Unlock Financial Success With Expert Tax Planning LLC In Dearborn, MI – Act Now!

Tax Planning LLC Dearborn MI: Maximizing Financial Benefits and Minimizing Tax Liabilities

Introduction

Hello Readers,

1 Picture Gallery: Unlock Financial Success With Expert Tax Planning LLC In Dearborn, MI – Act Now!

Welcome to this informative article on tax planning LLC in Dearborn, MI. In today’s complex financial landscape, effective tax planning has become essential for individuals and businesses alike. By strategically managing your taxes, you can maximize your financial benefits and minimize your tax liabilities. In this article, we will explore the concept of tax planning LLC in Dearborn, MI, and its significance for individuals and businesses in the area.

Now, let’s dive into the details of tax planning LLC in Dearborn, MI.

What is Tax Planning LLC?

Image Source: squarecdn.com

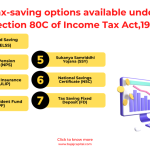

🔍 Tax planning LLC refers to the strategic process of organizing and structuring one’s finances to minimize tax obligations while complying with legal requirements. LLC, which stands for Limited Liability Company, is a popular business structure that offers flexibility and limited liability protection to its owners. By utilizing tax planning strategies, individuals and businesses can effectively manage their income, deductions, and credits to optimize their tax situation.

Benefits of Tax Planning LLC

🔍 Tax planning LLC provides several benefits, including:

📈 Maximizing tax deductions and credits

💼 Protecting personal assets from business liabilities

🌍 Minimizing self-employment taxes

💰 Utilizing favorable tax strategies for business growth

📚 Simplifying tax reporting and compliance

🏢 Facilitating business succession planning

🌟Enhancing financial security and wealth accumulation

Disadvantages of Tax Planning LLC

🔍 Despite its numerous advantages, tax planning LLC also has certain disadvantages, such as:

💼 Complexity in setup and maintenance

📝 Additional administrative tasks and costs

🔒 Limited life span and potential dissolution

💵 Potential income tax consequences when distributing profits

⚖️ Varying tax regulations and state-specific requirements

Who Should Consider Tax Planning LLC?

🔍 Tax planning LLC is a suitable option for:

👥 Small business owners and entrepreneurs

👩💼 Self-employed individuals

🗂️ High-income earners

🏢 Professionals with liability concerns

🌇 Real estate investors

🌐 Digital entrepreneurs

👨👩👧👦 Families with intergenerational wealth planning needs

When is the Right Time to Implement Tax Planning LLC?

🔍 The ideal time to implement tax planning LLC varies depending on individual circumstances. However, some common scenarios when tax planning LLC becomes crucial include:

💼 Starting a new business or venture

🏢 Expanding an existing business

👥 Forming a partnership or joint venture

🌇 Acquiring or selling assets

📈 Anticipating significant changes in income or expenses

Where to Seek Tax Planning LLC Services in Dearborn, MI?

🔍 Dearborn, MI offers several reputable firms and professionals specializing in tax planning LLC. It is advisable to seek assistance from qualified tax advisors, certified public accountants (CPAs), or tax attorneys who are well-versed in local tax laws and regulations. They can guide you through the intricacies of tax planning LLC, ensuring compliance and maximizing your financial benefits.

Why Choose Tax Planning LLC in Dearborn, MI?

🔍 Tax planning LLC in Dearborn, MI provides numerous advantages, such as:

🌟 Leveraging tax incentives and deductions specific to Michigan

🏢 Enhancing business growth opportunities in a thriving local economy

👥 Protecting personal assets from business liabilities under Michigan law

🔒 Preserving family wealth and securing future generations

⚖️ Complying with state and federal tax laws while minimizing tax liabilities

How to Implement Tax Planning LLC Effectively?

🔍 To implement tax planning LLC effectively, consider the following steps:

💼 Assess your financial goals and long-term objectives

📈 Identify potential tax-saving opportunities

📝 Determine the most suitable tax strategies for your situation

🗂️ Organize and maintain accurate financial records

📅 Plan your tax activities throughout the year, not just during tax season

👥 Consult with experienced tax professionals

🌟 Regularly review and update your tax planning strategies

Frequently Asked Questions (FAQs)

1. What are the tax advantages of forming an LLC in Dearborn, MI?

🔍 Forming an LLC in Dearborn, MI offers several tax advantages, such as:

📈 Pass-through taxation

👥 Flexibility in profit distribution

🏢 Limited liability protection

🌟 Deductible business expenses

⚖️ Tax credits and incentives

2. Is tax planning LLC only for large businesses?

🔍 No, tax planning LLC is suitable for businesses of all sizes, including small and medium-sized enterprises. It helps optimize tax benefits, minimize tax liabilities, and protect personal assets.

3. Can I handle tax planning LLC on my own?

🔍 While it is possible to handle tax planning LLC on your own, it is highly recommended to consult with experienced tax professionals who can provide expert guidance tailored to your specific financial situation.

4. What are the potential risks of improper tax planning LLC?

🔍 Improper tax planning LLC can result in various risks, such as penalties, fines, audits, and reputation damage. It is crucial to ensure compliance with tax laws and regulations while implementing effective tax strategies.

5. How often should I review my tax planning LLC strategies?

🔍 It is advisable to review your tax planning LLC strategies at least annually or whenever significant changes occur in your financial situation, business operations, or tax laws. Regular reviews help ensure that your strategies remain aligned with your goals and meet current legal requirements.

Conclusion

After understanding the significance of tax planning LLC in Dearborn, MI, it is clear that this strategic approach can provide individuals and businesses with substantial financial benefits. By leveraging the advantages of tax planning LLC and seeking assistance from qualified professionals, you can optimize your tax situation, protect your assets, and foster long-term financial growth. Don’t wait any longer – take action today and embark on your tax planning LLC journey!

Final Remarks

Dear Readers,

The information provided in this article is intended for educational purposes only and should not be considered as legal or financial advice. Tax laws and regulations are subject to change, and individual circumstances may vary. It is strongly recommended to consult with qualified professionals before making any decisions or taking actions based on the information provided. The authors and publishers of this article are not liable for any damages or losses arising from the use of this information.

This post topic: Tax Planning