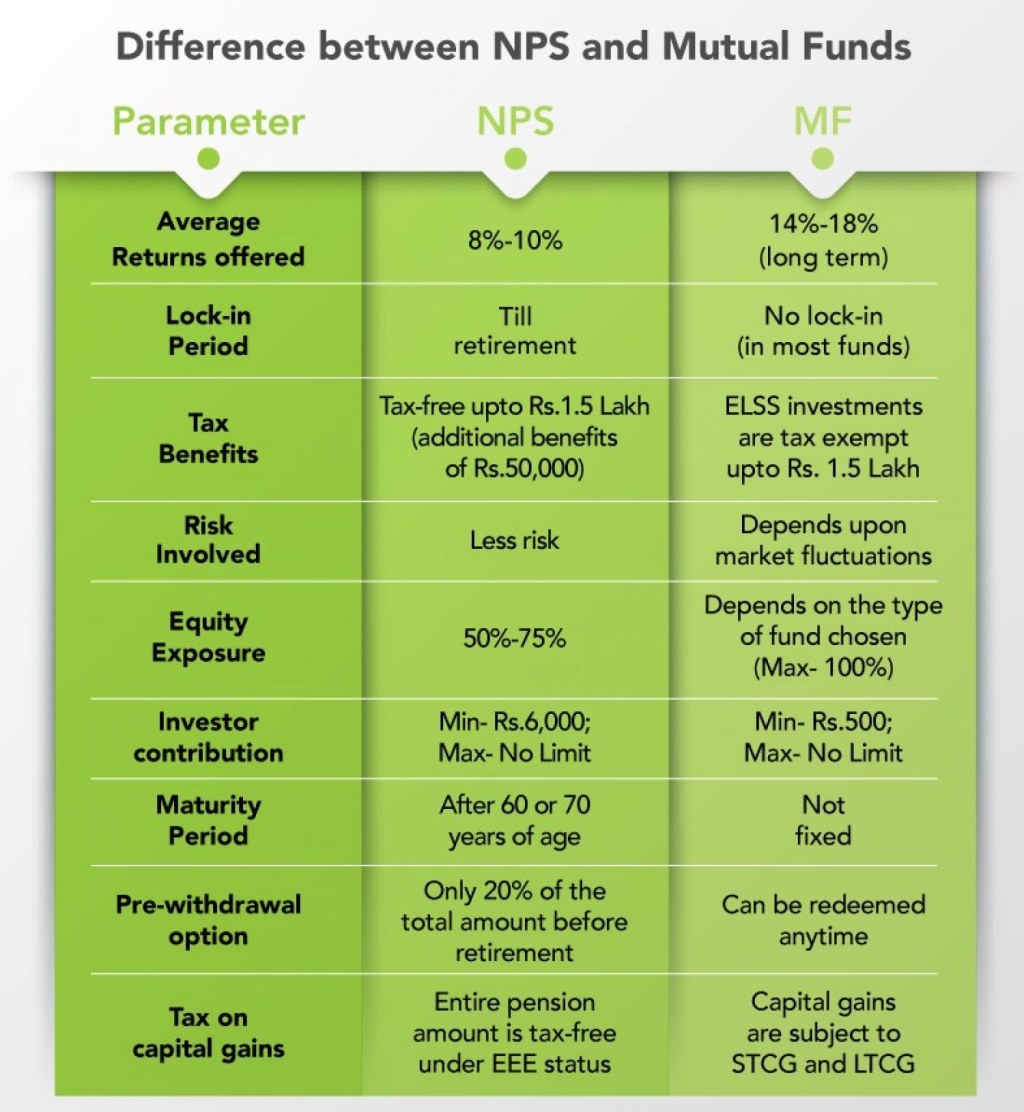

Investment Options in NPS Introduction Dear Readers, Welcome to our comprehensive guide on investment options in the National Pension Scheme (NPS). In this article, we will explore the various investment choices available within NPS, a government-sponsored retirement savings scheme in India. Should invest in NPS just for the tax benefits, NPS,Image Source: carajput.comBefore we delve into the details, let’s first…