Unlock Tax Benefits With Our Powerful Tax Plan 1031 Exchange – Act Now!

Sep

25th

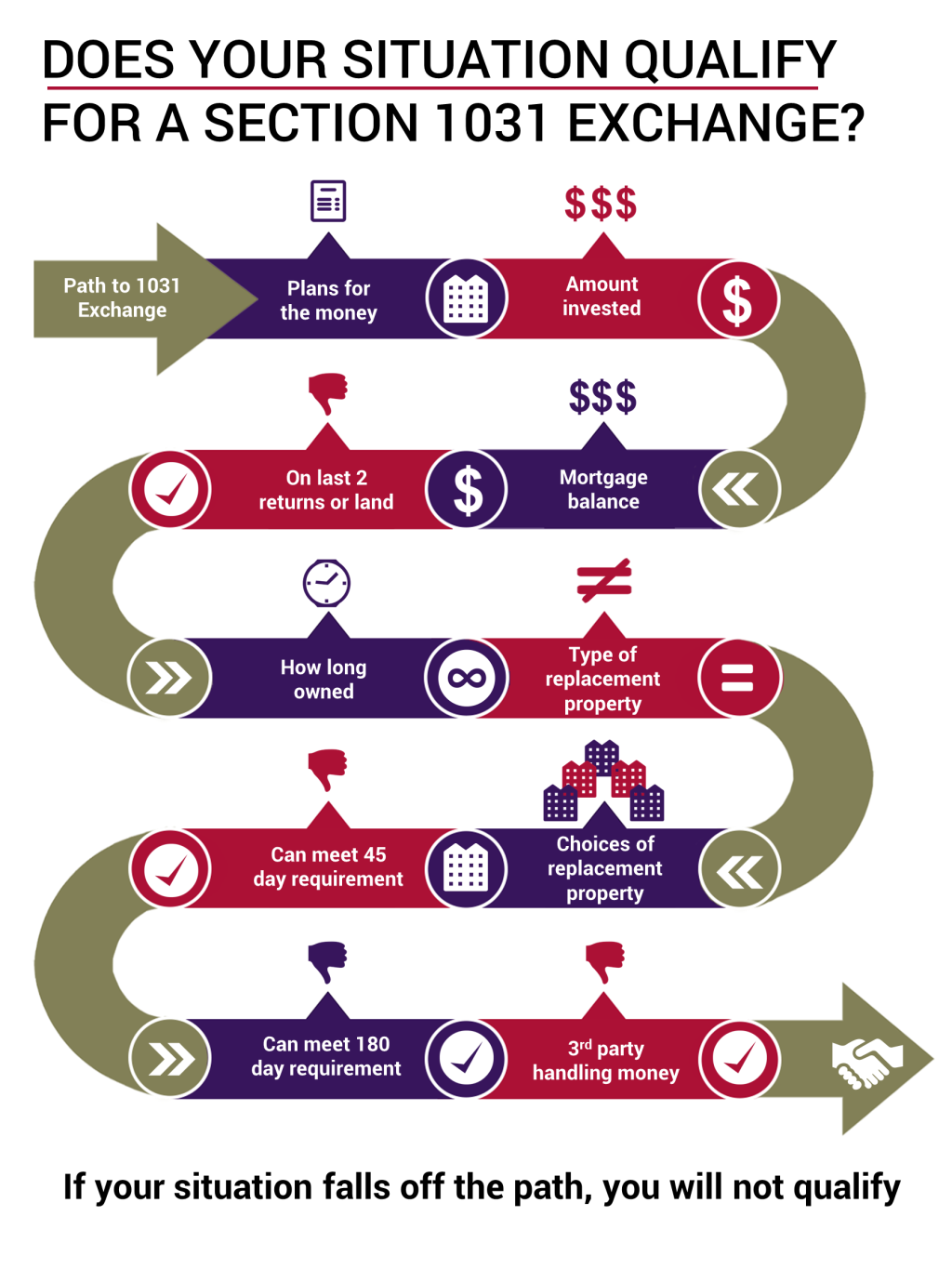

Tax Plan 1031 Exchange: A Comprehensive Guide to Understanding the Benefits and Implications Introduction Greetings, dear readers! Today, we delve into the intricacies of the tax plan 1031 exchange. Whether you are a seasoned investor or someone exploring the world of real estate, this tax plan is worth your attention. In this article, we will provide you with a comprehensive…