Unlock The Secrets To Effective Tax Planning Description And Maximize Your Savings Now!

Tax Planning Description: Maximizing Financial Efficiency

Introduction

1 Picture Gallery: Unlock The Secrets To Effective Tax Planning Description And Maximize Your Savings Now!

Welcome, Readers! In today’s article, we will dive into the world of tax planning and explore its significance in maximizing financial efficiency. Taxes play a crucial role in any economy, and understanding how to plan and optimize them can greatly benefit individuals and businesses alike. In this comprehensive guide, we will cover everything you need to know about tax planning, including its definition, benefits, and strategies. So, let’s get started on this enlightening journey to understanding tax planning and its importance.

What is Tax Planning?

🔍 Tax planning refers to the process of organizing financial affairs in a strategic manner to minimize tax liabilities while remaining within the boundaries of the law. It involves making informed decisions regarding investments, income, expenses, and other financial activities to optimize the overall tax burden. By implementing effective tax planning strategies, individuals and businesses can legally reduce their tax liabilities and retain more of their hard-earned money.

Understanding Tax Planning

Image Source: researchgate.net

📚 Tax planning involves analyzing the financial situation and identifying opportunities to minimize tax obligations. It requires a thorough understanding of tax laws, regulations, and incentives provided by the government. Tax planning is a proactive approach that aims to legally minimize tax liabilities by utilizing various deductions, exemptions, and credits available within the tax code.

The Objectives of Tax Planning

🎯 The primary objectives of tax planning are to reduce tax liabilities, maximize after-tax income, and optimize financial resources. By implementing effective tax planning strategies, individuals and businesses can achieve financial efficiency, improve cash flow, and allocate resources towards growth and expansion.

The Importance of Tax Planning

⭐ Tax planning is essential for various reasons. Firstly, it allows individuals and businesses to optimize their tax liabilities and retain more of their income. Secondly, effective tax planning can help in achieving financial goals, such as saving for retirement, funding education, or starting a business. Additionally, it enables businesses to reinvest their retained earnings into expansion and innovation. Lastly, tax planning ensures compliance with tax laws, minimizing the risk of penalties and legal issues.

The Role of a Tax Planner

👤 A tax planner or tax consultant plays a vital role in assisting individuals and businesses with tax planning. They possess extensive knowledge of tax laws and regulations and can provide valuable insights and guidance on optimizing tax liabilities. Tax planners analyze financial situations, recommend strategies, and help individuals and businesses navigate complex tax codes to achieve financial efficiency.

Common Tax Planning Strategies

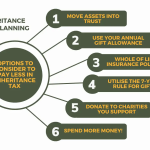

🔑 There are several tax planning strategies that individuals and businesses can employ to minimize their tax liabilities. These include maximizing deductions and exemptions, utilizing tax-advantaged investment accounts, managing capital gains and losses, utilizing tax credits, and structuring business transactions efficiently. By strategically implementing these strategies, taxpayers can effectively reduce their tax burden.

Who Needs Tax Planning?

🔍 Tax planning is relevant to individuals, businesses, and organizations of all sizes and types. It is especially important for high-income earners, business owners, self-employed individuals, and those with complex financial situations. However, tax planning is beneficial for everyone, as it can help individuals maximize their after-tax income, save for future goals, and comply with tax laws.

Individuals

👥 Tax planning is crucial for individuals, regardless of their income level. It allows individuals to minimize their tax liabilities, maximize deductions, and take advantage of tax-efficient investment opportunities. Additionally, tax planning helps individuals plan for major life events, such as buying a home, funding education, or preparing for retirement.

Businesses

🏢 Tax planning is equally important for businesses, regardless of their size. It enables businesses to structure their operations in a tax-efficient manner, minimize corporate tax obligations, and maximize after-tax profits. Effective tax planning can help businesses reinvest their earnings, expand their operations, and remain competitive in the market.

Self-Employed Individuals

💼 Self-employed individuals, such as freelancers, consultants, and independent contractors, have unique tax considerations. Tax planning is essential for them to optimize their tax obligations, maximize deductions, and comply with tax laws. By effectively planning their taxes, self-employed individuals can ensure financial stability and growth.

High-Net-Worth Individuals

🌟 High-net-worth individuals often have complex financial situations and face unique tax challenges. Tax planning is critical for them to minimize their tax liabilities, protect their wealth, and preserve assets for future generations. By leveraging advanced tax planning strategies, high-net-worth individuals can optimize their tax position and achieve long-term financial goals.

When Should Tax Planning be Done?

🔍 Tax planning is an ongoing process that should be done consistently throughout the year. However, certain key events and milestones trigger the need for comprehensive tax planning. These include:

Start of the Financial Year

📅 At the beginning of each financial year, individuals and businesses should review their financial goals, assess the previous year’s tax performance, and set tax planning objectives for the upcoming year. By starting early, taxpayers can take advantage of the entire year to implement tax-saving strategies effectively.

Major Life Events

💍 Major life events such as marriage, divorce, birth of a child, or purchasing a home can significantly impact an individual’s tax obligations. Tax planning should be done in conjunction with these events to ensure optimal tax efficiency and compliance.

Changes in Tax Laws

📜 Tax laws and regulations are subject to change, and it is crucial to stay informed about such updates. Changes in tax laws may present new opportunities or impact existing tax strategies. Regular tax planning ensures that individuals and businesses are aware of these changes and can adjust their tax planning strategies accordingly.

Business Milestones

📈 For businesses, tax planning is especially important during key milestones such as starting a new business, expanding operations, or considering an exit strategy. Effective tax planning can help businesses navigate tax implications and optimize their financial position.

Retirement Planning

🌅 As individuals approach retirement, tax planning becomes vital to ensure a smooth transition from active income to retirement income. By strategically planning their taxes, individuals can maximize retirement savings, minimize tax liabilities on withdrawals, and secure their financial future.

Where Can Tax Planning be Applied?

🔍 Tax planning can be applied in various areas of personal and business finances. Some common areas where tax planning is relevant include:

Income Tax

💰 Income tax planning involves optimizing tax liabilities related to various sources of income, including salaries, bonuses, investments, and rental income. By analyzing income sources, deductions, and credits, individuals and businesses can minimize their income tax obligations.

Capital Gains Tax

📈 Capital gains tax planning focuses on managing tax liabilities associated with the sale of capital assets such as stocks, real estate, and business interests. By carefully timing and structuring capital gains transactions, taxpayers can reduce their capital gains tax burdens.

Estate Tax

🏛 Estate tax planning involves structuring the transfer of assets to minimize estate tax liabilities upon the passing of an individual. This includes strategies such as creating trusts, gifting assets, and utilizing exemptions and deductions provided by estate tax laws.

Business Taxes

🏢 Business tax planning helps organizations optimize their corporate tax obligations. It includes strategies such as structuring business transactions, maximizing deductions, utilizing tax credits, and exploring international tax planning opportunities.

Retirement Savings

🌅 Retirement savings tax planning focuses on maximizing tax benefits associated with retirement accounts, such as 401(k)s and IRAs. By strategically contributing to retirement accounts and understanding the tax implications of withdrawals, individuals can optimize their retirement savings.

Why is Tax Planning Important?

🔍 Tax planning is of paramount importance due to various reasons:

Minimizing Tax Liabilities

💰 The primary goal of tax planning is to minimize tax liabilities and retain more income. By strategically utilizing deductions, exemptions, and credits, taxpayers can optimize their tax position and reduce the overall tax burden.

Optimizing Financial Efficiency

📈 Effective tax planning allows individuals and businesses to optimize financial efficiency. By retaining more income, taxpayers can allocate resources towards savings, investments, and growth opportunities, ultimately improving their financial well-being.

Compliance with Tax Laws

📜 Tax planning ensures compliance with tax laws and regulations. By staying informed about tax obligations and utilizing legal strategies to minimize taxes, taxpayers can avoid penalties, fines, and legal issues arising from non-compliance.

Protection of Wealth

🏦 Tax planning helps protect individuals’ and businesses’ wealth. By implementing estate tax planning strategies, individuals can preserve their assets for future generations, ensuring the long-term financial security of their families.

Strategic Decision-Making

⚖️ Tax planning provides valuable insights for making strategic financial decisions. By considering the tax implications of investments, business transactions, and major life events, individuals and businesses can make informed choices that align with their financial goals.

Financial Stability

🏦 Tax planning contributes to financial stability by enabling individuals and businesses to effectively manage their tax obligations. By minimizing tax liabilities and optimizing cash flow, taxpayers can maintain stability during economic fluctuations and unforeseen circumstances.

How Does Tax Planning Work?

🔍 Tax planning involves a systematic approach to optimize tax liabilities. Here is a step-by-step overview of how tax planning works:

1. Gather Financial Information

📊 The first step in tax planning is gathering all relevant financial information, including income statements, expenses, investments, and assets. This provides an overview of the taxpayer’s financial situation and serves as a foundation for further planning.

2. Set Financial Goals

🎯 Tax planning should align with the taxpayer’s financial goals. Whether it’s maximizing after-tax income, saving for retirement, or funding education, setting clear objectives helps in formulating effective tax strategies.

3. Analyze Tax Laws and Regulations

📚 Taxpayers should stay informed about the latest tax laws, regulations, and incentives. Understanding the tax code enables taxpayers to identify potential deductions, exemptions, and credits that can be utilized to minimize tax liabilities.

4. Identify Tax Planning Opportunities

💡 Based on the financial information and goals, taxpayers can identify tax planning opportunities. These may include maximizing deductions, utilizing tax-advantaged accounts, timing capital gains transactions, or exploring business tax planning strategies.

5. Implement Tax Planning Strategies

🔑 Once tax planning opportunities are identified, taxpayers can implement the chosen strategies. This may involve adjusting investment portfolios, structuring business transactions, contributing to retirement accounts, or utilizing specific deductions and credits.

6. Monitor and Review

🔍 Tax planning should be an ongoing process. Taxpayers should regularly monitor their financial situation, review tax strategies, and make adjustments as needed. This ensures that tax planning remains effective and aligned with the taxpayer’s changing circumstances.

Advantages and Disadvantages of Tax Planning

Advantages

1. 📈 Increased Savings: Effective tax planning allows individuals and businesses to maximize savings by reducing tax liabilities and retaining more income.

2. 💼 Business Growth: Tax planning strategies help businesses reinvest retained earnings into growth opportunities, such as expanding operations, hiring employees, or investing in research and development.

3. ⚖️ Compliance: Tax planning ensures compliance with tax laws and regulations, minimizing the risk of penalties, fines, or legal issues.

4. 🌅 Retirement Planning: Tax planning enables individuals to strategically plan for retirement by maximizing retirement savings and minimizing tax liabilities on withdrawals.

5. 💰 Wealth Preservation: Effective estate tax planning allows individuals to protect and preserve their wealth for future generations.

Disadvantages

1. 💼 Complexity: Tax planning can be complex, especially for individuals and businesses with unique financial situations. It often requires professional assistance to navigate through the intricacies of tax laws.

2. 📜 Changing Laws: Tax laws are subject to change, and taxpayers need to stay updated with the latest regulations. This can require additional time and effort to adapt tax planning strategies accordingly.

3. 💰 Increased Scrutiny: Aggressive tax planning strategies may attract scrutiny from tax authorities. It is essential to ensure that tax planning strategies remain within the boundaries of legal and ethical practices.

4. 🏦 Time and Resources: Effective tax planning may require significant time and resources to gather financial information, analyze tax laws, and implement strategies. This can be a challenge for individuals and businesses with limited resources.

5. 🌍 International Considerations: Tax planning for international transactions or investments involves additional complexities, including double taxation agreements, foreign tax credits, and compliance with international tax regulations.

Frequently Asked Questions (FAQ)

Q1: Who can benefit from tax planning?

⭐ Tax planning benefits individuals, businesses, and organizations of all sizes and types. It is particularly relevant for high

This post topic: Tax Planning