Unlocking The Secrets: Unveiling The Truth Behind Tax Planning – Legal Or Illegal?

Sep

30th

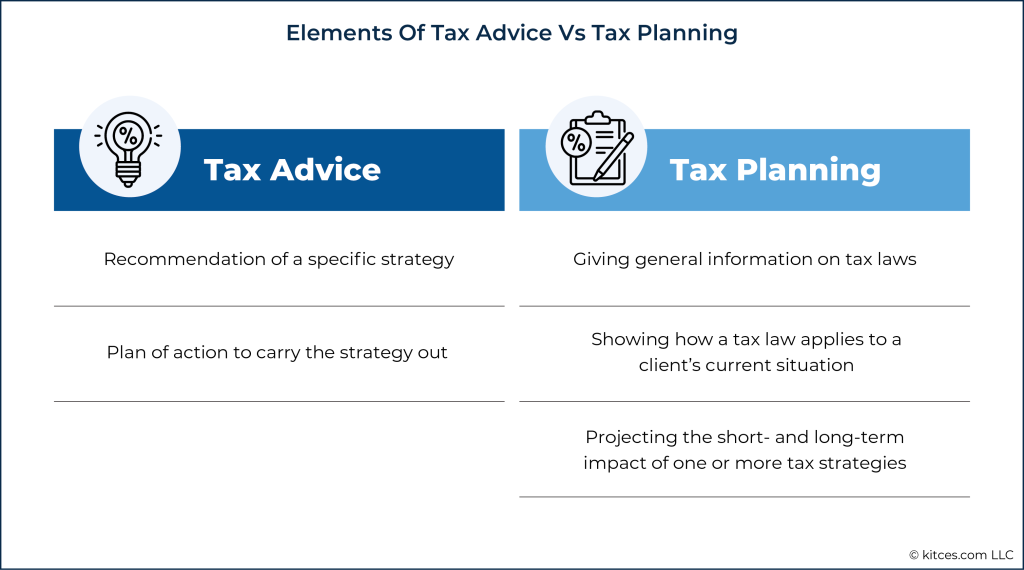

Tax Planning: Legal or Illegal? Introduction Dear Readers, Welcome to this informative article on tax planning. In this article, we will delve into the topic of whether tax planning is legal or illegal. Tax planning is a crucial aspect of financial management for individuals and businesses alike. It involves making strategic decisions to minimize tax liabilities within the bounds of…